🇳🇴 Company presentation AutoStore $AUTO (+3,36%) 🏪

Hi guys,

for a given reason, which I will explain in a moment, I want to introduce you to the Norwegian storage technology company AutoStore ($AUTO).

Storage technology? From Norway? Fabzy, a detailed company presentation?

Yes, you might wonder how all this fits together, so let's put it in context right away. If you're not interested in the personal "Why, why, why exactly this title at this time", just skip the next section and start again at "What can you expect?

In my last post, I mused about the Automation & Robotics ETF and wondered if it was still a good fit for me or if there were alternatives. You can read the whole thing again here: https://app.getquin.com/activity/fCCmolrVct?lang=de&utm_source=sharing

The result of my discussion was that I will continue to hold the sector ETF, as the only viable alternative to stay invested in automation would be to invest in individual stocks.

However, since automation A) involves many sub-sectors and B) I don't want to spend the time to do extensive research on a large number of individual companies, the ETF will continue to accompany me until it has to undergo a new review.

Two weeks and one year later, exactly what I supposedly didn't have time for has happened. I will invest in a single company from the automation industry. One whose product I myself already know through my job and until my post about the $2B76 I did not know that the company is listed on the stock exchange.

In principle, I have to thank getquin, i.e. our community, again, because without you the first post would not have been written, would not have been discussed in the comments and this following post would not have been written here.

Now I've been in the stock market for a year, have made my experiences and learned a lot. I have only been dealing with company figures more intensively for 3 months. Therefore, the following does not claim to be complete and does not represent any investment advice. If you are planning to invest, please do your own research. This post is my personal research and was the first time I went through all the news, reports and presentations on a company's investor relations site. I also see the whole thing as a good exercise for me, learning by doing 🙂

What can you expect?

I.

Companies and ventures

II. problem and solution

II. How we (should) be supplied with purchases in the future

IV. Company figures past and future

V. The hair in the soup

VI. puzzle piece for the portfolio

I. Companies and ventures

So we are talking about the company AutoStore Holdings Ltd. with its share $ (+3,36%)AUTO (+3,36%)which develops techniques for efficient warehousing and distributes them largely through partners.

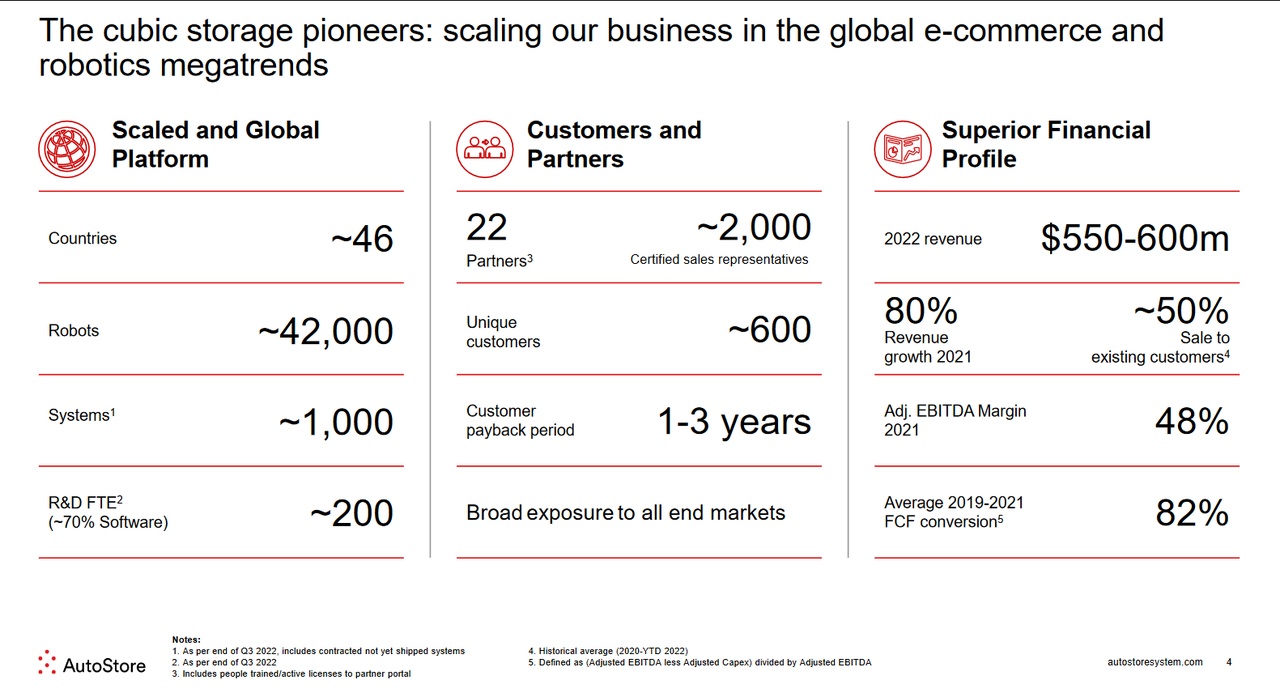

The company was founded in 1990, is based in Vindafjord, Norway and currently has about 710 employees. AutoStore did not have its IPO until October 2021, is listed on the Oslo Stock Exchange, and has a current market capitalization of about $6 billion with 2022 revenues of $550-600 million.

With its so-called "cubic storage" products, AutoStore operates with around 1000 installations in 46 countries. It uses a total of more than 42,000 robots.[1]

In 2019, AutoStore was Norway's first "unicorn", i.e. the first non-listed company with a market value of more than 1 billion USD.[2]

In 2021, AutoStore generated 64% of its revenues in the EMEA economic region, 29% in North America, and 7% in Asia.

A planned CEO change also took place at the turn of 2022/2023. The "old" CEO will retire on March 1, 2023.

AutoStore operates in the typical project business, in which the individual projects, including planning, manufacturing, installation and commissioning can sometimes take several years. It takes approximately 1-3 years for the company to receive all services from your customers on a given project and to receive all payments from your customers.[1]

The customer base also includes many familiar faces, such as Puma, crocs, DHL and UPS, Siemens and Bosch, the British supermarket chain ASDA, Decathlon and many more.[8].

If one takes a look at the top shareholders of the stock, it is at least noticeable that one does not find the usual suspects such as the Vanguard Group or BlackRock among the first places. The two largest shareholders in AutoStore together own 71% of the company and are, by name, Softbank with 38% and Thomas H. Lee Advisors LLC. (THL) with 33%. Softbank is known for investing in technology companies and manages the world's largest investment fund in the technology sector, the so-called "Vision Fund".

To wrap up the first impression on the company, here's a question in the round that I didn't get answered. Maybe you know more.

The ISIN of $AUTO (+3,36%) is BMG0670A1099, so the country code is BM, which stands for Bermuda. I have not found out why AutoStore does not have a Norwegian ISIN with country code NO.

If anyone knows the practice of being listed with a Bermudian(?) ISIN, please feel free to clarify in the comments 😀.

We know the company now, fair enough. But what is the product now?

II. problem and solution

A few buzzwords have already come up that I would now like to put into context: storage technology, cubic storage, robots.

In order to demonstrate the real added value that AutoStore offers, I would first like to build up a bit of basic knowledge.

What image do you have in mind if I ask you to imagine a large warehouse where, let's be Amazon, stores parts of its goods?

Spontaneously, I imagine high shelves, several halls, rows, aisles, levels, between which people, so-called "order pickers," run back and forth, sometimes driving forklifts and collecting the goods. "Picking" refers to the process of collecting and staging stored inventory for an order, followed by transfer to packing and shipping.

Picking can basically be done in two ways, the first I described above and can be abbreviated as MzW in German or PtG in English. This stands for nothing other than "Mensch zu Ware" or "Person to Goods". The principle follows from the name. The person always has to be active and scrub his miles if he wants to get goods from the warehouse. The disadvantages are obvious. You need

- a lot of personnel

- a lot of space

- a lot of time

Everything that a profit-oriented company would like to save in order to reduce costs.

That's why the second type of picking is much more interesting and you've probably already guessed it, it's called WzM or GtP, i.e. "Goods to Person". Now the human being no longer walks through the shelves, because the goods are transported directly from their shelf location to the order picker, who can always remain at his workstation, thanks to appropriate automation and conveyor technology. This alone means that we need fewer staff, less space and the goods can be made available much more quickly, measured in terms of the staff employed. The goods in such automated warehouses are usually also stored on shelves, but are automatically retrieved by a stacker crane and brought to a retrieval point, from where they are then transported to the order picker's workstation.

I already save personnel, space and time, but with AutoStore's special GtP solution I can add the Norwegian crown (höhö) to the whole thing:

- More space: 4x more storage capacity in the same area.

- Shorter distances and therefore faster picking

- Higher reliability: 99.7% uptime

- Modularity

- Energy saving

- ROI already after 2.7 instead of 4.7 years as in comparable GtP shuttle systems

Now don't keep us in suspense for so long @Fabzyshow us how AutoStore works!

AutoStore uses so-called bins, i.e. simple rectangular plastic containers that are stacked directly on top of each other in an aluminum frame. The goods are stored in the bins. This aluminum frame, together with the bins, extends in length, width and height, which is why it is called the "Cubic Storage System", as everything is built up like a giant cube.

Mobile robots travel on top of the cube, lifting the stored bins from the depths of the cube and taking them to an output point, where they are then dispensed at workstations known as ports. At the ports stands the picker, who can take out the stock needed for his order and have the remaining totes returned to storage. Due to the way it works, AutoStore is not tied to building specifications and can also replace or expand existing warehouses without major effort. So, in order to use AutoStore, new construction is not necessarily required.

In addition, AutoStore itself states that 10 such robots consume just as much electricity as a vacuum cleaner.

Please also have a look at the attached video https://www.youtube.com/watch?v=iHC9ec591lI

If that doesn't look mega cool.

But does this type of storage also have disadvantages?

Due to the compromised storage and the fact that the robots can only take the top container, the problem automatically arises that it takes a long time until a robot has removed the bottom container of a column.

All the bins above it must first be distributed to other free spaces. The average time it takes for a robot to access its required bin is given by AutoStore as 10-15 seconds. However, it can take 3-4 minutes to reach the lowest bin.

This problem cannot be prevented, but it can be avoided.

A common method in logistics is to store goods in the warehouse according to turnover frequency. Frequently used items are stored at the top of the cube, less frequently used items end up in the lower levels automatically, just by using AutoStore. In addition, the system can optimize itself during the night and, based on forecasts, already provide the goods in the upper levels according to the orders to be delivered the next day.[5]

Another disadvantage is actually still obvious. Not all items fit into the bins. AutoStore therefore focuses primarily on retail, grocery and e-commerce. Shoes and bags fit better into the bins than tables, bicycles, donkeys and llamas. Turtles would fit better, but I don't think animal welfare would go for that.

According to the company website, up to 90% of all items sold online fit into such bins.

III. how we will (should) be supplied with purchases in the future

What makes the whole story an investment case is the increased demands on logistics and supply chains, especially in e-commerce. Customers want their ordered items delivered faster and faster. "Same day delivery" is the next extension of "ordered today, delivered tomorrow." Grocery supermarkets are still reluctant to deliver groceries today, simply because it's not consistently profitable with current practices. Automation in warehouses plays a big role in reducing costs in the future.[3]

Furthermore, how can same-day delivery work even better in the future? By moving the warehouse from the outskirts to the city center, according to the vision. Large warehouses are not found in the middle of the city center; in most cases, they are placed on the outskirts of the city, thus naturally extending the duration of the "last mile", i.e. the distance from the warehouse to the customer.

The space-saving and modular design of AutoStore means that in future AutoStore warehouses can be integrated directly into shopping centers, for example. One company that is already doing this today is Decathlon in Western Canada.[4] The latest development of AutoStores in Canada is the AutoStore.

The latest AutoStore development in this context was installed for the first time just a few weeks ago: An AutoStore cube with 3 temperature zones: Room Temperature, Refrigerated and Frozen.[6]

The fact that, technologically speaking, the end has also not yet been reached is also demonstrated by the latest version 2 of the bins, where, in addition to improved rollers, electronics and motors, it is now possible to connect independent AutoStore warehouses. [7]

So for now, the company continues to innovate.

IV. Company figures past and future

Since the company has only been on the stock market since 2021, you won't find much past values on the usual stock portals; you have to pull them from individual presentations on the company's website. I limit myself to the year-on-year comparison of 2021/2022, the last Q3/2022 figures and the outlook for 2023 when looking at the figures.

First, the figures for sales and profit.

(in USD million)

- Sales

- 2021: 328

- 2022e: 591 (+80%)

- 2023e: 737 (+24%)

- EBITDA

- 2021: 158

- 2022e: 255 (+61%)

- 2023e: 351 (+38%)

(in USD)

- Earnings/share

- 2021: -0,02

- 2022:: 0,03

- 2023e: 0,06

AutoStore is profitable in 2022 and is expected to generate a profit of USD 255 million on sales of USD 591 million. This represents $0.03 of earnings per share, giving a current P/E ratio of about 70 at a dollar exchange rate of $2.13. At a dollar exchange rate of 1.70 USD, which the share had just a week ago, we are at a P/E ratio of 56. The high P/E ratio reflects the equally high expectations for the future.

By comparison, the P/E ratio of the benchmark OBX index of Norway's 25 largest companies by market liquidity is just 1-2.[9]

In a market of automated storage systems that grows on average 15% per year in terms of sales, AutoStore has grown 51% p.a. over the past 10 years and plans to continue growing 40% p.a. in the future.[1]

In Q3/2022, compared to Q3/2021.

- sales increased by 74

- the value of orders received increased by 11%

- the backlog increased by 37% to USD 470 million

Backlog refers to all the work that the company knows about today but has yet to accomplish. In short, AutoStore has $470 million worth of work in the pipeline today, which (excluding Q4/2022) is about 65% of projected revenue in 2023.

Gross margin high but recently declining

Another interesting value in the whole story here is the gross margin.

In Q3/2021 it was 68% and in Q3/2022 it declined to "only" 54%. AutoStore had to contend with the sharp rise in the price of aluminum, which is used to make the "grid" of the cube.

The peak of the aluminum price is considered to be overcome and it has fallen again, but due to the supply chain problems and the continuing inflationary pressure, the price of aluminum is still higher than bpsw. mid 2021. So one can see an easing here and together with a price increase of its products in Q4/2022, the margin for 2023 should be able to be increased again.

VIII. The hair in the soup

So far, I think it's a wonderful story, a great product, impressive figures and optimistic prospects for the future.

However, not everything is rosy in Norway and there is something that may have caused the CEO some sleepless nights.

For several years now, AutoStore has been involved in a patent dispute with the British food and technology group Ocado ($ (-0,64%)OCDO (-0,64%)).

In 2012, Ocado was a customer of AutoStore and in 2015 launched its own "Ocado Smart Platform (OSP)", which follows the same principle as the AutoStore solution. Robots driving on a grid to retrieve containers stacked on top of each other.

In several countries, including the U.S., UK, Norway, and Germany, the two companies are fighting legal battles over potential patent infringement and possible sales and manufacturing injunctions.[10]

In January 2022, a court in Germany ruled pro AutoStore, after which the stock rose 50% over the next 2 months before the macroeconomic environment brought it back down to earth.

Personally, it strikes me as odd why the question of possible patent infringement is so hard to make in favor of either party. So who is the "inventor" of this storage technology? A technology company that has been dealing with storage for 30 years and was first on the market with such a product. Or a food company that was itself first a customer and has only been on the market for about 8 years after the business relationship. However, I know too little about such legal disputes and the facts of the case will sometimes be much more complex than I can judge as a layman. Nevertheless, I see AutoStore in a much better position here.

The whole issue is therefore not yet off the table and is weighing on the share. Clarity would certainly provide plenty of tailwind here. Further court proceedings are pending in 2023.

VII. puzzle piece for my portfolio

For me, an investment case has been fulfilled here and I have recently invested in AutoStore with a mini position. At the turn of the year, the share price was still quoted at 1.79 USD, but in the last 4 days it has gained 20% to 2 USD. If I had hoped for a setback in the first 2 days, I could not help but open at least a small position on the third day. It is really unbelievable how the fear of missing out on something is with one. I wanted to wait again for more favorable prices, in order to enter then, but with each per cent plus (contrary to the first descents in the USA) the fear grew to miss something.

The chart and the figures do not yet allow any great insights from the past and what is a greenhorn like me primarily oriented, yes probably to the past. Certainly not an easy title to correctly assess it in the current environment as a beginner (Norway, tech sector, January rally, overvaluation, sheath to profitability, no price history). Is +20% now the end or will the price drop again significantly? Nobody will know. Therefore, I have now times the foot in the door and observe the next days and weeks again.

I would be very interested in the opinion of our experts, what you say to the presented company, so I am so free and link it @TheAccountant89, @BASS-T, @KapriolenCapital and @RealMichaelScott. The donkey reads the post anyway, I do not need to link. Here's a carrot 🥕 for you.

Doing research for the post was incredibly educational and also took much longer than I actually suspected. I had to adjust the current market cap up twice because of the +20% in the last few days 🤣.

You can not appreciate enough how many here put your free time in stock analysis and company presentations to present them to us.

Thank you guys so much for reading.

Sources:

[1]

[2]

[3]

[4]

https://de.autostoresystem.com/case-studies/decathlon-offers-unique-shopping-experience

[5]

https://de.autostoresystem.com/benefits/speed-and-efficiency

[6]

[8]

[9]

[10]