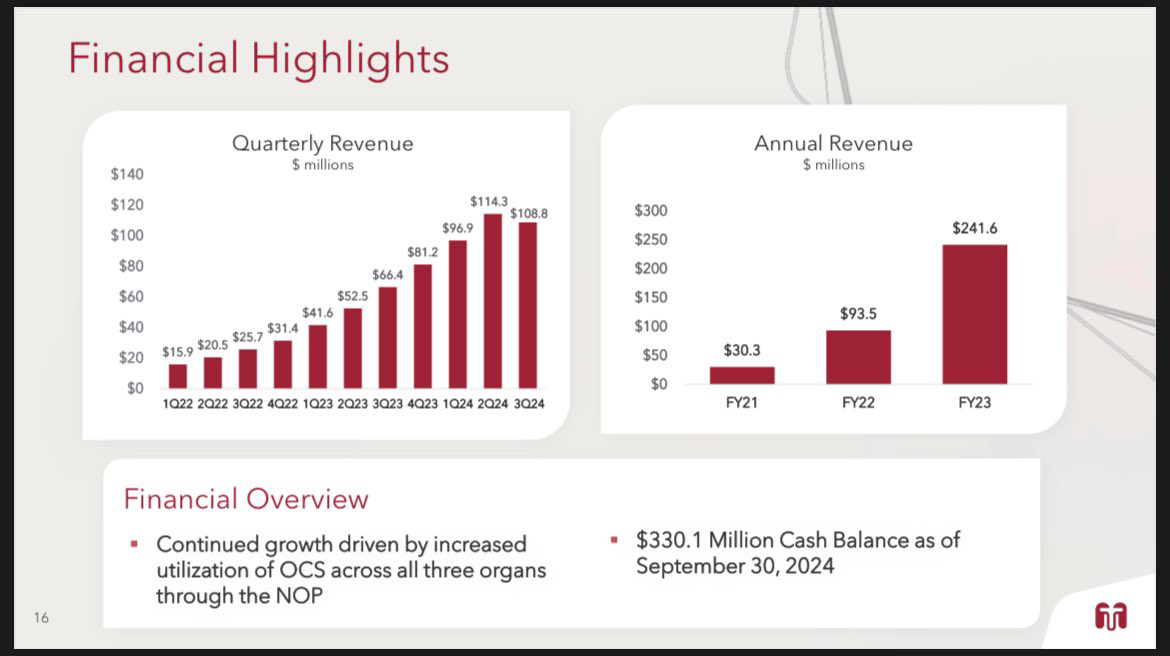

$TMDX (+1,52%) - Part 3

Summary of the most exciting parts of yesterday's Investor Day:

1. management is very confident that they can do 10,000 transplants. That is the publicly stated goal, but they have sites that could make far more possible.

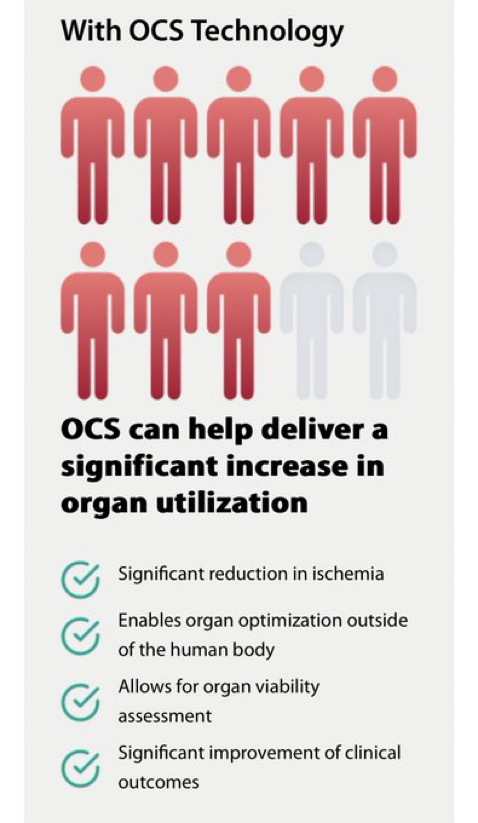

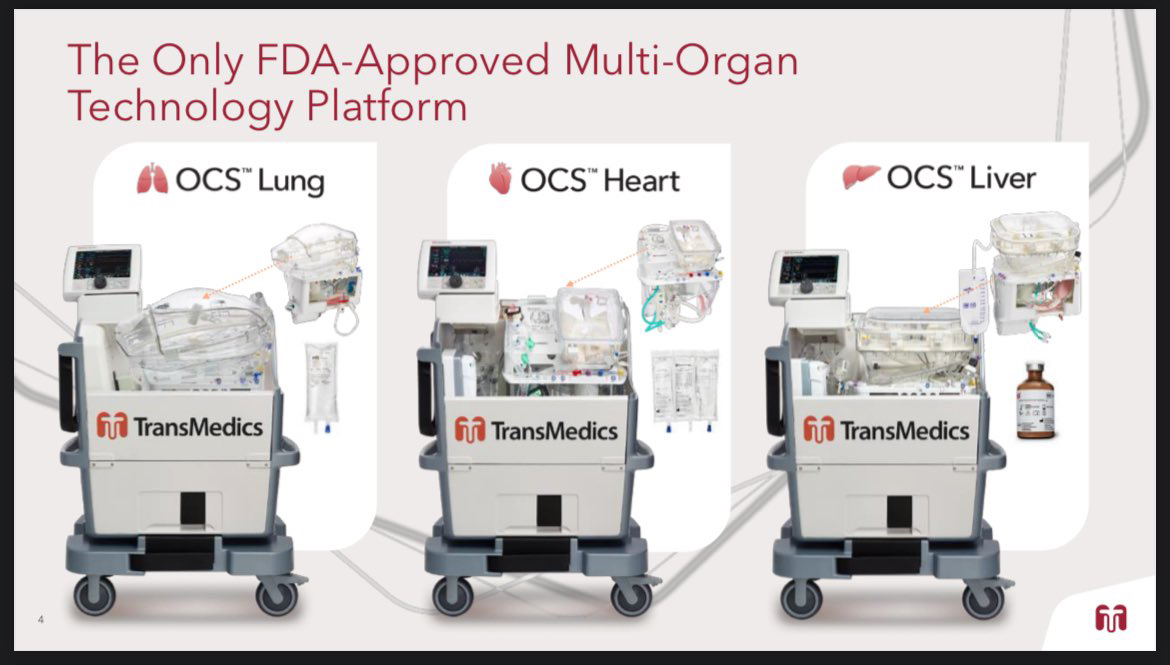

2. currently we use less than 20% of lungs, less than 30% of hearts and about 60% of livers. This means that the majority of the donor pool is completely unused.

3. there are many $TMDX (+1,52%) competitors that do not solve the ischemia problem. Ischemic damage occurs when an organ is not supplied with blood. The longer this lasts, the greater the risk of morbidity. There is no competitor that has a product that can eliminate ischemic damage and get the organ to the patient. $TMDX (+1,52%) has the only portable multi-organ perfusion technology in the world.

4 $TMDX (+1,52%) Data shows that it has reduced primary graft dysfunction in lung transplants by 50%, heart and liver by 65% and ischemic biliary complications in liver transplants by 84%.

5. $TMDX (+1,52%) presented its command center, the heart of the logistics business. This is the place where $TMDX (+1,52%) coordinates its missions (air and ground) to ensure that organs reach their destination as quickly as possible. It shows how$TMDX (+1,52%) X has full control over its entire business operations. It is one of the biggest moats for a small-cap company in the entire market.

6. data has shown that ischemic biliary complications in 4,300 liver transplants using $TMDX (+1,52%) transported organs are only 1.7%.

7. morning transplants are a key factor in the success of organ transplants and finances. Morning transplants have not been possible in the past, but with $TMDX (+1,52%) logistical possibilities they are now.

8 There are three next-gen programs that will lead to tremendous growth in 2025, all leveraging the large investments in the logistics network in 2024. These are the Next Gen Lung Program, the Next Gen Heart Clinic Program and the NOP Network, which will be a digital ecosystem with full transparency for all stakeholders involved.

9. $TMDX (+1,52%) have eliminated all edema in lung transplants within 24 hours. This is something they have not yet achieved in 2024. This was communicated to 175 lung transplant surgeons in Boston 2 weeks ago, so it's all very new and an exciting development for 2025.

9 Management also introduced Envision, an ecosystem that manages all aspects from organ procurement to transplantation. It also includes all financial management tasks such as case counts for OCS, OCS costs and automated billing. More rationalization. More efficiency.

10. the management has repeatedly emphasized that $TMDX (+1,52%) will be an international company. The TAM is huge.

11. the focus of development in 2025 will be on kidneys, with launch in 2029 after FDA clinical trials in 2027. this will add approximately 50,000 transplants to the TAM annually.

12. management discussed its vision for the next generation of OCS, which completely redefines how OCS works in order to $TMDX (+1,52%) enable the performance of over 30,000 transplants per year. Everything will be highly automated and closely connected to the cloud, resulting in tremendous financial efficiencies.

Conclusion: It all sounds very exciting, the company certainly has potential and enormous growth opportunities, but it will take time and you have to be patient.