An exciting company from an exciting sector. 🏦

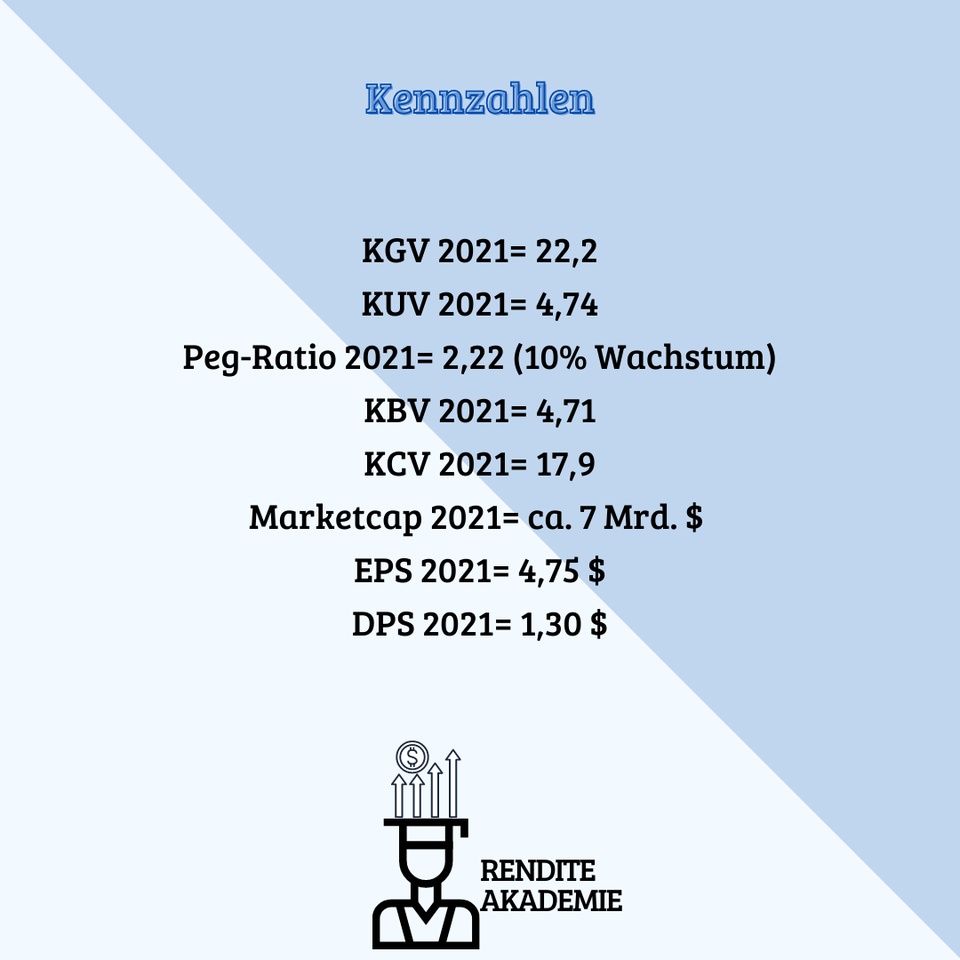

Based on current numbers, Houlihan Lokey is not a bargain. The investment banking sector is more favorably valued than HL (Goldman Sachs, JP Morgan, Morgan Stanley) as measured by P/E and P/E ratios. 🧐

As the dividend yield rises and the payout ratio falls, profits are more effectively distributed to shareholders in the form of dividends. 💸 In my opinion, always a good sign. In recent years, IPOs have increased significantly - about 2680 IPOS in 2021. Due to this increase, Houlihan Lokey also benefits.🔥

Due to the announcements of the FED to reduce or end the bond purchases and considerations to increase the key interest rate several times, highly indebted companies will face increasing problems, as the cost of further growth becomes more expensive. In the worst case, this will result in financial restructuring and insolvency for these companies. Since HL is a market leader in this area and active in many sectors, additional revenue may be generated here. Here, HL is already benefiting from the acquisition of AchPoint, as it has been able to expand its expertise in the technology sector. 📕

Especially in this sector, high debt levels for increasing growth are common.

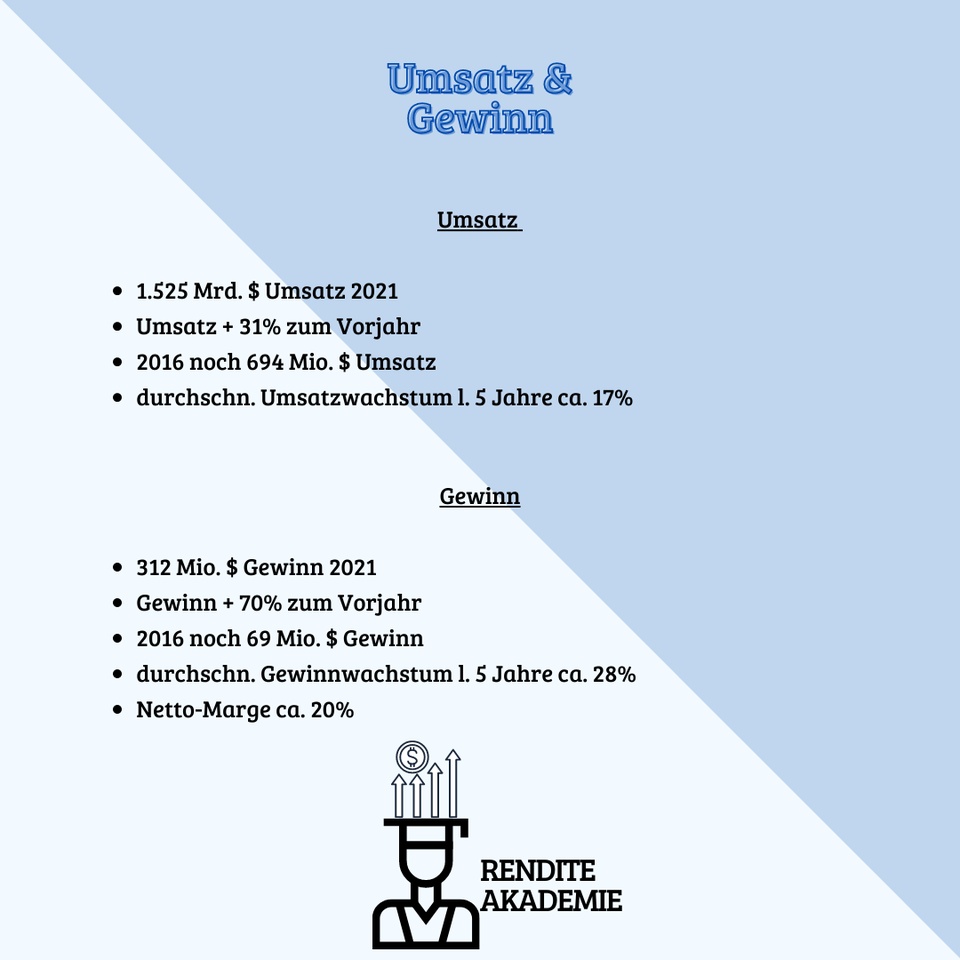

➞ For me, Houlihan Lokey is an attractive company. It has been able to steadily increase sales and profits over the last few years, with margins remaining the same and in some cases improving. According to the management, the strong business model of the last years will be maintained. In addition, the company is trying to close further deals with higher volumes, which would mean higher revenues. The fact that further investment banks seek the expertise of Houlihan Lokey shows your position in the market. 🐂