Like many others, here I have been a whole time in search of a strategy. I think that I have now found a very good way for me, which must now be followed.

The center will be two ETFs:

One is the $IWDA (+0,23%) and on the other hand the $EXI2 (-0,31%)

The first one is well known and should not be the topic today, only this much about it: I see more risks than opportunities for me with the EM and therefore consciously do without them, therefore no All country or similar.

The second ETF $EXI2 (-0,31%) is for me an excellent alternative to single stocks to put a focus on blue chips in my portfolio.

Since it is not one of the well-known indices/ETFs, I would like to explain it briefly.

Eligibility criteria and index construction of the

Dow Jones Global Titans 50 translated from the Dow Jones Titans Indices Methodology

Index Universe:

The index universe is defined as all stocks in the S&P Global BMI.

Selection Universe:

1. stocks from the index universe defined above that have not traded for more than 10 days in the last quarter are excluded. From the remaining universe, the top 100 companies ranked by market capitalization form the selection universe. Whether a company with multiple share classes is eligible for the index depends on the sum of the market capitalization of the eligible classes of the company.

2. companies must derive at least 30% of their revenues from foreign markets to be eligible for inclusion in the index. Companies currently included in the index are still eligible if they generate at least 20% of their revenues from foreign markets. Selection of companies for the index

1. the companies in the selection universe are ranked according to the following criteria:

- Market capitalization - Sales - Net income

2. a final rank is calculated for each company by weighting the market capitalization rank by 60%, the sales rank by 20% and the net income rank by 20%.

3. 50 companies with the highest final rank are selected and form the index, subject to the following buffers:

- Any company in the top 30 of the final ranking that is not yet included in the Index will replace the lowest ranking company in the Index included to date.

- Any company included in the index that is not in the top 70 in the final ranking is replaced by the highest ranked company not included.

- In the event of a tie in the final ranking, the company with the larger market capitalization is ranked higher.

Weighting

At each rebalancing, the index is weighted by market capitalization, with a cap of 8% for companies. The weighting is reviewed on a quarterly basis.

So much for the composition and functioning of the ETF.

My reasons for making the index the largest item in my portfolio:

- There are always at least 50 blue chip companies in the ETF, sometimes more.

- I would also be willing to put the individual shares of all the companies included in the portfolio.

- Since it is a stock ETF, where 30% of the income is tax-free (keyword partial exemption), any income (capital gains on sale, dividends) must be taxed at 18.4625% (church tax neglected). A big advantage compared to individual shares.

- Quarterly automatic rebalancing, no work for me.

- Every year in September the composition is reviewed and adjusted.

- If a company no longer meets the requirements, it is removed from the index during the quarterly rebalancing and replaced the following September.

- Rebalancing is done by market capitalization, but is capped at 8% per individual security.

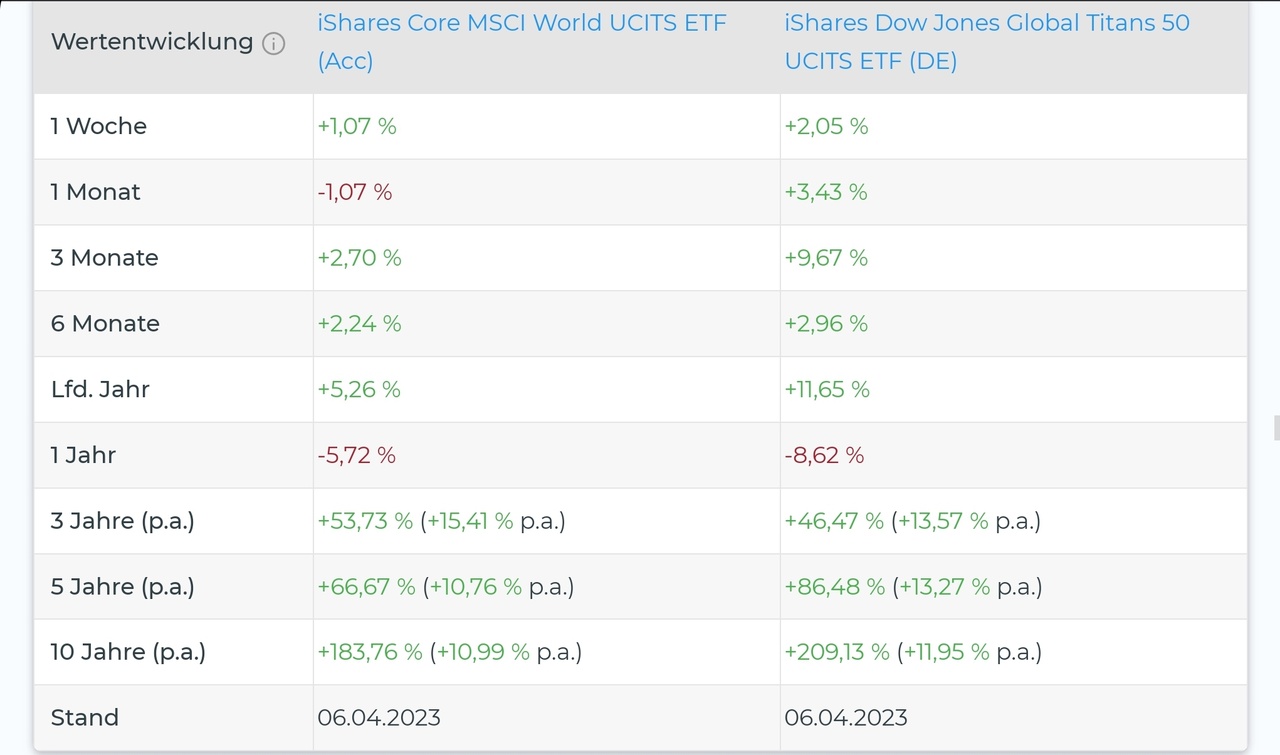

- The $EXI2 (-0,31%) performs better over the long term than the $IWDA (+0,23%) at least when looking at a holding period of 10 years or more. The target is a holding period of at least 30 years.

Of course, there are also disadvantages:

- The index is extremely US-heavy

- The index is tech-heavy

- 50 companies is not diversification, so I use the ETF to intentionally overweight the companies for me.

- 0.51% TER is not exactly low for an ETF.

- If one of the really big companies (Apple, for example) crashes over a long period of time, it can drag the index down quite a bit until it gets kicked out.

- A successful past is no guarantee for a successful future.

In the medium term, I will reorganize my portfolio in such a way that I will shift almost all individual stocks to the $IWDA (+0,23%) shift. Individual stocks from which I expect an above-average return may remain and, if necessary, will be expanded or newly included. The prerequisite is that they are not included in the $EXI2 (-0,31%) contained in the portfolio. Maybe one or the other sector ETF will be added.

The goal is to get a more manageable portfolio, where the majority is in the $IWDA (+0,23%) is in the portfolio. The $EXI2 (-0,31%) should provide a bit of outperformance and with one or the other individual stock and some cryptos you can then try to maximize the return, not to say: a little fun must be .

I would be interested in your opinion overall on the new strategy and in particular how you see the $EXI2 (-0,31%) see as an alternative to umpteen individual stocks?

Screenshot: https://de.extraetf.com/etf-comparison?etf=IE00B4L5Y983,DE0006289382