Expenditure/Revenue Recap 2022

Money is what people talk about! #recap2022

In the sense of getquin, which allows us all not only to track our own portfolios, but also to discuss money and investments.

First I want to talk about my income, then about my expenses and be as transparent as possible.

(For tracking I use Finanzguruwhich I use since May)

First my income:

In 2022 I have 55.222,26€ received.

My main source of income is my work in the white collar relationship, there I have 40.464,78€ received (December salary outstanding). The rest came from "rental income" of my girlfriend, tax office, profits (shares, sweepstakes, Ebay) and Co.

The income point is I think but not as interesting as the expenditure point:

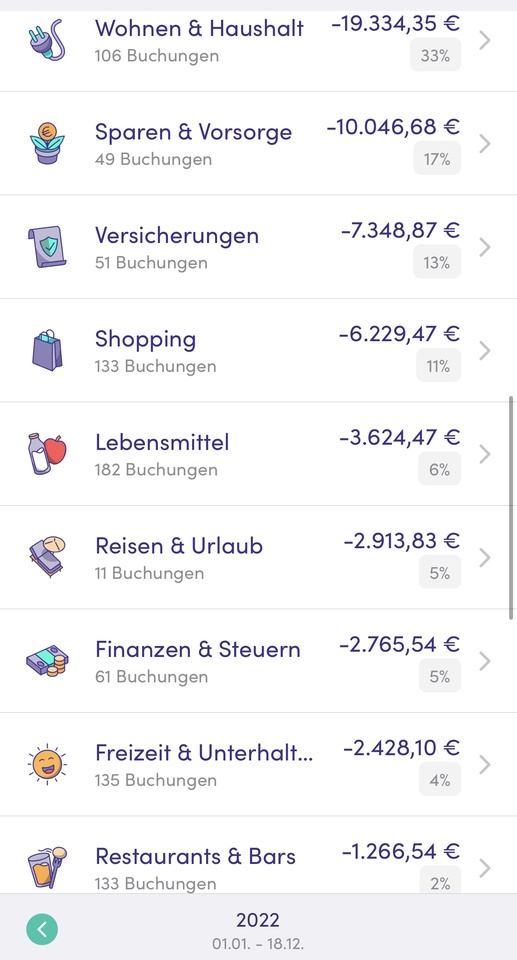

My expenses:

In 2022 I have 58.218,25€ spent.

The biggest chunk with 19.334€ lies there with the Living. The rent is always deducted in full from my account, my girlfriend then transfers your part. In total, I / we have paid 9,463 € in rent, and moved in April together. The Deposit from 2.550€ I took over alone (Rheinmetall 7er lever of March runs) and the largest part of the furnishings with 5.686€.

The rest comes from electricity, parking and miscellaneous.

Next comes Invest with 10.046€.

There went 8.213€ to TradeRepublic, 1.148€ in Crypto, 380€ in gold/silver and my little old building society contract was allowed to settle with 300€ happy.

The third point is 7.349€

InsurancesThis includes private health insurance and pension insurance, which is why the amount is so gigantic.

The PKV takes since August 3.487€ and the RV

2.425€Thus remain occupational disability with 784 €, legal protection, accident and liability with a total of 651 €.

Let's move on to a nicer point: Shopping with 6.229€

This of course includes forever of small items.

The ones that stick out are a new cell phone from $AAPL , a lot of $AMZN (+0,26%) and $EBAY (+0,18%) clothing $YOU (+0,31%)

$ASC (-0,95%) and a lot of untitled stuff from $PYPL (-0,38%) and Klarna.

But also some gifts for friends and family.

Right after even better: Food with 3.624€

3.315€ went to supermarkets and discounters (I work in a grocery store, so I see a lot of great and tasty things every day) and 262€ to $HFG (+0,69%)

2.913€ are for travel have been spent.

Of course beautifully well-behaved with $ABNB (+3,68%) !

Likewise, a vacation is included, which I will make only in February 23, but is already paid 🎌.

Finances and taxes forms a small loan from my dad, which I paid him back and Donations for good causes with 2.765€.

The 2.428€ at leisure expenses include books, subscriptions to $NFLX (+0,09%)

$GOOGL (+0,94%)

$AAPL (+1,34%)

$AMZN (+0,26%) and $DIS (-0,24%) , ventures, sports, hobbies, hairdresser, cinema and Rock in the Park.

The last of the major items that remain are Restaurants with 1.266€. The most went real restaurants at home and abroad with 684€ and 582€ to fast food from $MCD (-0,31%)

$DPZ (-0,94%)

$SBUX (-1,55%)

$RBD and $YUM (+0,93%)

The rest are then still smaller other expenses.

So... Holy Moly, that took longer than expected 😂.

I think I just took over an hour for all the analyses and the written record, but I think that I have also learned something from it.

Overall, I think that the expenses were ok, especially for the circumstances this year.

Next year I will invest and travel more and spend less on the apartment.

Who has made it down to here I would like to thank upright ❤️

It gives me so much pleasure to talk with you, to write posts and to get to know other views!

Absolutely gigantic thank you to everyone who has liked and commented on my posts this year! ❤️❤️❤️

I think that was my last big post this year, in the next it goes on 😃

Stop stop! There was something else! I want to know how it was with you!

I am clear, not all want to write something like that in numbers but I would be interested in how the expenses and income of you look in percent!

What percentage of your expenses go into investing? How many for rent/house away?

And to anyone doing a post on this, feel free to link, would love to see it! 😃

(Especially what a donkey spends on his meadow or a panther in Bali!).