Datadog- The pitbull of data analysis or just 3rd class after all

Part 1:https://getqu.in/YpHawB/

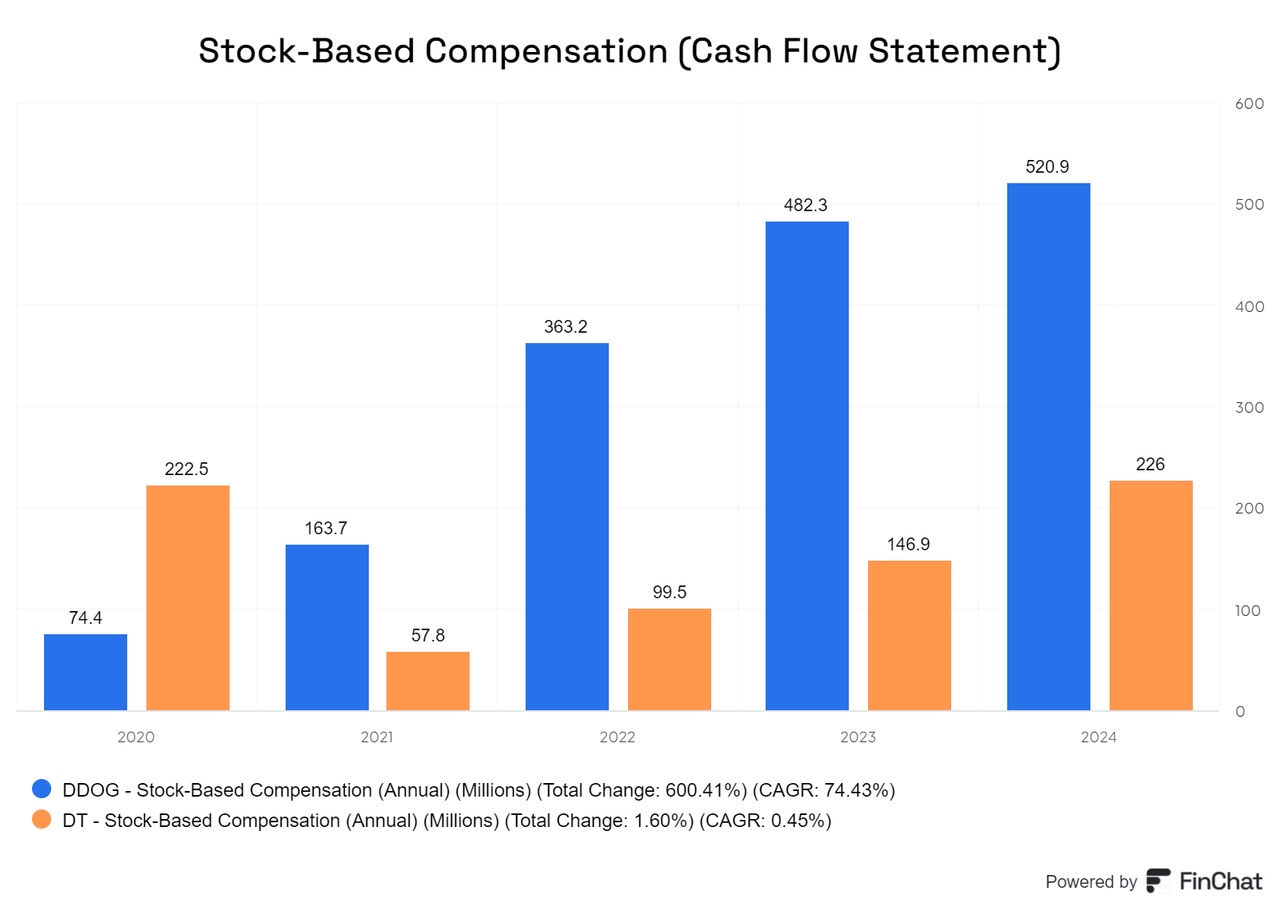

The stock-based compensation (stock-based compensation) has grown faster at $DT (+3,69%) has grown faster than at Datadog, but the absolute volume of stock-based compensation at Datadog is currently twice as high. This shows that $DDOG (+3,12%) Dynatrace is relying more heavily on granting share options to employees in order to attract and retain talent - a strategy that is particularly widespread in the technology sector.

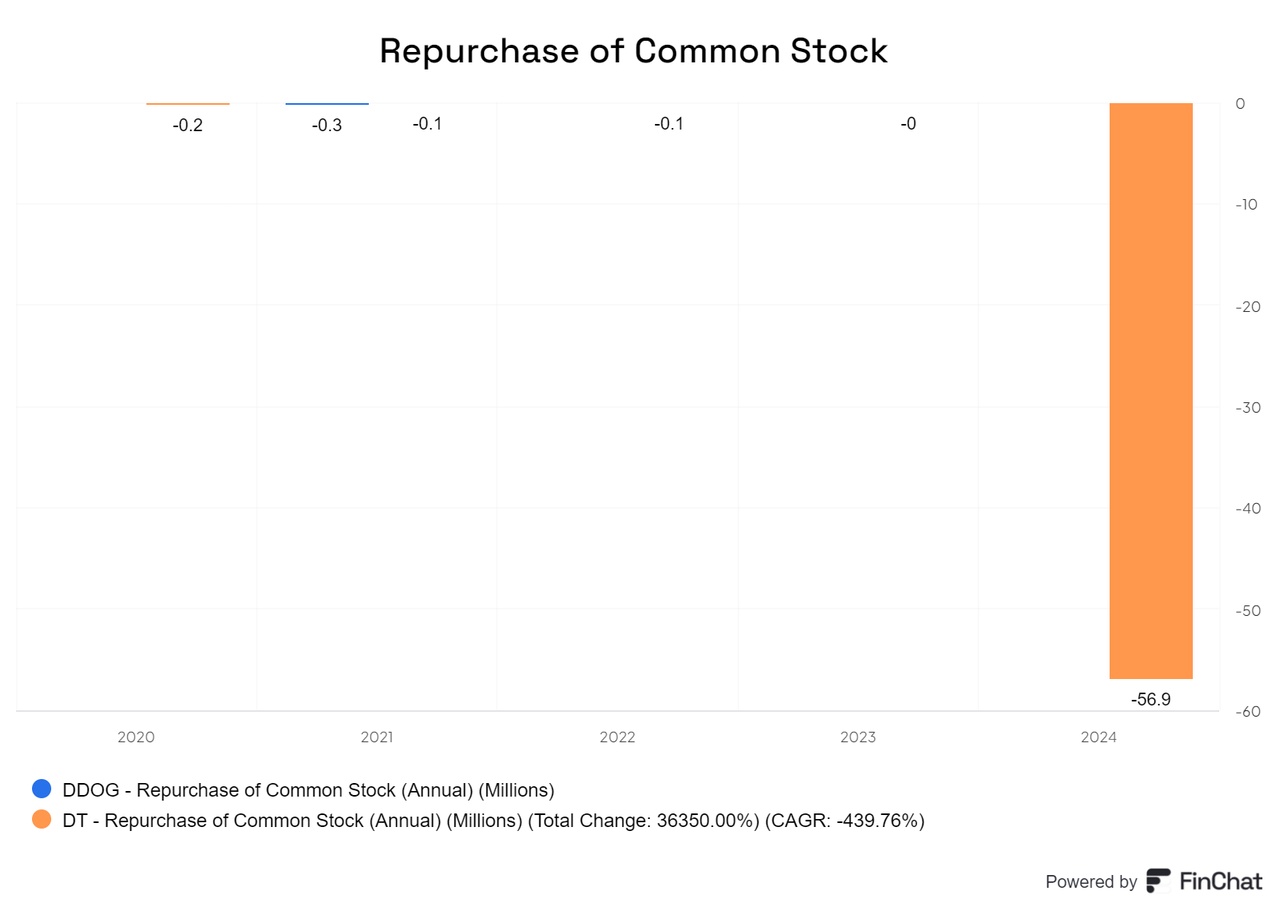

At Dynatrace, share-based remuneration is also increasing, but the company has already started to buy back shares from time to time

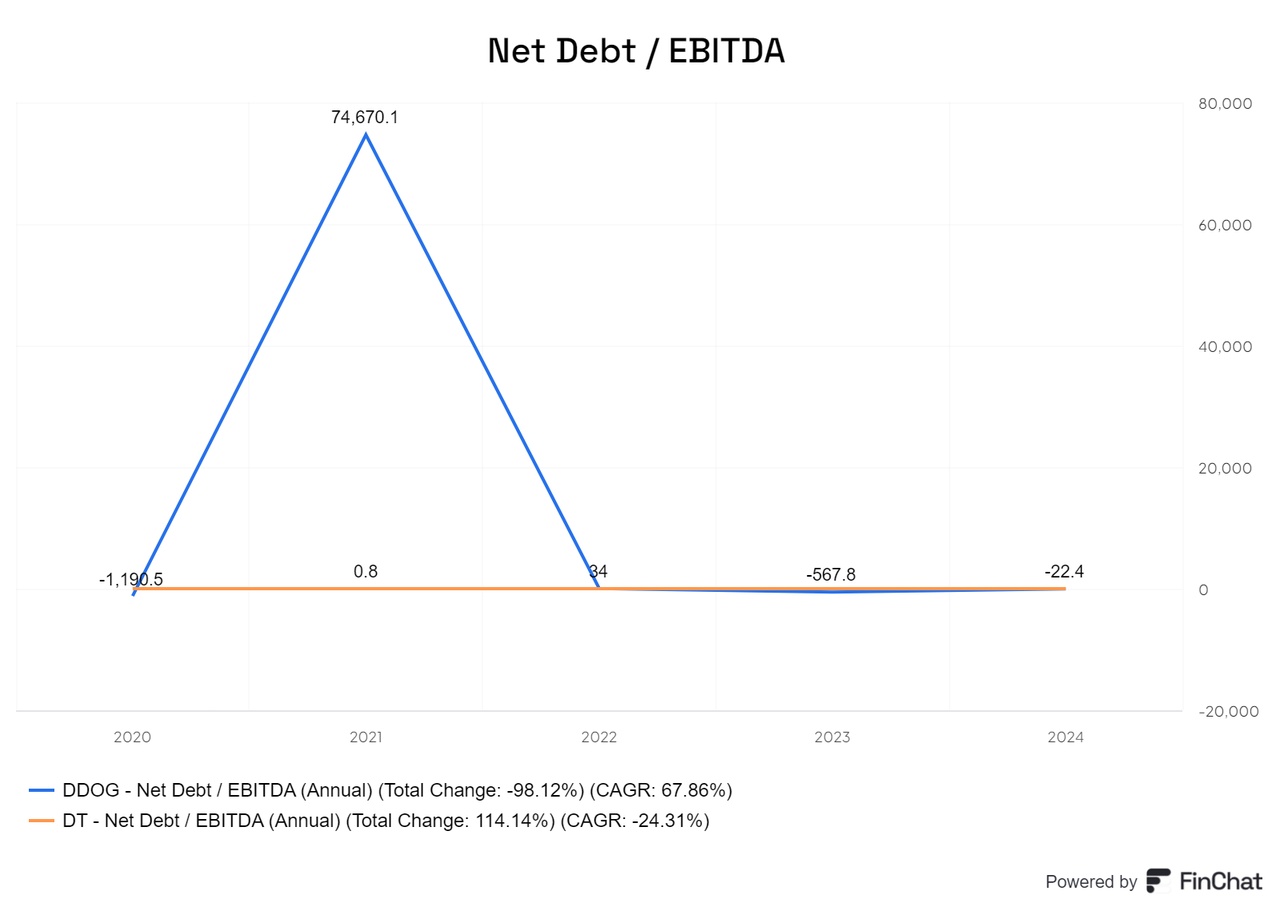

The net debt / EBITDA is negative for both, but even better for datadog

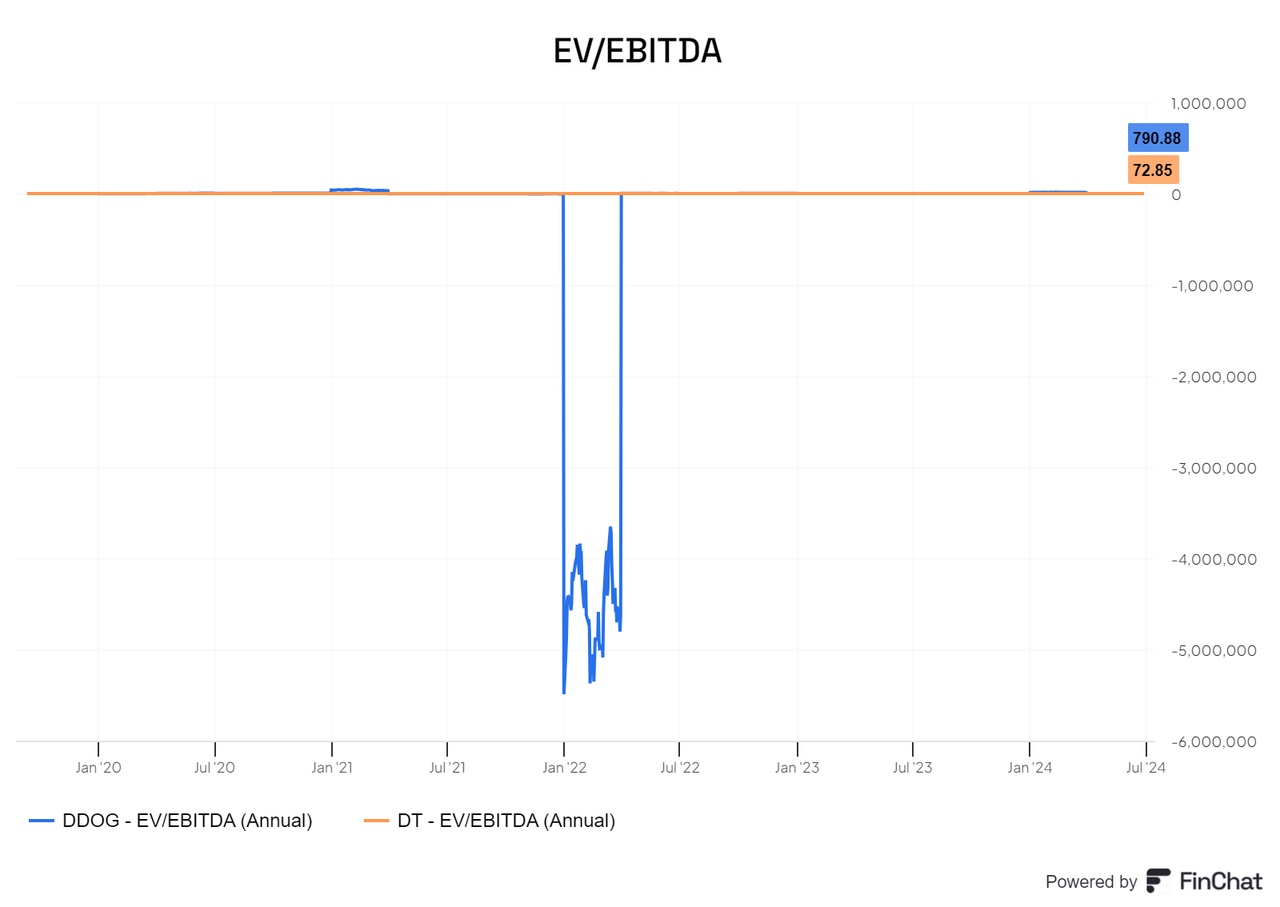

According to the EV/EBITDA multiple (Enterprise Value to EBITDA), Dynatrace is currently more attractively valued than Datadog, but in this case the attractiveness of Dynatrace according to EV/EBITDA is less meaningful in the current comparison. This is due to the fact that both companies are in different growth phases and with different strategic priorities. Datadog is investing aggressively in growth and expansion, which leads to a higher EV/EBITDA multiple, while Dynatrace is pursuing a more profitability-oriented approach and thus appears more attractive in this ratio.

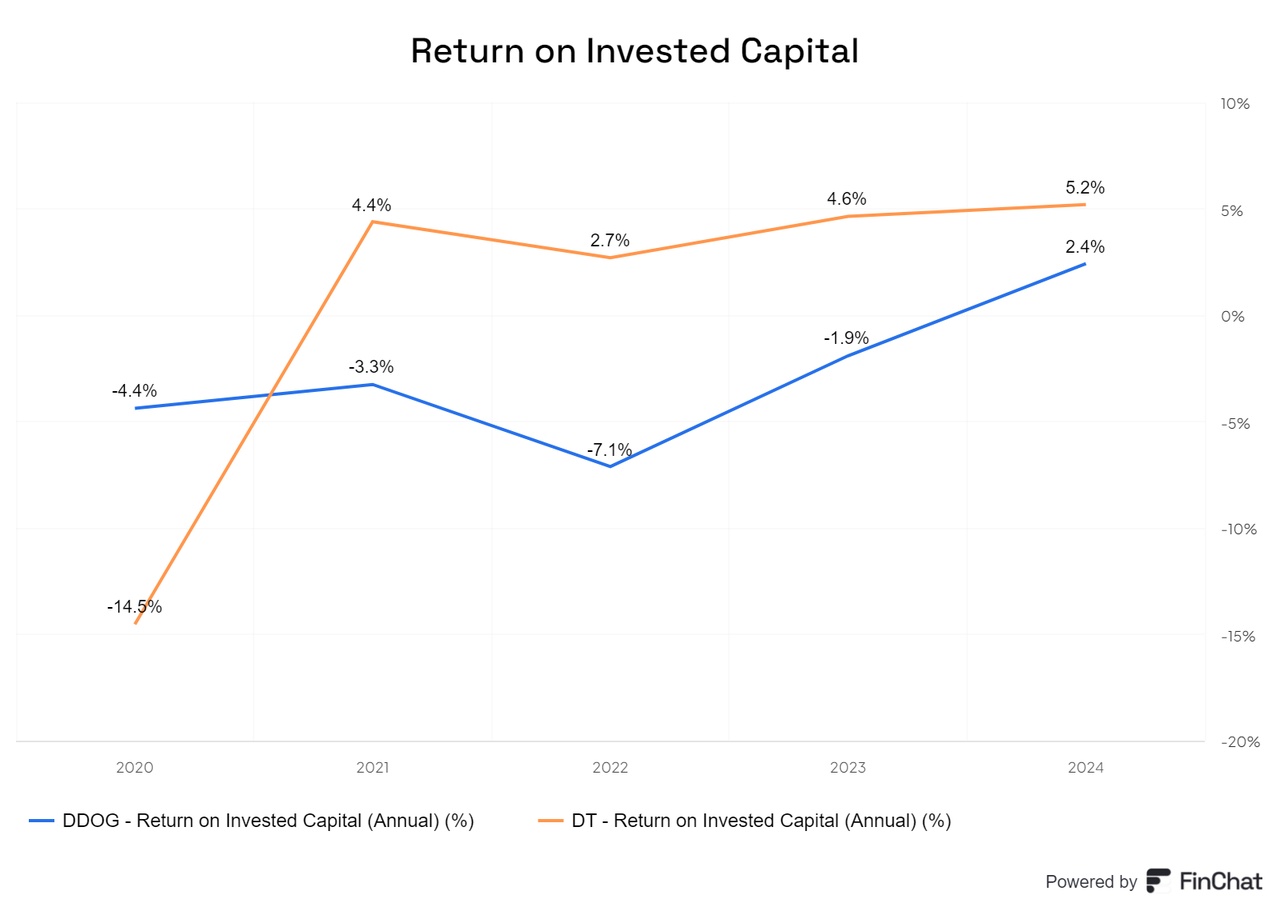

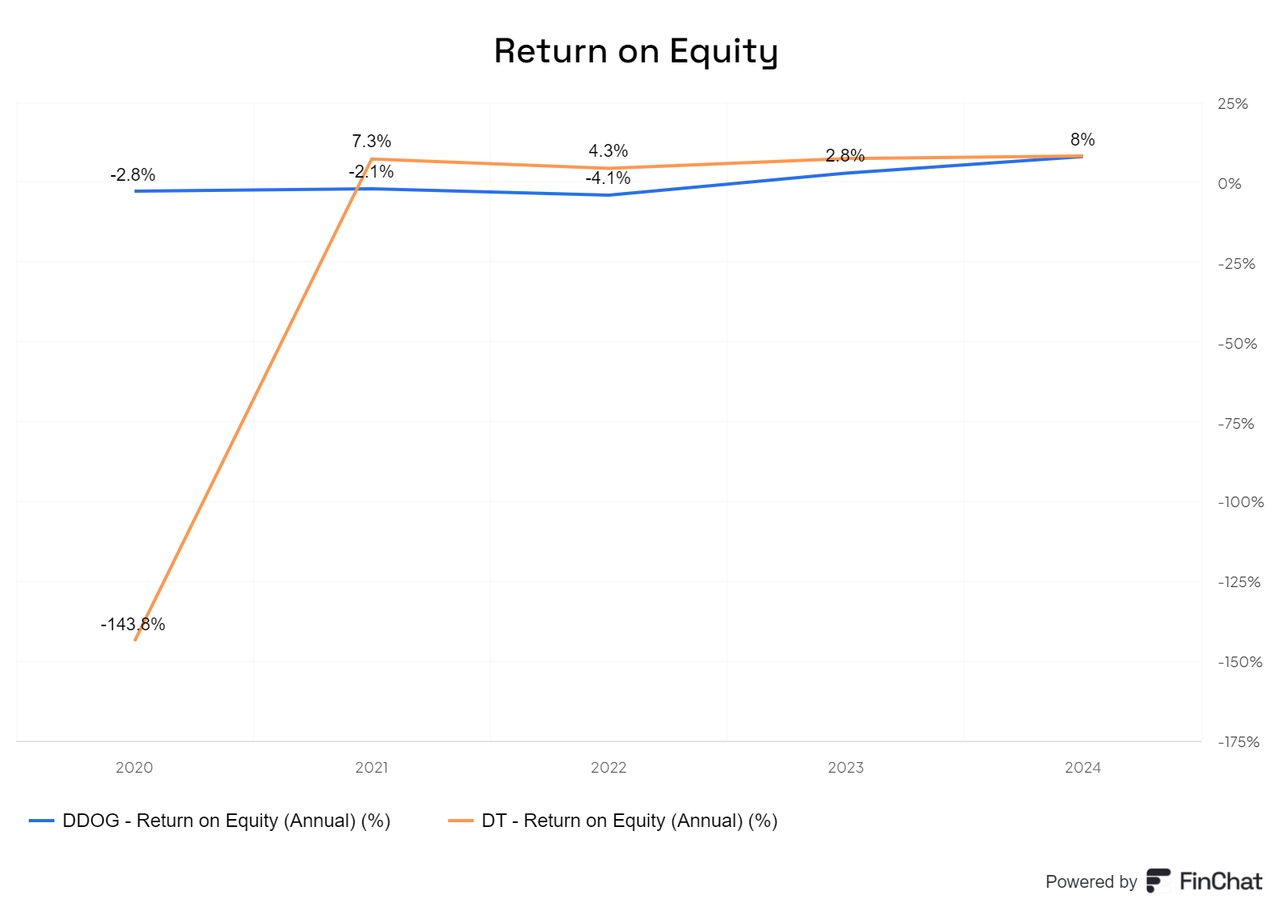

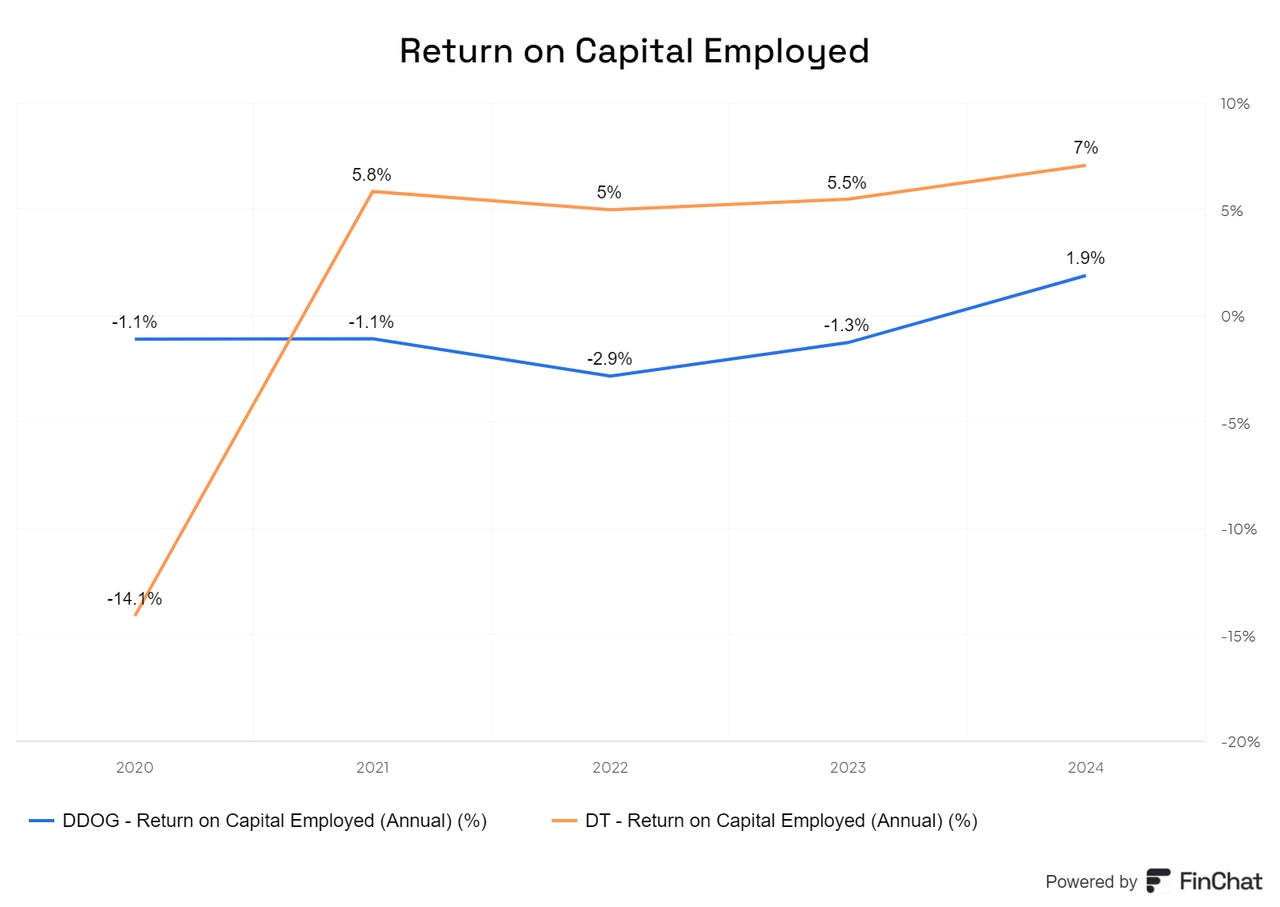

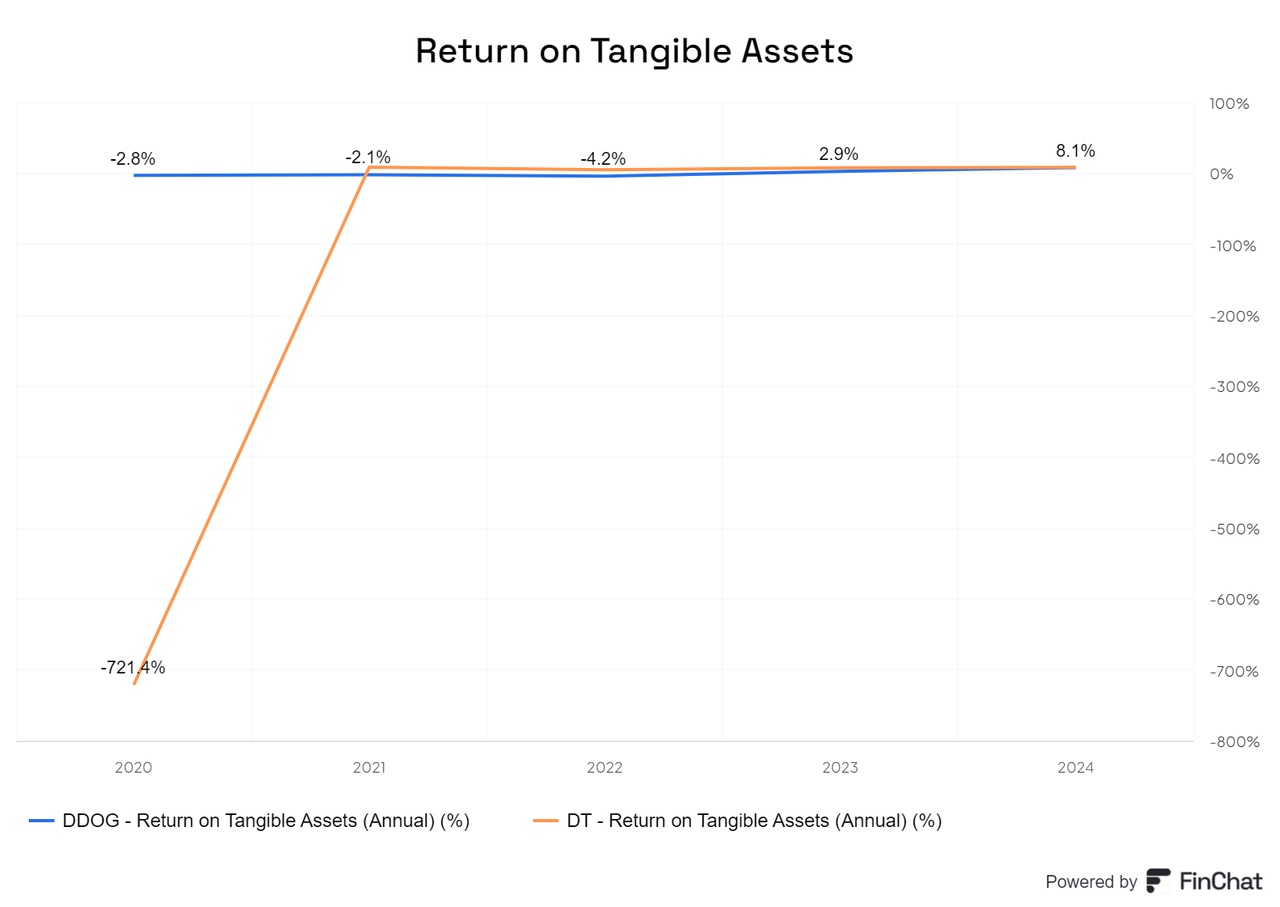

In terms of capital efficiency, Dynatrace has performed much better in the recent past. The company has apparently been able to utilize its resources more effectively and achieve a better return on capital employed. However, capital efficiency has not yet been the main focus for either company.

If both companies were to focus more on optimizing their capital efficiency, it is likely that Datadog would end up outperforming due to its faster growth momentum and market strategy to date. Datadog has shown that it is willing to invest in its future development to further extend its market leadership. If the company combines this growth strategy with a stronger focus on capital efficiency, it could further consolidate its position.

Therefore, one should not yet attach too much importance to current capital efficiency.

Conclusion

Looking at the remaining providers in the observability and cloud monitoring market, it is clear that apart from the large hyperscalers such as $AMZN (-0,51%) , $MSFT (+0,41%) and $GOOGL (-1,26%) which nevertheless need to be mentioned here, only a few specialized companies remain. $SPLK would be very interesting in this context, but is currently in the process of being acquired by Cisco, which is why it is not included in this comparison.

Of the remaining providers, Dynatrace and Datadog stand out in particular. Although the two companies do not offer exactly the same solutions, they have significant overlaps in their service offerings.

Both companies entered the market almost simultaneously and went public at around the same time. Nevertheless, Datadog has developed much more dynamically than Dynatrace since then. The founders of Datadog are still heavily involved in the company and still hold significant shares, which is a sign of long-term confidence in the company and its growth strategy.

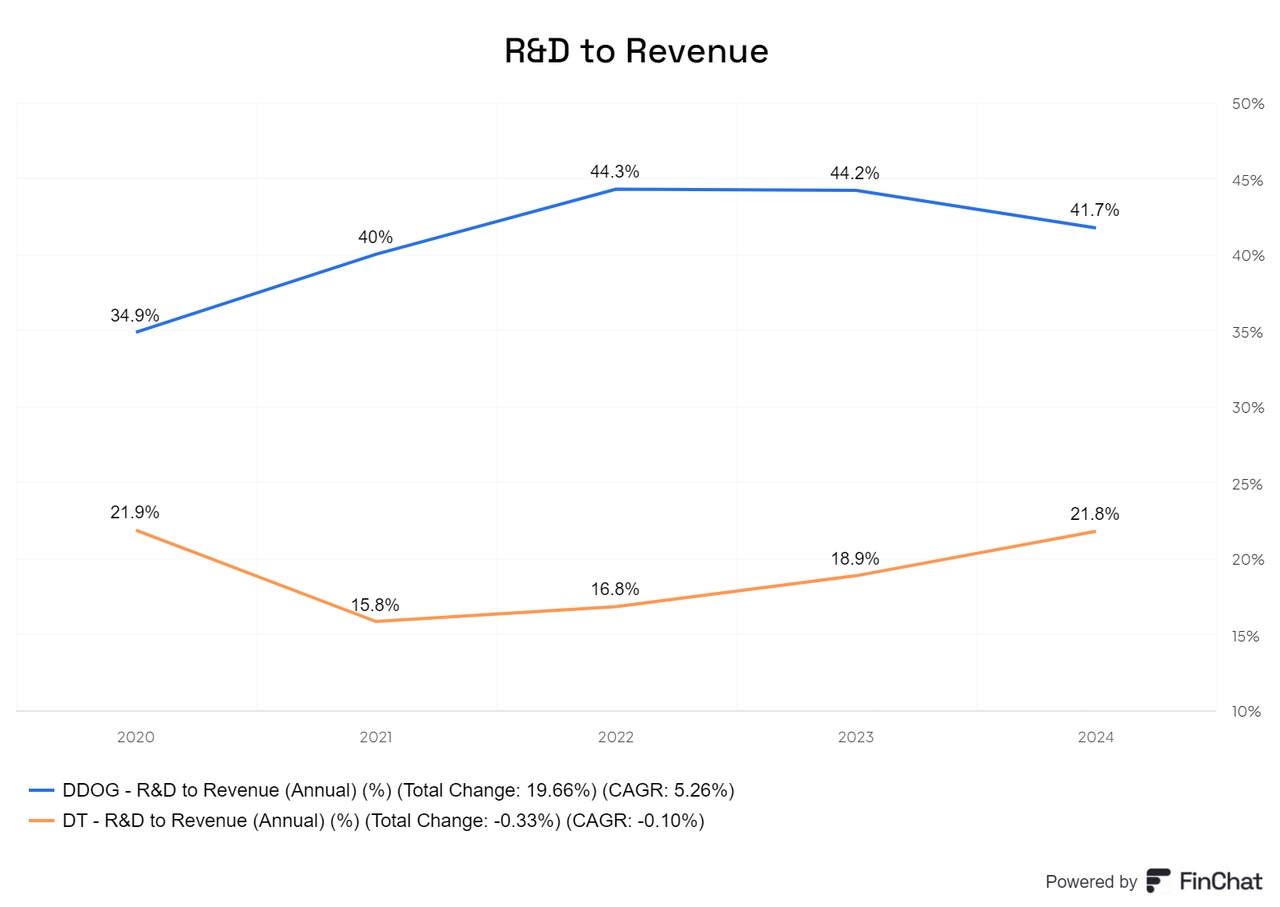

Another decisive argument is Datadog's strong focus on research and development. Datadog invests almost half of its turnover in R&D (Research & Development) in order to continuously improve its products, create more added value for customers and secure and expand its market position. This consistent approach to innovation has already borne fruit and is reflected in the company's impressive growth rate.

Although both companies are on a par in many metrics, I see Datadog as the "Dawg in the house". Another advantage of Datadog is its independence and flexibility, which allows it to focus specifically on its core business - unlike the large hyperscalers, which are less agile due to their extensive and often complex structures.

In addition, many customers value Datadog's independence from the large cloud providers. In a market where hyperscalers already dominate the infrastructure, Datadog's focus on monitoring in the cloud is a convincing differentiation. Customers prefer independent providers that are not dependent on their own strategy and have the expertise to focus on a specific area.

All in all, these factors suggest that Datadog is in a strong position to continue to grow and consolidate its place as market leader, despite the challenges posed by hyperscalers.