A top pick for me in the long term. Buy and hold! 🚀

Therefore topped up again today. 💳

A top pick for me in the long term. Buy and hold! 🚀

Therefore topped up again today. 💳

Nu Holdings: The path to market leadership in digital banking - growth, innovation and expansion in Latin America.

In this article, I provide insights into Nu Holdings $NU (-0,2%)'s growth, key financials, products, competitors, economic risks, cash and card payment behavior and expansion in Latin America.

Finally, I share my personal buys on the stock.

1. company overviewt

-Year of foundation: 2013.

-Head officeSão Paulo, Brazil. 🇧🇷

-Stock exchange listing: NYSE under the symbol NUsince December 2021.

-Regional presenceActive in Brazil, Mexico, Colombia, Germany, Argentina, Uruguay and the USA.

-Number of employees7,686 worldwide.

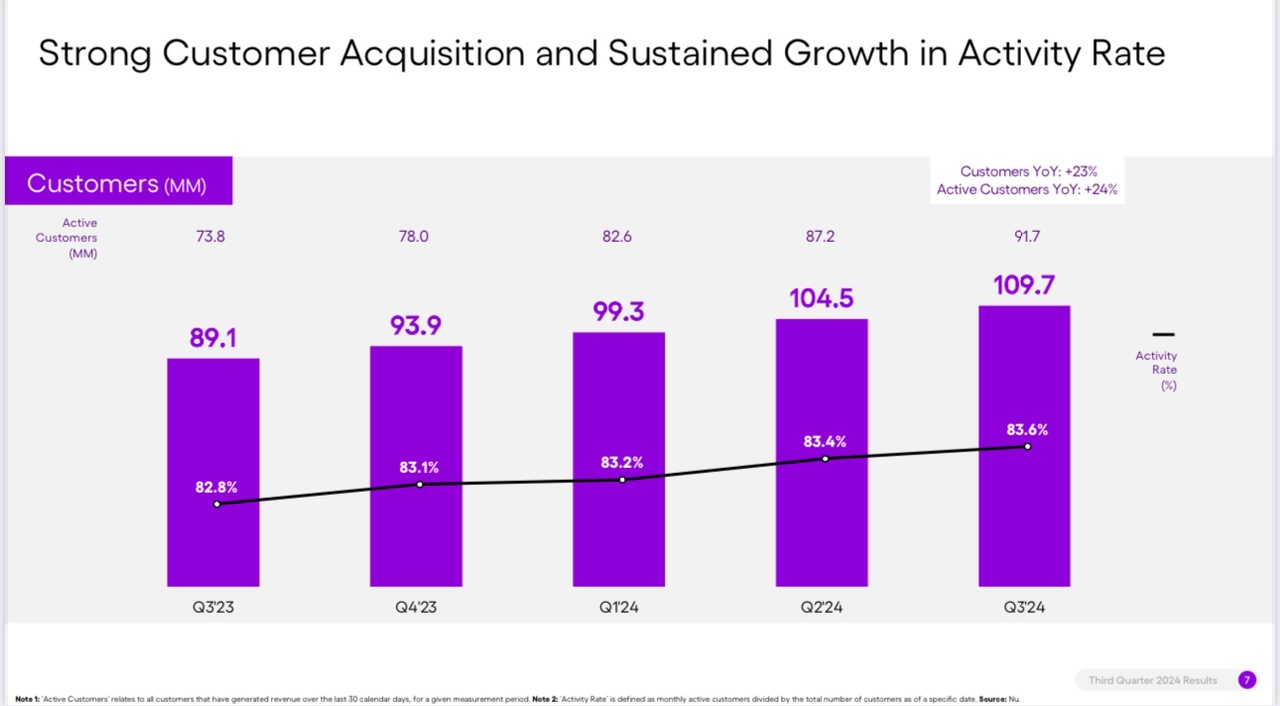

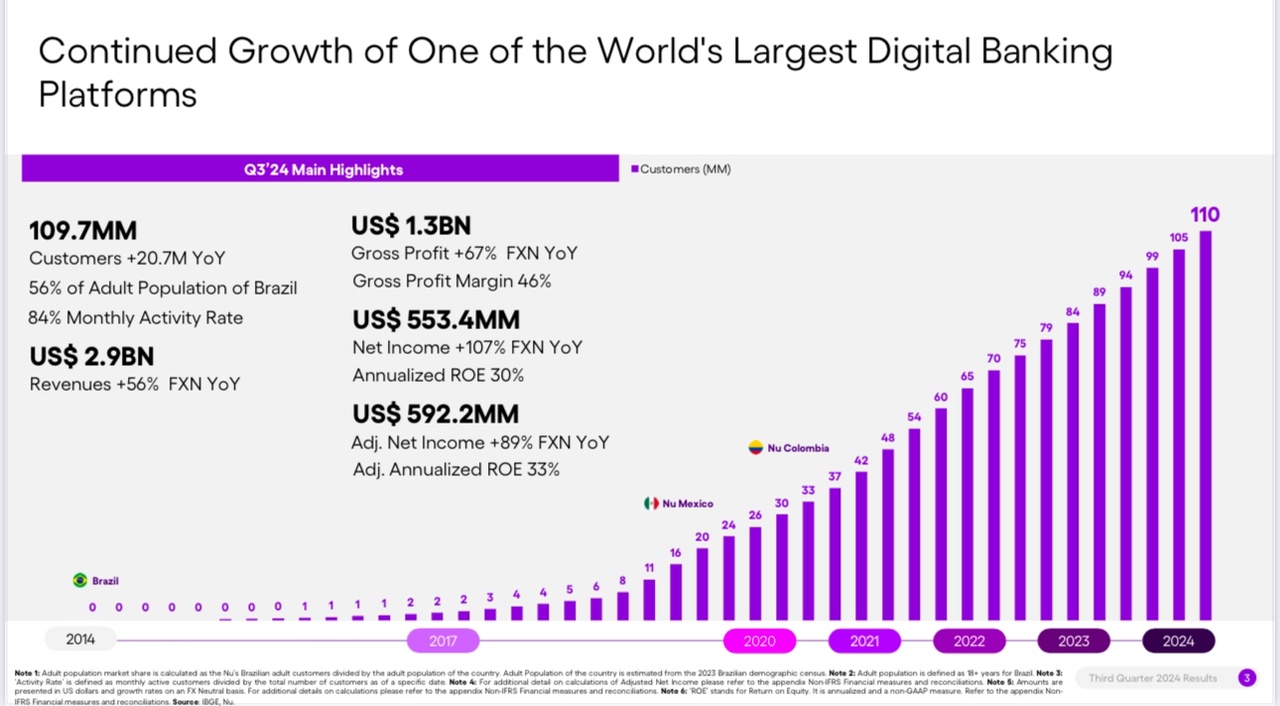

-Number of customersOver 110 million worldwide, 60% of them in Brazil.

-CEODavid Vélez Osorno, co-founder.

-MissionTo promote financial inclusion and transformation of traditional banks through user-friendly digital solutions.

2. financial performance (Q3 2024)

-Total revenuesUSD 2.9 bn (+56% YoY, FX neutral).

-Net profitUSD 553.4 million (+107 % YoY)

-Gross profitUSD 1.348 bn (+67 % YoY), gross margin 46 %.

-DepositsUSD 28.3 bn (+60 % YoY).

-Loan portfolioUSD 20.9 billion (+47 % YoY).

-Return on equity (ROE): 30 %.

-Cost efficiencyAverage cost per active customer: USD 0.7/month.

-Asset quality: Decrease in non-performing loans (15-90 days) to 4.4 %.

3. products and services

-Credit cardsFree and premium cards such as the "Ultraviolet" card for wealthier customers.

-Digital accounts: "NuAccount" for private and business customers.

-Credit solutionsPIX Financing", unsecured and secured loans.

-Investment solutions"NuInvest" for ETFs, shares and funds; "NuCrypto" for cryptocurrencies.

-InsuranceLife, vehicle and household insurance.

-Loyalty programIntroduction of "Nucoin", a token-based system.

4. market behavior and payment habits

-Bank account coverage in Brazil70% of the population have a bank account.

-Pix payment systemMore than 150 million users; increasingly replaces cash with real-time payments, with over 140 million active users.

-Card payments: In Brazil, over 60% of the transaction volume is processed by cards, a growing market due to Nu and similar providers.

-Cash usage: Cash remains important in rural areas and for small transactions, but the proportion is falling in urban areas due to the spread of digital payment platforms.

5. market development

-Customer growth:

-Brazil 🇧🇷: 98.8 million customers (56% of the adult population).

-Mexico 🇲🇽: 8.9 million customers.

-Colombia 🇨🇴: 2.0 million customers.

-Global expansionFurther markets are being targeted by Nu, particularly in Europe and Latin America.

6. competitive advantages

-TechnologyAI-powered platform that enables Nu to efficiently develop products and optimize credit decisions.

-ScalabilityFully digital solution with low operating costs.

-Financial inclusionEnables access to financial services for unbanked populations, especially in Brazil and Mexico.

7 Sustainability and ESG

-ESG ratingMedium risk (24.82 points in 2024).

-Responsible lending: Focus on transparent and fair lending.

-Community engagementFinancial literacy initiatives and microcredit support.

8. strategic goals

-Product diversificationExpansion of NuCrypto and the "NuInvest" platform.

-Geographic expansion: Development of new markets in Latin America and Europe.

-InnovationFurther development of the payment infrastructure with a focus on real-time transactions and open finance.

9. banking transactions in Brazil

Bank accounts and financial behavior in Brazil:

-Bank account coverageAround 70% of the Brazilian population has a bank account, with the introduction of digital banks such as Nu contributing significantly to financial inclusion.

-Unbanked populationApproximately 16% of Brazilians will not have access to banking services in 2024, often from rural or low-income areas.

-Pix systemThe real-time payment system Pix has over 150 million users (144 million active), replacing cash in many situations and making bank accounts even more accessible.

Cash and card payment behavior:

-Cash usageCash remains relevant for small transactions in Brazil, Mexico and Colombia, especially in rural areas. Nevertheless, the use of digital payments is increasing significantly.

-Card payments: In Brazil, card payments account for over 60% of the transaction volume.

Digital banks such as Nu are encouraging this development by offering fee-free card solutions.

-Digital payment methodsPix is used for over 75% of real-time transfers.

It is revolutionizing both person-to-person and business transactions and is increasingly used for recurring payments.

10. differentiating features of Nu Holdings

Nu Holdings has differentiated itself from other digital banks through some innovative and lesser-known strategies, including:

-Strong focus on customer engagement and cross-sellingNu pursues a strategy that focuses not only on customer acquisition, but also on maximizing lifetime value through cross-selling and up-selling. This is made possible through targeted products and services that serve the needs of the existing customer base.

-Internationalization and regional market penetrationWhile many digital banks focus on local markets, Nu has strategically expanded to the entire Latin American market and beyond.

In Mexico and Colombia, Nu is focusing on consistently increasing deposit yields to remain competitive in these growing markets.

-Innovative financial products and flexible loansBy continuously adapting and expanding its offering, such as through the use of "PIX Financing" and a focus on flexible, secured loans, Nu ensures that its products meet the needs of different market segments as well as regulatory requirementsy

-Commitment to sustainability and financial educationNu takes a proactive approach in supporting financial education and social responsibility, which not only contributes to brand loyalty, but also to long-term customer loyalty.

11. share performance and analyst opinions

Nu Holdings has had a remarkable performance in the stock market. The stock has performed strongly in 2024, rising over 90% due to strong revenue growth and expansion into new markets.

The stock is currently trading at around USD 12.03, with an average 12-month price target of USD 15.63, representing a potential upside of around 29.93%.

Analysts set their price target between USD 11 and USD 19, depending on their assessment.

Key analyst opinions:

-Goldman Sachs has raised the price target from USD 17 to USD 19, representing a potential upside of 57.94%.

-The general consensus rating for the share is "Buy", indicating a positive analyst view on the future development.

Despite market volatility and rising interest rates in Brazil, the long-term outlook for Nu Holdings remains promising.

The expansion in Mexico and Colombia as well as the strengthening of the commitment in Brazil continue to drive growth.

12. competitive environment of Nu Holdings

Nu Holdings is one of the leading digital financial services providers in Latin America, but the market is highly competitive.

The company is in direct competition with traditional banks, regional FinTechs and international digital banks.

The following provides an overview of Nu Holdings' most important competitors as well as their strategies and market positions:

-Traditional banks in Latin America

The traditional banks in Latin America, such as Itaú Unibanco, Banco do Brasil and Santander Brasilare Nu Holdings' main competitors.

These banks have a strong customer base due to their decades-long presence and established infrastructure.

They also offer digital banking solutions to keep up with FinTechs, but their systems are often less user-friendly and innovative than Nu's.

-Strengths:

-Established brands and customer trust.

-Broad branch network and robust infrastructure.

-Higher capital resources for investment in digital transformation.

-Weaknesses:

-Slow adaptation to digital innovations.

-Higher fees and less flexibility in product design.

Insufficient focus on the needs of younger, tech-savvy generations.

-Digital banks and FinTechs

In the FinTech sector, companies such as Banco Inter, XP Inc., Revolut and Neon are direct competitors. These companies also offer digital financial products such as accounts, credit cards, loans and investment opportunities and have gained significant market share in recent years.

-Banco InterA Brazilian FinTech that follows a digital business model similar to Nu and offers a broad product portfolio. Banco Inter has successfully established itself in the field of digital banking services and also offers real estate and insurance services.

-Competitive factorBanco Inter has similar business models and customer needs to Nu, but without the same international expansion and market penetration.

-XP Inc.A leading Brazilian digital investment and securities trading company.

It offers a platform for buying and selling stocks, bonds and other securities.

-Competitive factorWhile XP does not compete directly with Nu in terms of digital banking services, it targets the same tech-savvy customer base that is also interested in neobanking solutions.

-NeonNeon is another Brazilian FinTech that offers similar products to Nu, including digital accounts, credit cards and loans.

However, Neon has focused more on the consumer segment, while Nu is increasingly targeting business customers.

-Competitive factorNeon offers similar services but does not have the same brand awareness and market penetration as Nu.

-RevolutAn international FinTech company operating in several countries, including Brazil.

Revolut offers digital banking services and a wide range of financial products, including its own cryptocurrency platform.

-Competitive factorRevolut competes with Nu, particularly in the area of international payments and cryptocurrency services. However, Revolut is not yet as well established in Brazil as Nu.

-Payment services and technology companies

In recent years Stripe, PayPal, and Mercado Pago have become increasingly important, particularly in the area of payments and online transactions.

These companies offer solutions that challenge Nu Holdings, especially in the areas of international payments and digital wallets.

-Mercado Pago: As part of the marketplace Mercado Libre Mercado Pago has a strong presence in Latin America.

It allows users to make payments, send and receive money and also offers loans.

-Competitive factorMercado Pago is a strong competitor in terms of mobile payments and loans and benefits from Mercado Libre's strong brand recognition, giving Nu and other digital banks great competition.

-PayPal and StripeThese two global payment processors have a strong market position due to their broad product portfolios and globally established infrastructure.

They offer easy payment methods and mobile solutions that challenge Nu in terms of payments.

-Competitive factorThese companies are direct competitors to Nu when it comes to payments, money transfers and business settlements.

However, Nu offers a broader range of financial services, while PayPal and Stripe are more focused on payment solutions.

-Nu Holdings' competitive strengths

Despite strong competition from established banks and FinTechs, Nu Holdings has several strategic strengths that set it apart:

-Ease of use and technologyNu is a leader in creating a user-friendly platform that enables seamless integration of financial services via mobile devices.

The user experience and customer service is a strong selling point.

-Cost structureNu keeps operating costs low by operating largely digitally and not maintaining expensive physical branches.

This allows it to offer competitive rates and lower fees than traditional banks.

-Innovative productsThrough continuous innovation, such as the launch of "Nucoin", a cryptocurrency platform, and customized lending solutions, Nu appeals to a wide range of customers who need both traditional and modern financial products.

-Strong brand awareness and customer loyaltyNu has managed to gain the trust of the younger generation who rely on digital solutions and benefits from a high activity rate and customer satisfaction.

13. economic risks for Nu Holdings in the banking environment in Brazil

Brazil, as the largest market for Nu Holdingsoffers both opportunities and significant economic risks.

The country is one of the most important economic players in Latin America, but suffers from structural problems that can affect the business environment for banks and financial services providers.

The economic risks for Nu Holdings and other banks in the banking environment in Brazil are described below:

-Economic instability and inflation

Brazil has struggled with high inflation and economic instability in recent years. While the Brazilian economy has shown signs of stabilization in 2024, high inflation rates and fluctuating growth rates can lead to uncertain conditions for businesses, including digital banks such as Nu.

-InflationHigh inflation can reduce the purchasing power of consumers, leading to a reduction in demand for financial services. This can also affect the profitability of banks and FinTech companies, as rising operating costs and loan defaults can put pressure on margins.

-Interest rate changesThe Brazilian central bank has pursued an aggressive interest rate policy to combat inflation, resulting in high interest rates. High interest rates can have a negative impact on the demand for credit and increase financing costs for banks.

-Political uncertainty and regulatory risks

Political instability and regulatory uncertainty are other significant risks for companies in Brazil, including Nu Holdings.

The country regularly faces political turmoil, changing governments and inconsistent regulation.

-Political uncertaintyChanging political majorities and their different economic policy approaches can lead to unstable conditions for banks.

Political uncertainty can reduce confidence in the financial sector and have a negative impact on investment and consumer behavior.

-RegulationBrazil has strict regulations in the financial sector, which can change quickly.

Nu Holdings must continuously ensure that it remains compliant with new regulatory requirements, particularly in the area of data protection and financial supervision.

Changes in regulation could result in additional costs or adversely affect Nu's business model.

-Currency risks

The Brazilian currency, the real (BRL)is susceptible to fluctuations on the international market.

Due to its strong dependence on global commodity prices and the volatility of the financial markets, the real can fluctuate strongly against the US dollar or the euro.

-Exchange rate risksSince Nu Holdings operates in several countries, a devaluation of the Real could affect the company's profitability, especially in international transactions or if the company generates profits in other markets that need to be converted into Real.

-Inflation and devaluationA sharp devaluation of the real could not only increase the cost of imports and working capital, but also affect the creditworthiness of Brazilian consumers, which could lead to an increase in loan defaults.

-Access to capital and financing costs

Nu Holdings relies on access to capital to fund its growth in Latin America and beyond.

The ability to raise capital could be affected by general economic conditions, political uncertainty or market perceptions of risk in Brazil.

-Raising capitalHigher interest rates and economic uncertainty could increase the cost of raising capital.

In an environment of rising interest rates and high inflation, it could become more difficult to secure favorable financing terms, particularly for expansion into other markets or for the development of new products.

-Debt risksIf Nu Holdings has a high leverage ratio, this could make the company more vulnerable to interest rate increases or market fluctuations.

An increase in borrowing costs could slow down profitability and growth.

Socio-economic challenges and unbanked population

Another risk for Nu Holdings in Brazil is the fact that a significant portion of the Brazilian population is still unbanked or underbanked, which may limit the reach of digital banking solutions.

-Access to financial servicesDespite the growth of digital financial services, many Brazilians do not have access to traditional banking services, and the cost of digital banking products could be a barrier to wider adoption.

-Digital divideWhile technology is widely available in urban areas, rural regions and low-income populations often lack access to modern digital financial solutions, which may limit Nu's growth potential in these areas.

~Personal opinion:

Nu Holdings clearly remains an extremely promising stock for me in the financial and FinTech space, and I definitely want to add to it.

I really like the company's strong growth and continuous expansion. Unfortunately, the share is currently not available in ING's savings plan.

My first purchase in February 2024 at a price of €7.93 turned out to be a real stroke of luck.

In June 2024, I increased my position at a price of €10.52, followed by another purchase in August 2024 at €8.63.

In October 2024, I invested at € 11.33 and recently, in December 2024, I acquired a smaller position at € 11.26.

Best regards

Michael

+ 3