Raiffeisen Bank International ($RBI (+0,31%) ) canceled its planned sale of high-risk AT1 bonds on Wednesday after a "negative market reaction" to a report that the US was putting pressure on the bank over a deal with Russian oligarch Oleg Deripaska.

RBI HAS participated in the issuance of additional Tier 1 bonds in the amount of 650 million euros with a demand of more than 1.6 billion euros from investors.

But hours before the bonds were to be priced, Raiffeisen withdrew the offer, citing the Reuters article that Washington is putting pressure on the bank to complete a complex and controversial €1.5 billion asset swap with Deripaska to drop. This is a deal that would allow the bank to repatriate profits from Russia.

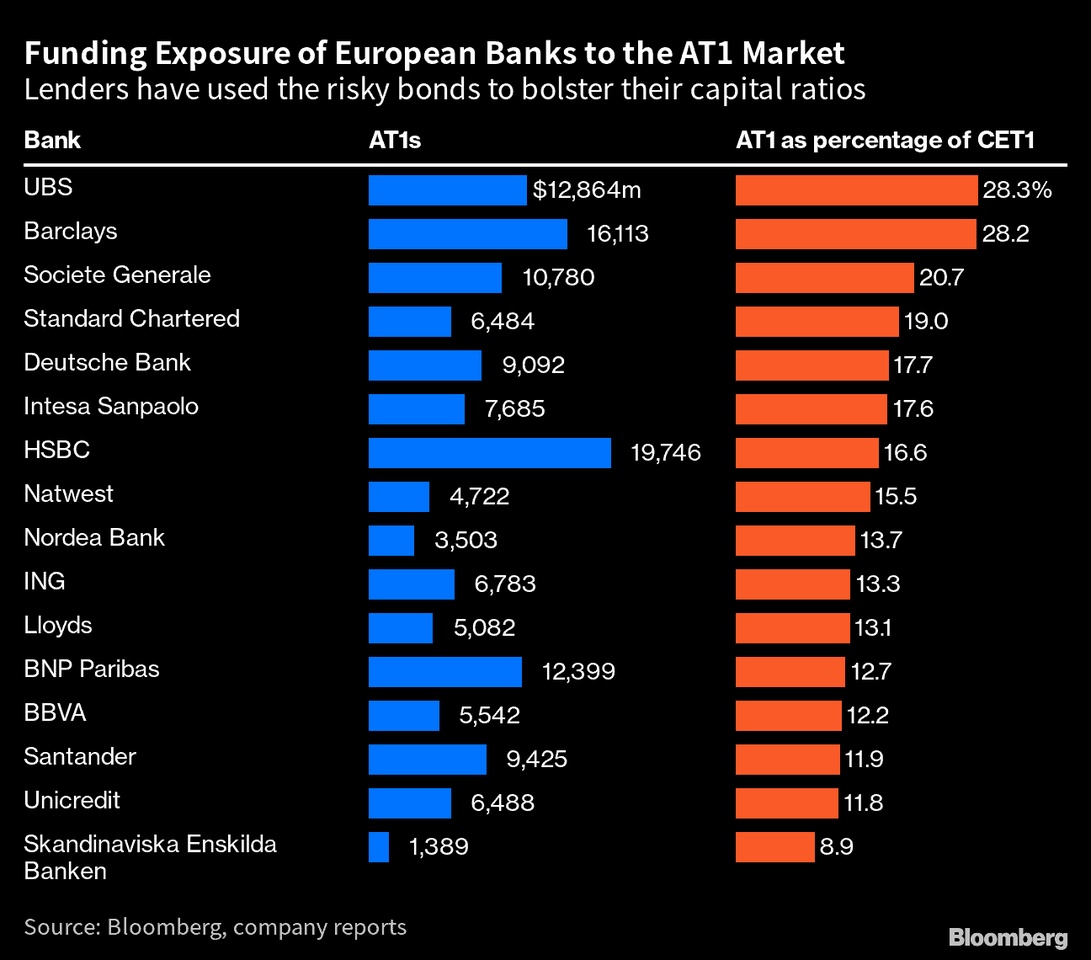

The strong demand for AT1 bonds on the market is due to the insolvency of Credit Suisse ($n/a ). At the time, the regulatory authorities released 17 billion US dollars in Credit Suisse Bonds defaulted.

Raiffeisen is currently the largest European lender still active in Russia and has made enormous profits since the start of the war in Ukraine. Last year, almost half of the half of its profits came from its Russia division, but these have been frozen by the Kremlin.