🐺 CD Projekt: Of sorcerers and cyberpunks - the masters of digital worlds 🏙️ Part 1:https://getqu.in/dYjIcI/

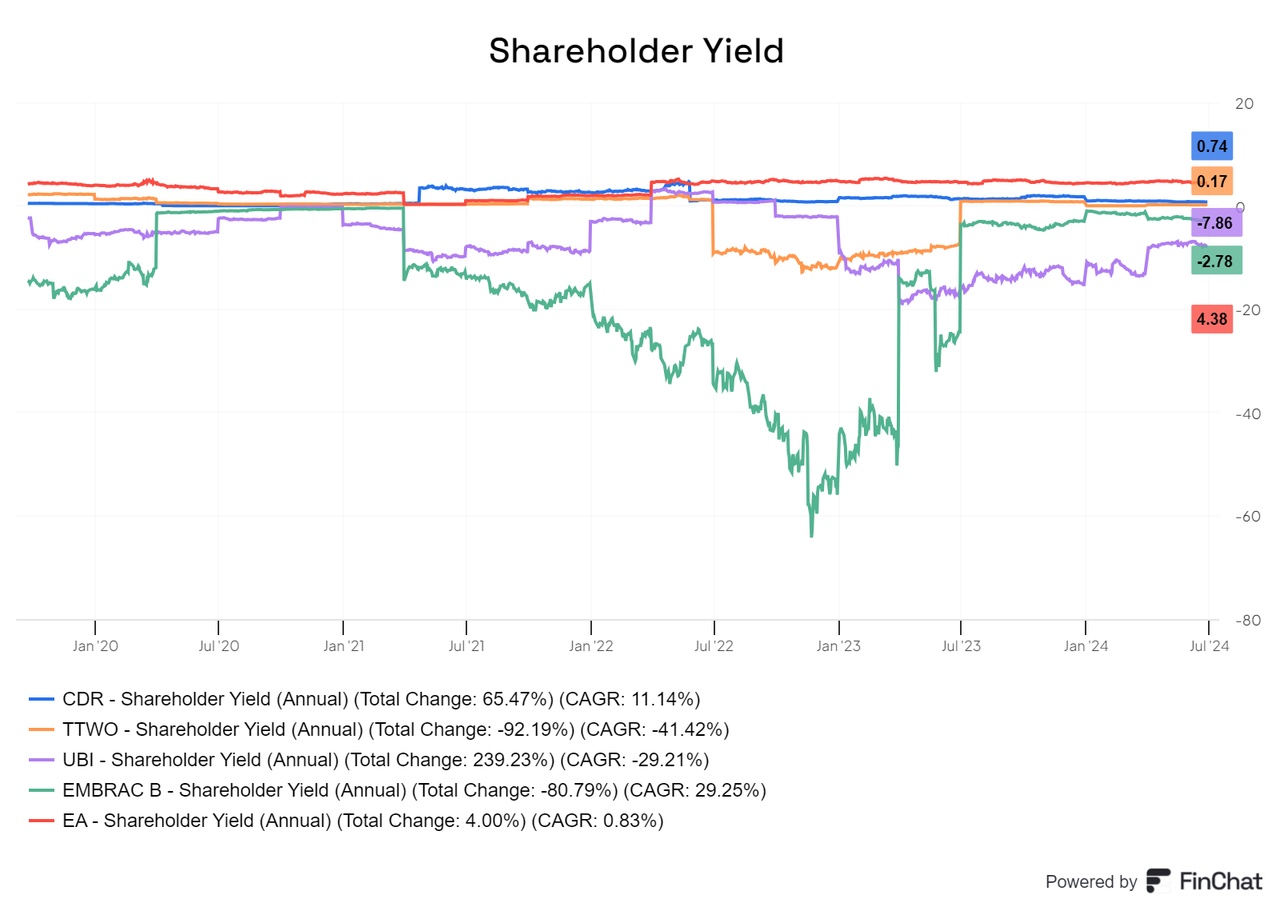

Current $CDR (-0,91%) Projekt has the second-best shareholder yield among providers, even if this is quite small.

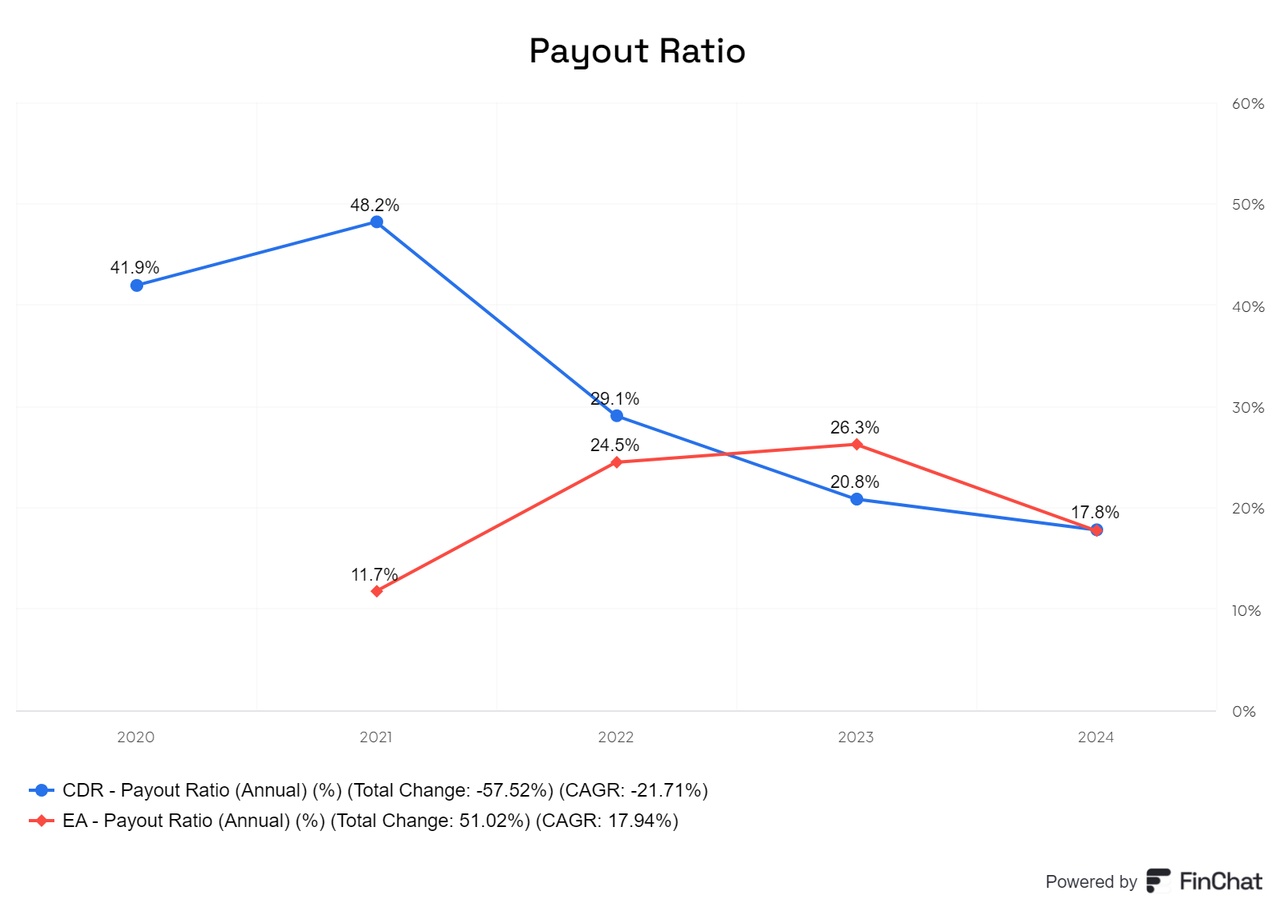

CD Projekt's payout ratio is relatively low and therefore still has plenty of room to increase.

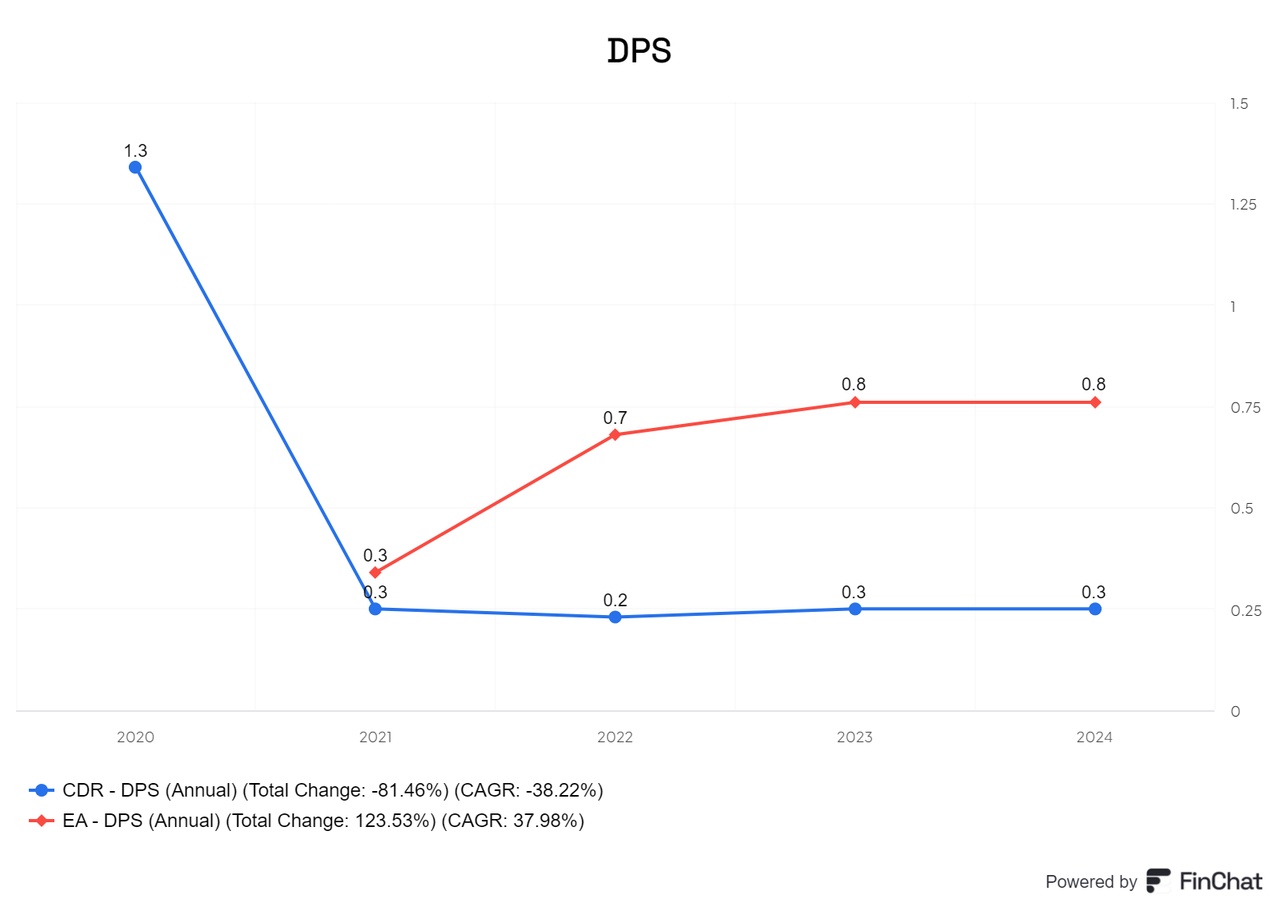

The dividend is around USD 0.30 per share

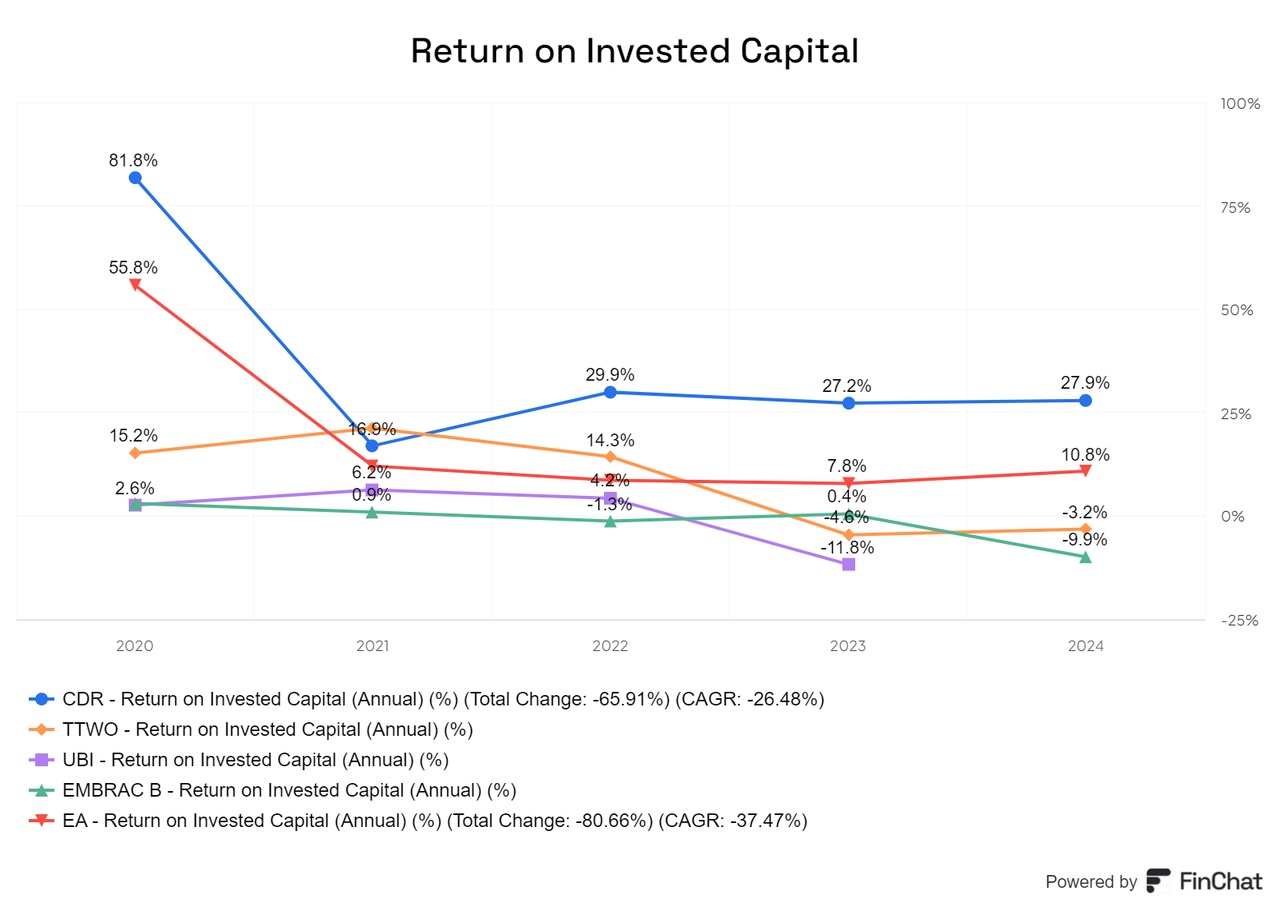

CD Projekt's return on invested capital (ROIC) is twice as high as that of most of its competitors and, at more than 10 %, also exceeds the important threshold.

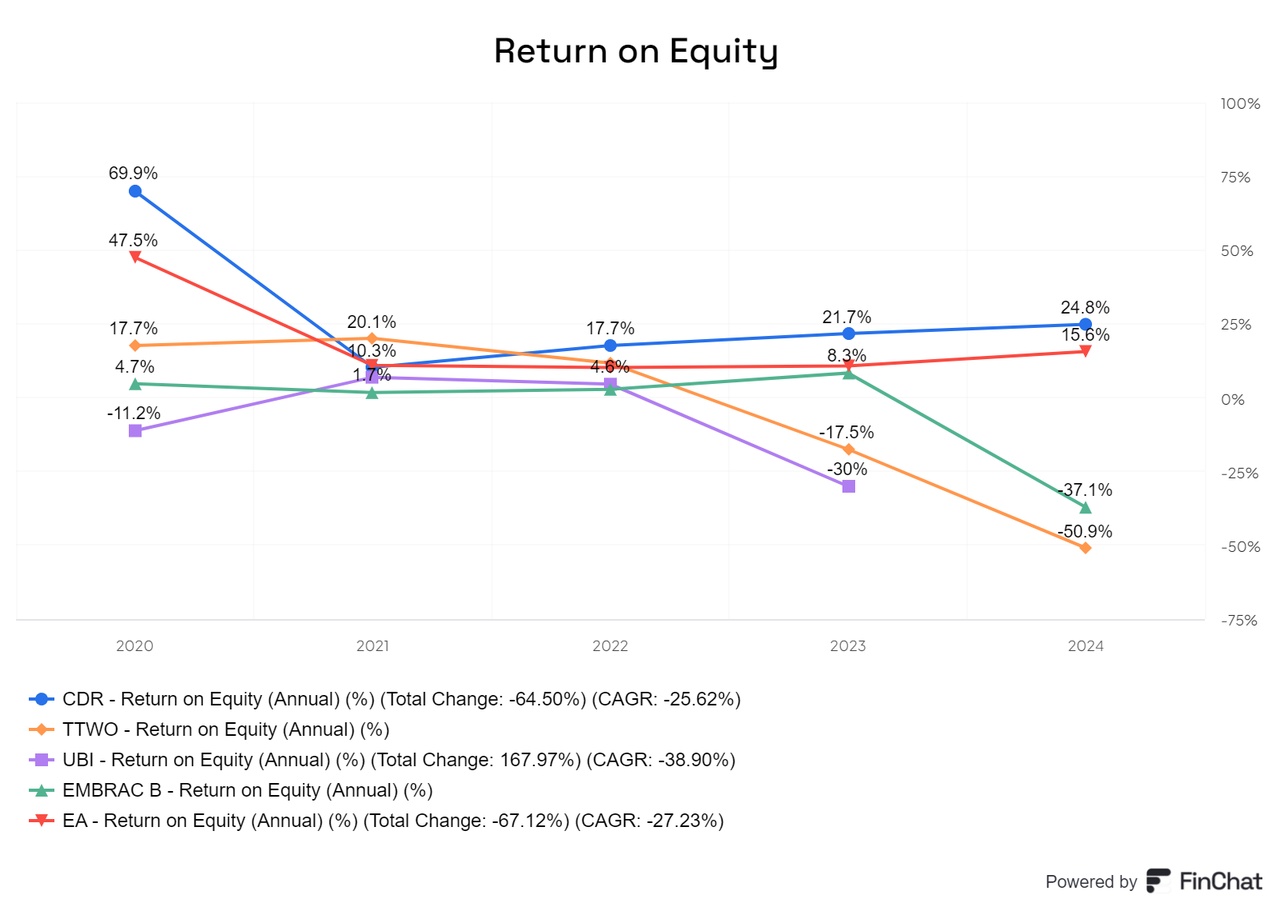

CD Projekt's return on equity (ROE) is also above 10 % and is the best in the industry.

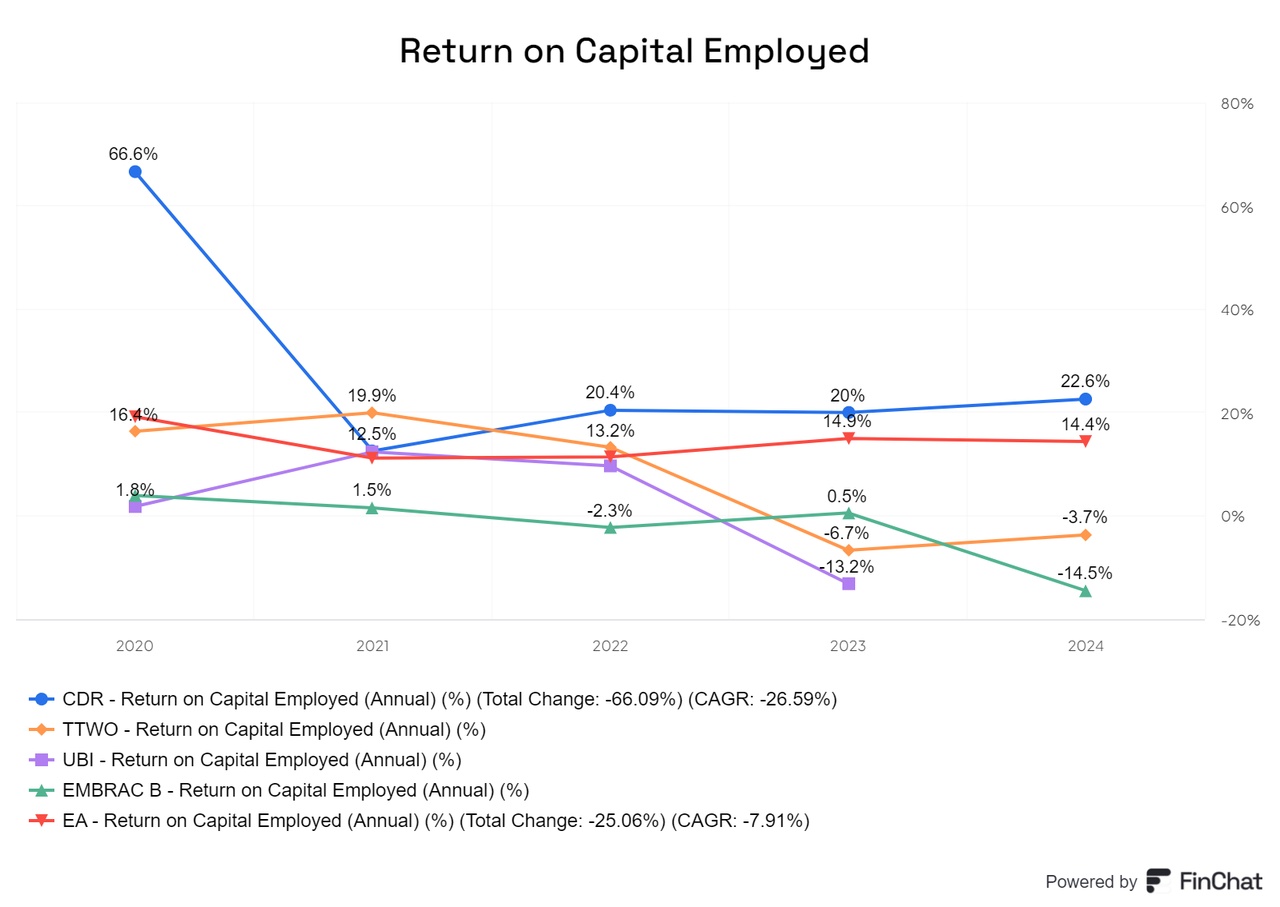

The situation is similar for return on capital employed (ROCE), which is also above 10 % and is the best indicator in the industry.

Conclusion

With CD Projekt, you are not only supporting some of the best games in the world, but also a first-class European games producer. The capital structure and valuation speak for themselves, and the share is one of the best valued in comparison. Although there have been mistakes in the past, the company has learned from these experiences and is now firmly back in contact with the community. Irrespective of this, it is still well managed.

Although CD Projekt has few but strong IPs, game development looks promising. If you want to invest in the industry, there are really only four options, three of which are not pure game producers ($MSFT (-1,05%) , $7974 (-2,81%) and $6758 (+1,35%) ). If you are looking for a pure gaming provider, CD Projekt is clearly the first choice and shows the greatest potential. As a fan of games, I am all the more pleased that I can invest in a company without having to rely solely on my emotions, and I am therefore happy to buy again when the price reaches 30- 36 euros.