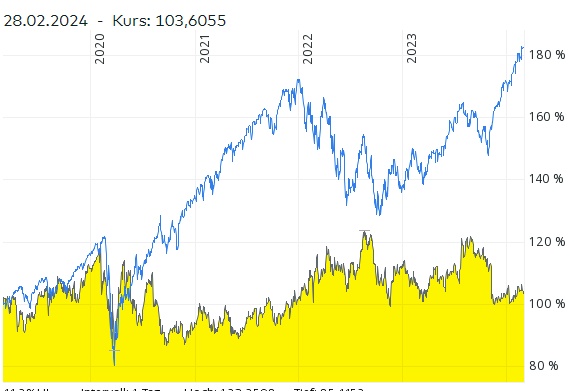

🚀💔 Sometimes paths part ... After a long journey with $BDX (+0,06%) since 2019, I have decided to say goodbye today. Despite the hope of shining with the strong pricing power and excellent customer access and outperforming the S&P500, I fell short of my expectations. $BDX (+0,06%) fell short of my expectations.

📉 A look back shows: EPS growth of just 6.08% over the last 5 years - not what I had hoped for. The current valuations are also too high for a company without real growth.

TTM (Trailing 12 Months)

P/E RATIO (P/E): 55

CCV (P/FCF): 26.31

NTM (Next 12 Months)

KGV (P/E): 18.06

KCV (P/FCF): 18.77

🔍📊 In the appendix you will find a visual comparison of $BDX (+0,06%) vs. $VUSA (-0,28%) (S&P 500 ETF) - a picture is worth a thousand words.

💡 Lesson learned and let's move on! What are your experiences with other investments that didn't perform as expected? Do you wait and see or do you sell?