J&J -Q3 2024

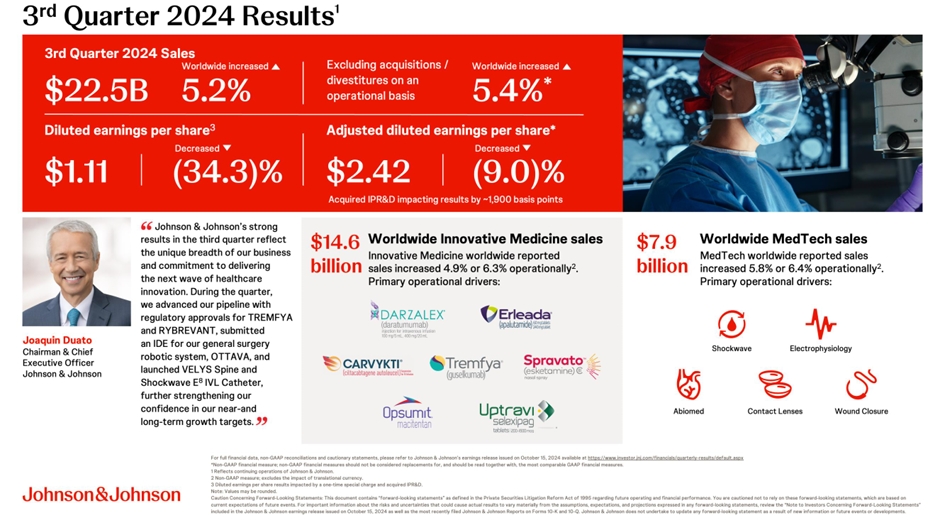

The results of $JNJ (+2,5%) for the third quarter of 2024 reflect a solid performance across all business segments, supported by strategic progress and operational growth. The company reported global sales of 22.5 billion US dollarswhich represents an increase of 5,2 % compared to the previous year, with operating growth of 6,3 % amounted to 6.3%. The US market in particular recorded strong growth with an increase in sales of 7,6 %.

In terms of profit, diluted earnings per share fell by 34,3 % to 1.11 US dollarswhile adjusted diluted earnings per share fell by 9,0 % to 2.42 US dollars fell. This decline was largely due to expenses for acquired research and development projects (IPR&D), which which reduced the result by around 1,900 basis points burdened the result.

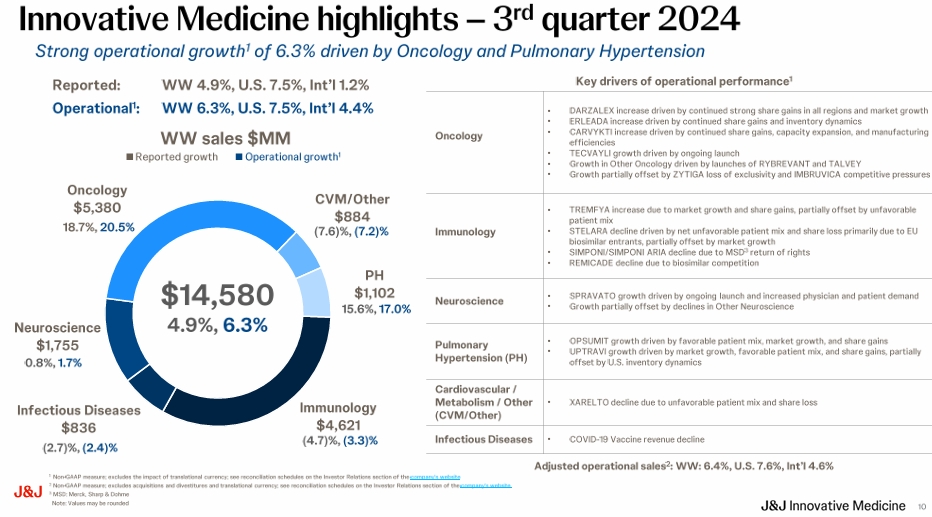

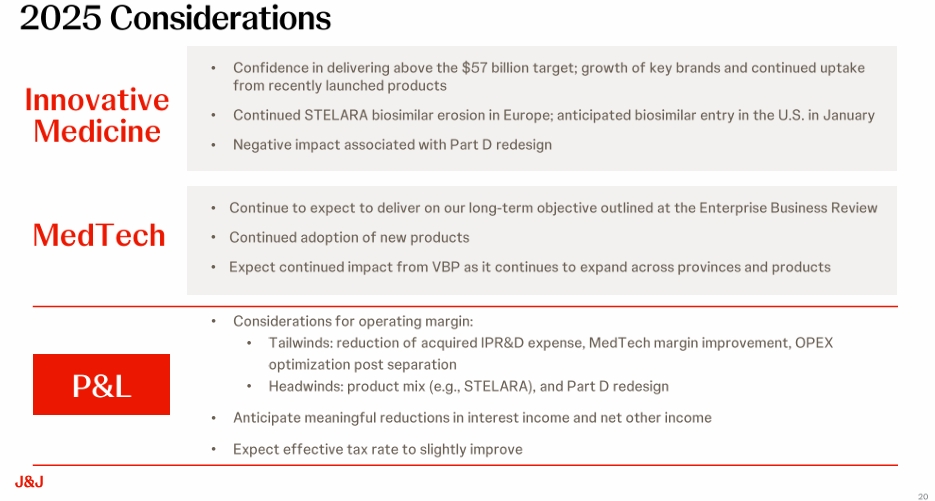

In the Innovative Medicine-segment generated sales of 14.6 billion US dollars were achieved, an increase of 4,9 % or operationally by 6,3 %. The main growth drivers included the strong results of DARZALEX, CARVYKTI and ERLEADAwith sales at DARZALEX increasing by 20,7 % increased.

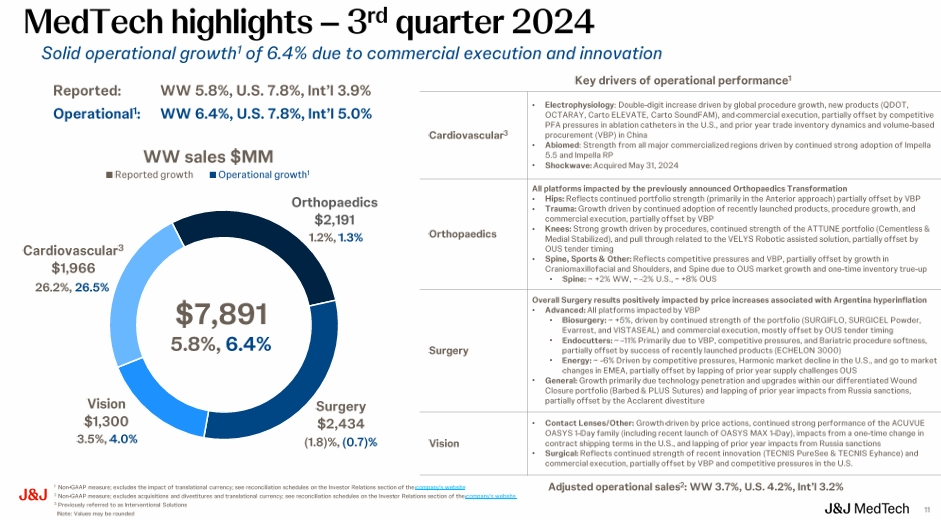

The MedTech-segment also showed solid growth, with a global increase in sales of 5,8 % and operationally by 6,4 %supported by innovations in electrophysiology and the successful market launches of new products such as the VELYS Spine and the Shockwave E8 IVL catheter.

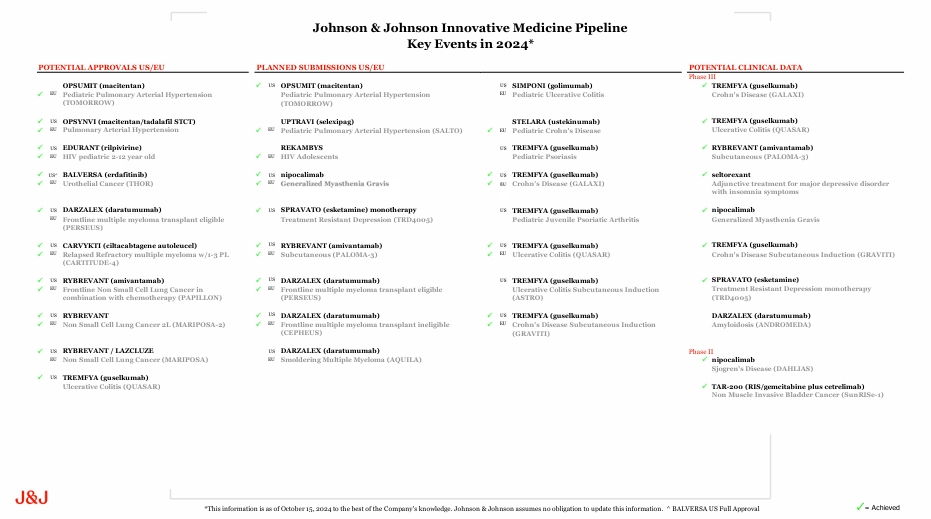

Strategically, Johnson & Johnson made important progress in its product pipeline, including approvals for TREMFYA and RYBREVANTas well as submissions for new therapies in various areas of application. In addition, the acquisition of V-Wave was completed, which should further strengthen the company's position in the field of cardiovascular medicine.

Looking to the future, Johnson & Johnson has revised its forecast for 2024 and expects adjusted operating sales growth of between 5.7% and 5.7% and 6.2% and adjusted operating earnings per share between 9.86 and 9.96 US dollars. The company remains focused on leveraging its extensive healthcare capabilities to drive long-term growth and innovation.

I have maintained my position in the stock and hope that the Medtech division will be floated soon. Even if that doesn't happen, I still see it as a great stock.