ANALYSIS KEYENCE CORPORATION $6861 (+0,29%)

Key or shotty stock for my dividend portfolio? The top 5 Japan companies in quickcheck

Today, according to the last poll from the beginning of the month, it will be about Keyence. A company of the currently 2nd richest Japanese in the world Takemitsu Takizaki (see (17)).

Before we start, as always, my disclaimer.

Disclaimer: This is not investment advice. It is also not a solicitation to buy and/or sell financial products. I only describe my personal opinion here. You have your own responsibility towards your investments. Therefore no liability.

To get an overview of the company Keyence I use the following outline.

PART 1

Keyence in facts, figures and data

Keyence's business areas, products and fundamental situation

PART 2

The Keyence share - a Japanese giant?

PART 3

Keyence in Japan

Japan - a nightmare for ETF investors?

Opportunities and risks of Keyence's industry

As some of you have noticed, in the future I will split my posts when they reach a certain length. In this case, Part 1 will include the first chapter, Part 2 will include the second chapter, and so on. This is in this form still relatively easy to divide, but in the future may require 2-4 parts depending on the topic. Since this is my last post for now, I will look at the feedback and decide on my future here on Getquin. It is ultimately a simple effort-benefit estimate.

Enough about me and this sorry GIF topic. We will now start with Keyence's Japanese market to get a first look at the group's market environment. Some people make the mistake to look at stocks only from a global perspective and to try to show the profitability and valuation of groups by means of rules of thumb. In my view, however, this is only one part of many that make up a whole puzzle. I will evaluate KEYENCE first from a fundamental-balance sheet point of view, then from the share's point of view and finally from the market's potential.

Let's start with Keyence itself, so that we know what we are talking about:

Keyence in facts, figures and dataKeyence's business areas, products and current situation

KEYENCE (= "KEY OF SCIENCE") from Osaka was founded in 1974 and is one of the top 5 companies on the Japanese stock exchange with a market capitalization of 92.19 billion euros. The company achieved sales of 755.2 billion yen in fiscal 2021, with KEYENCE having total assets of 2,324 billion yen. The products are very diverse in the field of machine measurement and mainly include (see (1), (16)):

- Sensor technology

- Products for optics control via AI

- Microscopes

- Process sensors

- And further measuring technology for industrial application also with integration of 3D measuring devices

In addition to this specific product and service portfolio, it is also striking that a total of only 3 companies are larger market capitalized and well-known companies such as Mitsubishi, Softbank or Hitachi are valued much smaller. Looking at the difference of Keyence to Sony, the current difference is 90T JPY according to (4). Sony is valued at JPY 12.96 trillion at the time of this analysis, which is the equivalent of 92.359 billion. Depending on the stock exchange and the exchange rate, the values fluctuate - but all have in common that the gap is not too big (see (2), (3), (4), (5)).

It is 1- ( €92.19 billion / €92.359 billion ) = 1 - 99.82% = 0.183%.

So Sony and Keyence are separated by only 0.183% in market capitalization. This is very close together and highlights that Keyence obviously plays a big role in the Japanese economy. But who is this big relatively unknown player and what makes it stand out?

A search on the homepage of the Japanese parent company helps here. We see that Keyence can boast an equity ratio of 93.5%. That usually speaks for the company's ability to get credit in times of crisis. Why?

A company that is already cross-financed via loans can usually not offer any collateral. This means that the bank has to take a risk and can, if necessary, sit on the loan. This speaks either for no lending or the issuance of money against horrendous interest rates. Especially in times of rising interest rates, a high equity ratio is relatively desirable and the 93.5% is really a good base. It can be particularly important for dividend investors, because equity includes, among other things (see (6)):

- the subscribed capital

- Any reserves

- Profit and loss carried forward

- The net profit for the year

Dividends are (or at least should be) paid from net income. So does Keyence have hammer dividends and is virtually the king among Japanese dividend stocks?

Full of anticipation because of blissful ignorance, one opens e.g. Marketscreener or the stock finder and finds out: 0.56% dividend yield.

A GOOD HALF PERCENT DIVIDEND YIELD! WOW!

A second check on Aktienfinder confirms the tragedy: it really is only dividend yields around the half percent mark, and that despite no reduction for 10 years, a payout on free cash flow of around 23%, and a reduction on earnings of only 17.7%. Absolute dream figures when compared with better-known companies in the dividend world (see (7), (8)).

To keep it reasonably fair, I now deliberately do not compare Keyence with Altria, Coca-Cola or the like, as the business model would be zero comparable. Altria is, in my opinion, arriving as a cigarette company in the cash wow phase just before Poor Dogs, Coke is a standard product and almost 100% acyclic (see Christmas Coke) and the two standard dividend companies do not sell tech products. At most in the Happy Meal *wink*.

Why is Keyence doing this?

Roar from the back row, "Because it's tech!"

That's not entirely wrong, yet my example of INTEL (which I simply find structurally very exciting as well) shows that tech and high dividends are not necessarily mutually exclusive. As my viewers on YouTube should have seen by now, INTEL offers according to (9) a dividend yield of 5.44% with a stability of 99% and no decrease for 30 years. If you close your eyes and listen to these parameters, you might think you are at a cigarette, oil or other dividend company. In fact, INTEL delivers significantly more dividend yield compared to KEYENCE. Why I still see INTEL critically and what dangers there are among other things, you can see in my YouTube video (see (9)).

Up to this point, it should be enough for us to realize that there are other ways than tech companies.

What reason could KEYENCE have for its low dividend yield? They seem to have money, don't they?

It's always a question of corporate structure, which significantly shapes the stock. That means: If I have a perpetual runner that can hardly be improved and with which I can implement moderate price increases, I may be tempted to economize in terms of CAPEX expenses. This means that I do not need money for research and development and instead make it available to the capital market. Additional dividend increases and/or special distributions may also attract new shareholders.

A negative example of this is the TUI share, which I also analyzed here recently. Since money was needed to service loans, among other things, more shares were issued. Mathematically, nothing happens - whether you have 1 share for 10€ or 2 for 5€ each is irrelevant for your final result. But it does matter to the capital market. You can read how he responded and why I am currently critical of TUI in my article.

But the example of TUI shows that growth and stabilization have to be financed by loans - and these loans are currently particularly unfavorable due to the rising interest burden. Money for CAPEX is then rather a secondary matter.

KEYENCE, on the other hand, has a good starting point with the equity ratio mentioned above and no significant net debt. The gearing is even negative with currently -2.35x. This means that the difference between assets and liabilities can be in favor of the assets, which implies negative liabilities. Negative debt is then often assets again (see (10),(11)).

Huh?

You want to buy a kebab and pay the 8€ with your credit card. You still have 10€ on the account. Normal people calculate now: My money = 10€ money in possession - 8€ cost of kebab = 2€. The degree of indebtedness calculates inversely with the indebtedness: Indebtedness = 8€ costs for kebab - 10€ money in possession = - 2€.

In the result you have a negative net debt, because your cash reserves are sufficient to service your debts. If you want to show: This is called "Net Cash Position".

If we now calculate an x arbitrary income factor as pseudo Ebitda against it, we get the ratio of your negative debt to your income. That's why the debt ratio is always given as a multiple.

What does this mean for KEYENCE?

KEYENCE, like you (who should perhaps make different financial decisions regarding kebabs), obviously has more cash on hand than debt and therefore ends up with a negative debt to income ratio, just like you in the example. That wasn't so difficult, was it?

Basically, this simplified explanation is enough to understand the "mystery" of negative debt. Frankly, I plan to follow Capriolensonne's suggestion and produce several shorts. Each just under a minute long on just such questions "Why is this debt negative?", "What is free cash flow?"....

I took a first step in this direction with my short on "What is the S&P 500?" and of course I'm looking forward to your opinions on it. Would you guys want to see this? There are a lot of questions from new users lately and maybe it can help someone.

Back to Keyence: we now know that Keyence is a top 5 company from Japan, it has no significant debt, the gearing ratio may not be a problem and they obviously don't offer a high dividend.

But what do the sales say?

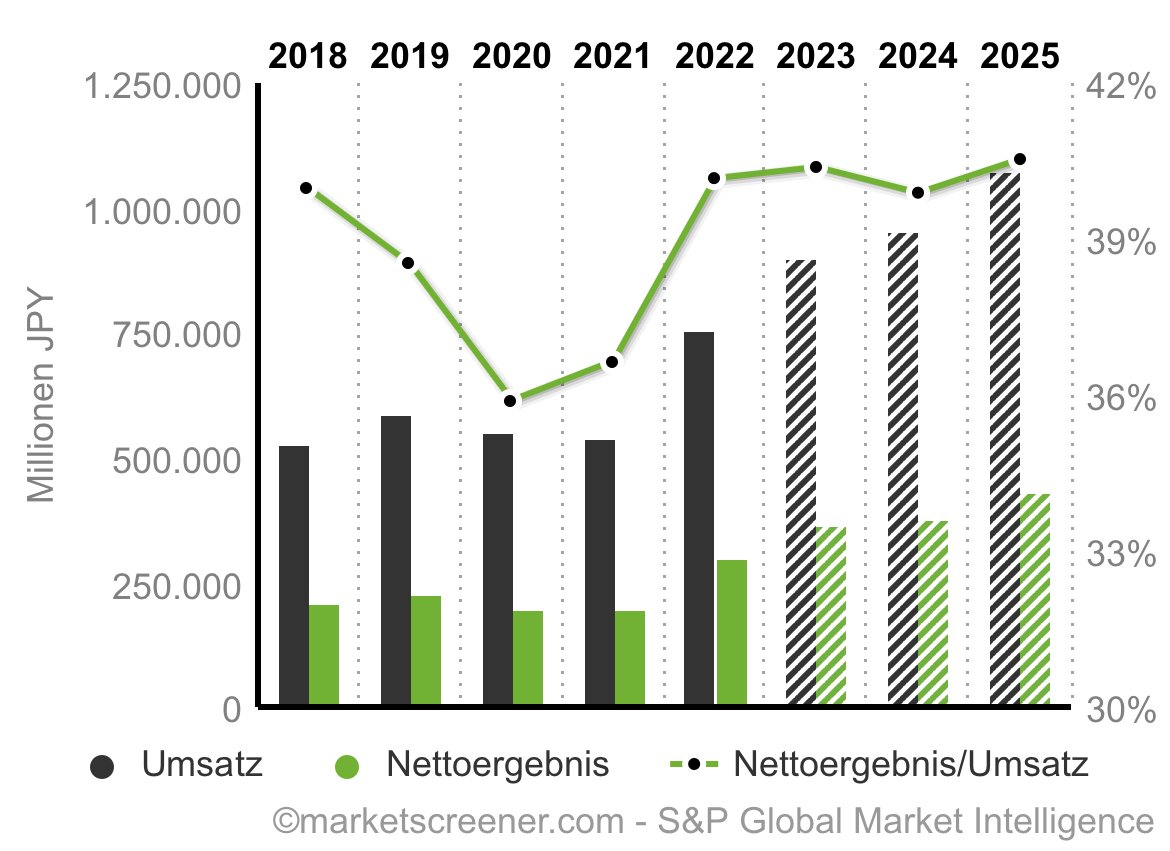

Keyence's revenues have been in a channel between JPY 944.139 billion since 2020 to in 2022 at JPY 1,004.572 billion. That has been 4.916 billion converted for 2022. This is a significant step, and is expected to be as high as approximately JPY 1,796 billion in the future in 2025. Free cash flow is also seen to be on a positive trend and if we compare 2020 with 2025, it is almost a doubling of FCF (see (10)):

195,191 / 350,950 = 55.62% <> 350,950 / 195191= approx. 180%.

So we see that 2020 has just reached 56% of what analysts believe KEYENCE will achieve in the future. An increase of 1.8 times in FCF, which is hardly used for dividends anyway, certainly shows potential. But what bothers me when looking at the figures?

I am mainly disturbed by the fact that equity is increasing, the equity ratio is high, however the return on equity lets us down a bit. It indicates how effectively the management is using the available equity and applies the net result to the available equity.

KEYENCE has achieved values here between 10.7% to 14.8%. As of 2023, these values are between 14.4% to 15.6%. Why do I not like this?

Simple fraction calculation: If the denominator increases, the fraction decreases if the numerator does not increase in the same or higher ratio. This is exactly what happens here. Unfortunately, the net result does not increase in the same proportion. If you look at it, you can see that it does:

2022: JPY 303,360 million

2023: 364,228 million JPY

2024: 381,370 million JPY

...

Nevertheless, the return on equity falls from 14.8% in 2022 to 14.5% in 2024, which is not particularly pleasing as it indicates less efficient management with the available resources (here: equity). For the moment, this may be complaining at a high level - nevertheless, I found this point interesting (see (10), (12)).

In addition to the management, as a shareholder I am always very interested in what my invested money is spent on. I know that sounds rather platitudinous. But would you as a senior pay people to go shopping without having a basic idea of the expected costs?

Accordingly, the return on assets helps us. It puts KEYENCE's net income in this example in relation to its assets. To put it bluntly: "Are they going to buy a golden BMW with my money or are they going to invest profitably in a new warehouse management system?" This is very important, because as an investor you often only have the possibility to browse through larger PDF documents with declarations of intent for the future. This RoA parameter makes the company's investments and their sense transparent to everyone. That's why RoE and RoA are indispensable parts of any stock analysis for me (see (12), (13), (14)).

What are assets anyway?

I reactivate my knowledge from my studies and work for you. There are 4 different asset types. Off the top of my head I call them as follows (cf. (14)):

- Fixed assets

- Current assets

- "Financial assets"

- Intellectual property

Fixed assets are most often a building, equipment, factory or something else tangible with a shelf life of more than one year plus depreciation over time.

Current assets are the short-lived brother of fixed assets and include cash, inventory, and prepaid services less than one year. So, hypothetically, a shipment from one Keyence factory to another with pre-payment and payment advice several months in advance could count as a service belonging to current assets - even though it is intangible.

Also not tangible are intellectual property, which is essentially based on patents, stocks, bonds and such. If KEYENCE owned shares in sister companies, for example, they would be in this column from KEYENCE's point of view. For the other side, of course, it would be different. For company B, the shares issued to KEYENCE would be part of the debt. This for those of you who are interested (see (14)).

What does this mean for KEYENCE now?

RoA is declining for KEYENCE - from its current high of 19.9%, it will be only 69.35% of today's value in 2025 and will be around 13.8% should the analysts be right. Basically, this implies that either assets will increase in a greater proportion than net income or, alternatively, net income will fall.

In KEYENCE's case, we have already learned from the RoE that net income will increase. Thus, a look at the expected assets shows that this will almost double from JPY 1,524.366 billion today to JPY 3,161.557 billion. The aforementioned catalog of asset types will thus become larger, but the net income currently will not. KEYENCE will thus be able to sit on an ever larger mountain of assets, should the analysts be right. What does the company itself say?

KEYENCE itself shows its shareholder data on its Japanese site. Here, certain "financial highlights" are published for the individual annual financial statements. If you look at the operating margins over 50% plus the increasing operating profit, it shows a relatively strong performance of an increase from 2,768 billion yen to 4,180 billion yen. That's more than one and a half times and pretty much a 51.01% increase (see (15)).

Does this situation, which seems fundamentally good for the time being, also have a positive effect on the share?

That's what my second part will be about! :)

I look forward to your feedback and put the videos on Intel and the S&P 500 in the attachment.

Did you like the article? Do you also want to see the stock and market analysis? Then I look forward to your feedback in the comments :)

https://www.youtube.com/watch?v=qZyokxgW_Ds

https://www.youtube.com/watch?v=qDd-Nkqy1dU&t=996s

#aktie

#aktien

#dividende

#dividenden

#aktienanalyse

#keyence

#tech

#japan

Sources

(1) https://www.keyence.co.jp/company/financial-info/

(2) https://www.keyence.de/about-us/corporate/

(3) https://www.finanzen.net/aktien/keyence-aktie

(4) https://de.tradingview.com/markets/stocks-japan/market-movers-large-cap/

(6) https://www.lexoffice.de/lexikon/eigenkapitalquote/

(7) https://de.marketscreener.com/kurs/aktie/KEYENCE-CORPORATION-6492212/

(8) https://aktienfinder.net/dividenden-profil/Keyence-Dividende

(10) https://de.marketscreener.com/kurs/aktie/KEYENCE-CORPORATION-6492212/fundamentals/

(11) https://diyinvestor.de/nettofinanzverschuldung-so-berechnen-wir-net-debt-und-net-financial-debt/

(13) https://billwerk.io/wiki/article/roa-return-on-assets/

(14) https://www.investopedia.com/terms/a/asset.asp

(16) https://www.keyence.de/products/?gclid=EAIaIQobChMIy8jw8ryN_AIVTbTVCh3mEQLFEAAYASABEgIusPD_BwE

Graphics: https://m-de.marketscreener.com/kurs/aktie/KEYENCE-CORPORATION-6492212/