Savings plan idea

Hey everyone! I'm currently using this app for the first time and just wanted to get some advice, as I've seen that we're in a really pleasant community here, which spreads a lot of positivity in contrast to other platforms!

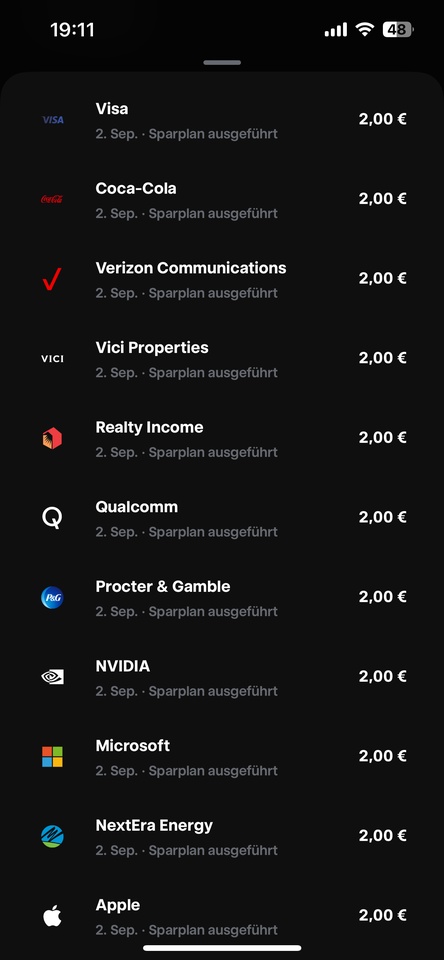

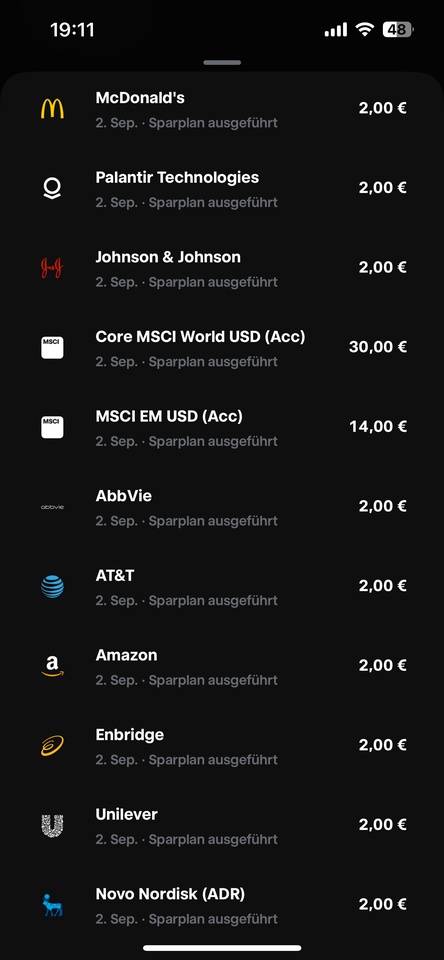

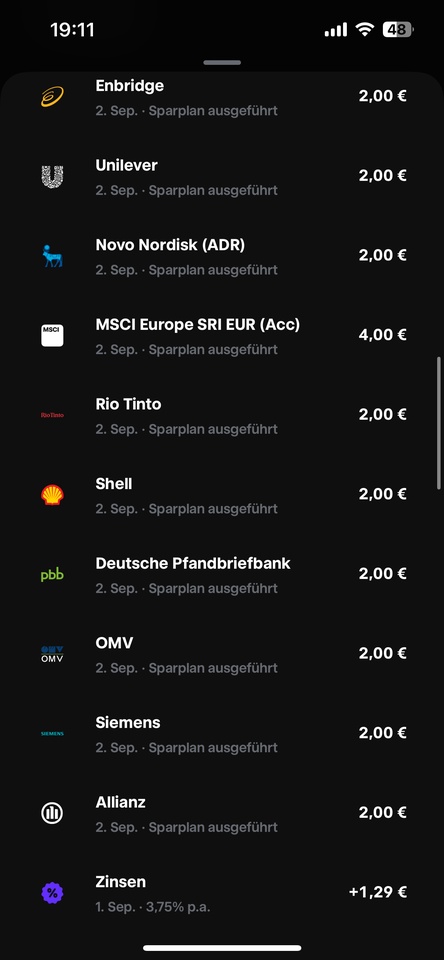

Well, the one in the pictures is my current game plan (hope the screenshots are displayed correctly).

Short explanation:

I opened my Trade Republic account about a year ago on a school trip (exactly on my 18th birthday). Since then I have invested 30€ per month at first, and 35€ per month for the last 3 months. The focus has always been on ETFs and I have tried to stick as closely as possible to 60-30-10 with $IWDA (+0,23%) , $EIMI (-0,21%) and $IESE (-1,54%) as well as possible.

In addition, I tried out individual stocks with €1 each, just to see what would happen. I have always adjusted these, etc.

A few days ago I thought I could expand my portfolio, as I'm currently receiving my first salary and have therefore increased my savings rate. I've increased the ETFs to a total of €50, plus around €20 in dividend shares and a few other shares that I think make sense.

I have deliberately selected so many individual stocks so that I only have to adjust the amounts when increasing the savings rate, especially because I will do this again soon, or buy more if I think it makes sense.

Now I wanted to ask you, what do you think?

Any tips or similar?

You can see my entire portfolio here.

Thanks for any tips anyone can give me!