Crypto is just gambling?!

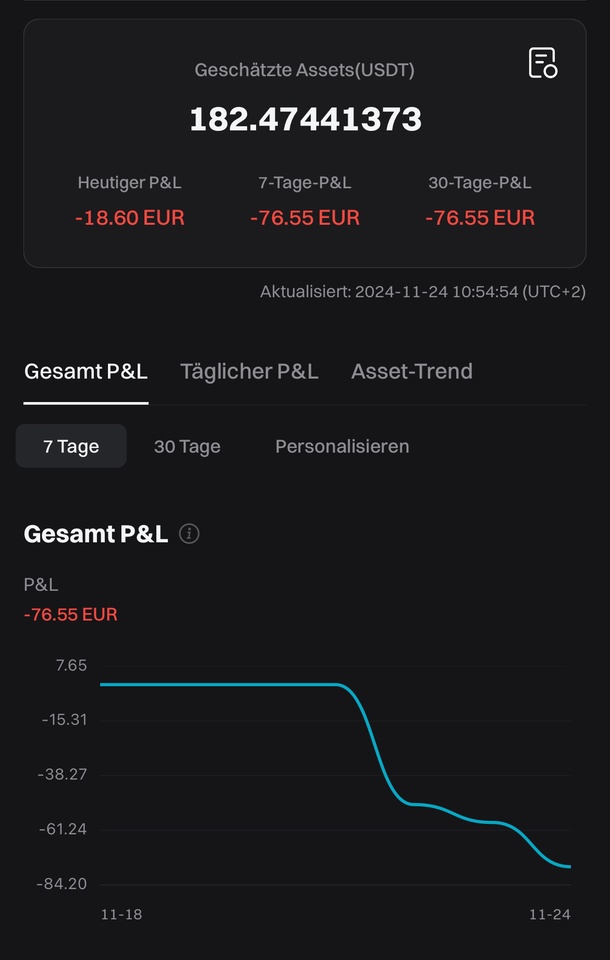

After two days 50% in the red?

Meal,

As you may have noticed, I have decided to take up crypto trading.

It's been a week now and I'm going to tell you what happened.

Which broker?

When it came to the question of which broker I should use, I decided on Binance based on all the recommendations.

I verified myself there via video call, which is super quick and easy, and then deposited money. As I wanted to start with "smaller" sums, I started with €250.

After finding out more, I realized that the "Bitget" platform would be more suitable for me.

There it is possible to conclude future trades and then leverage them.

In short, future trades are contracts that are offered at the same price as the currency = you don't buy a spot, i.e. not a "real" Bitcoin.

After I registered on Bitget, I bought €250 worth of Bitcoins on Binance on the recommendation of Hoss - don't ask me what the advantage is, but it's really quick - transferred them to Bitget and then transferred my Bitcoins to USD-T futures in Bitget.

This is, so to speak, the currency that is needed to conclude these futures trades.

However, USD-T futures are identical to the US dollar, i.e. the same conversion rate.

My trades

Full of euphoria, I naturally wanted to start trading straight away.

That's why I looked at the $BTC (+0,43%) price and had invested with 100% conviction that Bitcoin would crack the 100k mark today, with all my capital and a 50x leverage :(.

Yes, you're right to think, WTF is he stupid.

I quickly felt it and my stop loss was triggered overnight.

Long story short, 60€ minus with the first trade.

With the realization that this was pure gambling and that it simply doesn't work that way, I sat down early on Saturday and tried out a bit.

I quickly realized a strategy, which I then implemented using $ETH (+1,61%)

$XRP (+6,53%) and $SOL (+1,36%) practiced.

I invested €50 with a 10x leverage at what I considered to be a realistic point in time for a positive price reversal, i.e. the price was moving sideways or had just broken through a previous resistance level. I set a stop loss at -5% in each case so as not to be liquidated in the event of a price drop.

In all three cases, be it luck or not, the entry is pure prediction anyway, the price rose.

When a previous resistance level was breached, i.e. the price had bounced off it several times previously, I then pulled my stop loss above my entry price and thus ensured that my position could only close in positive territory. In addition, I increased my leverage to 100x and reduced my margin by 95%. In other words, instead of 50x10 it was then 5x100, less money but the same position size.

I had then practiced this with all three and in the end I went out with approx. 20€+. A great experience.

I realized that the crypto market is anything but gambling and that you really can make profits with proper risk management and without greed.

Yesterday evening was the next day for me.

I had opened a $SOL (+1,36%) position, which unfortunately backfired badly and the position closed €20 in the red.

Findings:

The main finding is that trading at the weekend really makes little sense. Because the big investors do their spot buying during the week, the volume growth only comes from the future trades. I could imagine that many open short positions at the weekend, which seems to make more sense to me than going long.

Another insight is that crypto trading only makes sense if you are very unemotional about it. I definitely want to get into that habit in the near future, because if I don't look at it rationally at €250, how will it be with larger sums?

Next week I'm going to look into new strategies, trade a bit and also deal with the subject of taxes, because you shouldn't neglect that under any circumstances.

What were your first experiences with crypto trading, what is your favorite altcoin? How do you see it, will Bitcoin still break 100?

Have a nice Sunday. See you next week📈

My summary of week 1: