🚜 Deere: From king of the field to prince of construction? Part 1:https://getqu.in/27HkzI/

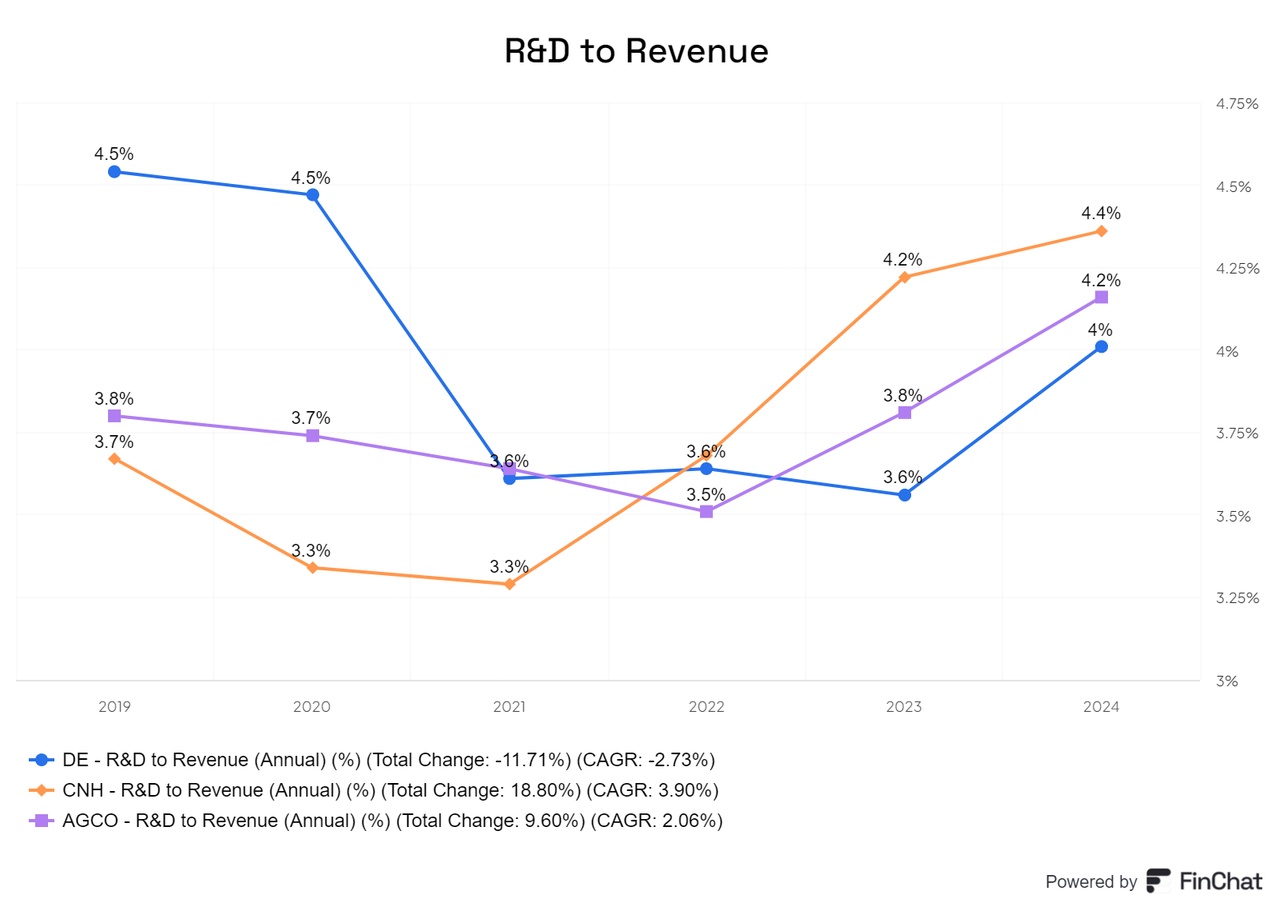

In the area of research and development (R&D) $DE (+0,19%) Although Deere spends slightly less in percentage terms, the company invests the most in this sector in absolute terms.

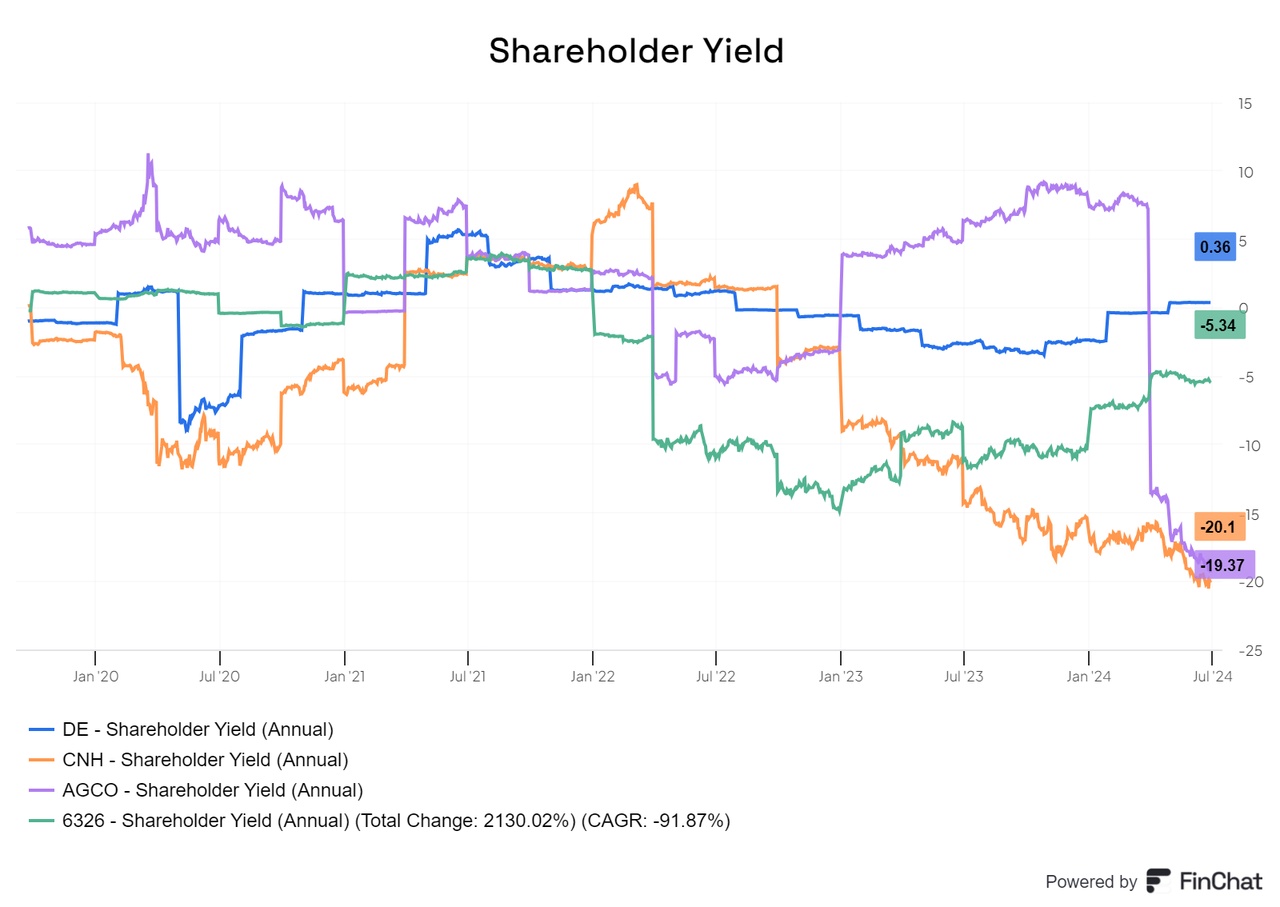

In terms of shareholder yield, Deere offers shareholders the highest and best returns, but these are rather low compared to other sectors.

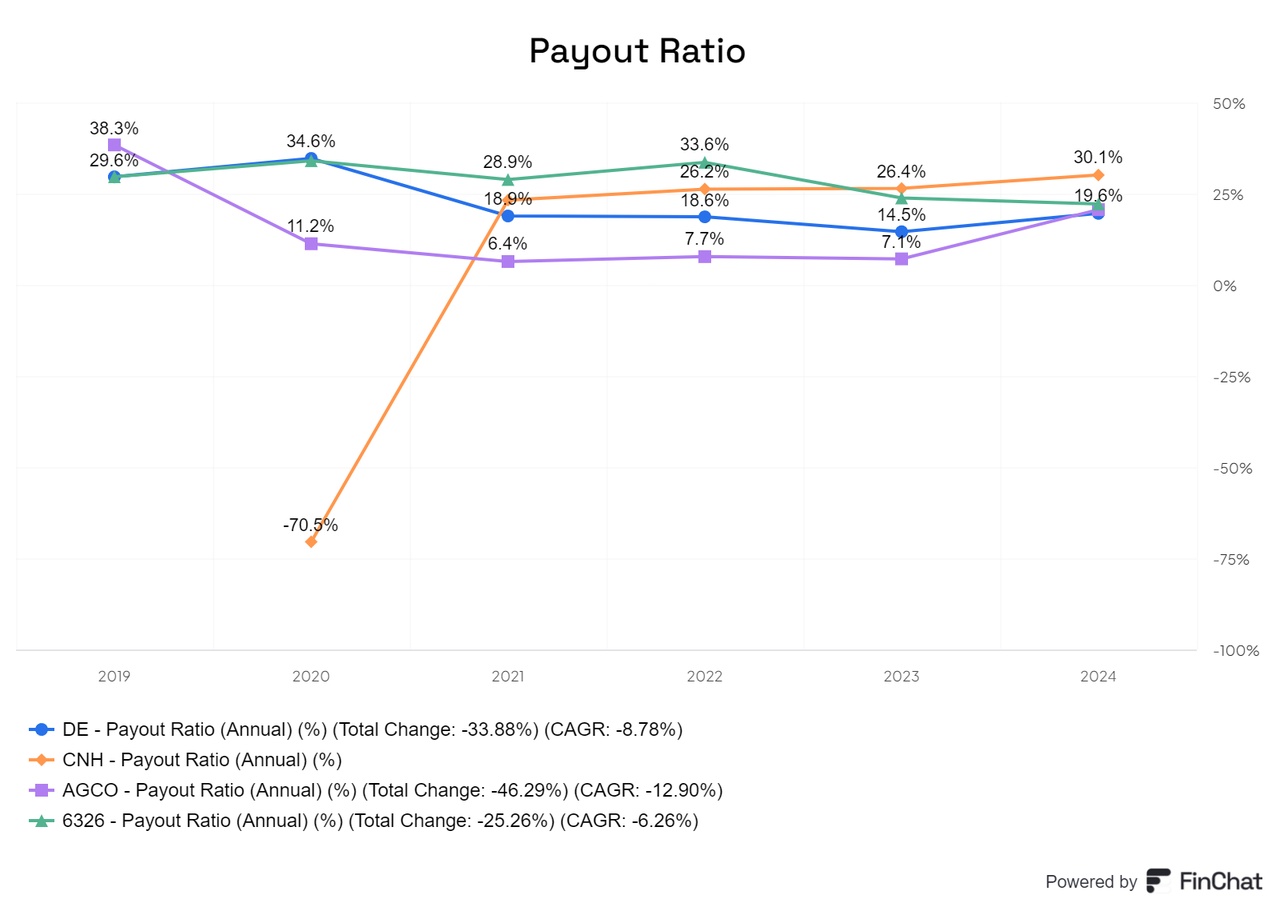

The payout ratio for all is in the green zone.

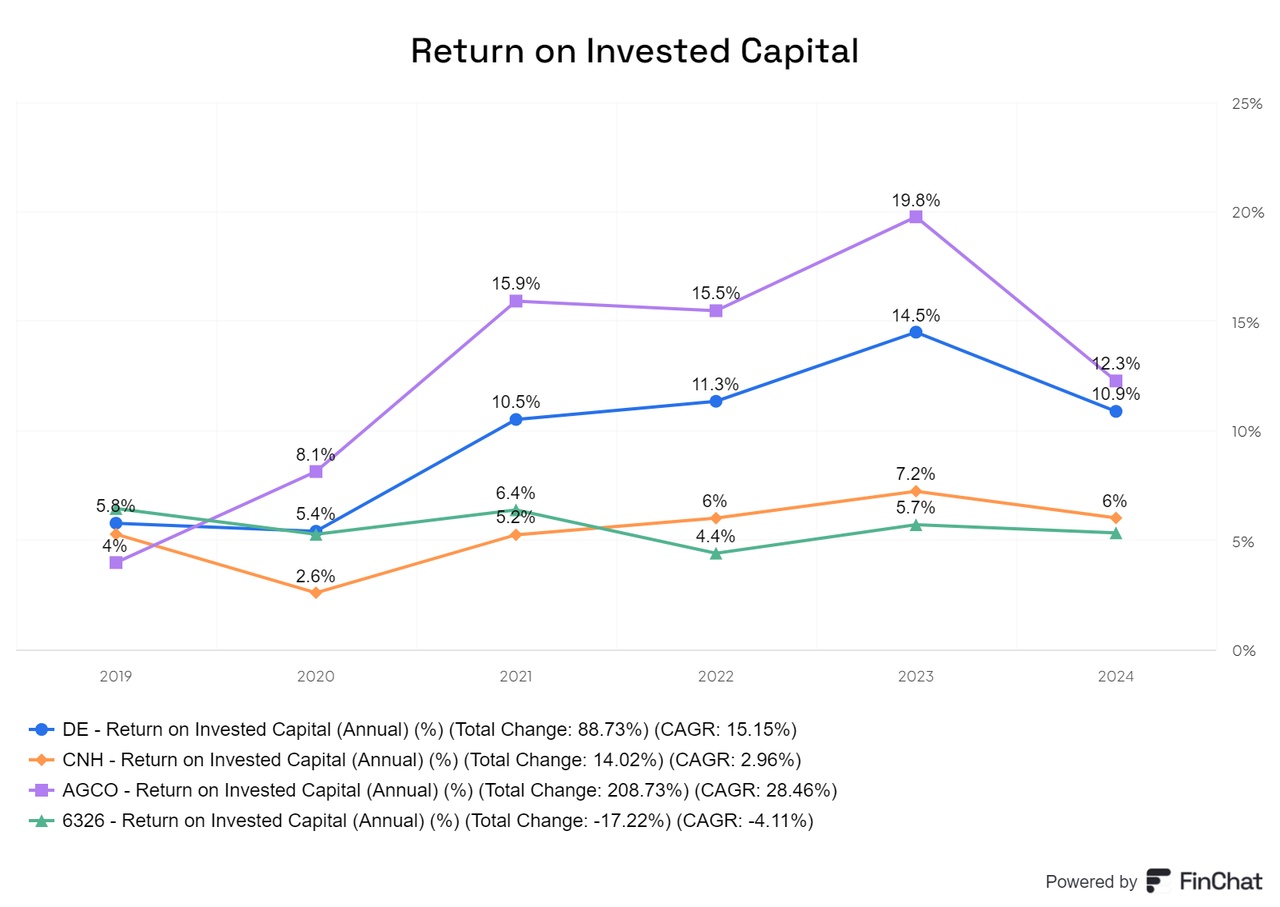

In terms of Return on Invested Capital (ROIC), Deere is behind AGCO, but has a return of over 10%.

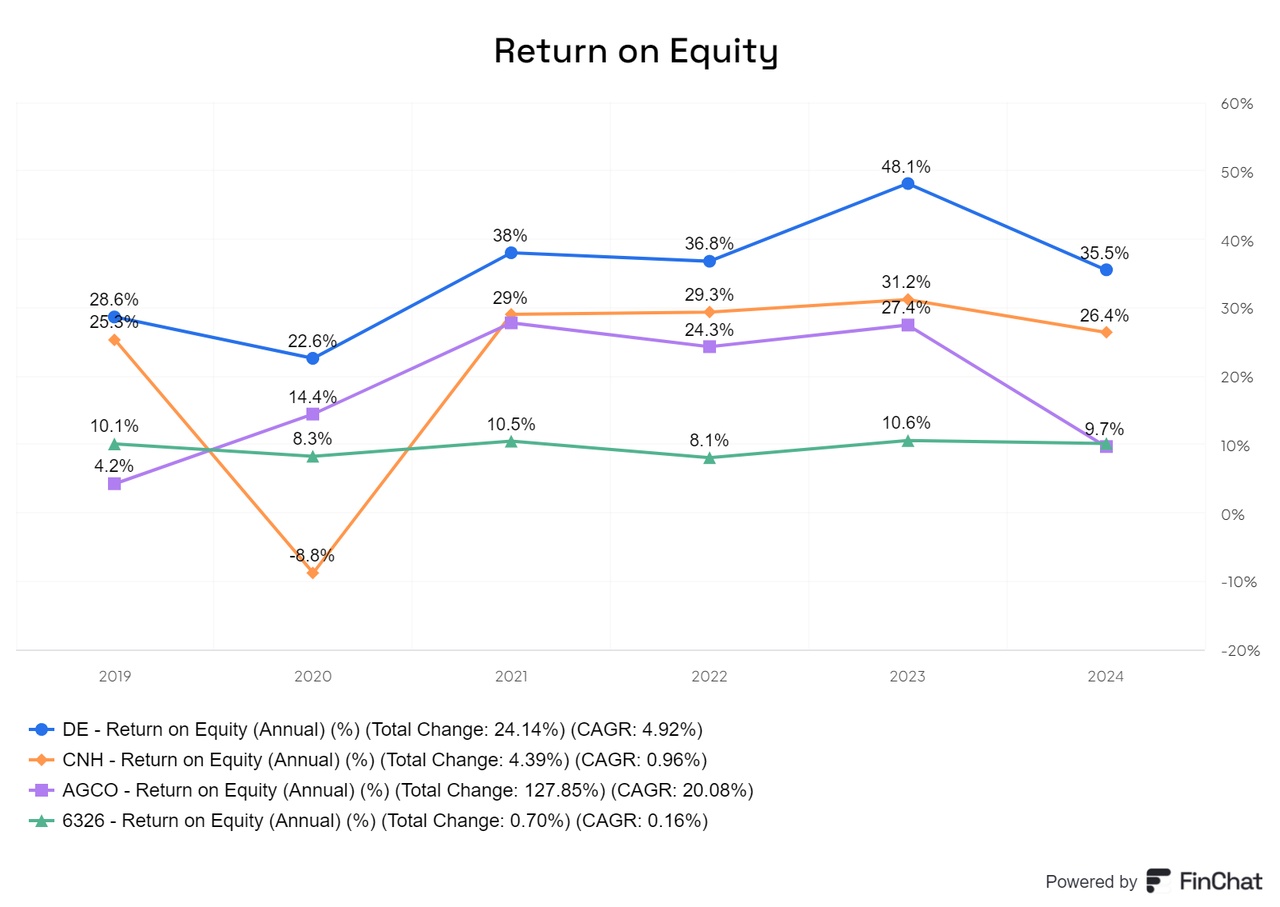

Deere is by far the best positioned company in terms of return on equity (ROE)

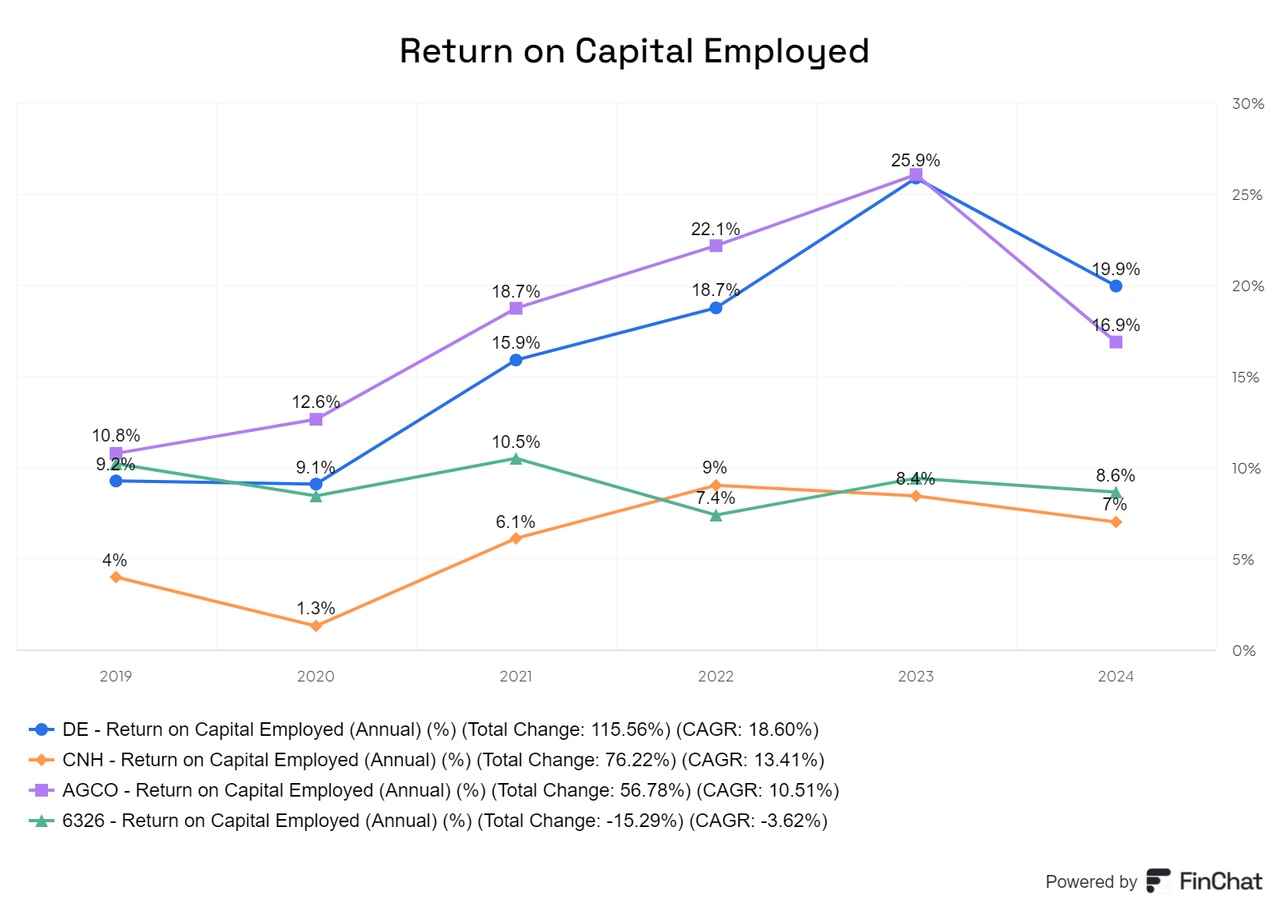

In the area of Return on Capital Employed (ROCE), Deere is also above 10 % and is thus the front runner, just ahead of AGCO. $AGCO (+2,63%) .

Conclusion

Deere has developed extremely well in recent years and is expanding successfully in various areas. The company has a strong brand and can show the best figures in almost all aspects. Looking to the future, Deere is also well positioned and has the opportunity to invest significantly more in the automation of its machines due to increasing margins. Deere is also the market leader in the US, which underlines the company's strong position in a challenging and competitive environment.

Thanks to its solid base in recurring revenue (ARR) and efficient data collection, I see Deere as the most future-proof investment opportunity in its industry. The company is able to finance costs and projects optimally, which brings significant benefits. In addition, Deere remains close to the competition in the area of research and development and does not fall behind.

I bought the shares a few months ago in the hope that Deere will successfully master the change and move ever closer to Caterpillar.

AGCO looks extremely attractive due to its current valuation. However, it remains to be seen whether this is a real bargain or a long-term downward correction, but it could be something for one or two people