Depot review August 2024 - calm before the (September) storm?

While September has lived up to its name so far (worst month on the stock market, negative in more than 50% of cases), August was a boring month in my portfolio. In keeping with the vacation season, my portfolio also shifted down a gear.

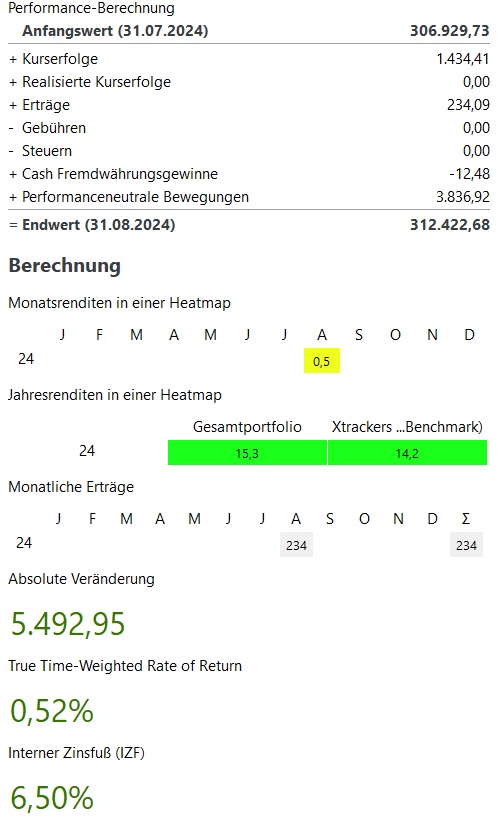

Monthly view:

In total, August was +0,5%. This corresponds to price losses of ~1.400€.

This was therefore unable to fully make up for the losses from the previous month of July (-2.2%).

Winners & losers:

There was therefore not much going on on the winners' and losers' side in August.

On the winning side are MercadoLibre and Palo Alto Networks at the top with ~€1,000 each. They are followed by Starbucks, Crowdstrike and Meta.

On the loser side are the crypto assets in my portfolio in August. Ethereum at the top with price losses of €1,500, Bitcoin in 3rd place with €900. Alphabet with ~€1,000 in price losses.

The performance-neutral movements in August were just under €4,000, after being somewhat lower in the previous months due to private issues.

However, only just under €1,400 of this went into shares, the rest is cash.

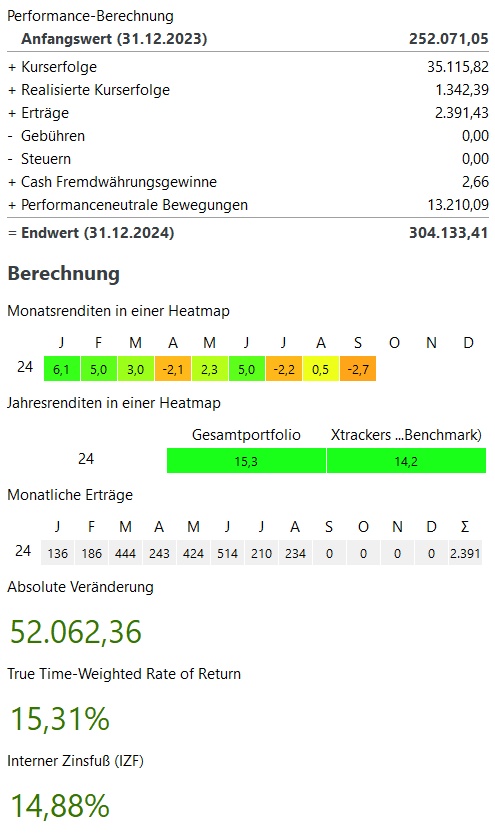

Current year:

My performance in the current year is +15,3% and thus still slightly above my benchmark, the MSCI World at 14.2%. Even if the gap is slowly narrowing.

In total, my portfolio currently stands at ~312.000€. This corresponds to an absolute growth of ~€60,000 in the current year 2023. ~44.000€ of this comes from price gains, ~2.400€ from dividends / interest and ~13.000€ from additional investments.

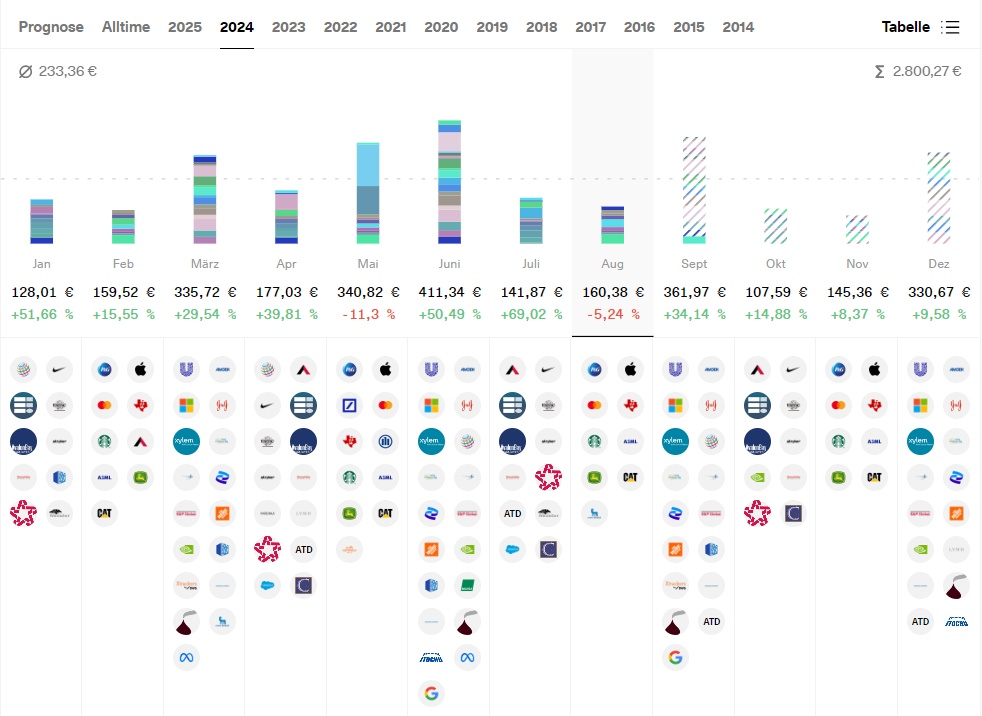

Dividend:

- Dividends in August were 24% above the previous year at ~€160

- Procter & Gamble is in the lead with almost €50 (gross) dividends every 3 months

- In the current year, dividends after 7 months are +24% over the first 8 months of 2023 at ~1.840€

Buys & sells:

- I bought in August for approx. 1.400€

- As always, my savings plans were executed:

- Blue chipsTSMC $TSM (+0,43%) S&P Global $SPGI (+0,02%) Procter & Gamble $PG (-1,24%) Johnson & Johnson $JNJ (+0,03%) Hershey $HSY (+0,03%) Caterpillar $CAT (+0,86%) Amgen $AMGN (+0,51%) Alphabet $GOOG (+1,03%) Alimentation Couche-Tard $ATD (+1,09%)

GrowthBechtle $BC8 (+0,82%) Synopsys $SNPS (-1,06%)

ETFsMSCI World $XDWD (+0,24%) Nikkei 225 $XDJP (-0,32%) and the WisdomTree Global Quality Dividend Growth $GGRP (-0,09%)

CryptoBitcoin $BTC (-1,37%) and Ethereum $ETH (-0,51%)

Sales there were none in August

Target 2024:

My goal for this year is to reach €300,000 in my portfolio. Due to the extremely positive market performance this year, my portfolio currently stands at ~€312,000.

However, after the first few days of trading in September, my portfolio only stands at €304,000. Compared to the level of €320,000 at the end of June, this is now a significant decline in total assets.

It therefore remains exciting to see how the share price will develop in the last third of the year. However, if we see a year-end rally after a weak September, I am optimistic about my target.