Why I am currently bearish on the market, a report.

1. macroeconomic environment

US exceptionalism: dominance and risks

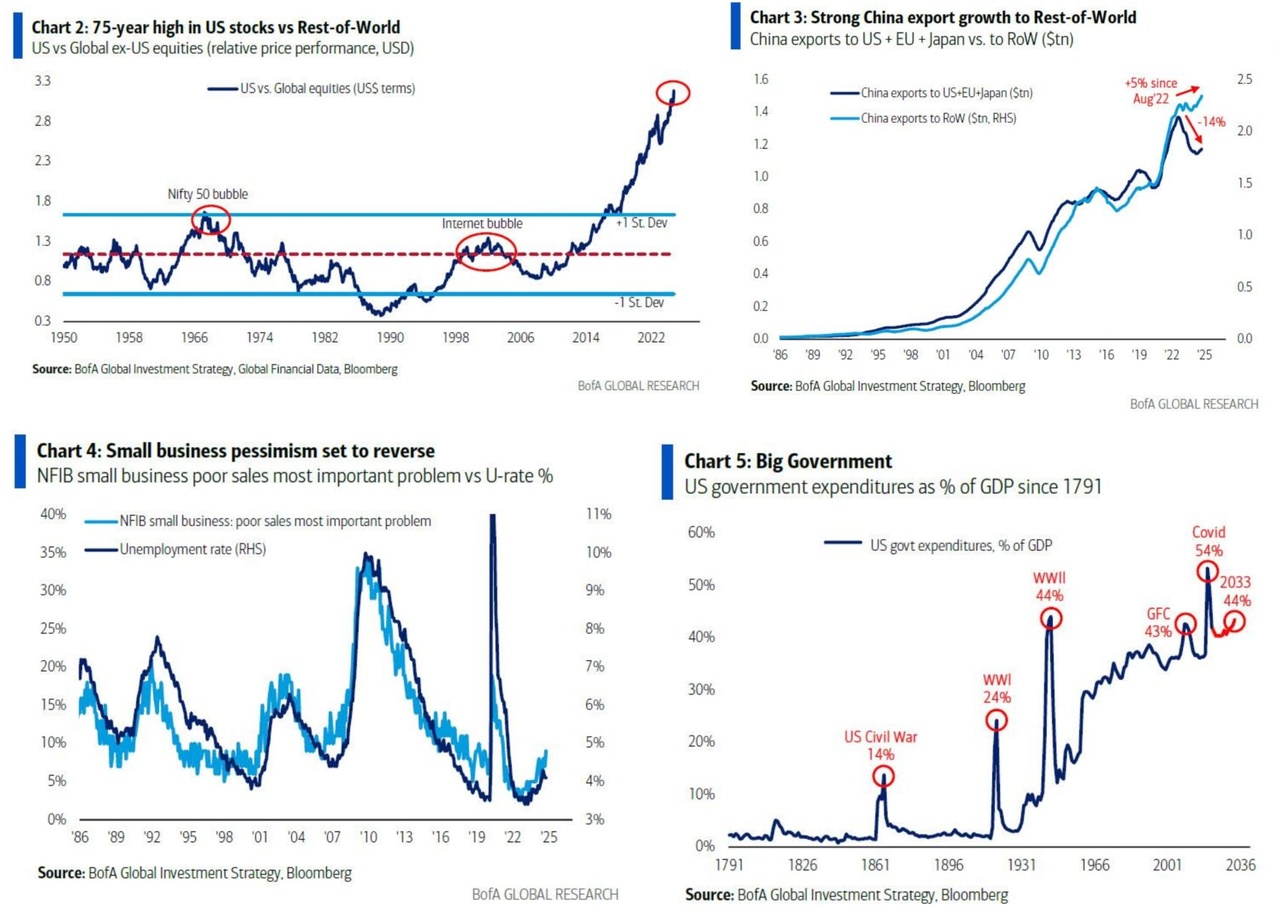

- US market at all-time highs:

- S&P 500 and other indices are at a 75 year high compared to the rest of the world. This is based on strong macroeconomic fundamentals, the attractiveness of the US market and a high risk appetite among investors.

- Problematic strengthSuch a level could indicate overvaluation. Any weakness in the US growth data could trigger an abrupt correction.

- Record high US dollar:

- The US dollar is at a 55 year high in the real effective exchange rate (REER). (The REER measures the competitiveness of a currency against the currencies of its major trading partners, taking into account inflation and trade volume) This increases the pressure on emerging markets and burdens the competitiveness of US exporters.

- John Connally's paradox ("The dollar is our currency, but your problem"): While a strong dollar is a sign of global confidence in the short term, it creates tensions, especially for countries with high dollar debts. (Argentina, Brazil, Chile, Turkey, India, etc.)

Interest rates and inflation

- Rising interest rates and risks in the credit market:

- Should yields on 3Y US government bonds rise to 5 % (and the 2-year to 4.5 %), financing conditions could deteriorate sharply. This would particularly affect credit-dependent sectors such as small capsemerging markets and corporate bonds.

- Financials (KBE)Banks may initially benefit from higher interest rates, but could collapse if financing conditions deteriorate. financing conditions become excessively restrictive. KBE stands for Credit-Bank ExposuresThis refers to the loans and financing that banks grant to companies or other institutions.

- US financial conditions are tightening:

- With expectations of interest rate cuts by the FED canceled and long-term yields rising (even without political measures), the first "cracks" in liquidity are appearing:

- Gold: Outflows of -1.6 bn $.

- EM Equities: Strong sell-off.

- Risk parity strategies: Vulnerable to volatility

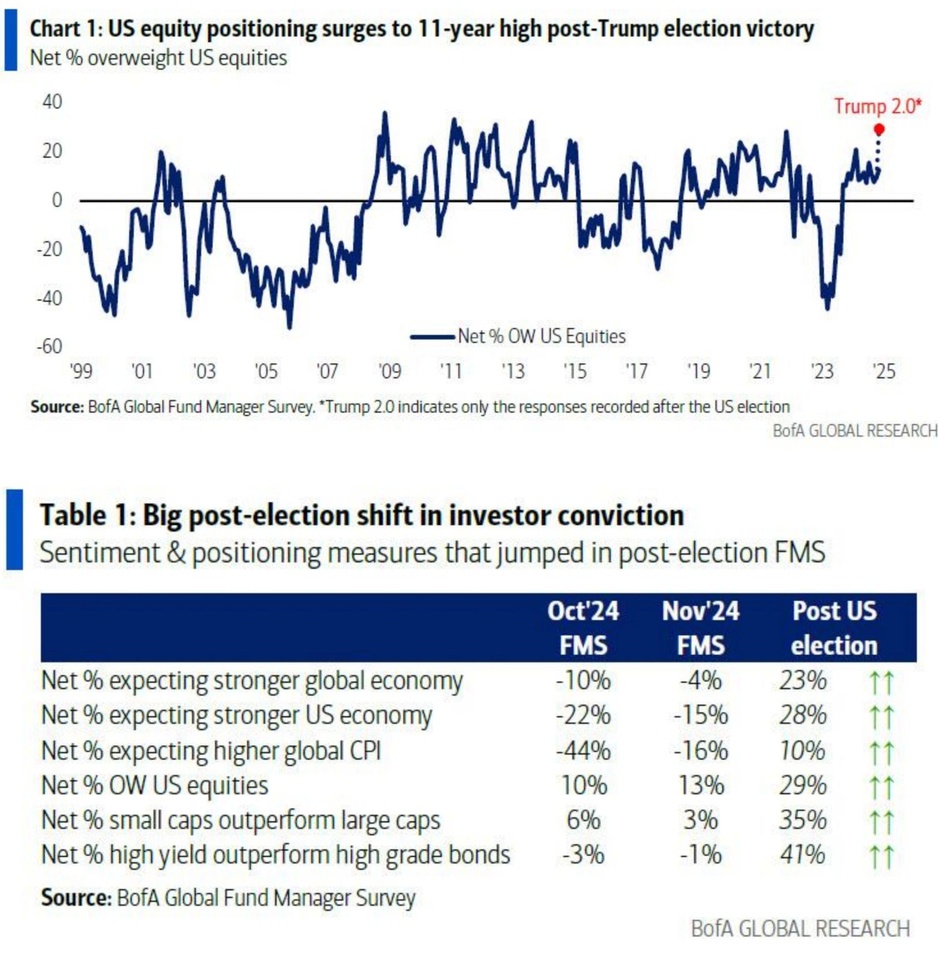

Trump 2.0 and his radical policies

- The return of a "Trump-like" approach could move markets sharply:

- Positive in the short term: Tax cuts, infrastructure programs and protectionist measures could boost growth and investment in the US in the short term.

- Negative in the long termTrade wars, higher tariffs and global decoupling could weigh on growth worldwide.

- You can find out more on my account

2. market movements and financing conditions

US equity markets

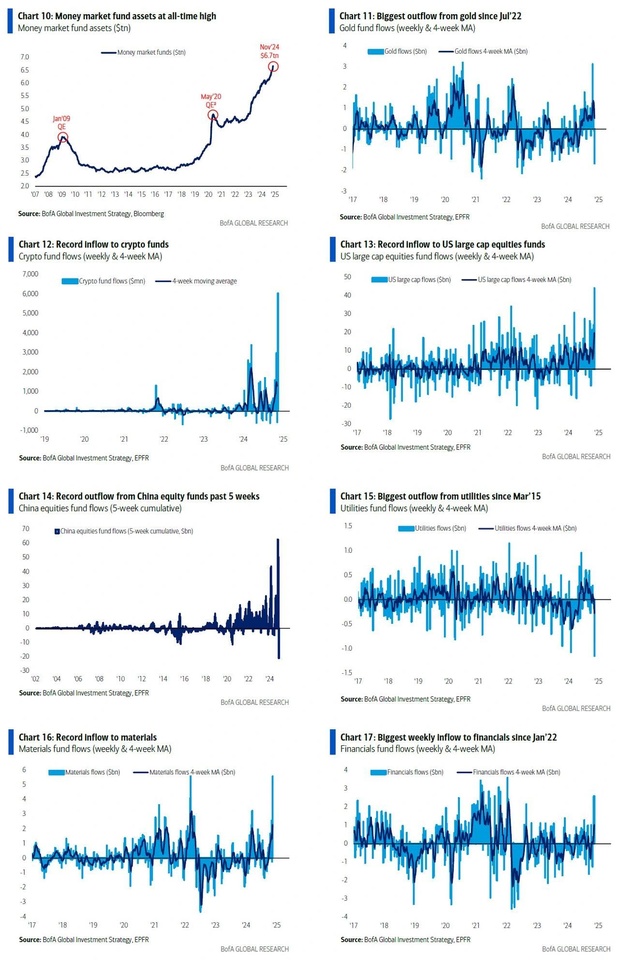

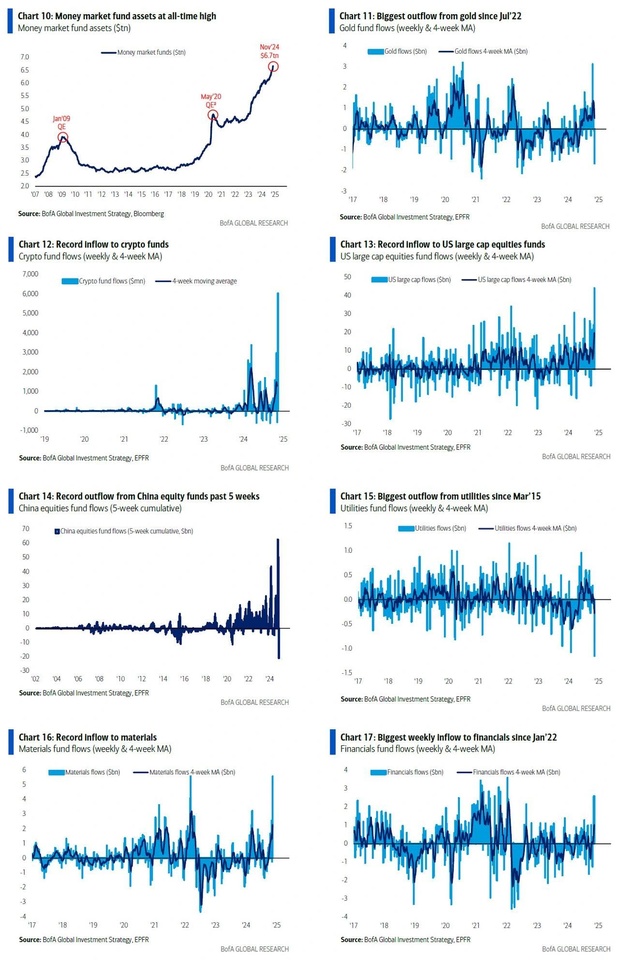

- Massive capital inflowsUS equities are seeing the largest inflows since March 2024 (+$55.8bn), with records in large caps (+$44.1bn) and a focus on small caps (+$6.7bn).

- Sector-specific trends:

- Materials (+$5.6bn)Investors expect infrastructure programs and investments in the real economy.

- Financials (+$2.6 billion)Banks benefit from higher interest rates, but could suffer from rising defaults or recession risks.

Gold and commodities

- GoldOutflows of -1.6 bn $ show a clear move away from "safe havens". This is typical for a phase of risk appetite.

- Commodities and semiconductors:

- Commodity producers benefit from short-term demand due to inventory build-up.

- Semiconductors (SOX back to 200-day line): In particular "blue collar" semiconductors ($STM (+0,45%) , $ON (+1,79%) , $MCHP (+2,04%) ) in particular are suffering from weak global PMIs, which shows their dependence on EM production.

3. global trends and emerging markets

Capital outflows and global disparities

- EM markets: Largest outflows since 2015 (-$7.5bn in one week).

- China under pressure:

- Record outflows (-$21.1bn over 5 weeks) point to a confidence deficit.

- Macroeconomic challengesWeak growth, real estate crisis, capital controls.

- Geopolitical tensionsTrade barriers and US sanctions act as an additional burden.

Risk of a global recession

- EAFE (Europe, Australasia, and Far East) (-8 %) and India (-10 %) under pressure:

- Weaker economic data and capital outflows signal growing global fears of recession.

- Emerging markets in crisis:

- Weaker currencies and rising dollar costs are making it difficult for countries such as Brazil, Argentina and Turkey to refinance their debt.

4. capital flows and investment strategies

Fund Flow Highlights:

- Cryptoinflows of $6 billion reflect the willingness to invest in alternative assets.

- Bank Loansinflows of $2.1bn show an increase in riskier credit strategies.

- EM: Outflows from equities (-$7.5bn) and bonds show a clear reduction in risk.

Hennington Research Approach:

- US positioning:

- Favored large caps and materials short term as long as the US economy is supported.

- Reconsider exposure to small caps as they are vulnerable to interest rate changes.

- Avoid emerging markets:

- Capital outflows and dollar weakness continue to weigh on these markets.

- Monitor yield risks:

- A breach of 5% in 30-year Treasuries could mark a turning point. Watch bond markets at all times.