Europa was a Phoenician princess who was abducted by Zeus

---------------------------------------------------------------------------------------------------------

I would be interested in your opinion:

Could this be a good time to pick up shares in a Europe ETF?

---------------------------------------------------------------------------------------------------------

The European equity market has underperformed the global equity market in recent years and feels more unpopular than ever. However, in my opinion it has good potential for the future, forget the political unrest and other "news". We are doing better than ever before and things are slowly and steadily moving upwards.

So wouldn't that be the perfect entry scenario, for example by means of a savings plan in a Europe ETF? Perhaps a factor ETF.

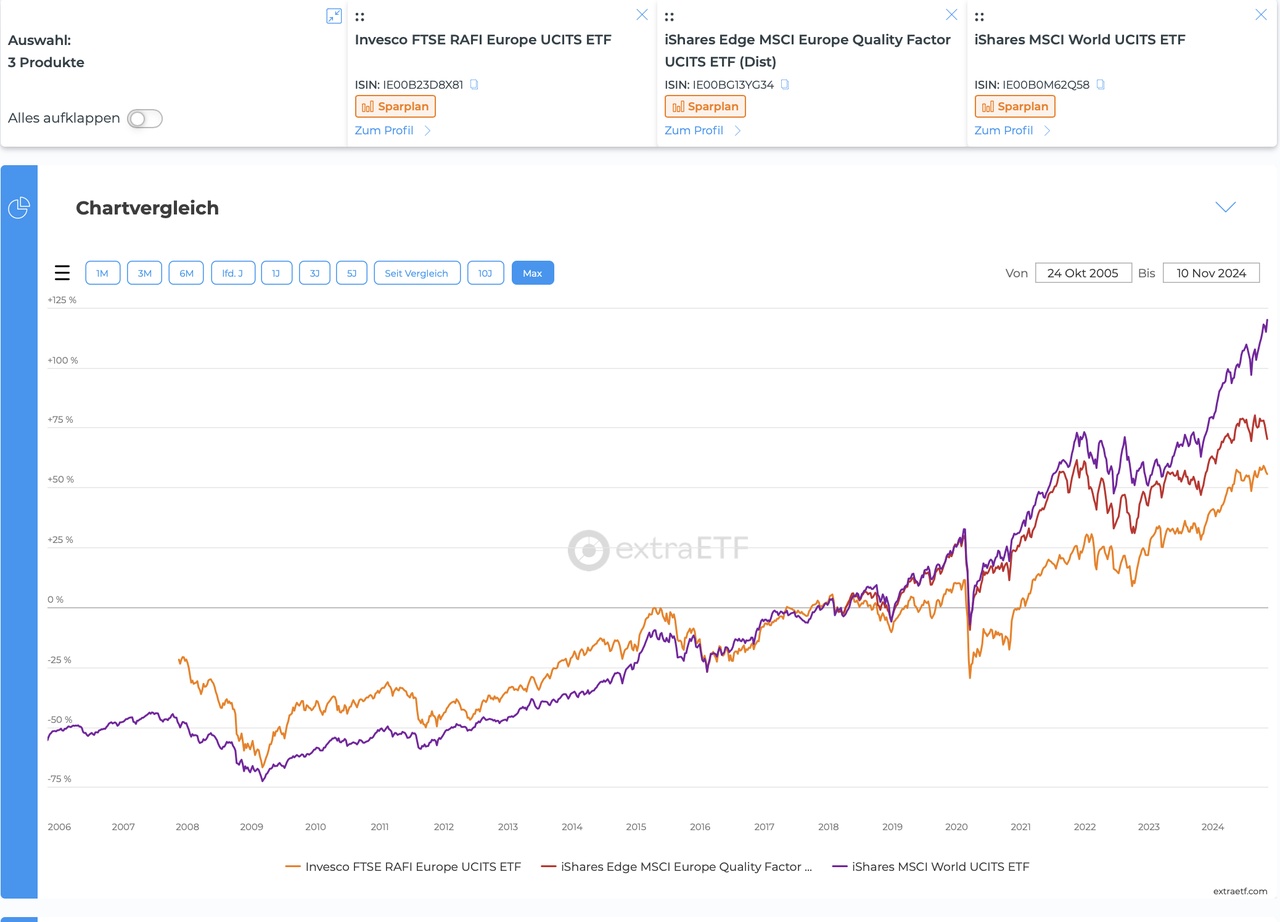

One of these, for example:

Do you know of any other interesting Europe ETFs?

---------------------------------------------------------------------------------------------------------

Alternatively, you could even make a country bet and bet on the UK, Switzerland, France and Italy, for example. Now don't say that country bets are bad, because both India and China seem to have worked. The disadvantages of the country bet would be, depending on the strategy, more ETFs, more risk, more effort. That's why I tend to favor the Europe ETF solution.

---------------------------------------------------------------------------------------------------------

But in your opinion, does it make sense to invest in a European ETF at all, or are you just adding a drag on returns to your portfolio? After all, most large US companies make their sales worldwide and therefore indirectly invest in Europe, among other places.

---------------------------------------------------------------------------------------------------------

Thank you for reading, sharing your opinion, assessment, experience and food for thought

---------------------------------------------------------------------------------------------------------