++News at Clinuvel: Why 30% return in one month?!++ $CUV (-1,77%)

Servus dear GQ-Community, from my side came no longer longer posts, because the Abitur is slowly approaching...

Those who follow my posts regularly know that I am a shareholder of Clinuvel Pharmaceutical, and have already written a share presentation about the Australian smallcap. Authored. Here it is again for your perusal:

https://app.getquin.com/activity/aHswuVFNaJ?lang=de&utm_source=sharing

https://app.getquin.com/activity/aHswuVFNaJ?lang=de&utm_source=sharing

I was asked if I could write an update on the position, as quite a bit has happened around the stock. Below are two factors that have had a possible effect on the price of the stock:

Insider selling at Clinuvel:

As written earlier, Clinuvel is a small cap. When investing in such a "small" company, what matters most to me, besides the balance sheet, is the management. If the management holds large stakes in the company in addition to a good balance sheet, I am interested.

From the point where the management sells the shares in large volumes, one should be vigilant with small companies, because no one knows the company as well as the bosses. But you can't let bad news destroy your investment case, because you never know all the information. So that you are all informed, I will now give you an overview:

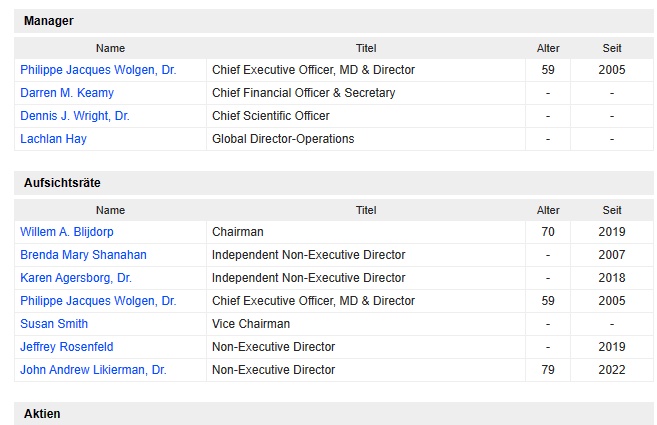

Shareholder structure: (If the table is not displayed, please check the charts)

Chairman

70

2019

Independent Non-Executive Director

-

2007

Independent Non-Executive Director

-

2018

Chief Executive Officer, MD & Director

59

2005

Vice Chairman

-

-

Non-Executive Director

-

2019

Non-Executive Director

79

2022

Those involved in insider transactions in the last 24 months were: Brenda Shanahan, Jeffrey Rosenfeld and Philippe Wolgen.

Transaction totals are as follows:

Insider sales: Jeffrey Rosenfeld (A$20,730.12) and Philippe Wolgen (A$16,143.00). Total 5,161,659.65 shares

Insider buying: Brenda Shanahan (A$628,250.00) and Philippe Wolgen (A$4,259,344.65). Total: 198,306 shares

Why the insiders sold shares, only they know. As an outsider, I would not like to speculate. What is unmistakable is the high amount of sales compared to purchases. My approach: I will follow the transactions closely and then weigh them. If more insiders sell large amounts of shares, I may sell part of my position at a good profit.

Agreement on drug distribution with health insurers:

2022 has already been written:

"Clinuvel Pharmaceuticals Limited announced that it has entered into a second agreement with the GKV-Spitzenverband (GKV-SV) for the ongoing treatment and reimbursement of SCENESSE® (afamelanotide 16mg) in adult patients with erythropoietic protoporphyria (EPP). SCENESSE® is the only approved treatment for adult EPP patients in Europe."

This was a dispute between German health insurers and CUV. After an initial losing round for Clinuvel, an agreement has now been reached between the German health insurers and CUV. The settlement was already agreed last year, and has little relevance to the current share price. Some speculate that Clinuvel may be negotiating with other health insurers on the distribution of the drugs. However, I have no credible information not found.

Sources:

Insider sales at CUV:

2. https://www.marketbeat.com/stocks/ASX/CUV/insider-trades/

Agreement on drug sales with health insurers:

#update

#health

#clinuvel

#aktien

#getquin

#geld