The semiconductor industry has recorded an increase of 40-50% since the beginning of the year

Brief overview:

($NVDA (+4,07%) , $AMD (+7,17%) , $ASML (+1,84%) , $KLAC (+2,26%) , $CDNS (+0,37%) , $LRCX (+5,36%) , $TXN (+0,57%) , $TSM (+1,02%) , $LRCX , $KLAC (+2,26%) , $INTC (+2,36%) , $QCOM (+1,34%) ....)

The largest contribution to this was made by companies such as $NVDA (+4,07%) (Nvidia), $TSM (+1,02%) (Taiwan Semiconductur) and $AVGO (+3,4%) (Broadcom).

Here are a few companies you should know:

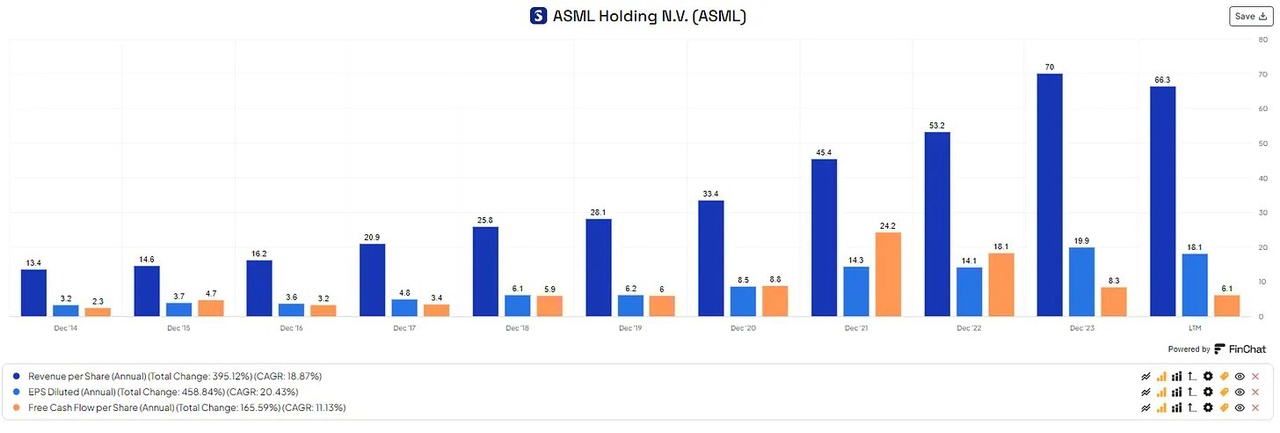

ASML - $ASML (+1,84%) :

- ASML is a leading manufacturer of photolithography machines for semiconductor manufacturing

- The share has gained approx. 42.2 % in the last 5 years

- The 5-year average ROIC of ASML is 21.23 %.

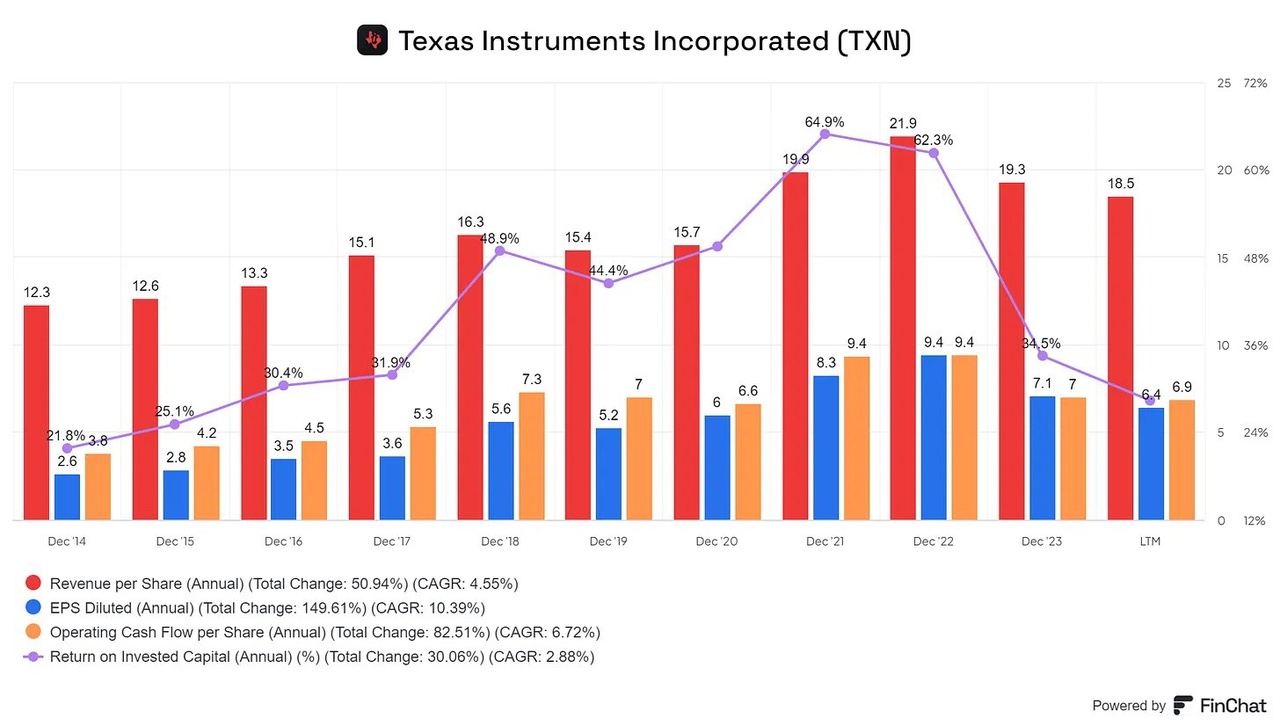

Texas Instruments- $TXN (+0,57%) :

- Texas Instruments specializes in analog and embedded processing chips that are critical to a wide range of electronic applications

- The share has achieved an average annual growth rate of approx. 14.6 % over the last 5 years.

- Earnings per share have increased by 12.19% over the last 10 years

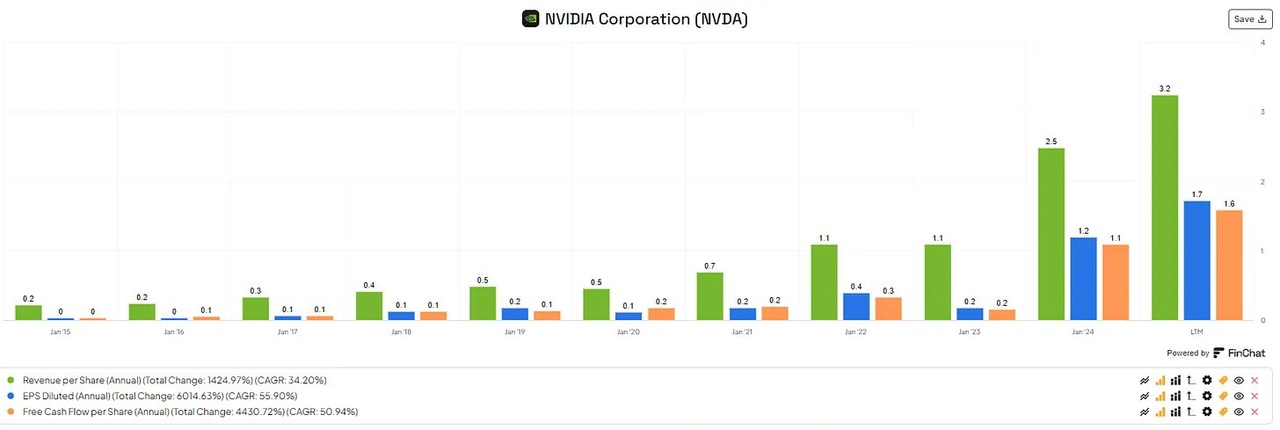

NVIDIA- $NVDA (+4,07%) :

- Nvidia is a global leader in graphics processing units (GPUs) and artificial intelligence (AI).

- The average annual increase in sales over the last 5 years was 49.37%

- Future EPS growth is estimated at 31.74%

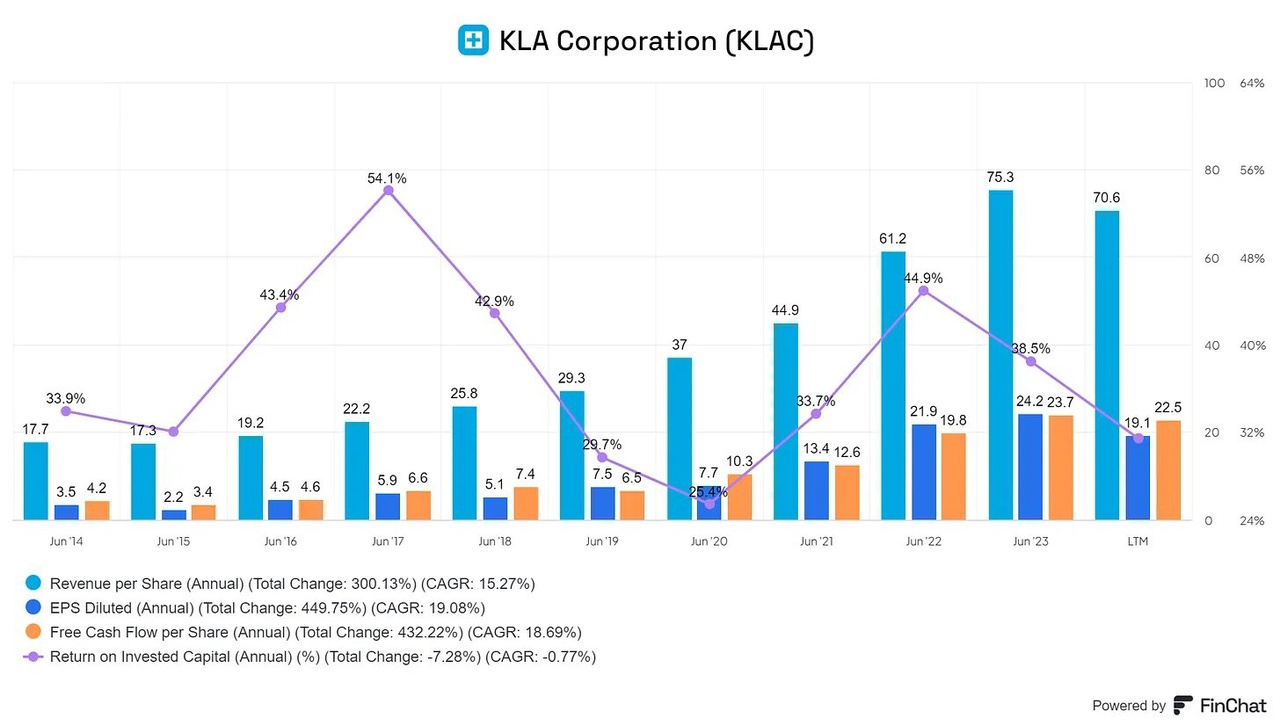

KLA Corporation - $KLAC (+2,26%) :

- KLA provides advanced inspection, measurement and data analysis solutions that are essential for high-quality semiconductor production

- ROIC 5-year average is 34.66%

- FCF per share has increased by 18.7% over the last 10 years

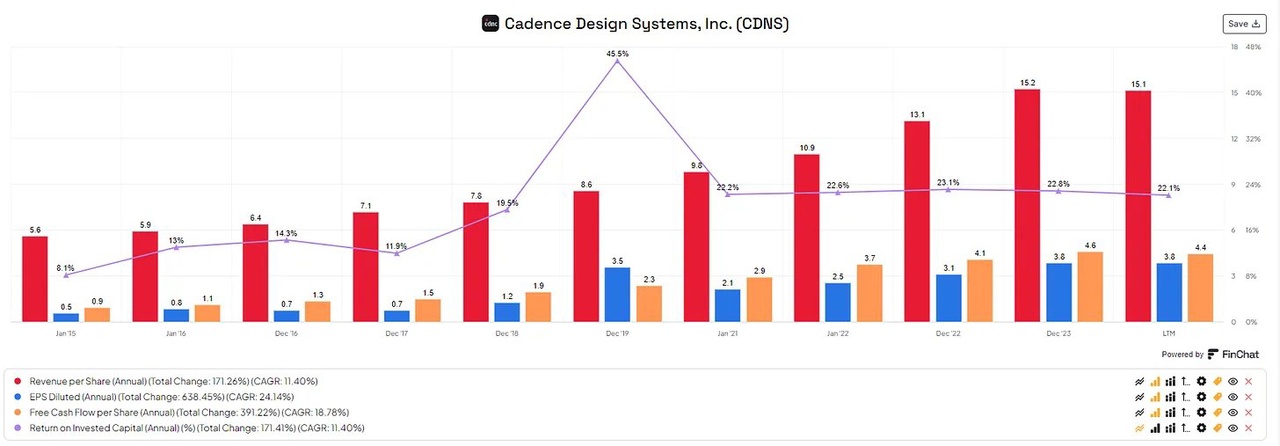

Cadence Design Systems $CDNS (+0,37%) :

- CDNS provides software and engineering services for electronic design automation (EDA).

- The share price has increased by an average of approx. 34.5 % annually over the last 5 years

- The free cash flow per share has averaged 18.78% per year over the last 5 years.

Data from: https://finchat.io/