$NU (-0,2%) - Current weakness of $NU (-0,2%)

$NU (-0,2%) is the largest fintech company in Latin America and one of the largest in the world.

By comparison, the company has 109.7 million customers and 91.7 million active customers per month, of which 100 million are in Brazil.

The population of adults aged between 16 and 65 in Brazil is 143 million, which means they make up 70% of the Brazilian population.

In addition to this $NU (-0,2%) Mexico and Colombia are growing incredibly fast and I think Argentina will be the next investment area in 2-3 years.

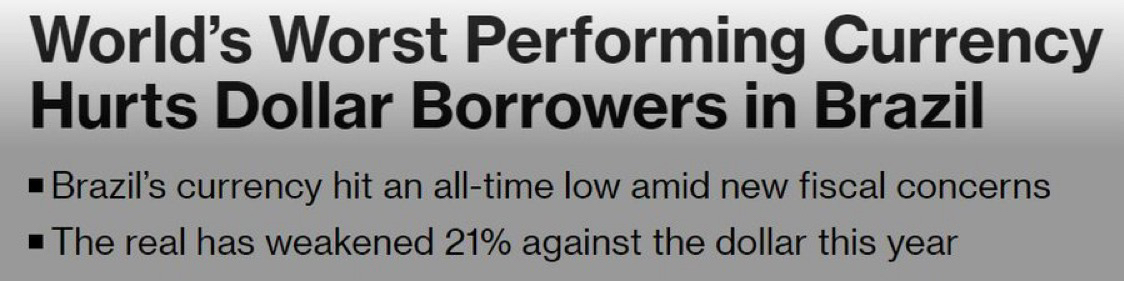

The current situation in Brazil:

- Brazil has had a difficult few months:

1. their budget deficit plan has not been as good as it needed to be (or as investors would have liked).

2. consumer confidence and investor sentiment have hit rock bottom.

3. the Brazilian real hit a record low against the US dollar, losing 21% in one year.

- What is Brazil doing about it?

The government said it would "take care of it", but the steps taken so far are too small to make a big difference.

They have a plan to limit government spending, increase taxes on the rich and also curb tax exemptions.

They also sold US dollars in the hope of stabilizing the currency, providing liquidity and signaling some kind of confidence in the real ... but the success has not been great.

- Resilience of $NU (-0,2%) despite weakness

The Brazilian economy has not been particularly strong for some time, yet business performance has been excellent:

- Over 110 million customers

- Sales increase of 56

- Net profit margin of 36 % achieved

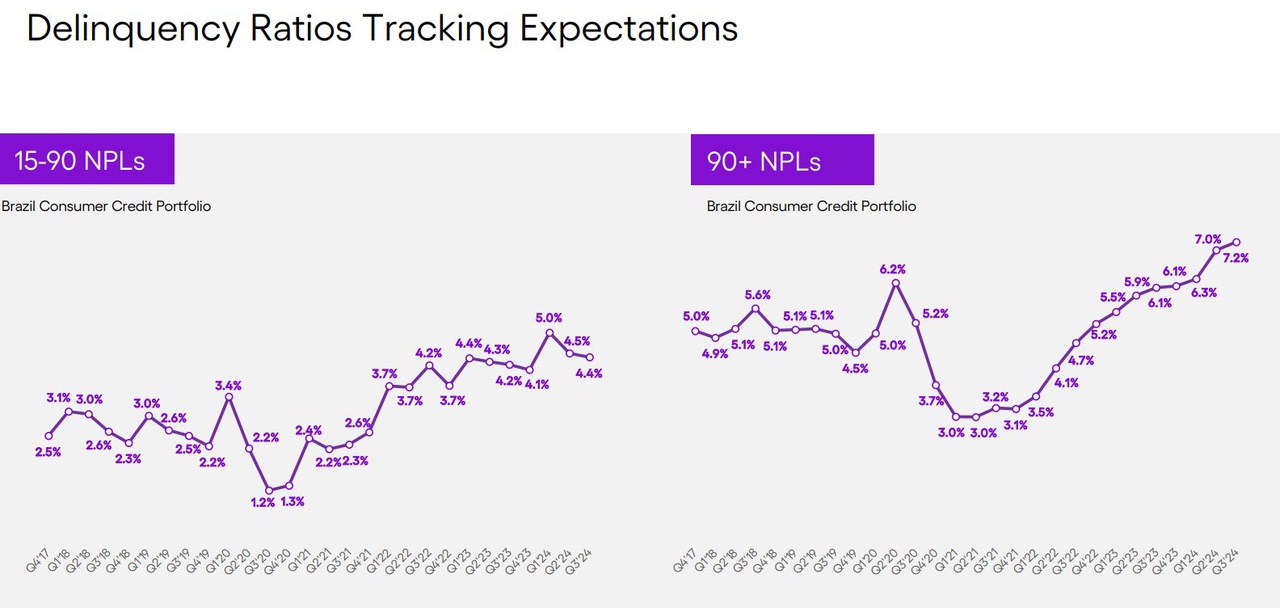

- Robust risk management:

$NU (-0,2%) takes a conservative approach to provisioning. With a coverage ratio of 16.6% (previous year: 14.5%), they are well positioned to absorb any credit losses. (They have a lot of capital that they can deploy)

The coverage ratio indicates the ratio of covered deposits to the available reserves of the respective statutory deposit guarantee scheme. If the secured deposits and the available reserves are equal, the coverage ratio is 100 percent. If the available reserves are lower than the deposits to be protected, the coverage ratio is below 100 percent.

- Interest rate increases

The biggest advantage is that $NU (-0,2%) can benefit from higher interest rates.

Lula (Luiz Inácio Lula da Silva- President) has announced that he will curb the exorbitantly rising interest rates ... so he has to be $NU (-0,2%) be careful how aggressively he proceeds here.

The default rate is the amount of overdue debt. This ratio is expressed as a percentage and is generally used to characterize a financial institution's loan portfolio. The delinquency ratio is calculated by dividing the total number of past due loans by the total number of loans held by a lender.

Personal opinion: I believe that the weak phase is a good opportunity to enter the market and that there is still a lot of growth potential ahead of us.

However, the next few quarters could be bumpy and one should be aware of this when investing.

✌️