52 weeks high

Hi folks,

due to the 52'weeks high at Coupang a short introduction.

Important key figures are increased 🚀

Turnover/billion: 2024: 30.3

2025: 35,3

2026: 39,9

2027: 44,6

Earnings per share/USD: 2024: -0.01

2025: 0,54

2026: 0,87

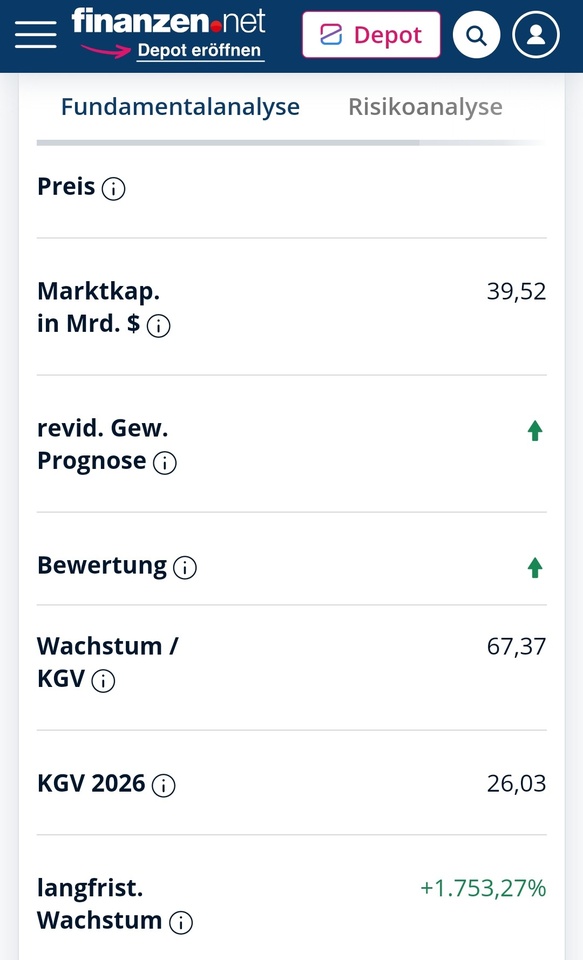

KGV: 2025: 40.84

2026: 25,31

2027: 29,33

P/E RATIO: 1.45

EbiT/million 2024: 451.33

2025: 1362,88

2026: 2117,81

Free cash flow /million: 2024: 1104.28

2025: 1754,08

2026: 2564,42

Book value per share/USD: 2024: 2.37

2025: 3,09

2026: 4,01

EbiT margin: 2024: 2.26%

2025: 3,96%

2026: 4,96%

2027: 6,97%

Coupang LLC, the South Korean e-commerce giant, has reached a 52-week high of USD 23.77. This milestone underscores the company's significant growth trajectory over the past year, which was characterized by a substantial 27.13% increase in share value. Investors have shown increasing confidence in Coupang's business model and expansion strategies as the company continues to capitalize on the burgeoning online retail market in South Korea and beyond. The 52-week high represents a pivotal moment for Coupang, reflecting both the company's resilience and potential in a competitive e-commerce landscape.

In other recent news, South Korean e-commerce giant Coupang Inc. has been making waves with robust growth and promising forecasts. In the second quarter of 2024, the company reported a 30% increase in currency-adjusted revenue and a 12% increase in active customers despite a net loss of USD 77 million. The company's gross profit exceeded 2.1 billion US dollars, marking a significant milestone.

Analyst firm CLSA has raised its rating on Coupang from "Hold" to "Outperform", reflecting a positive outlook for the company's projected growth and profitability. The firm has also raised its price target for Coupang shares to USD 31.00, a significant increase from the previous target of USD 18.00. This adjustment is based on the forecast of 17% annual revenue growth for the next five years and an improvement in Coupang's operating margin, which is expected to increase from 1.9% in 2023 to over 5% by 2027

Meanwhile, Morgan Stanley maintained its Overweight rating on Coupang shares, although the company slightly reduced its earnings forecasts due to a slowdown in the growth of its initial sales in the second quarter of 2024. The company's analysis points to expected improvements in free cash flows and opportunities for international growth, particularly in Taiwan. These recent developments reflect Coupang's ongoing business strategy and performance.