Stock presentation Sojitz $2768 (+0,54%)

Banzaaaaai🇯🇵

The idea for this came from the Trade Republic newsletter,

where it was about Sōgō Shōsha

was about the 7 largest trading houses in Japan:

- Mitsubishi

- Mitsui

- Itochu

- Sumitomo

- Marubeni

- Toyota

- Sojitz

Of these, I found Sojitz the most interesting.

Sojitz was formed from the following two companies, shown in the abbreviated timeline:

1892 Japan Cotton Trading established 1928 Nisshoiwai Corporation established

1943 Renamed Nichimen Company 1953 Nisshoiwai IPO in Osaka

1982 Renamed Nichimen Corp.

2003 Acquisition of Nisshoiwai from Nichimen Corp.

2004 Umbenennung des neu entstandenen Konzernes in Sojitz Holdings Corp.

Overview of business segments

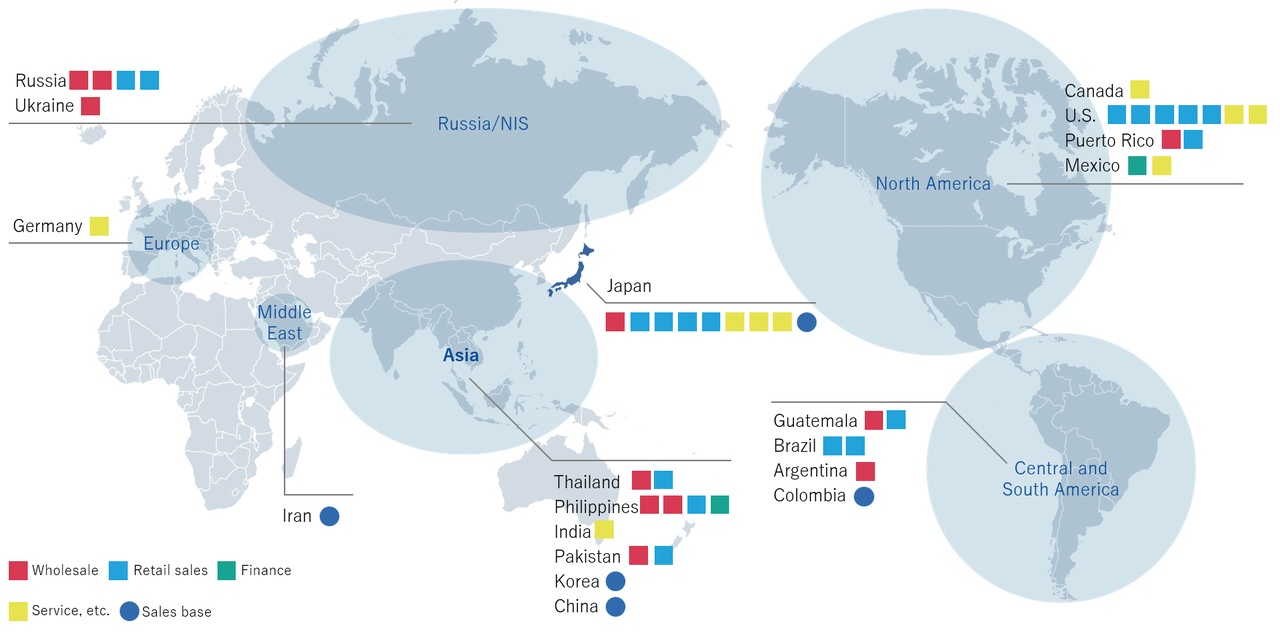

Here the mainstays are sales, service, financing, after-sales and distribution for the major brands.

For example, Sojitz handles sales for BMW in Japan,

Geeley in the Philippines or Hyundai in Pakistan.

A new addition is a camper manufacturer, K Access Corporation.

The idea behind this is to sell people a camper as an office.

In my opinion an idea with a future,

Anyone who has been to Japan knows how cramped it can be in offices/streetcars etc. Who wants to have a look at an office camper

- 4600 employees in 40 offices

- 40 years of experience in business

- Large market share in emerging markets

- FY21 45.6 billion JPY sales

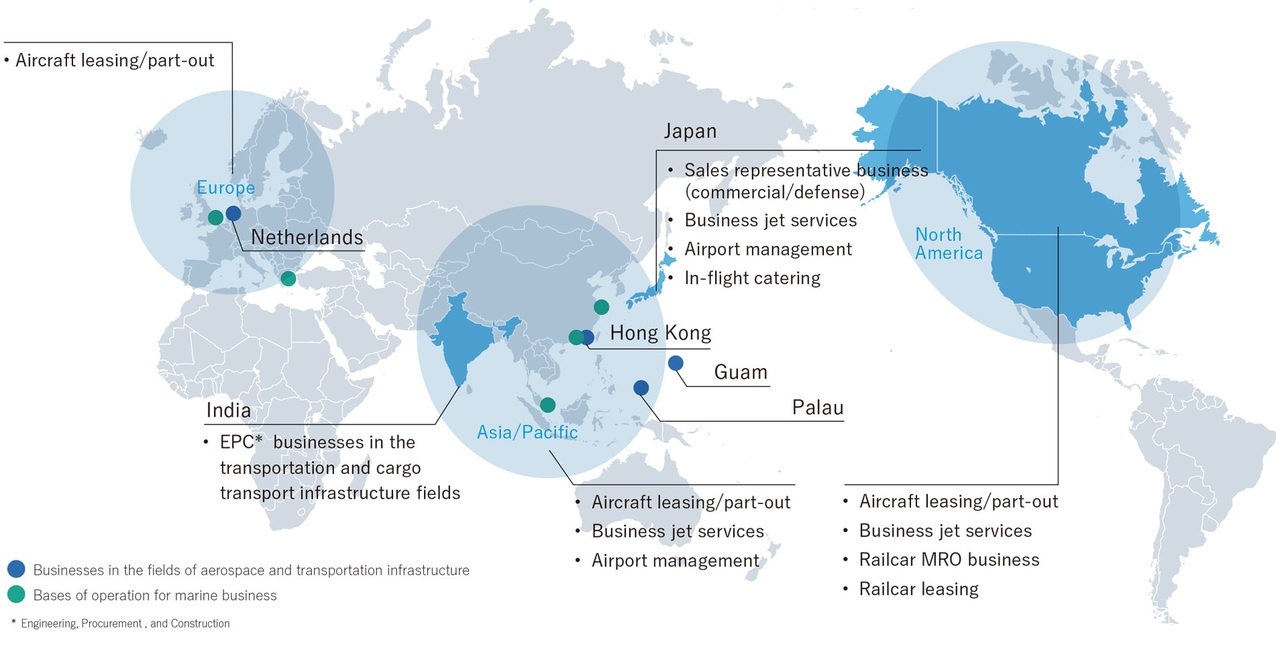

2. Aerospace & Transportation Division:

Transport Rail & Fly:

- This includes the subsidiary. Southwest Rail Industries Inc, leasing company for bulk and liquids, holding 2500 wagons in its portfolio.

- Aircraft leasing based in the Netherlands, Hong Kong, Tokyo, Guam and Palau. Approximately 900 aircraft on lease or sale.

- Catering for onboard meals etc, similar to British Compass Group.

- Procurement and leasing for Militärische Flugzeuge

- Business Jet Leasing

- Satellite Leasing for Telekommunikation

- Raketenantriebe und Satelliten for the Japan Space Program.

- Sales of the Aerospace & Transportation division FY21 JPY 16.2 billion

3. Infrastructure & HealthCare Division

HealthCare:

- So far, only two participation in hospital projects in Australien and Turkey.

According to the IR page, they would like to invest more in this sector, similar to what an Omega Health or a Medical Properties does,

- IT solutions for HealthCare platforms, development of a proprietary

Infrastructure:

- Gas and LNG storage in Spain, Nigeria, Qatar and Indonesia.

- Renewable Energy Solar/Wind in Ireland, Taiwan, USA, Mexico, Peru and Chile.

- Gas power plants in Saudi Arabia, United Arab Emirates, Oman, Sri Lanka, Indonesia, Mexico and USA

- A joint venture for green hydrogen, is in the Spanischen market under construction

- Telecommunications towers in the Philippines and the USA

- Design and construction of industrial parks in India and Uzbekistan

- Sales FY21 JPY 16 billion

4. Metals, Mineral & Recycling

Metals and Minerals:

- Here Sojitz is still the "old" hand company, mines are operated in South Africa, Russia, Australia, Canada and Brazil with export destination Japan/Asia.

- Products include copper, chromium, manganese, coal, iron ore and aluminum.

Recycling:

The division is still in its infancy for the most part, attempts are being made to research a recyclable lithium ion battery, CO² certificates are being traded and some money is being invested in sintering and 3D printing technology.

- Sales FY21 60 billion JPY

- Customer base of 5000 companies

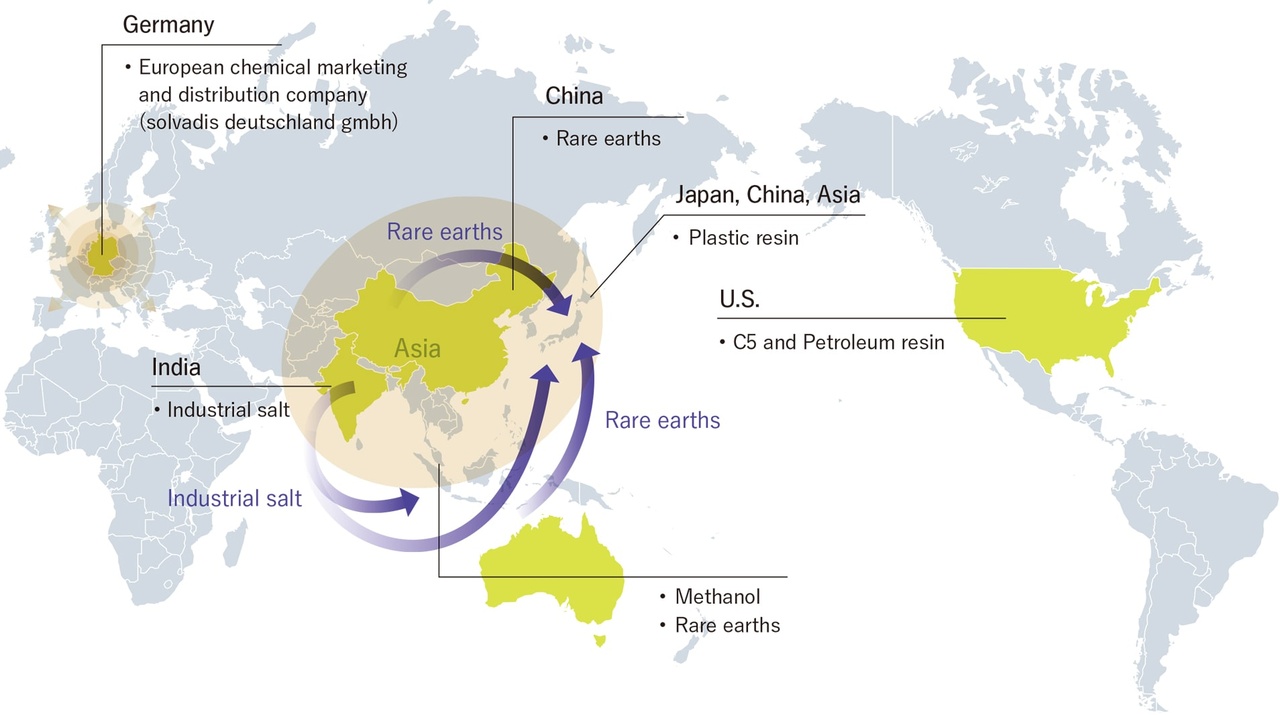

- In Germany headquarters of the European branch Solvadis GmbH

- One of the largest producers of petroleum resin (C5). It is used, among other things, in rubber production or as an additive in the white and yellow lane stripes on roads.

- Refining of PEP plastic, for clothing and packaging.

- Sales FY21 60 billion JPY

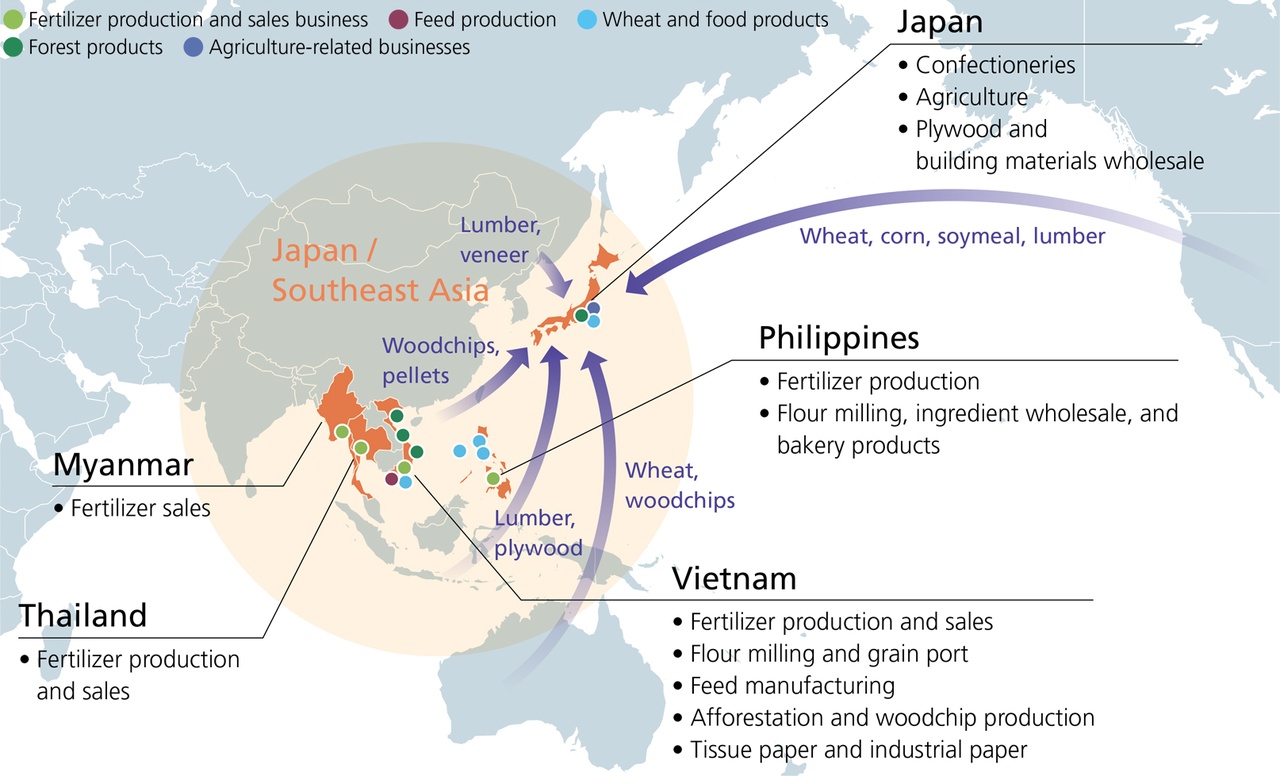

6. Consumer Industry & Aggriculture Business Division

- And again the old Handeslhaus shows up, from the USA, Vietnam, Myanmar and Indonesia raw materials or semi-finished products are imported for food and agriculture.

- Aggriculture: In Vietnam, Thailand and Myanmar the raw material for fertilizer is prepared and processed.

- Consumer Industry: Wood for house construction is imported from Russia and Southeast Asia and refined into more or less high-quality building materials in Japan.

- In the Philippines, there are soybean mills supplying large Japanese bakeries and paper mills for the recycling of low-grade wood.

- Sales FY21 31.3 billion JPY

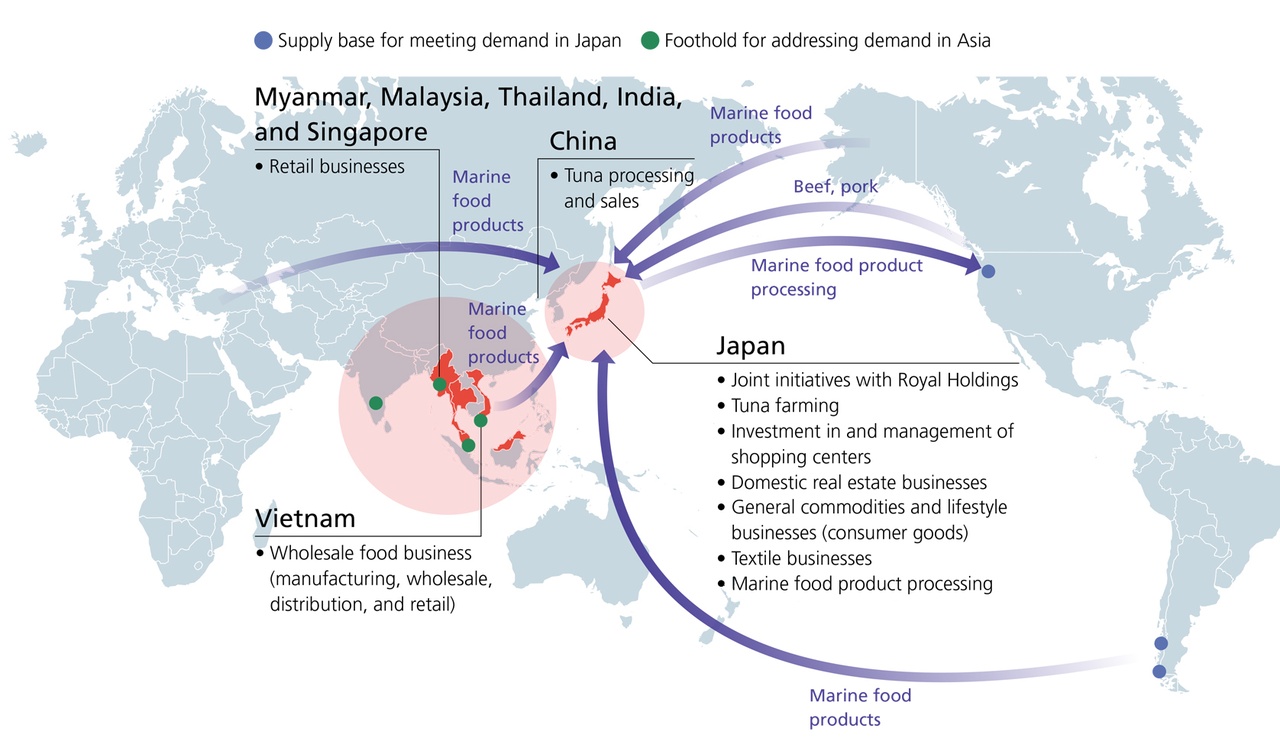

7. Retail & Consumer Service Division

- Fishing and processing, the fish goes to Vietnam where it is processed, packaged and frozen before making its way to Japan.

- The biggest branch here makes tuna, attached is an idea from Sojitz to recognize good from bad Thunfisch per App from bad

- The Mini Stop chain in Vietnam and Royal Host in Japan also belong to this branch.

- meat/fish substitute products under the name Nikuvege

My conclusion:

For me, Sojitz is a buy and will soon land in my portfolio,

the dividend yield of 5.30% is deserved with a wealth of business areas.