𝗴𝗲𝘁𝗾𝘂𝗶𝗻 𝗗𝗮𝗶𝗹𝘆 𝗦𝘂𝗺𝗺𝗮𝗿𝘆 01.07.2022

Hello getquin!

New month, new luck, new market news. Topics today will be the purchase of a German startup, the most likely intervening interest rate hike, and Gazprom's unpaid dividends. Lets jump straight in:

𝗘𝘂𝗿𝗼𝗽𝗲 🌍:

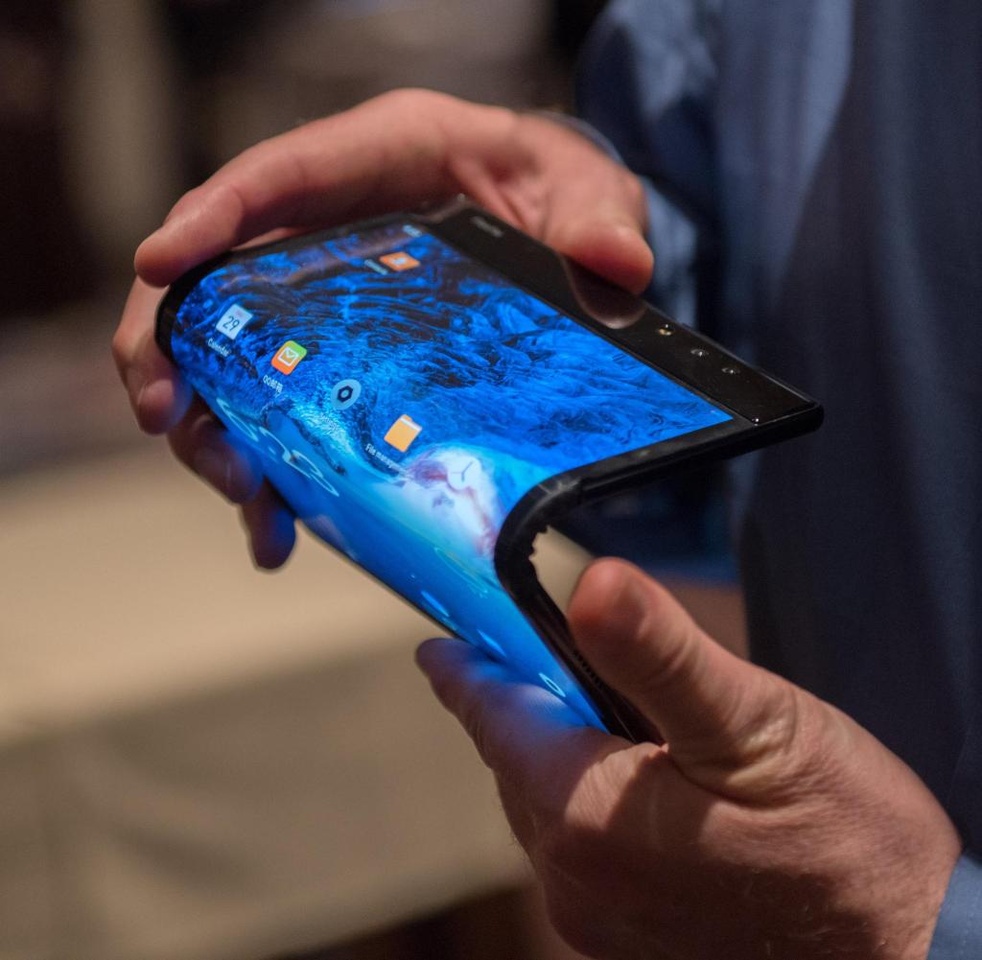

Samsung buys German startup Cynora

Yesterday noon it was announced that Samsung had acquired the German startup Cynora, which specializes in improving OLED displays and foldable displays, for $300 million USD. Cynora has patented many of their ideas involving foldable smartphone technology, which is a key reason for Samsungs interest, as they have been developing foldable smartphones since 2018 but have been criticized for their lack in quality. Samsung was much less interested in Cynora's employees than the company and its employees, as most of them have already been laid off or will be. It is not yet certain if all employees will be laid off, but its not looking good.

More here: https://bit.ly/3yxFj5T

🟥 $SMSD (-1,21%) Samsung (🔽 -1.40%)

𝗔𝘀𝗶𝗮 🌏:

Gazprom shares slump after dividend cancellation

The Russian state-owned company Gazprom had to return large parts of their 2021 profit to the Russian government due to the shortage of money in Russia. This now means that they could not pay their dividends. This is the first time that this has happened to the company since 1998. Family Sadygov, Gazprom's deputy CEO, said in an interview that it would be "not opportune" to "pay out" the dividends based on 2021 results. In almost direct response to this, the price of Gazprom shares plummeted by about a quarter.

For more insights here: https://cnb.cx/3nw5XGb

🟥 $OGZD Gazprom (🔽 -11.01%)

𝗦𝗽𝗲𝗰𝗶𝗮𝗹:

First rate-hike in 11 years

The increase in the key interest rate, which many people expected, is to take effect this July due to the high inflation. The increase will be 0.25 points for the time being, but the key interest rate is expected to rise even further. It will be the first increase in the euro-zone since 11 years, but it was already desired by many people from the ECB under the leadership of Mario Draghi, whose main task was to fight inflation.

What do you guys think about the rate hike?

More about the increased interest rate here: https://bit.ly/3I8mrh7

Stocks of the day:

🟩 TOP $Engie Brasil Ene (🔼 +31.17%)

🟥 FLOP $CYTK (+3,99%) Cytokinetics (🔽 -19.39%)

🟥 Most searched $BAS (-0,12%) BASF, 41.34 (🔽 -0.48%)

🟥 Most traded $BAS (-0,12%) BASF, 41.34 (🔽 -0.48%)

🟥 S&P500, 3,781.00 (🔽 -0.12%)

🟥 DAX, 23,19 (🔽 -0.09%)

🟩 $Bitcoin ₿, (🔼🔽 +0.75%)

Time: 15:30

𝗙𝘂𝗻 𝗙𝗮𝗰𝘁:

Did you know that in Papua New Guinea, people still occasionally make purchases with shells and stones? Do you think this will soon return to Europe? Let us know your thoughts in the comments below as always! 👇