Sector Performance & Week in Review | $SPY (+0,01%)

S&P 500 posts weekly loss as hopes for December rate cut fade on robust retail sales and Fed comments

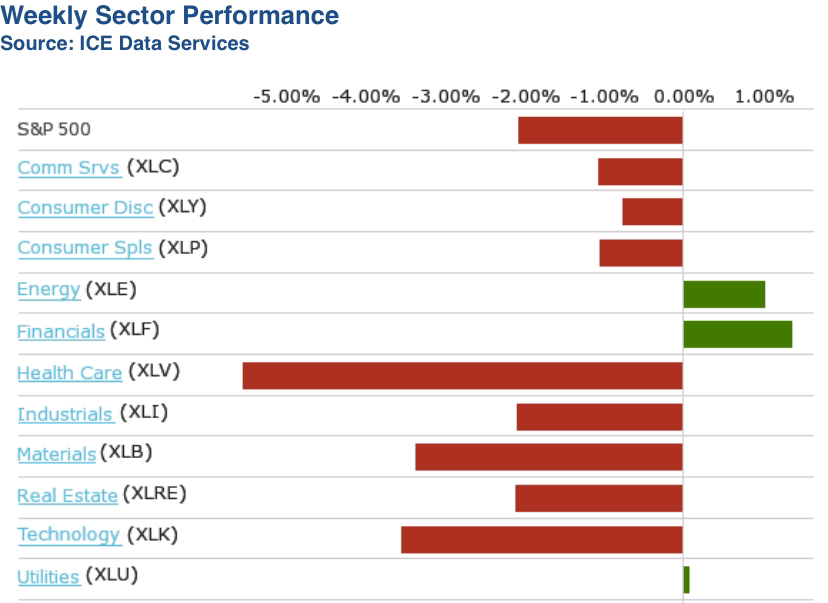

The Standard & Poor's 500 Index fell 2.1% this week as better-than-expected retail sales and comments from Federal Reserve Chairman Jerome Powell dampened expectations of a December rate cut.

The market benchmark closed Friday at 5,870.62 points. Despite the weekly loss, the index is up 2.9% since the beginning of the month thanks to a rally following the US presidential elections and a 25 basis point rate cut by the Fed. The increase for the year 2024 is 23 %.

Data published on Friday showed that retail sales in the US rose more strongly than expected in October, supported by an increase in car purchases. At the same time, the figure for September was revised upwards. The report further lowered expectations for a rate cut, especially after Powell's statement that "the economy is not sending signals that should lead us to cut rates quickly".

Sector Performance:

Healthcare stocks led the broad decline with a 5.5% drop, followed by a 3.3% decline in materials and a 3.2% drop in technology. Industrials, real estate and communication services also recorded losses of over 2% each.

The healthcare sector was weighed down by concerns over President-elect Donald Trump's nomination of Robert F. Kennedy Jr. as Secretary of Health and Human Services, as Kennedy is a known critic of vaccination. Shares of vaccine maker Moderna (MRNA) posted the biggest percentage drop in the sector, falling 21%.

In the materials sector, shares of Celanese (CE) fell 13% after analysts from BMO Capital and UBS downgraded the stock due to weaker-than-expected third-quarter results and fourth-quarter guidance.

In the technology sector, shares of Super Micro Computer (SMCI) plunged 24% after the company announced that it would not be able to file its quarterly report on time due to an internal review process.

Only two sectors posted weekly gains: Financials rose 1.4%, while energy gained 0.6%.

Outlook:

Several reports on the housing market are expected in the coming week, including the November builder sentiment barometer on Monday, housing starts and permits for October on Tuesday and existing home sales on Thursday. The final November consumer confidence reading will be released on Friday.