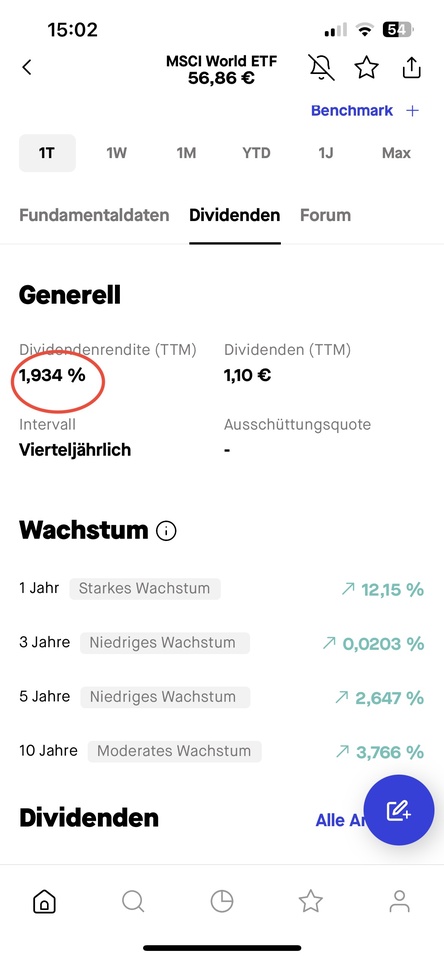

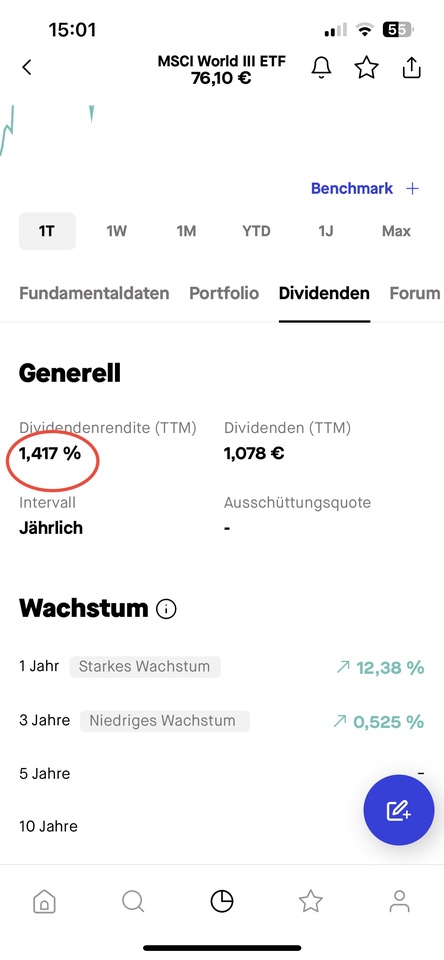

How can it be that two MSCI World ETFs one different high dividend yield have? See pictures:

$AHYQ (-0,95%) and $IWRD (-1,22%)

How can it be that two MSCI World ETFs one different high dividend yield have? See pictures:

$AHYQ (-0,95%) and $IWRD (-1,22%)