📈 DIVIDEND SEASON 2024 - WHICH COMPANIES WILL SURPRISE POSITIVELY WITH THEIR DISTRIBUTIONS AND WHICH WILL DISAPPOINT? 📊

Many here tend to attach more importance to regular distributions when investing in shares; an exciting comparison of returns here in a current Artikel which I will briefly discuss:

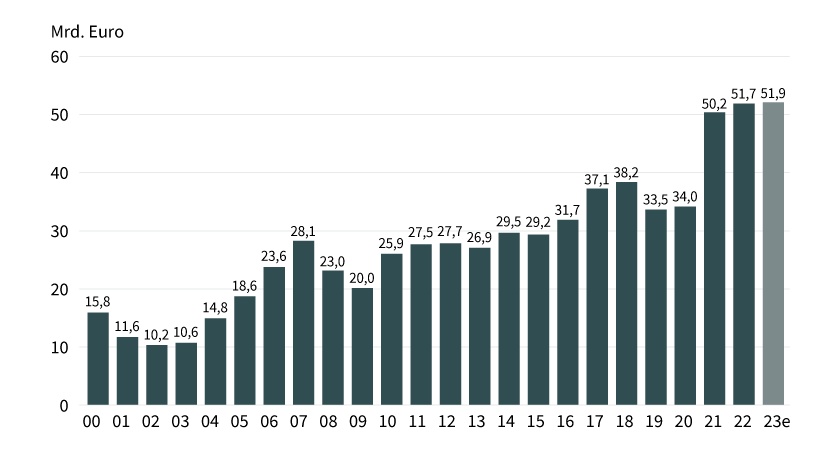

Despite challenges such as the war in Ukraine and persistent inflation, the $DBXD (+0,24%) recorded strong price gains last year. But is this development also in line with the dividends? The dividend amount does not necessarily correlate with the share price performance. (1)

30 of the 40 DAX members have already announced their dividends. Some surprised positively, while others (e.g. $BAYN (+0,1%) ) were disappointing.

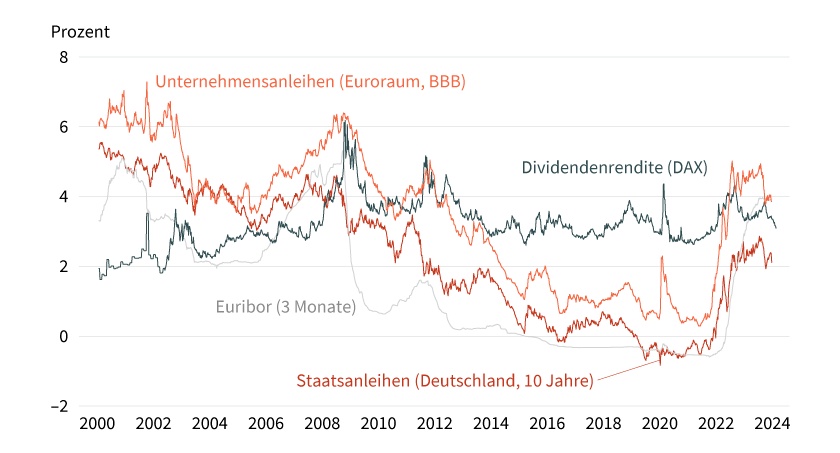

The change in the attractiveness of dividend yields in relation to corporate bonds will also be very relevant in the future...

For example $SIE (+0,1%) offers a dividend yield of 2.6 %. However, investors in corporate bonds can expect an attractive yield of 3.0%. (3)

In the article you will find among others for $DHL (+0,1%)

$BMW (+0,1%) and many other DAX companies the comparison of corporate bonds to dividend yields :)

https://www.ideas-magazin.de/2024/ausgabe-264/titelthema/

(1) Introduction

(2) Section "Eleven positive and 5 negative DAX surprises"

(3) ibid. "DAX dividends 100 basis points above the bond yield?"

#Rohstoffe

#Finanzen

#Marktausblick

#commodities

#marketsentiment

#finance 📊

This article is part of an advertising partnership with Société Générale