The $1.4 trillion market. Is the hydrogen hype starting up again?

For those interested in the hydrogen economy, Deloitte has published a really nice and argumentative study on a possible and futuristic hydrogen economy.

A short summary:

Similar to what I have already done in some posts, the introduction discusses the uses of hydrogen in general. This refers, for example, to basic chemical production, fertilizer products, but also the excess storage of electricity by electrolysers. But of course also alternative heat supply and transportation. (I include steel production in the industrial supply).

This generally results first in a basic assumption of the study on a rapid surplus of electricity, which in turn is also a weakness of the study, or at least may leave a bad taste in the mouth of Europeans.

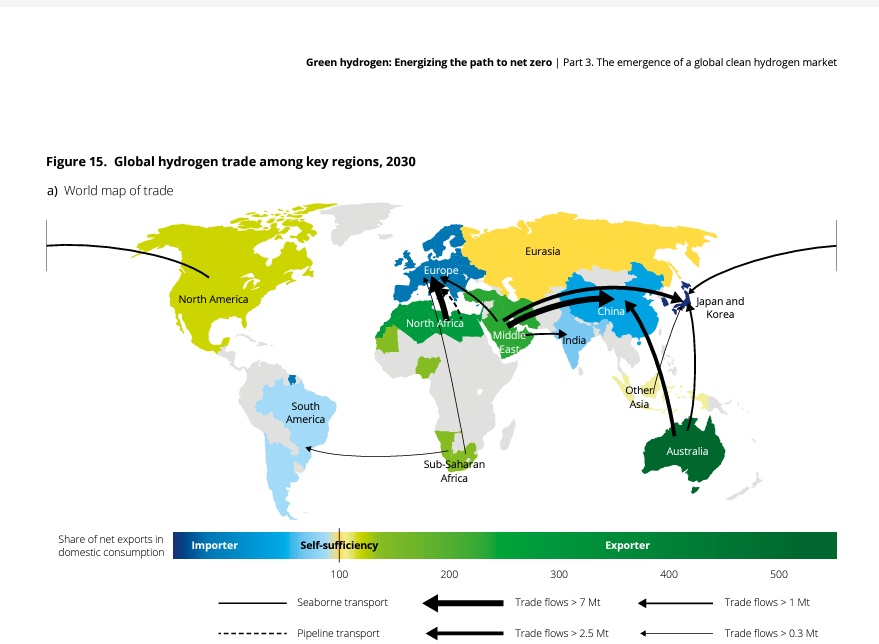

Because exactly this is also the economic conclusion of the study: The insight that Europe will lose in the international comparison! The big winners will be the countries bordering the Mediterranean and the Oriental countries.

will be. This defeat is of course due to the intensity of wind and sun. The worldwide dependencies are increasing. Thus, globalization continues to increase. Europe in particular is likely to be hit hard politically, as the U.S. forces its way into a more independent position. The "inflation reduction act" has already created a solid foundation. China, as the second major economic power, will nevertheless be drawn into a probable dependency from the Orient.

Perhaps it is a deliberate goal that a realignment of the BRICS partnerships is therefore already taking place today?

The plausible chances for the next decades:

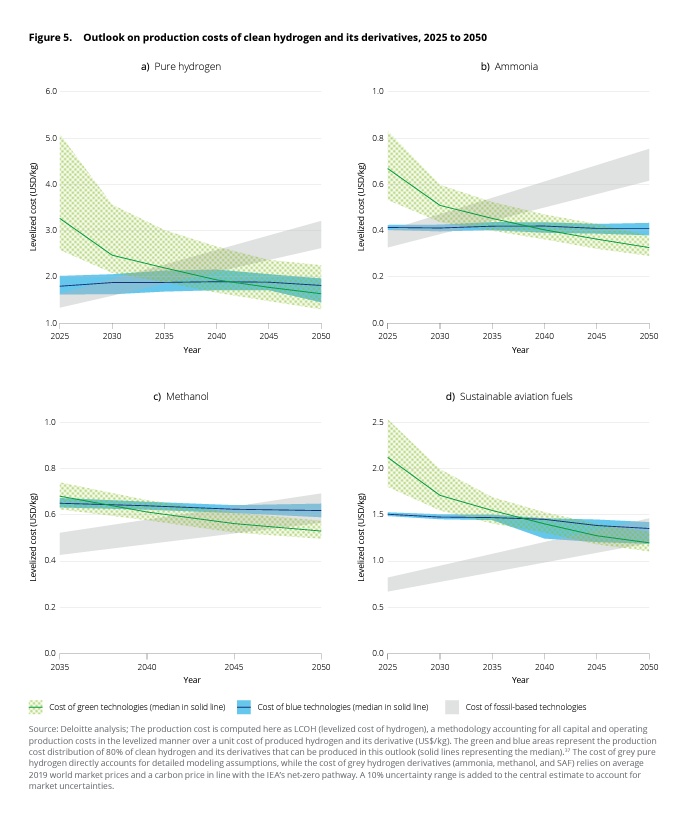

A really nice addition I feel is the price forecast. This is because it does not present hydrogen as the only image. A certain competition, perhaps also correlation, between hydrogen and LNG is assumed.

Furthermore, the price forecasts give a quite realistic result in the production of hydrogen and its derivative products, such as ammonia and methanol, which is more or less in line with my personal market expectations. Thus, the diversification is approached just as realistically that neither pure electric energy nor pure hydrogen will be able to establish themselves technically and economically.

How credible is this study?

First of all, it is a study that is likely to spread optimism. Neither political nor economic upheavals have been factored in. Nevertheless, it is a really nice and descriptive study for those interested in the industry. The price forecasts are illustrated realistically and comprehensibly. The calculation bases and the analyzed data are also included.

Personal opinion:

The study reflects to a very large extent my views of a possible future economy, that diversification of a wide variety of energy sources can bring a more secure and economic future. The realization of the study will most likely not come true, but still gives a rough overview of the current investments of the energy industry internationally.

In the short term, one can currently see a budding hype of the H2 industry again. In particular, $PLUG (+2,06%) is currently experiencing an unwarranted upward trend. Although sales are increasing, losses are likely to continue to widen. Well ... For a "trade" I like to take the percentages, but in the long term they will probably disappear.

In the long term, one should therefore focus on proven energy companies, such as $SHEL (+0,58%) or $TTE (+0,55%) but the previous industrial giants of $LIN (+0,39%) , $AI (+0,51%) and $APD (+1,46%) should not be underestimated. Proven knowledge always pays off for the companies for the future!

For people who actually want to delve deeper into the matter, the PDF is available for viewing here: