Small, but one of my favorite portfolios!

This one has been around since 2019 and has a special statement in it!

Anyone who has known me for a while and has been following me since 2019 will already be familiar with this portfolio. I opened it with a broker in November 2019 to produce content. In this update, I'll be happy to tell you what content and what's so special about €3,650.

I'm sure you've all heard it before from family members, close acquaintances or friends: "I have no money" or "I have no time for the stock market"! But is that really the case? Do you need a lot of time and a lot of money for the stock market? That's exactly what I want to question with this portfolio. I opened a portfolio with a broker in November 2019 and opted for the most favorable option, a 60/40 split of 2 ETFs. At that time, savings plans still required at least €25. So I put 35€ in the $IWDA (+0,35%) MSCI World and €25 in the $IEEM (+0,34%) MSCI EMI chose! In addition, I had a 100€ bonus from the broker, which I invested in $DIS Walt Disney (EK 85€).

So, what time and money did I need here? I set up the savings plans once in the broker and made a standing order from my account. That was it. I could also imagine that 60€ per monthwould hurt very few people. So this could also be a portfolio for a single mother, or someone who doesn't earn too much but still wants to fulfill something at some point.

That's all the time and money that went into this portfolio.

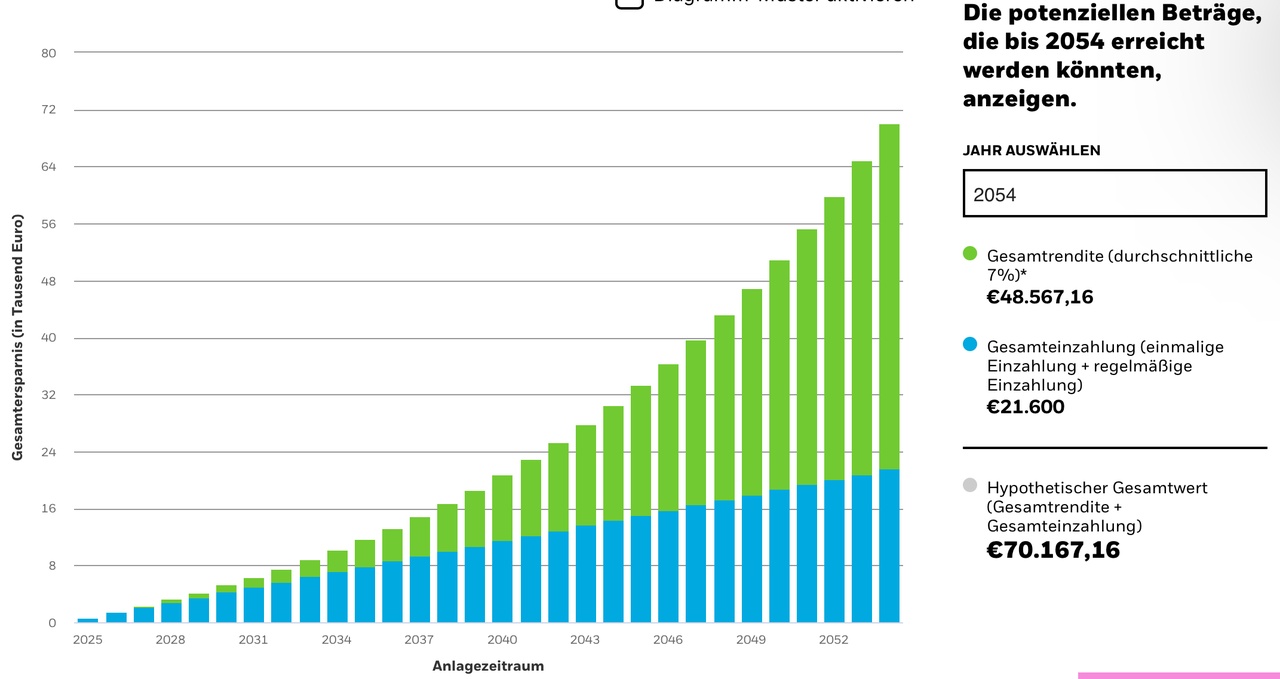

Unfortunately, I'm still some way off the target of 6-7% p.a., but the portfolio is still young. It should run for exactly 30 years. I created it when I was 36 and I want it to run until 66. Disney had two difficult years and the EM ETF has not yet been able to develop its strength. At the time, however, I deliberately opted for the higher risk and a 60/40 split instead of the standard 70/30, as I still see a lot of potential in the emerging markets due to the long term! The dividends in 2024 are now already just under €30 per year, as I chose a distributing EM at the time. The plan is to add another ETF at some point, which will then only be paid from the dividend. Perhaps from the 10th year onwards.

This is neither my main portfolio nor my retirement provision, but just a project. Whenever someone tells me again that they have no time and no money, I take my cell phone out of my pocket, log into this broker and show them exactly this portfolio. Which is still possible with little effort and little money.

Would you advise someone with little money to invest in a portfolio like this (perhaps €50 - €60 in an All World ETF instead of this variant), or would you rather advise them not to do it at all?

In the attached picture, you can see the possible return if we settle somewhere around 7% p.a. at some point and make up for the weak years 2022 and 2023. At 66, you can certainly make very good use of that. I'll be updating this portfolio from time to time. There will be a detailed post on Instagram on Sunday. I have the portfolio here at getquin, but it is hidden and not integrated into the "Aggregated". As I said, it's a separate project for me!

With this in mind, best regards from the Baltic coast