Wind power plant expansion in Germany

I have just come from a lecture on building law in which the new Wind Energy Area Requirements Act (WindBG), which will come into force on February 1, 2023, was presented.

This was launched by the Ministry of Economics and has the goal that by the end of 2032 2% of the state's land area in Germany should be used for wind turbines (WEA) on a mandatory basis.

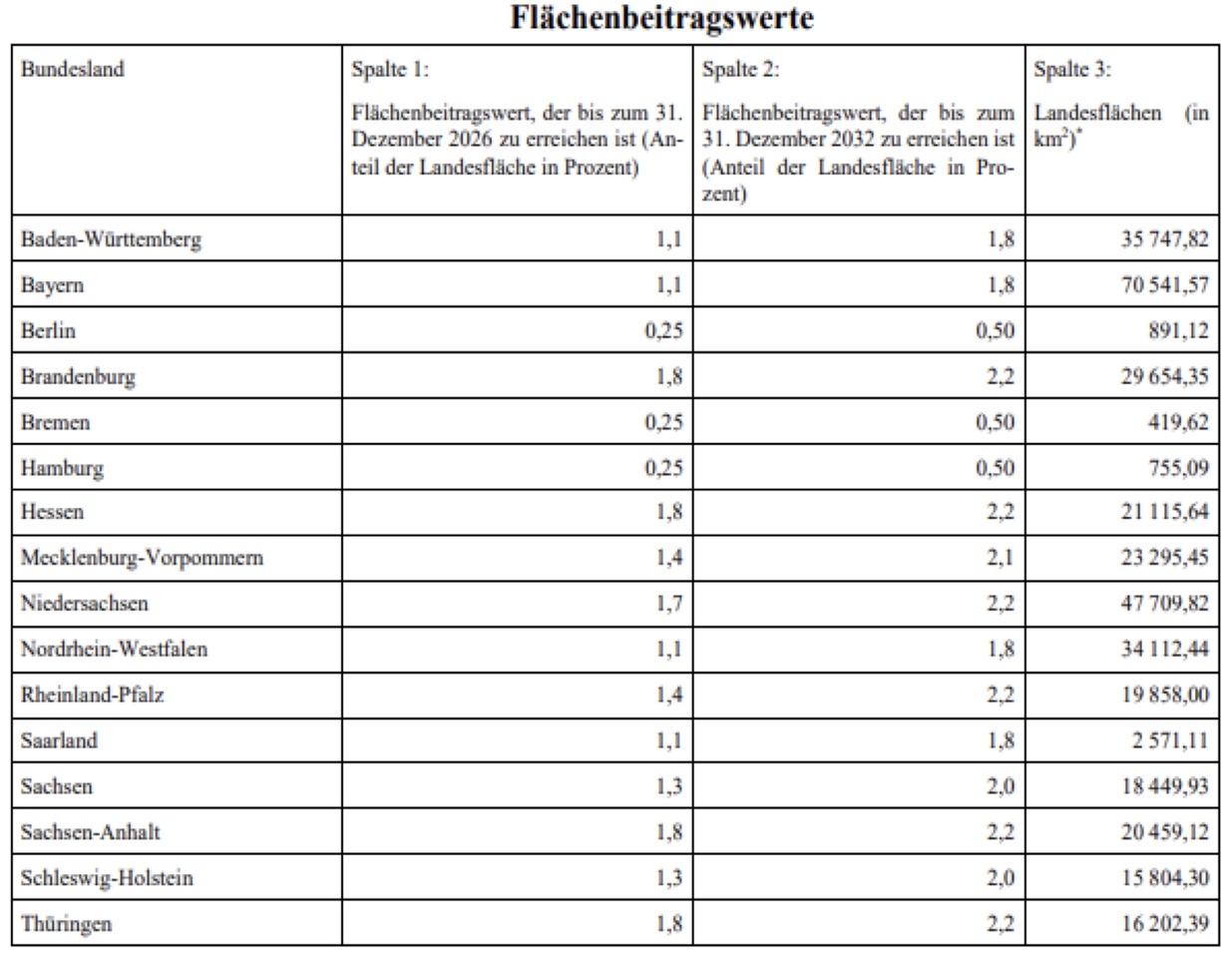

This is regulated individually for each federal state and depends on the area of the state (Table: Contribution parameters).

The current ACTUAL value is unfortunately difficult to determine, as the areas are individually regulated, unfortunately I have not found anything reliable.

From a documentation of the Bundestag from 6.8.2022 shows that according to the Energy Watch Group by 2030 23.903 WTGs will be needed. For this purpose 11.140 new + renewed turbines will be needed.

However, according to the German Wind Energy Association the number of wind turbines depends on many factors, such as the size of the area or the layout of the site. These go in a calculation of a total of approx. 35.000 new WTGs with higher rated power.

Now I asked myself in the lecture which companies there are in the industry and above all which are listed on the stock exchange. (With regard to the expansion in DE)

Spontaneously I thought of Vestas Wind $VWS (+1,93%) of which I have already seen several turbines.

Which companies come to your mind?

Have you already dealt with the topic?

I would be happy about an exciting exchange!

Sources:

- BauGB 52nd edition WindBG

- Documentation of the Bundestag: https://www.bundestag.de/resource/blob/920010/1b3b64814f254ca223d8a9eb85b7ea24/WD-8-062-22-WD-5-101-22-pdf-data.pdf