Small share presentation of Weyerhaeuser $WY (+0,42%)

Weyerhaeuser is a so-called Timber-Read, a company owning forest and forest land with management of these areas and forests.

Management consists of small seedlings, rearing, processing, logistic and reforestation.

Field of activity in the USA:

Here, Weyerhaeuser owns approximately 11 million hectares of land and 35 production units

Field of activity in Canada: 14 million hectares of land

The business is divided into 3 main areas:

Timberlands

Real Estate, Energy & Natural Resources

Wood Products

In the area Timberlands is the largest private owner in North America.

49% of revenues go to third party customers within the U.S. and Canada.

25% goes to the company's own processing mills.

26% is shipped for export to other countries.

Export

69% of the total export goes to Japan, 21% to China, 9% to Korea, 1% to India

Real Estate

The goal is to get the most out of every meter of land.

Parts of the land were converted for example for the mining of natural gas, areas were used for wind & solar parks, road construction for infrastructure, expansion of radio masts.

Virtually every m2 of land is used for the best opportunity to increase yields.

Wood Products

Processing of own wood, the company produces cheap wood products

In the field of construction timber, it is the 2nd largest supplier, and in the field of pressed wood, etc., it is the 4th largest supplier on the market.

Custom made parts are also produced and resold.

65% of it goes to home builders, 20% to craft companies, 15% to industrial companies.

Currently, only 2% of the total stock is ever cut down and 100% is reforested.

The energy that is consumed there is obtained from our own biomass.

Attached are a few graphics that I found on the Weyerhaeuser company website.

Finances

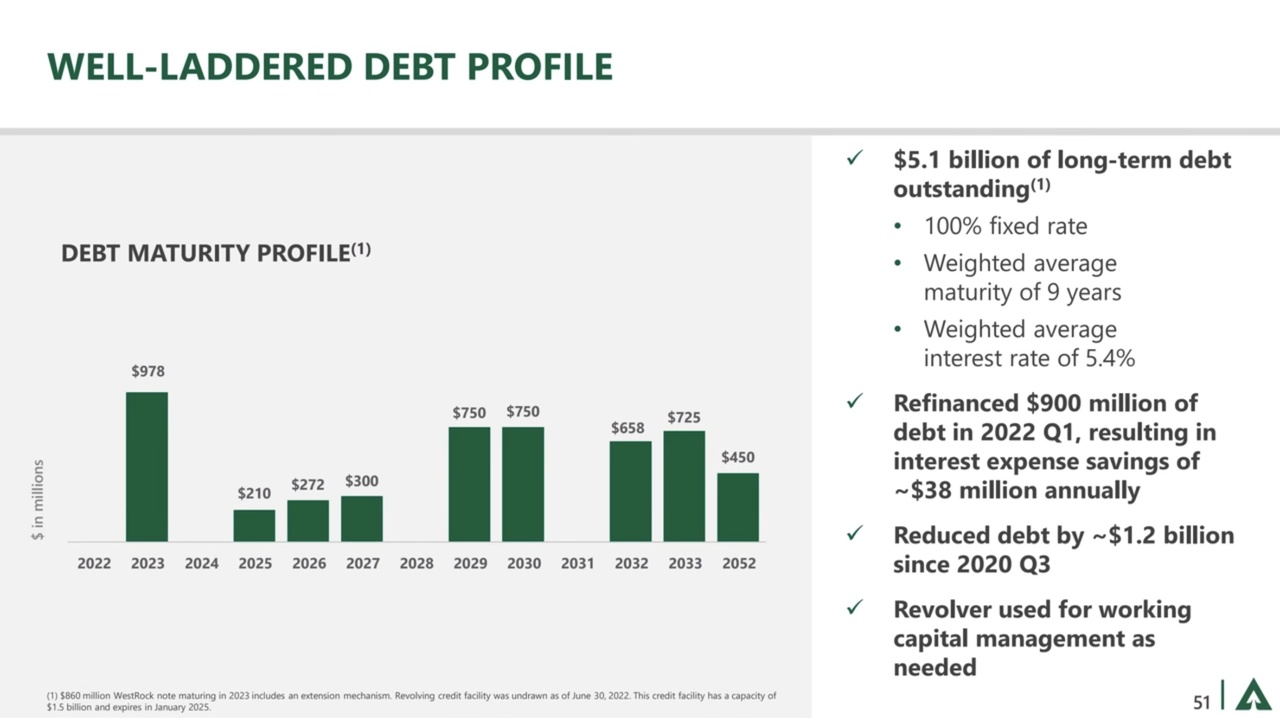

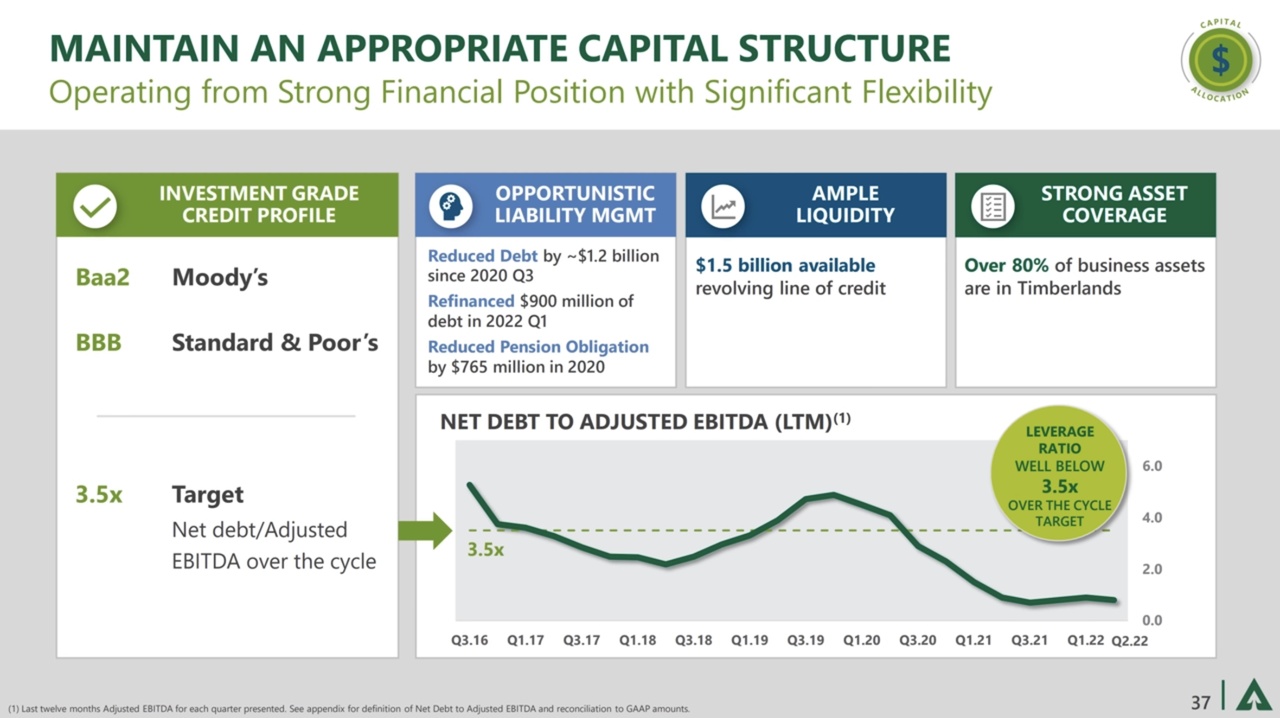

Ratio of net debt to ebita has been reduced significantly the last few years, as shown in the attached image.

The company has $1.5B on hand for further acquisitions.

Existing debt has been financed on a long-term basis. This year, for example, $978,000M is coming due.

On average, the loans run with an average maturity of 9 years and have a fixed rate of 5.4%.

Market cap 24.00B, revenue 10.64B

Dividends

Also a goal from the company is to increase wood production by 5% over the next 3 years and in parallel also increase dividends by 5%.

The funding for the dividends is expected to come from the Natural Climate Solution business, among others, and from development and operational cost reduction from the wood products business.

Dividends were unfortunately suspended at the pandemic time, but the way I see it is that companies are doing everything they can to protect the business, not to take a crowbar to dividends.

Also, a new approach has been made to dividends. These are now paid out in small tranches in the form of a small basic dividend and a special dividend as a special distribution, if the purse allows.

For all dividend hunters maybe something for the watchlist.

Further information about the company that may have been forgotten, I can gladly add. Just hack into the keyboard and post ;-)

Source: www.weyerhaeuser.com