Many users here are rightly enthusiastic about dividend growth ETFs.

The most popular are probably:

Fidelity Global Quality Income $FGEQ (+0,06%) and

WisdomTree Global Quality Dividend Growth $GGRG (+0,04%) / $GGRP (-0,09%)

On extraetf.com and finanzfluss.de you can find these under the investment strategy - dividends.

Which is understandable at first glance, but unfortunately only half the truth.

What you are actually buying here is the quality factor, but this does not appear under Fundamentals / Quality.

What is the quality factor?

The quality factor is part of an investment strategy that selects high-quality companies. The criteria for this factor can be "hard" (e.g. return on equity and free cash flows), but the application of this factor can also be based on "softer" criteria such as the quality of management, corporate governance and market position.

If you want to apply this to an index, you take an investment universe (e.g. the MSCI World) and place one or more filters over it that exclude all stocks that do not meet the criteria.

The remaining stocks can then either be sorted according to market capitalization/balances or other criteria can be added.

Let's take a look at what the target investment objective of the MSCI World Sector Neutral Quality Index is:

"The MSCI World Sector Neutral Quality Index captures large and mid-cap representation across 23 Developed Markets (DM) countries*. The index aims to capture the performance of securities that exhibit stronger quality characteristics relative to their peers within the same GICS® sector by identifying stocks with high quality scores based on three main fundamental variables: high Return-on-Equity (ROE), low leverage and low earnings variability."

In simple terms, this means that as much as possible should flow back to shareholders (through dividends or share buybacks), attention should be paid to sales growth and debt should be low.

These are virtually the prerequisites for sustainable dividend growth.

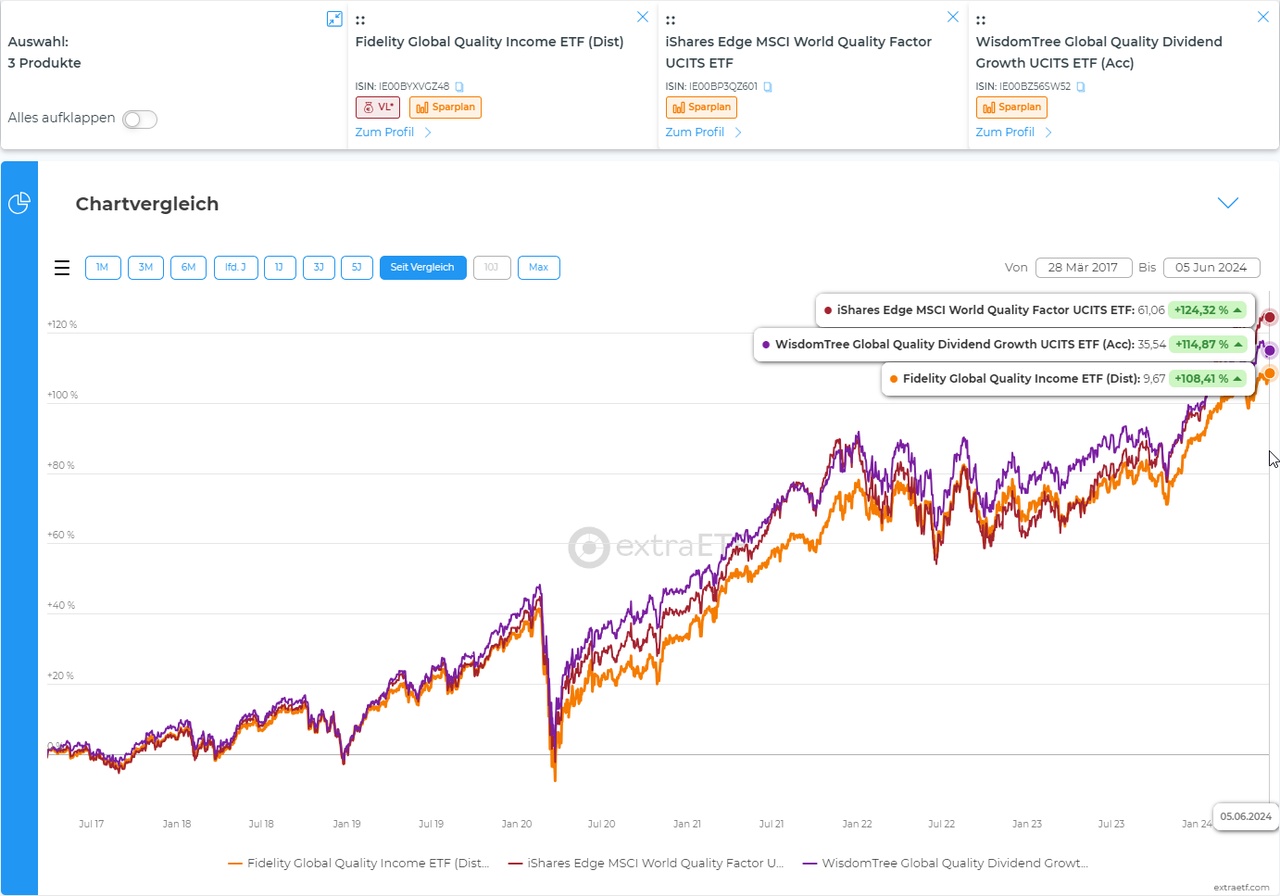

As all 3 ETFs (Fidelity Global Quality Income, WisdomTree Global Quality Dividend Growth and iShares / Xtrackers MSCI World Quality) invest in shares with similar characteristics and these overlap to some extent, it is no wonder that they also perform very similarly.

https://extraetf.com/de/etf-comparison?products=IE00BYXVGZ48-etf,IE00BP3QZ601-etf,IE00BZ56SW52-etf

It should be mentioned that the WisdomTree Global Quality Dividend Growth differs the most from the other two in terms of its composition. But with 589 stocks, it also holds twice as many stocks as the Global Quality Income or MSCI World Quality. And it also includes momentum screening.

Index Description:

"The index is rules-based, fundamentally weighted and is comprised of high quality dividend[1]paying companies from global developed markets, risk-filtered using a composite risk score ("CRS") screening, which is made up of two factors (quality and momentum), each carrying an equal weighting."

So the WisdomTree Global Quality Dividend Growth is only secondarily a dividend ETF.

It is actually a multi-factor ETF with a dividend filter.

To summarize, what is being done here is simply factor investing with extra steps and you could just as well use the cheaper MSCI World Quality $IS3Q (+0%) / $XDEQ (-0,05%) as well.

Gerd Kommer is proud of you. 😘

Pro tip: there is no MSCI Emerging Markets Quality ETF in Europe, but for the reasons described above you can buy the Fidelity Emerging Markets Quality Income

$FYEQ (-0,1%) as a proxy for the reasons described above.

(Edit: I use this myself $PEH (-0,08%) )