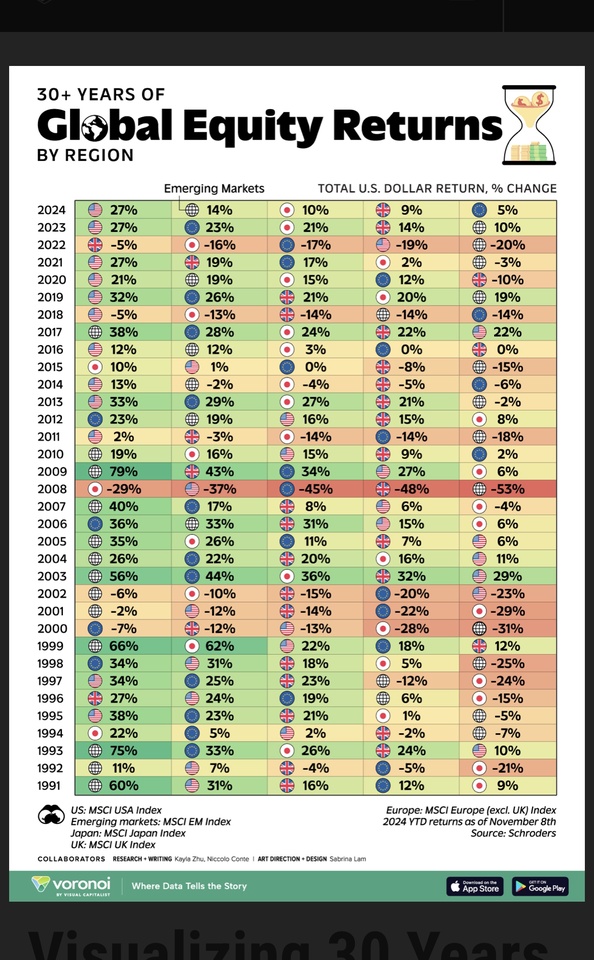

- The U.S. has been the dominant global equity market as the top returning region for 10 years out of the past 15, when including 2024 year-to-date performance.

- In the period before that, emerging markets were the best-returning region, providing the best returns 12 years in the two decades spanning 1991 to 2010.

- Between 2001 to 2010, the MSCI Emerging Market Index , composed of equities from countries like China, Taiwan, India, Brazil, and South Korea, posted robust returns of 15.9%, significantly outperforming developed market stocks over the same period. However, since 2011, emerging market equities have seen just 0.9% in annualized returns.

- The biggest period of underperformance for U.S. equities was after the dot-com bubble crash.

- From 2002 to 2005, the U.S. was the worst-returning region in terms of equities, with 2002 seeing the worst return ever for U.S. equities at -23%.

- Europe’s returns have been less volatile than emerging markets, with fewer extreme highs and lows. However, the region has often underperformed U.S. equities, particularly in recent years. European markets have experienced a strong rebound so far in 2024, driven by easing energy concerns and resiliente consumer spending.

$CSPX (+0,1%)

$VUSA (+0,08%)

$EIMI (+0,05%)

$XMME (-0,18%)

$SMEA (+0,43%)