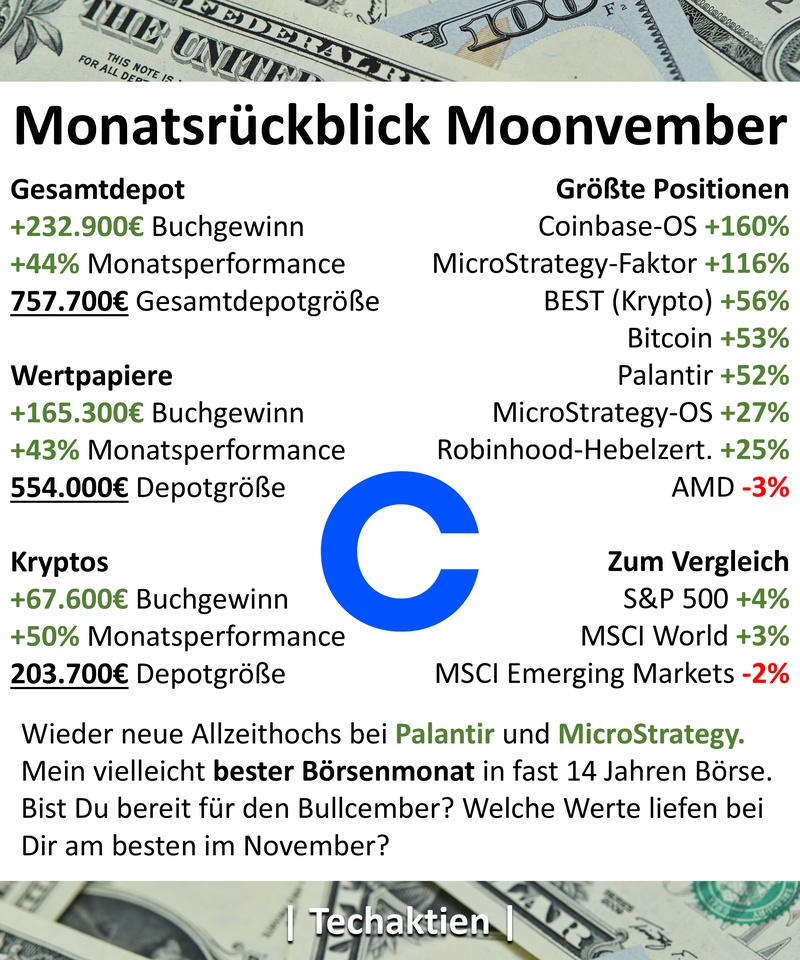

Month in review Moonvember 🤑💰📈

Total portfolio

+€232,900 book profit

+44% monthly performance

757,700€ Total portfolio size

Securities

+€ 165,300 book profit

+43% monthly performance

554,000€ Depot size

Cryptos

+67,600€ book profit

+50% monthly performance

203,700€ Depot size

Largest positions

+160% Coinbase-OS $COIN (-3,06%)

+116% MicroStrategy factor $MSTR (-4,54%)

+56% BEST (crypto) #bitpanda

+53% Bitcoin $BTC (+0,28%)

+52% Palantir $PLTR (-4,97%)

#pltrgang

+27% MicroStrategy-OS $MSTR (-4,54%)

+25% Robinhood lever cert. $HOOD (-3,38%)

-3% AMD $AMD (-4,97%)

For comparison

+4% S&P 500

+3% MSCI World

-2% MSCI Emerging Markets

New all-time highs again for Palantir and MicroStrategy. Perhaps my best trading month in almost 14 years on the stock market.

>> Are you ready for Bullcember? Which stocks performed best for you in November?