British American Tobacco $BATS (-0,24%)

confirmed the FY2024 guidance

As expected, growth should pick up again in HY2 and the investments in the US market and strategic inventory sales should pay off.

RRP and Combusibles are expected to improve their sales growth compared to HY1.

The profitability of RRP is also expected to improve.

Debt reduction is also continuing according to plan.

Pictures are from the Investor Day 2024

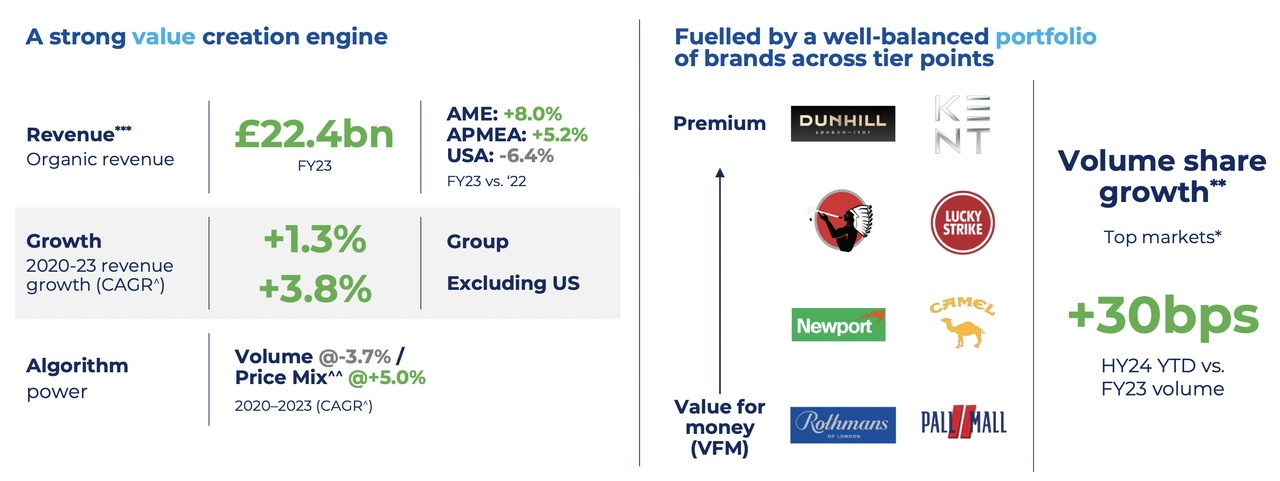

Combustibles

- Volume share gains in AME and APME

- Value share gains in AME and APME

- Volume share flat in US

- Value share down 30 bps in US

- US volume continues to shrink by around 9%

Risk Reduce Products

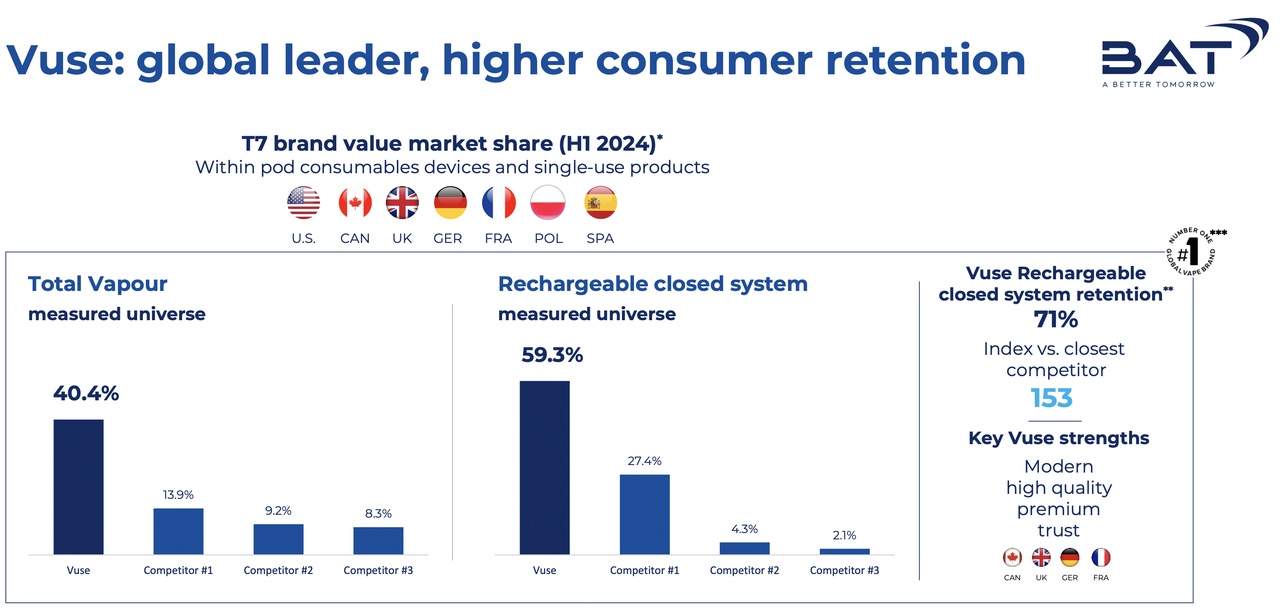

Vuse

- Global Value Share maintained >40% in key markets.

- US performance continues to suffer from unregulated products.

- In Louisiana, the first major regulatory successes are driving growth in the regulated market again.

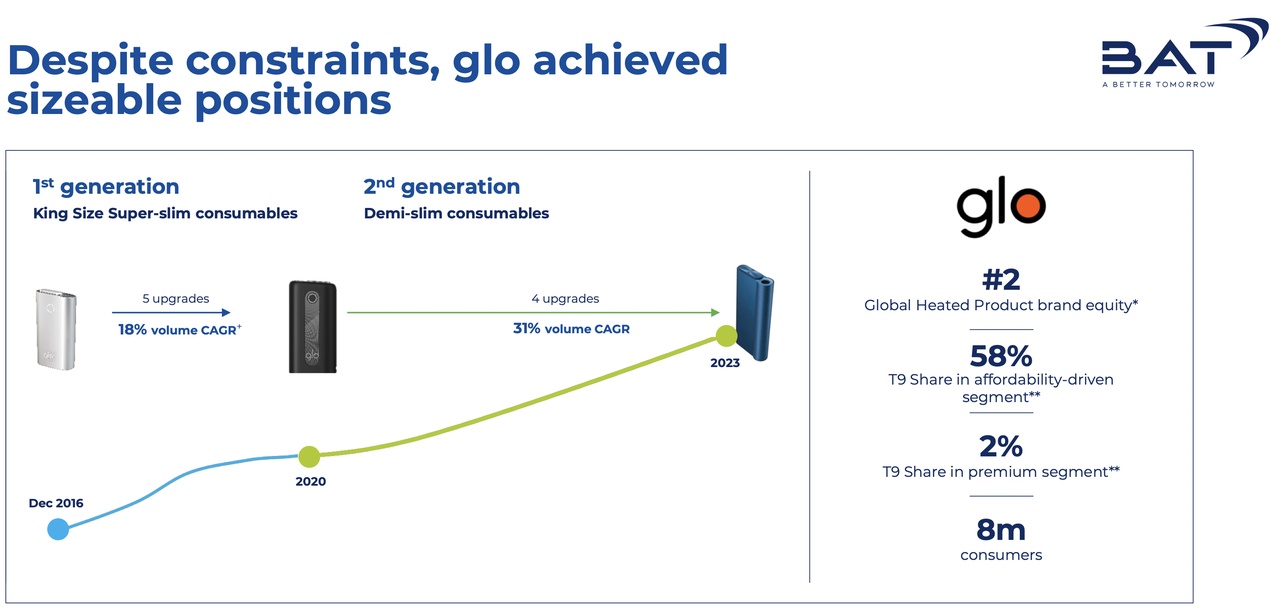

GLO

- HY2 should be significantly better than HY1

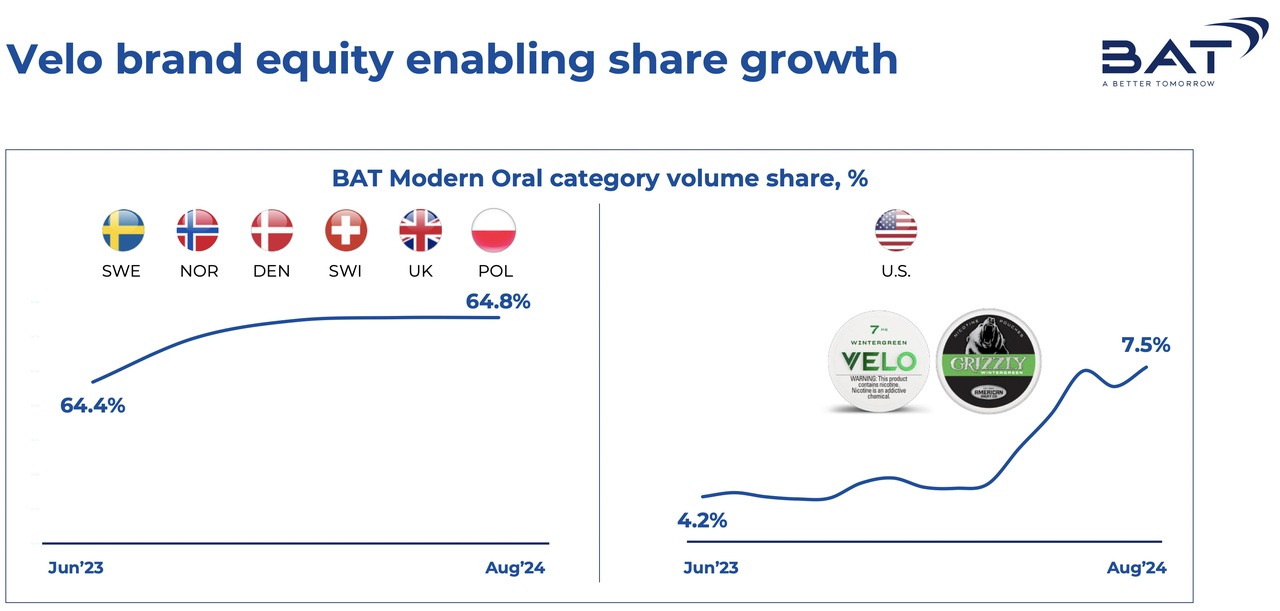

VELO

- Continued market leader outside the USA

- Strong momentum continues to drive volume, sales and profit growth

- New USA branding of VELO and Grizzly drives volume share gains +180bps to >6%

- Portfolio expansion in the USA with VELO Plus

A few more quotes from T. Marroco (CEO)

"Our Quality Growth imperative is delivering higher returns on more targeted investments across all three New Categories, and that prioritization and focus is already transforming our business in Europe. We are making further progress increasing profitability across New Categories, and I am particularly pleased with the improvements in Heated Products and Modern Oral."

"We will continue to reward shareholders through strong cash returns, including our progressive dividend and sustainable share buy-back, and we remain committed to returning to our mid-term guidance of 3-5% revenue and mid-single digit adjusted profit from operations growth on an organic constant currency basis by 2026."