Genmab A/S

Company presentation

Genmab A/S is a Danish biotechnology company specializing in the development of innovative therapies to fight cancer. Founded in Copenhagen in 1999, the company is primarily dedicated to the research and production of monoclonal antibodies for oncology treatment. An outstanding product of $GMAB (-0,05%) is the proprietary Duobody® technology platform, which aims to optimize the treatment of various types of cancer.

Core business and key products

Genmab's core business is the development and commercialization of antibody therapies. Key products include:

- Darzalex (daratumumab): A monoclonal antibody for the treatment of multiple myeloma.

- DARZALEX FASPRO: A subcutaneous formulation of daratumumab.

- Duobody® technology platform: A proprietary platform for the development of bispecific antibodies.

Mission and vision

Genmab's mission is to develop innovative and differentiated antibody products that sustainably improve the lives of cancer patients. The company's vision is to be a leader in oncology through pioneering research and development in antibody therapy.

Historical development

Founded in 1999, Genmab went public on the Copenhagen and Frankfurt stock exchanges in 2000. The IPO raised 1.56 billion Danish kroner (approximately 209 million euros) for the company. In 2002, Genmab was delisted again in Frankfurt.

Business model & core competencies

Genmab's business model is based on the development and commercialization of innovative antibody therapies. The company's core competencies lie in the research of monoclonal antibodies and the Duobody® technology platform. This technological expertise gives Genmab a significant competitive advantage in the field of cancer therapies.

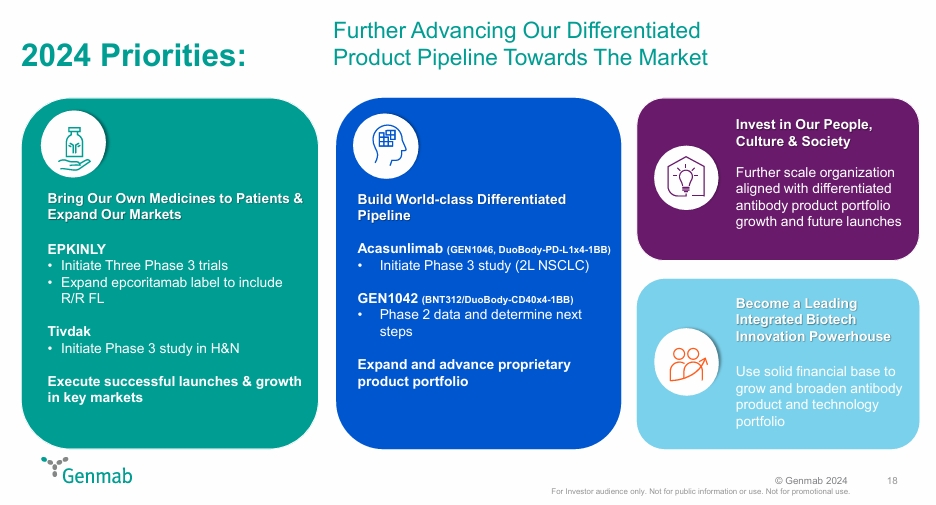

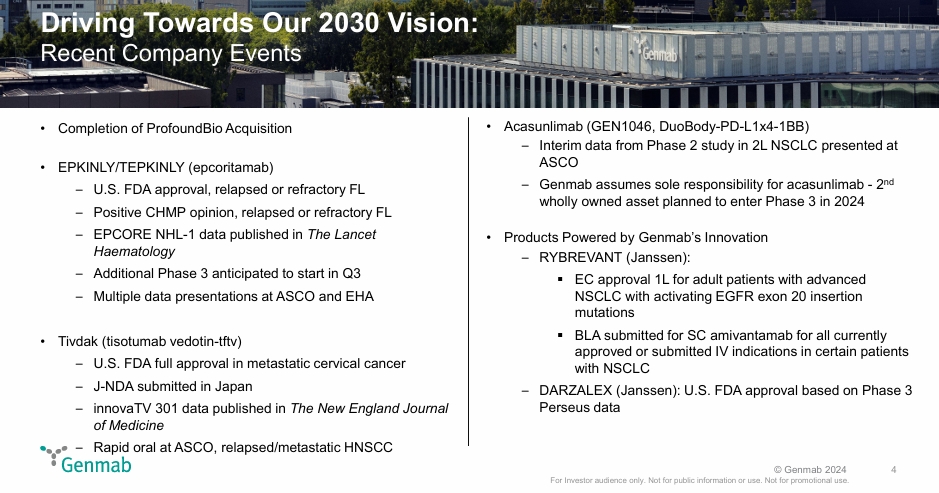

Future prospects & strategic initiatives

Genmab is continuously investing in the further development of its antibody technologies and the expansion of its product pipeline. This promising pipeline points to strong growth potential.

Market position & competition

Genmab has established itself as a major player in the field of antibody therapies. The company competes with large pharmaceutical companies such as $ROG (+0,46%) , $NOVN (-0,1%) and $GSK (-0,54%) , with which it also has development and marketing partnerships. Genmab's market position is strengthened by its innovative technologies and strong partnerships.

Total Addressable Market (TAM)

The global market for monoclonal antibodies in cancer therapy is growing steadily. In view of the increasing incidence of cancer and the growing demand for targeted therapies, Genmab has considerable growth potential.

Development

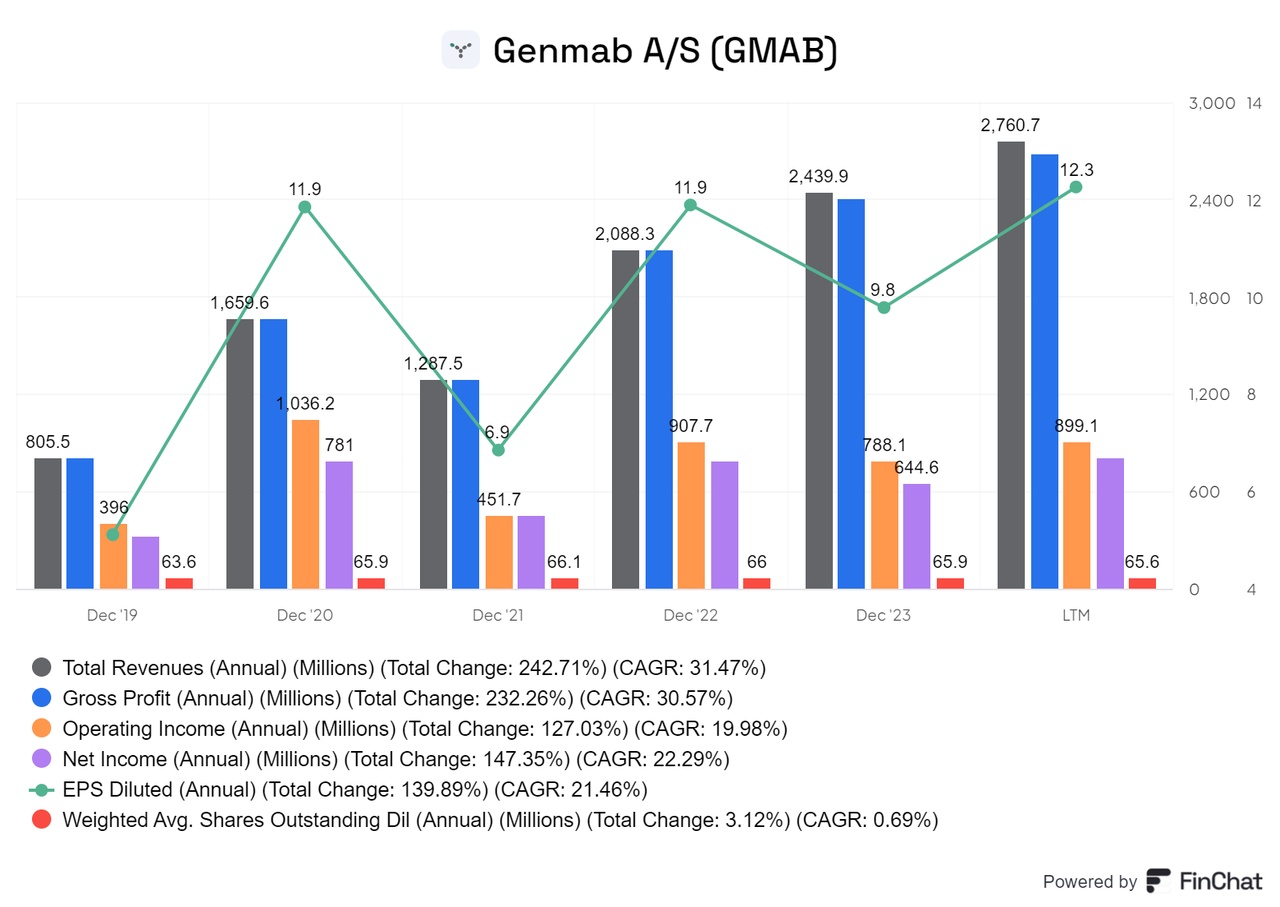

Sales are growing at a CAGR of 31%, while the gross margin is growing at a CAGR of 30%. EBIT shows a fluctuating but increasing development with a CAGR of 20%, and net profit is growing at a CAGR of 22%. The number of shares issued is also falling.

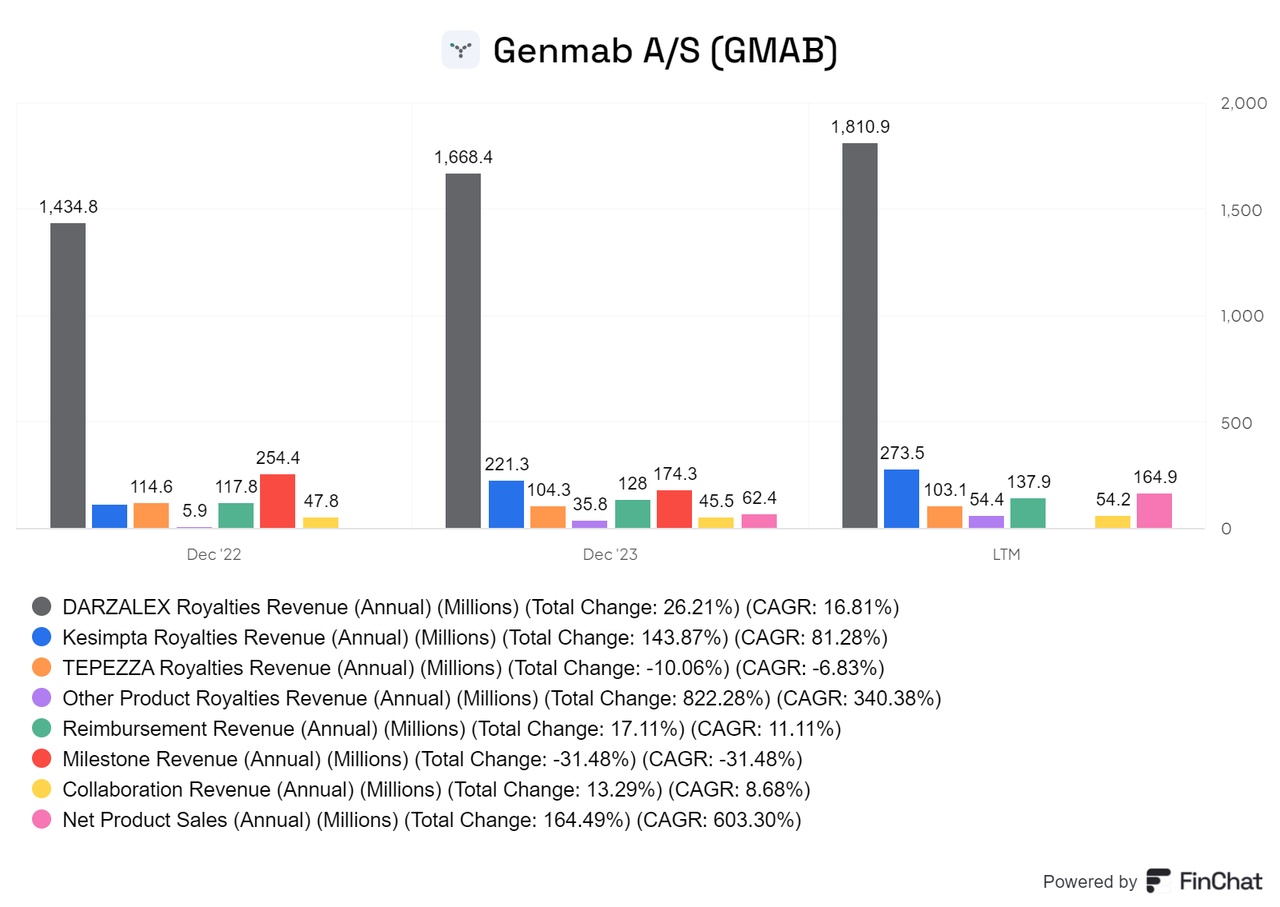

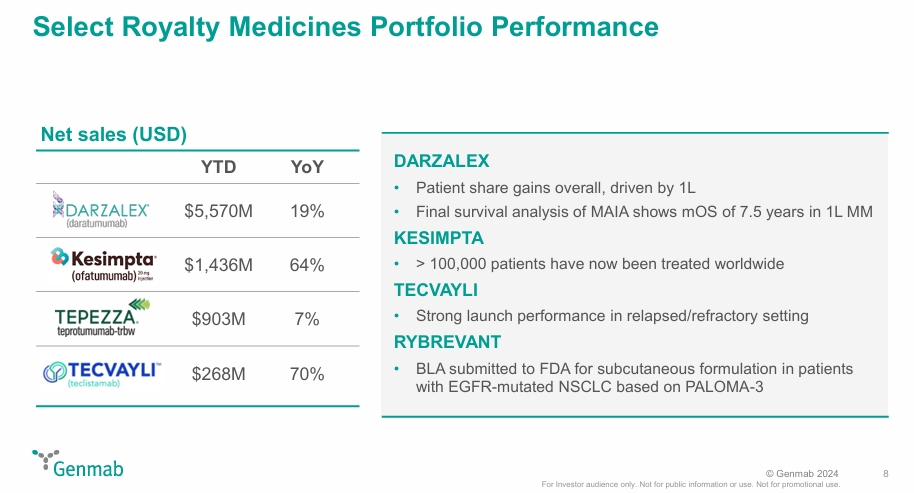

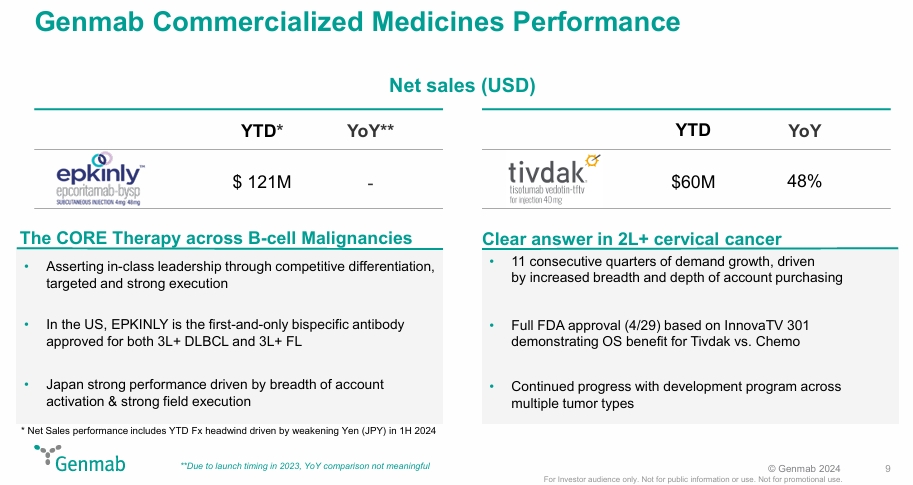

Darzalex is clearly the sales driver and therefore the company's most important product. Nevertheless, the other products are also making progress and growing steadily.

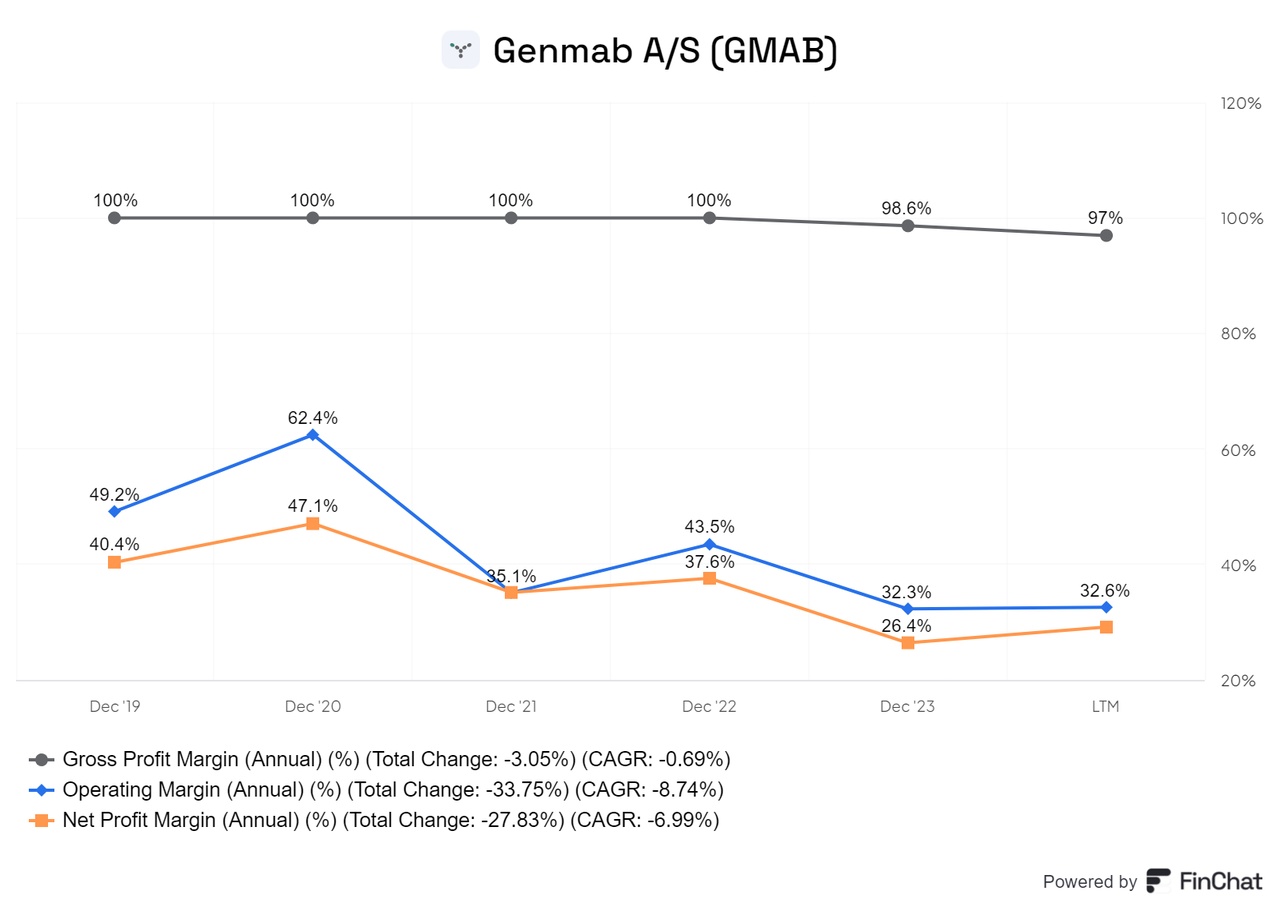

Licensing has enabled the company to maintain a gross margin of 100 % for a long time. However, as it is now beginning to take marketing into its own hands, this margin is expected to decline. At the same time, however, the operating and net profit margins should increase. Overall, however, the margins are encouraging, with a net profit margin of over 25%

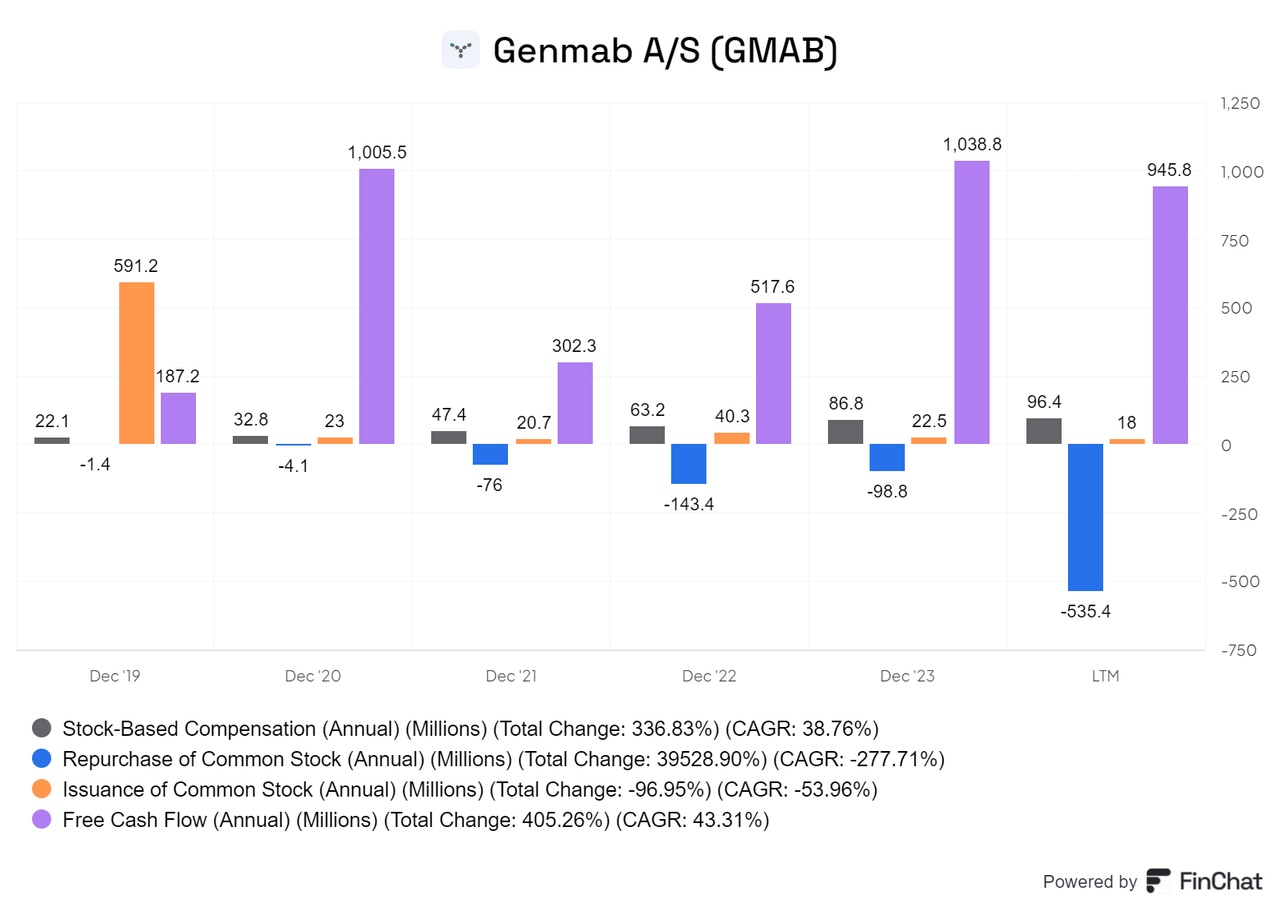

SBC has risen well, but remains in line with the company's performance. Moreover, there is no dilution of shares due to the buybacks. The free cash flow (FCF) has also increased solidly, so there is nothing to complain about here.

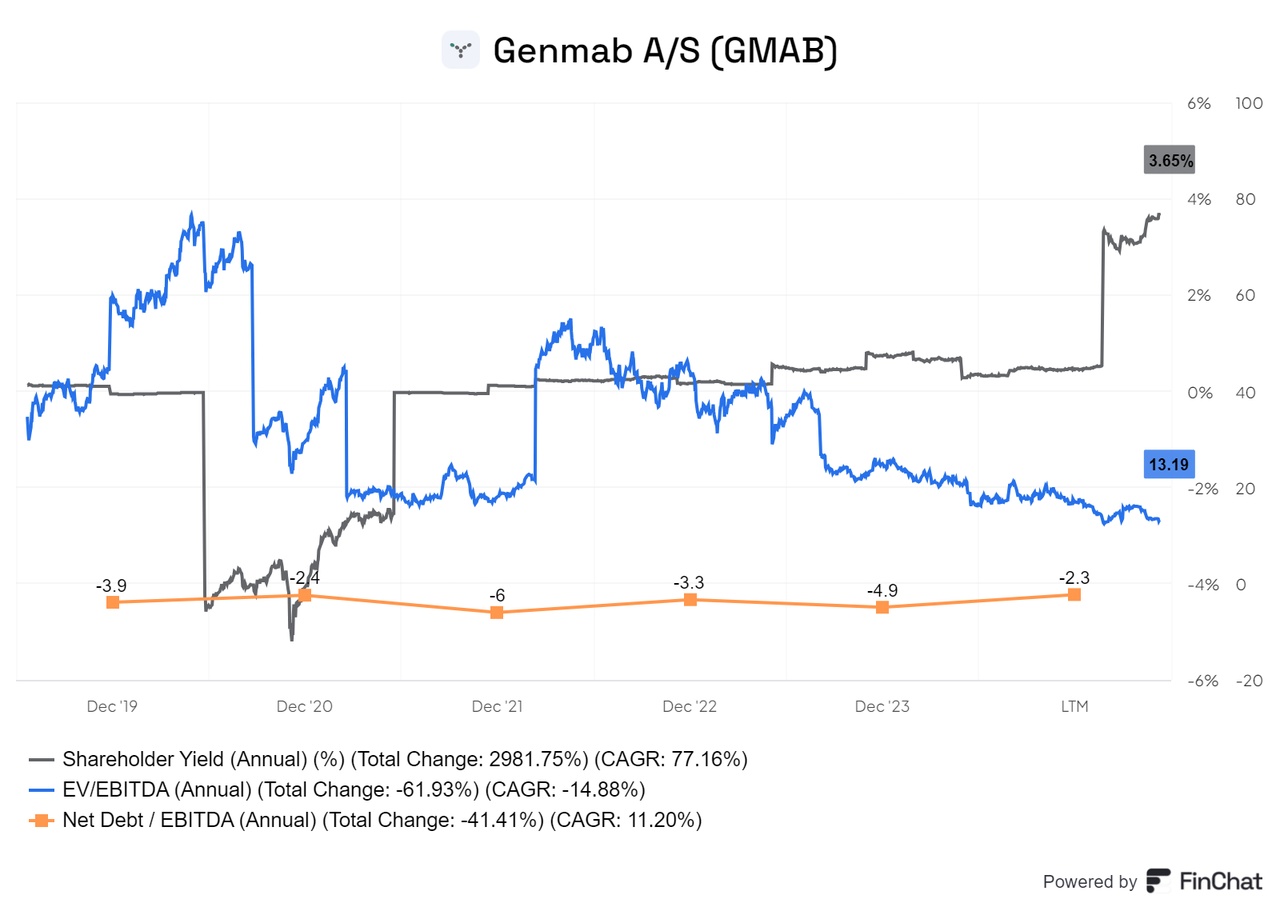

The shareholder yield is just under 4%. The ratio of enterprise value (EV) to EBITDA falls when EBITDA rises and market capitalization falls. In addition, the ratio of net debt to EBITDA is negative, which is also positive.

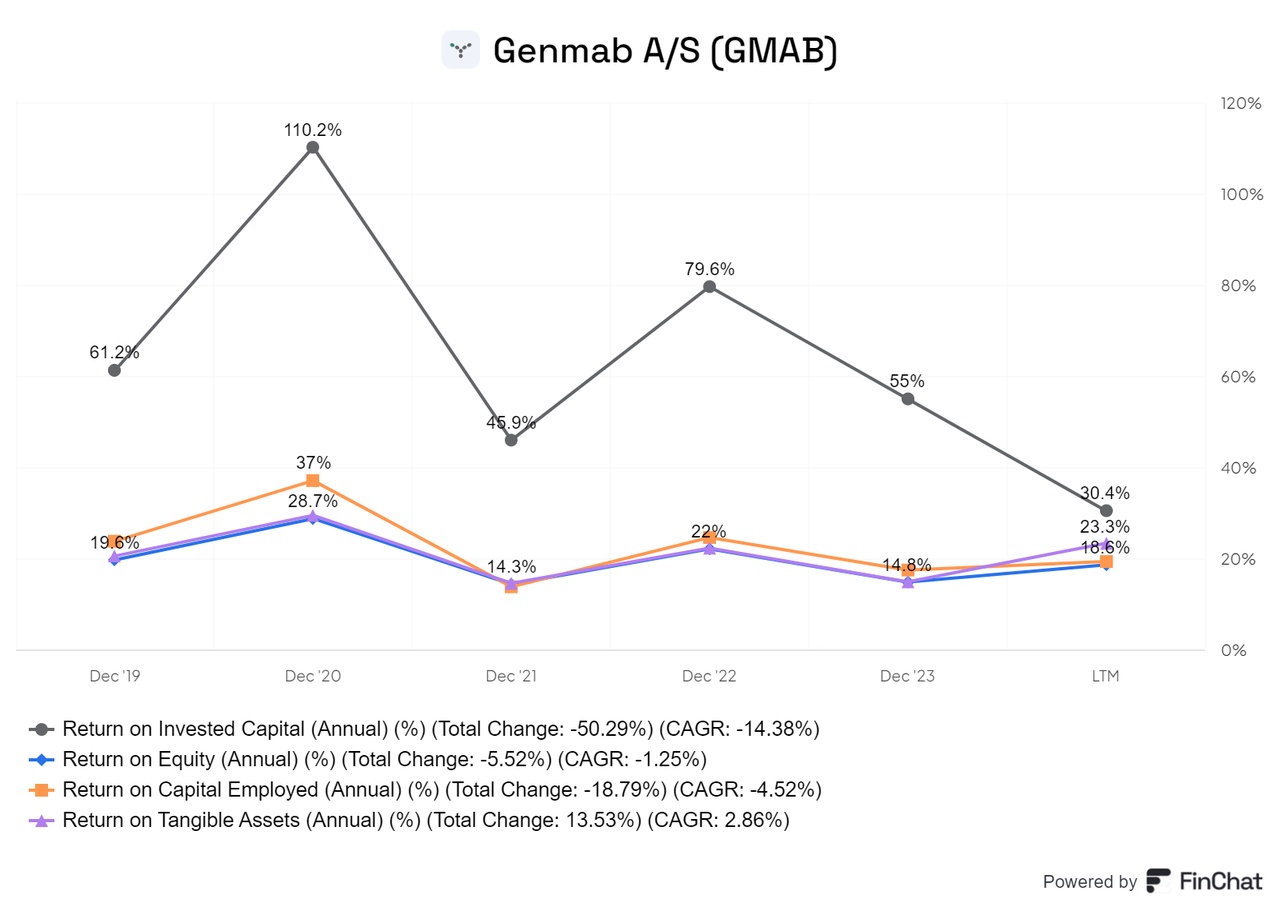

Genmab's capital efficiencies are exceptional and are all above 10%.

Conclusion

Genmab A/S, with its focus on innovative antibody therapies and a promising product pipeline, is well positioned to capitalize on the growing opportunities in the field of cancer treatment. The company's solid financial performance and strategic partnerships highlight its potential for future growth and innovation in the biotechnology sector.

Although the share price has fallen recently, Genmab still has significant growth opportunities ahead. The promising pipeline and the upcoming launch of new products are expected to contribute significantly to operating income. In addition, the company has an impressive capital efficiency and benefits from the positive economic situation in Denmark.

Denmark has traditionally established itself as a center for medical technology and biotechnology. The explosive development of companies like Novo Nordisk could also have positive spillover effects for other medical companies, including Genmab. Overall, this is an interesting company that I believe is undervalued based on my DCF analysis.