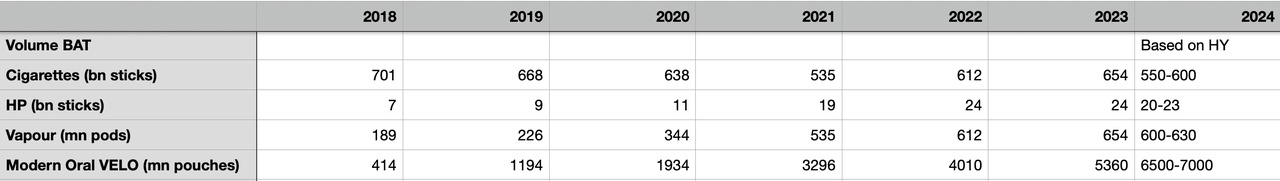

Here is some historical data on $BATS (-0,24%)

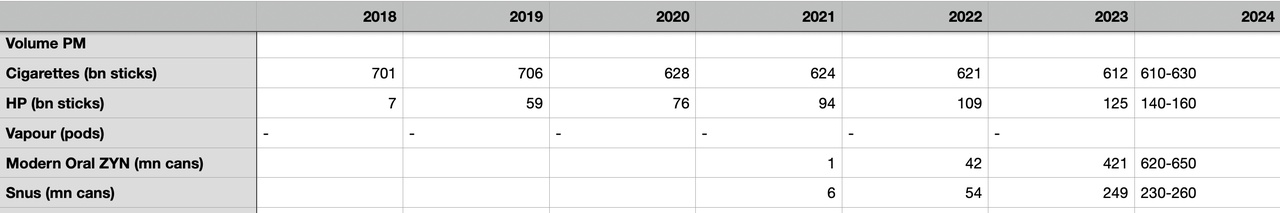

$PM (+0,48%)

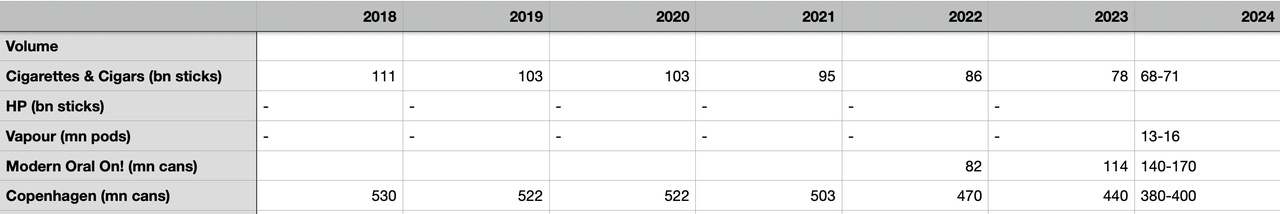

$MO (+0,78%) and what I expect for 2024.

As BAT only has an HY report, the egg estimate for 2024 is somewhat inaccurate.

I find it interesting that BAT's alternative products have been ignored for years, even though they have been solidly positioned since 2018.

Mind you, this is about volume and not sales in general.

The losses at Altria and BAT in cigarettes are due to the generally declining US market. In the case of Philip Morris, I am even assuming stable volumes with a good probability of growth.

BAT at HP will stagnate if not shrink unless something fundamental changes in HY2. With HILO, if the attack on the premium segment succeeds, the volume should increase again. Phillip Morris is very likely to make substantial gains again.

At BAT, I expect some stagnation in the vapor segment; the big problem here is also the US market, where the unregulated segment continues to eat into market share. Altria can scale NJOY better due to its low market share and should end the year satisfactorily.

In the modern oral segment, Philip Morris and BAT should be particularly convincing. How much Altria ultimately grows depends on how much it can maintain the market share it has gained now that ZYN no longer has supply problems.

Due to the strong volume growth,

Philip Morris to increase RRP's revenue share from 13% in 2018 to >35% in 2024,

BAT from 3.7% to >13%,

Altria (with Copenhagen) 8.9% to 11% (without Copenhagen) <4%.

The main catalysts for volume growth in the future are the IQOS USA launch, VEEV launch in Europe, global ZYN launch, HILO launch, Velo product innovations, action against unregulated vapes, Ploom and SWIC USA launch.

These catalysts should all be in full swing by the end of 2025 and show success in 2026.