Token unlocks are playing an increasingly important role in the valuation of tokens.

But what is behind them and what influence do they have on the price of a token?

Token Unlocks 101

Token unlocks describe an event in which a certain portion of a token that was previously locked (locked) becomes accessible to the respective shareholders - investors, team or the community.

- They are part of the so-called "vesting schedule", a schedule that determines how many tokens are put into circulation at what time.

An example: The vesting schedule of $AVAX (+0,12%)

The gradual release of the tokens is primarily intended to align the interests of the individual stakeholders and incentivize the team and investors in the long term.

Effects on the price

The influence of unlocks on the price of the respective token depends on several factors.

1️⃣ The size of the unlock

The more tokens become tradable at once, the greater the (anticipated by the market) selling pressure (anticipated by the market), which is why some tokens experience a price drop weeks before a major unlock.

2️⃣ The general market sentiment

In a bullish market phase, when demand is higher, even major unlocks can be more easily digested by the market.

💡 In addition, a study that analyzed over 500 unlocks found that only unlocks with less than 1% of the total volume have no measurable impact on the price of a token. If you want to delve deeper, you can find a link to the study in the sources section below.

Why is this important?

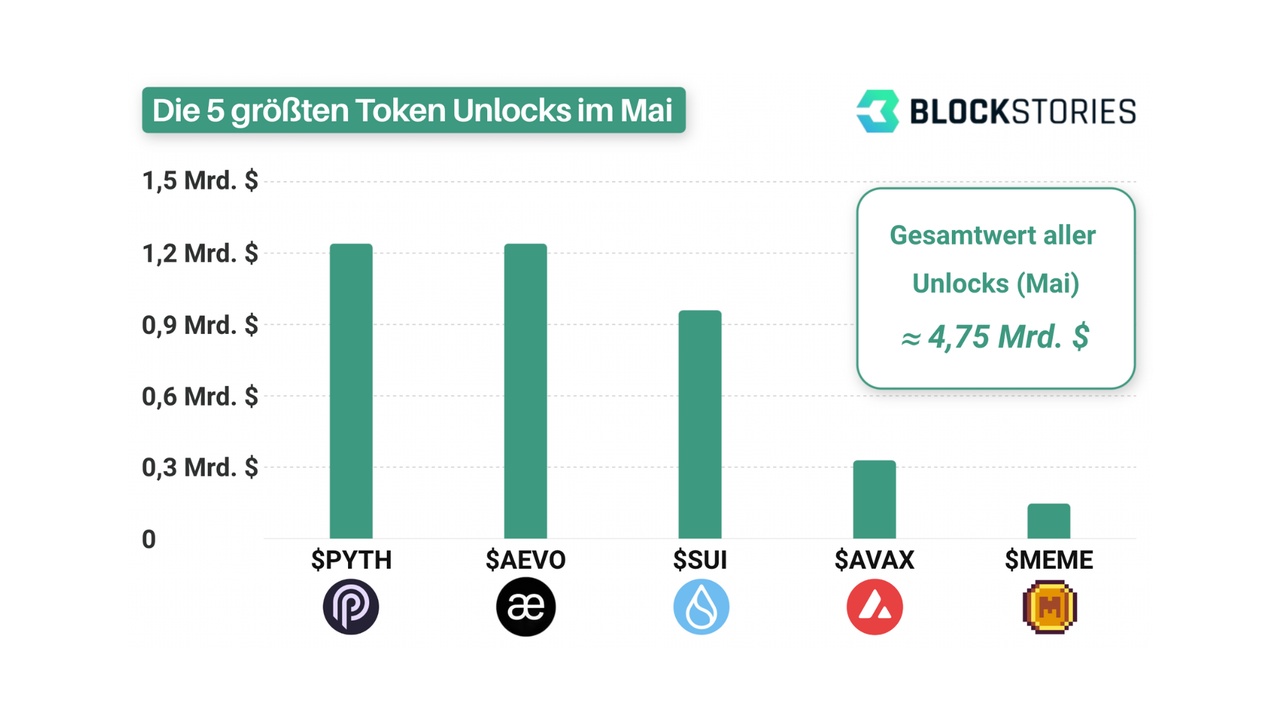

In May, we can expect numerous large token unlocks, with tokens worth around USD 4.75 billion coming onto the market.

This makes May the biggest token unlocks of the year so far.

- For comparison: In April, tokens worth just under USD 1.8 billion became available.

It will be all the more exciting to see how the upcoming unlocks will affect the respective tokens.

- For example, $AEVO and $PYTH will be made available at 752% and 141% of their current circulation volume respectively.

Zoom out

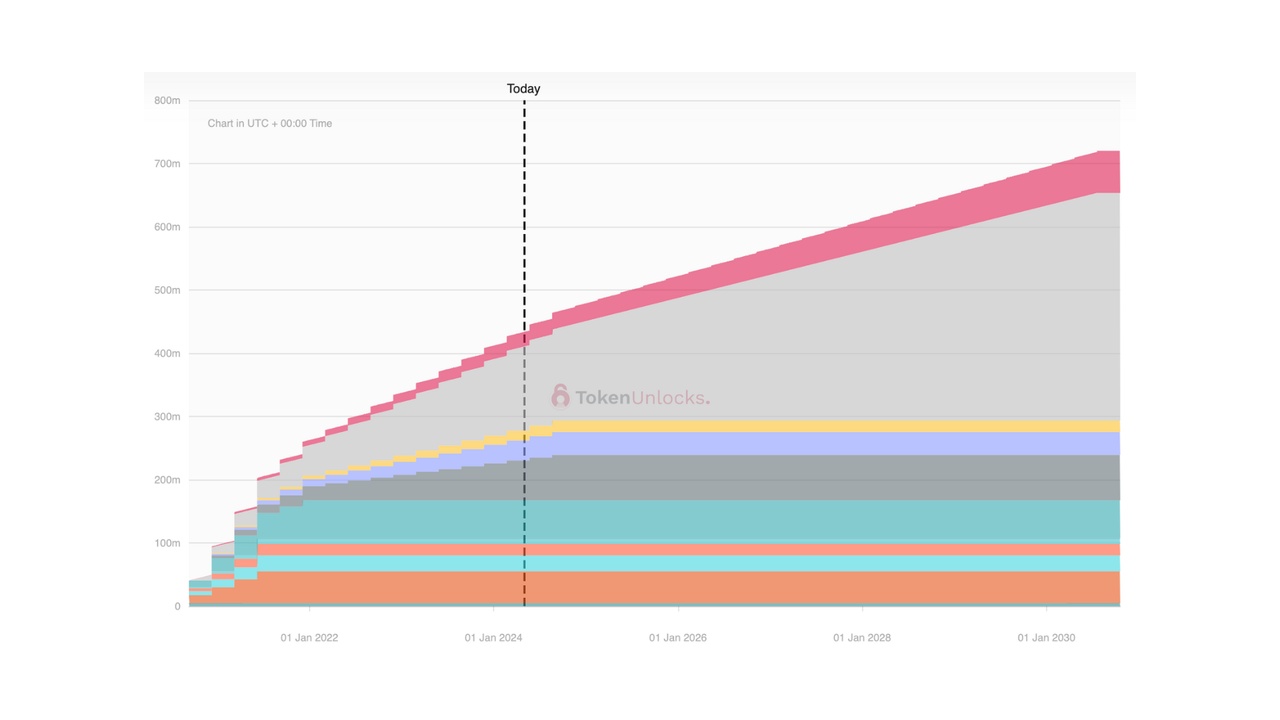

In the first four months of this year alone, altcoins worth around USD 70 billion were launched, of which just USD 8 billion are already liquid.

To avoid ending up as the "exit liquidity" of insiders, investors should always take a look at the vesting schedule of tokens before making investment decisions.

P.S. - Want more insights?

Twice a week we provide 15,000+ readers...

- a market commentary,

- the most important news of the last few days

- and insights into the most relevant events in crypto

Straight to your inbox. 📬

Subscribe here for free: https://www.blockstories.de/

------

Sources

Today's edition: https://blockstories.beehiiv.com/p/eigenlayer-stellt-eigen-vor-alle-hintergrnde

An overview of all token unlocks: https://token.unlocks.app/

The study on Token Unlocks: https://6thman.ventures/writing/we-analyzed-5000-token-unlocks-this-is-what-we-found/