S&P 500 falls for second week in a row, energy leads broad-based decline

The Standard & Poor's 500 Index fell 2%, dropping for the second week in a row, triggered by concerns about the Federal Reserve's future monetary policy and a possible government shutdown.

The market index closed the week at 5,930.85 points and is now down 1.7% in December, but remains well in positive territory for 2024 with a year-to-date increase of 24%.

On Wednesday, the Federal Open Market Committee (FOMC) cut the central bank's key interest rate by 25 basis points, as expected. However, the monetary policy committee signaled fewer interest rate cuts in the coming years than previously assumed and at the same time raised its inflation forecasts. Inflation, as measured by personal consumption expenditure (PCE), is now estimated at 2.4% for this year (previously 2.3%) and 2.5% for 2025 (previously 2.1%). These developments fueled concerns among investors and weighed on share prices.

In addition to these concerns, a possible government shutdown loomed after a bipartisan agreement on funding until mid-March failed last week and a budget bill proposed by Republicans in the House of Representatives for three months of funding was not passed late on Thursday.

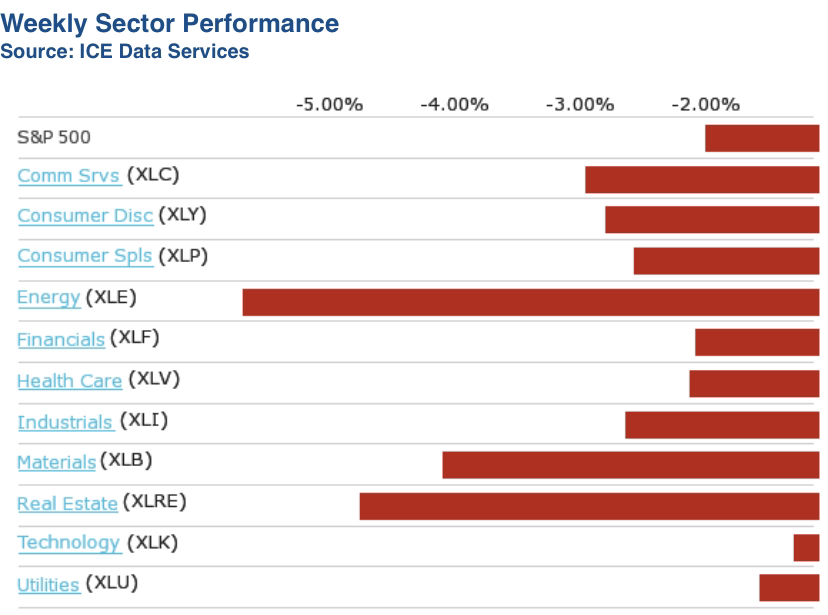

All sectors of the S&P 500 posted weekly losses, led by a 5.6% decline in the energy sector, followed by a 5% drop in the real estate sector and a 4.2% decline in the materials sector. Other sectors with declines of at least 2% were industrials, consumer discretionary and defensives, healthcare, communications services and financials.

In the energy sector, the shares of Phillips 66 (PSX) recorded the biggest loss, falling 10% for the week. The company announced the sale of DCP GCX Pipeline, which holds a 25% non-operating interest in the Gulf Coast Express Pipeline, to an affiliate of ArcLight Capital Partners for pre-tax proceeds of $865 million in cash, subject to adjustments.

In the real estate sector, the shares of VICI Properties (VICI) fell by 7.5 % after KeyBanc downgraded the rating from "overweight" to "sector weight". In addition, VICI Properties announced that its subsidiary VICI Properties LP completed a public offering of USD 750 million of unsecured senior notes with an interest rate of 5.125% and a maturity date of 2031.

In the materials sector Nucor (NUE) and Steel Dynamics (STLD) were among the losers as both steel producers announced fourth-quarter earnings below analysts' expectations due to lower prices. Shares of Nucor fell 6.9%, while Steel Dynamics lost 5.5%.

In the coming week, the markets will close three hours early on Tuesday, December 24, and remain closed on Wednesday for Christmas. Due to the holiday-related closures, there will be few economic data releases, including December consumer confidence on Monday, November durable goods orders and new home sales on Tuesday, weekly initial jobless claims on Thursday and November merchandise trade balance on Friday.