Mensch und Maschine Software SE

Company presentation

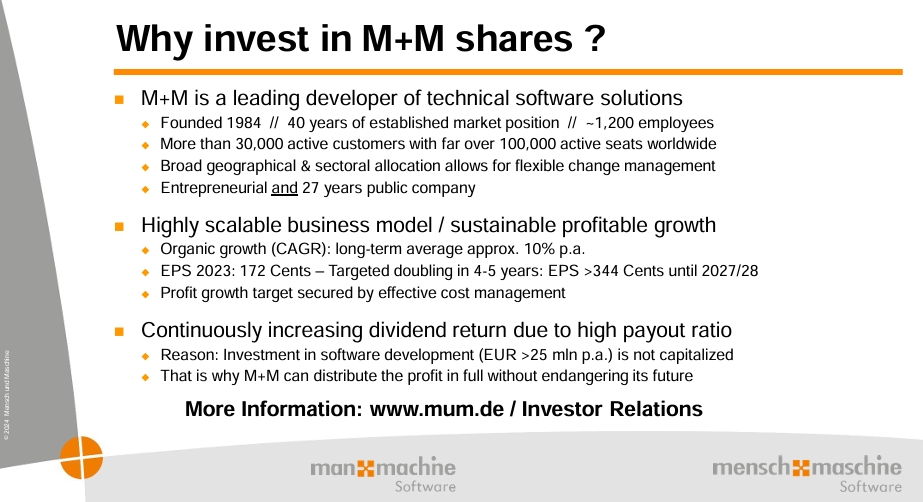

Mensch und Maschine Software SE ($MUM (-0,22%) ) is a leading provider of CAD/CAM software headquartered in Weßling, Germany. Founded in 1984, the company has developed into a major player in the field of digitization solutions for industry, construction and infrastructure. M+M employs over 1,000 people at around 75 international locations.

M+M's core business is divided into two main segments:

M+M SoftwareThis segment develops and distributes standard software solutions for CAM, BIM and CAE.

M+M Digitization This segment offers customized digitization solutions, training and consulting services.

M+M's mission is to support companies in their digital transformation and provide innovative software solutions for complex technical challenges. The company's vision is to remain the leading provider of CAD/CAM solutions in Europe and to continuously expand into new technologies and markets.

Historical development

Since its foundation, M+M has reached several important milestones:

- 1997: Stock market debut on the Neuer Markt as the eighth company.

- 2002Acquisition of the CAM specialist Open Mind AG, which expanded the expertise in the field of manufacturing software. In the same year, M+M acquired a majority stake in Dataflor AG, a developer of software for gardening and landscaping.

- 2019Acquisition of the software manufacturer Sofistik, which specializes in the calculation, dimensioning and design of construction projects.

These strategic acquisitions have helped M+M to diversify its portfolio and strengthen its market position in various industries.

Business model & core competencies

M+M's core competencies lie in its deep technical expertise in CAD/CAM software and its ability to translate complex customer needs into individual digitization solutions. The company benefits from long-standing customer relationships and a strong partner network.

Future prospects & strategic initiatives

M+M is committed to continuous innovation and expansion into new technology areas. Current growth initiatives include:

- Increased investment in BIM technologies for the construction industry.

- Expanding the range of CAM solutions for advanced manufacturing.

- Developing solutions for the digital factory and Industry 4.0.

In the medium term, M+M aims to further strengthen its market position in Europe and expand into new geographic markets.

Market position & competition

M+M has established itself as one of the leading providers of CAD/CAM solutions in Europe. The company competes with large international software companies as well as specialized niche suppliers. The main competitors include:

- $ADSK (-2,98%) (USA)

- $DSY (-1,5%) Systèmes (France)

- Siemens Digital Industries Software (Germany)

M+M differentiates itself through its strong local presence in Europe, customized solutions and comprehensive consulting and training services.

Total Addressable Market (TAM)

The global market for CAD/CAM software is expected to reach a volume of over 25 billion US dollars by 2028, with an annual growth rate of around 7%. Important growth drivers are:

- Increasing digitalization in the manufacturing industry.

- The increasing demand for BIM solutions in the construction sector.

- The growing importance of Industry 4.0 and IoT.

M+M is well positioned to benefit from these trends and further expand its market share in Europe.

Development

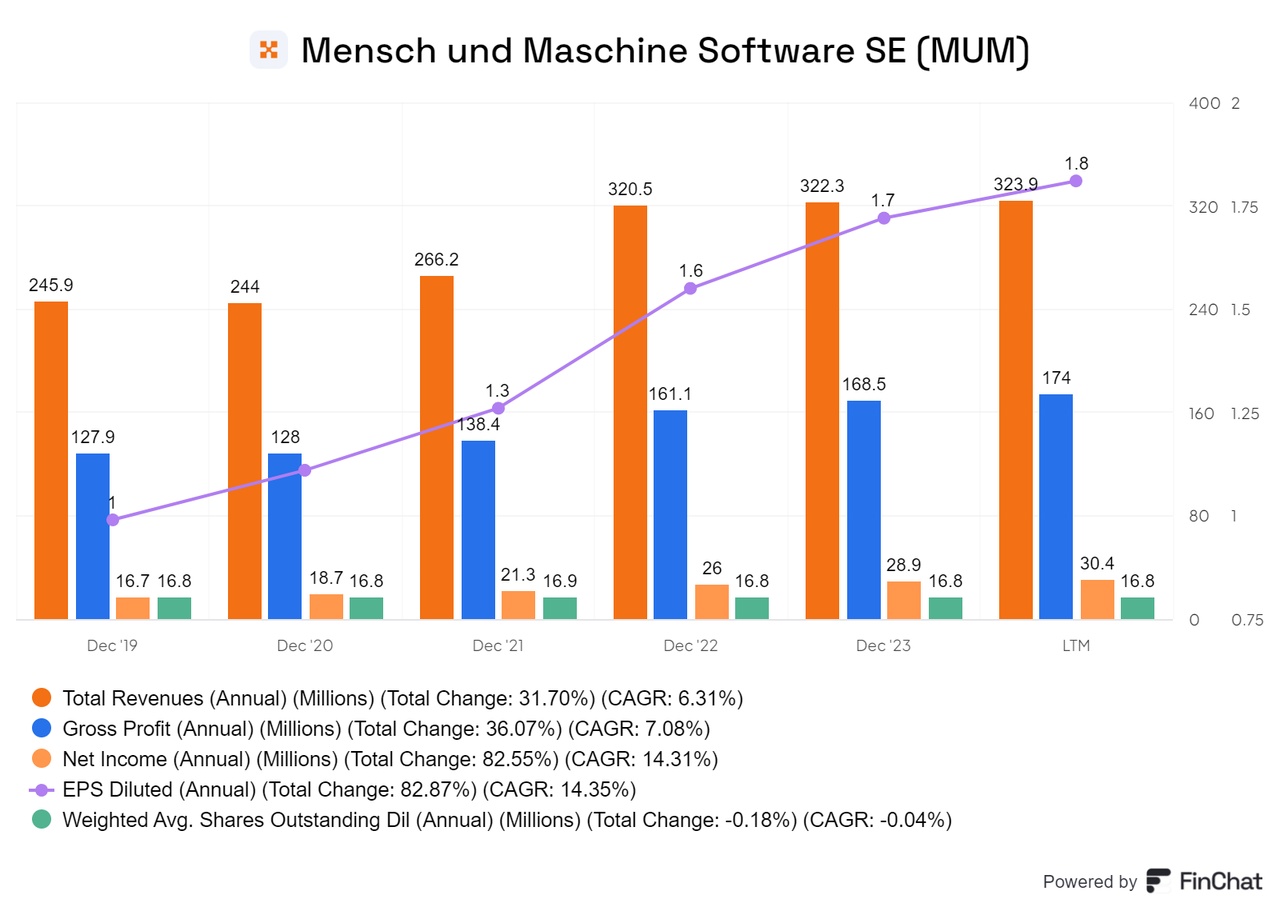

Sales have grown at an annual growth rate of 6%, which is acceptable. In contrast, however, net profit has grown at a 14 % CAGR, which is very positive.

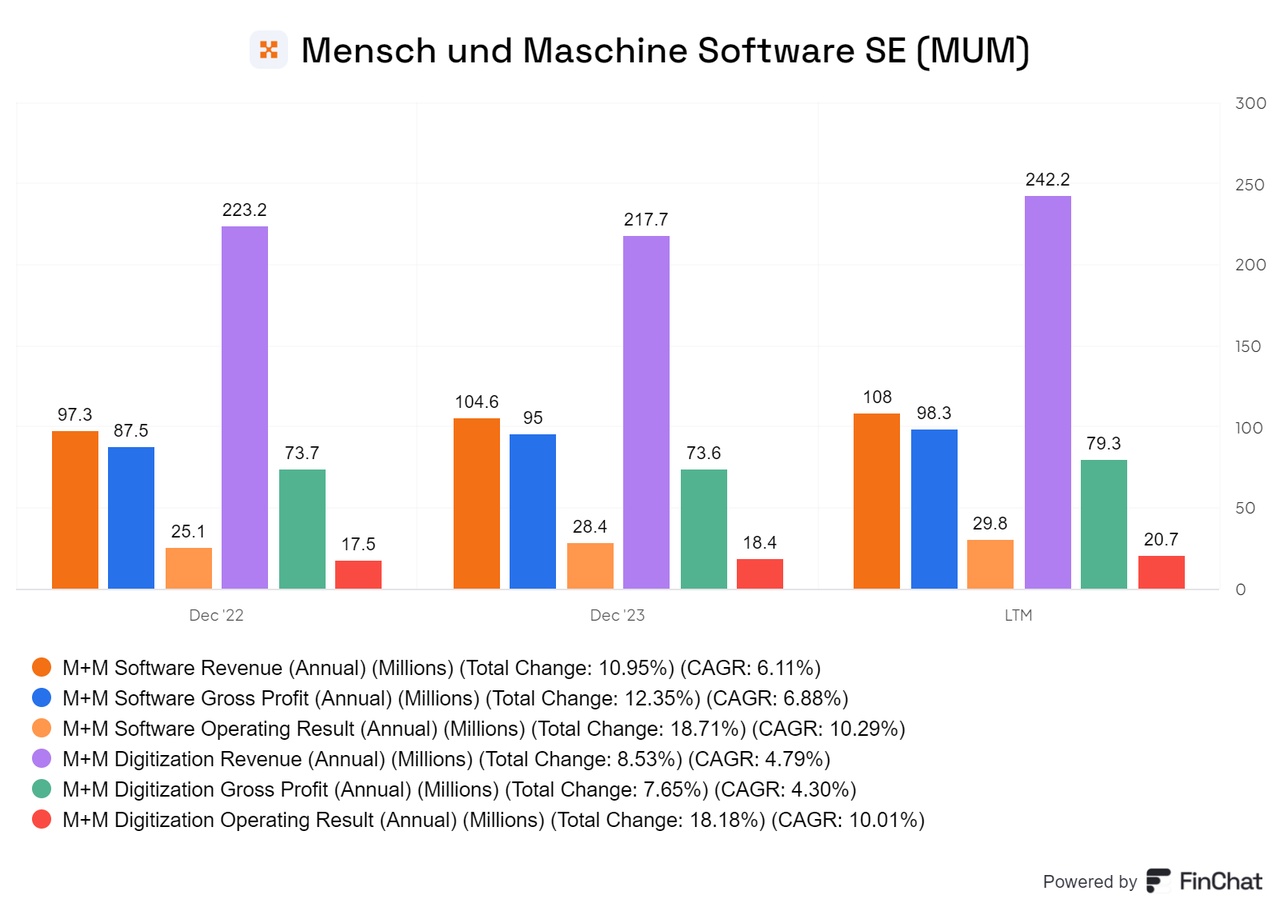

In terms of turnover, the digitalization sector is significantly larger than the software sector, but contributes less to gross profit. Nevertheless, despite the lower absolute amount, the digitization sector has a better margin than software.

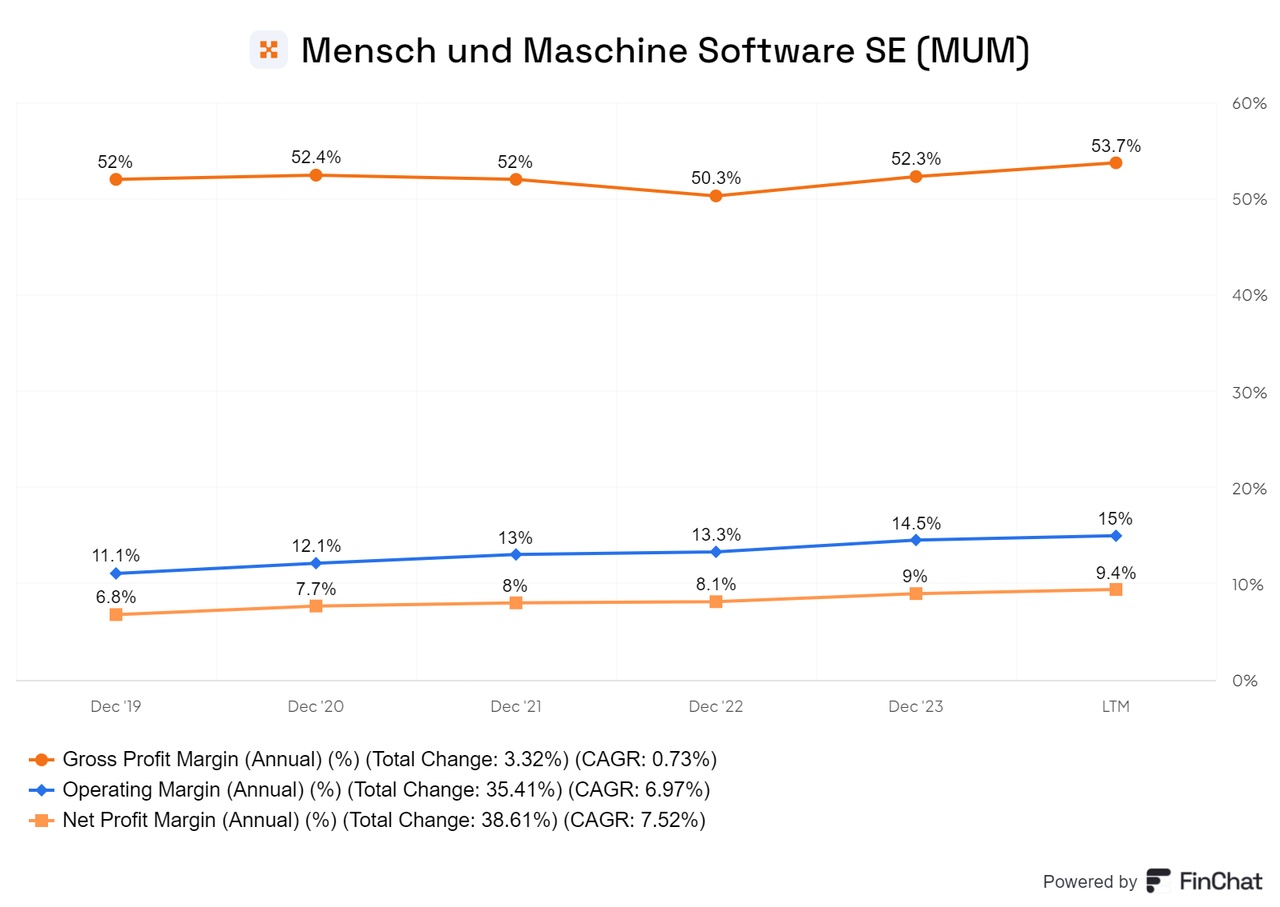

The gross margin is just under 54%, while the operating margin is 15% and net profit is approaching the 10% mark with an annual growth rate of 7%.

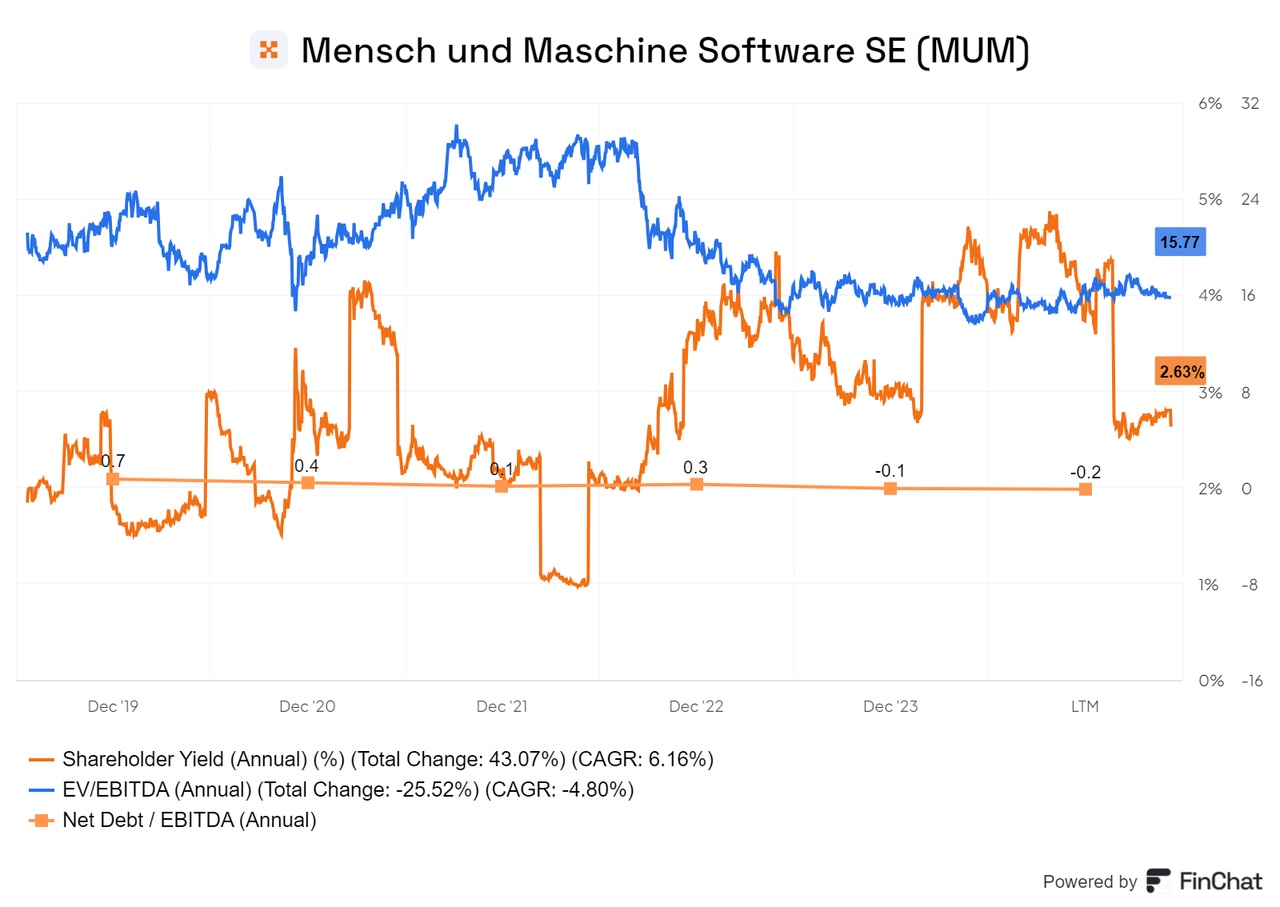

The shareholder yield is 2.6%, while the ratio of enterprise value to EBITDA is average. In addition, the ratio of net debt to EBITDA is negative.

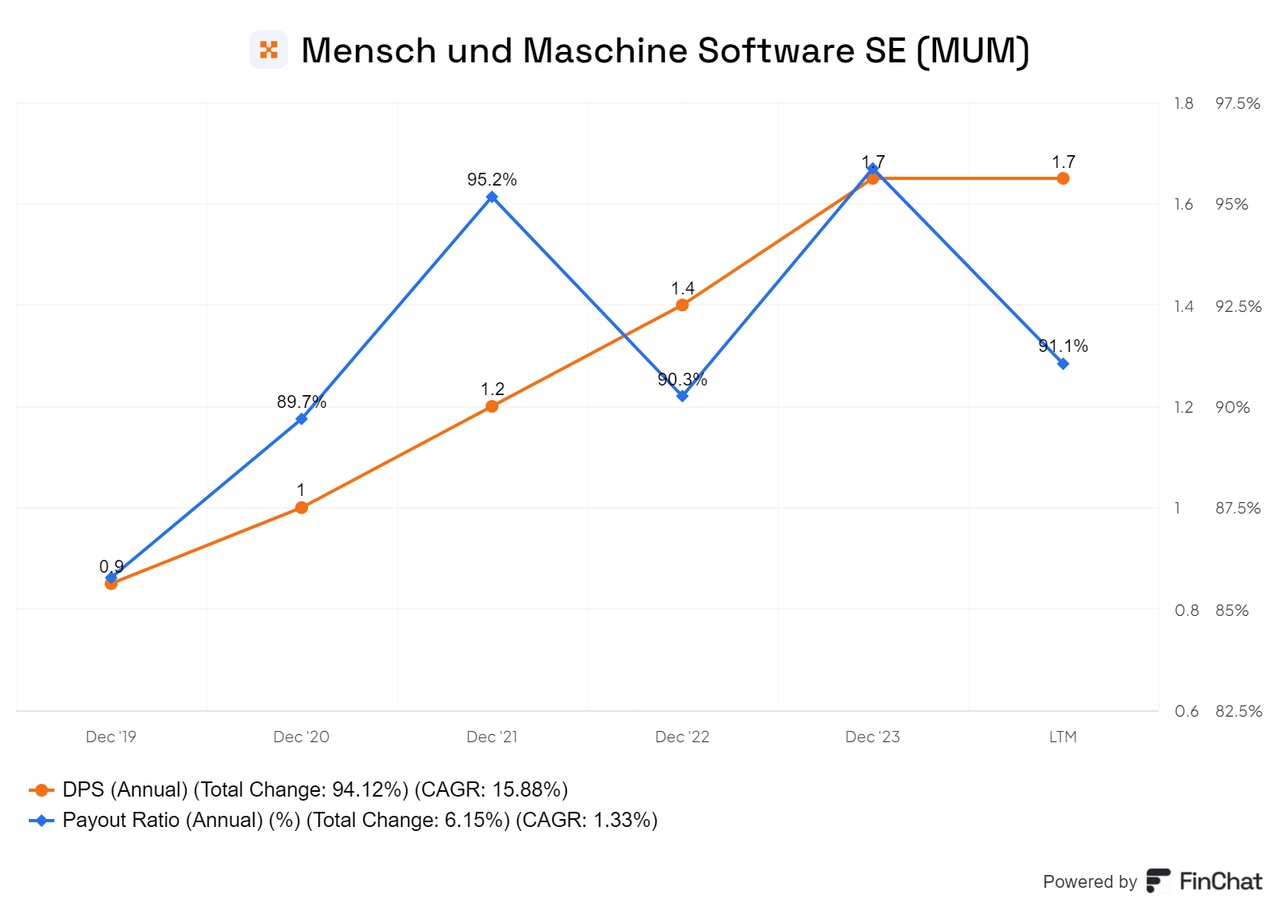

The payout ratio is very high and could remain at around 90% for the time being, or possibly even lower. The dividend per share is rising continuously and should maintain this trend.

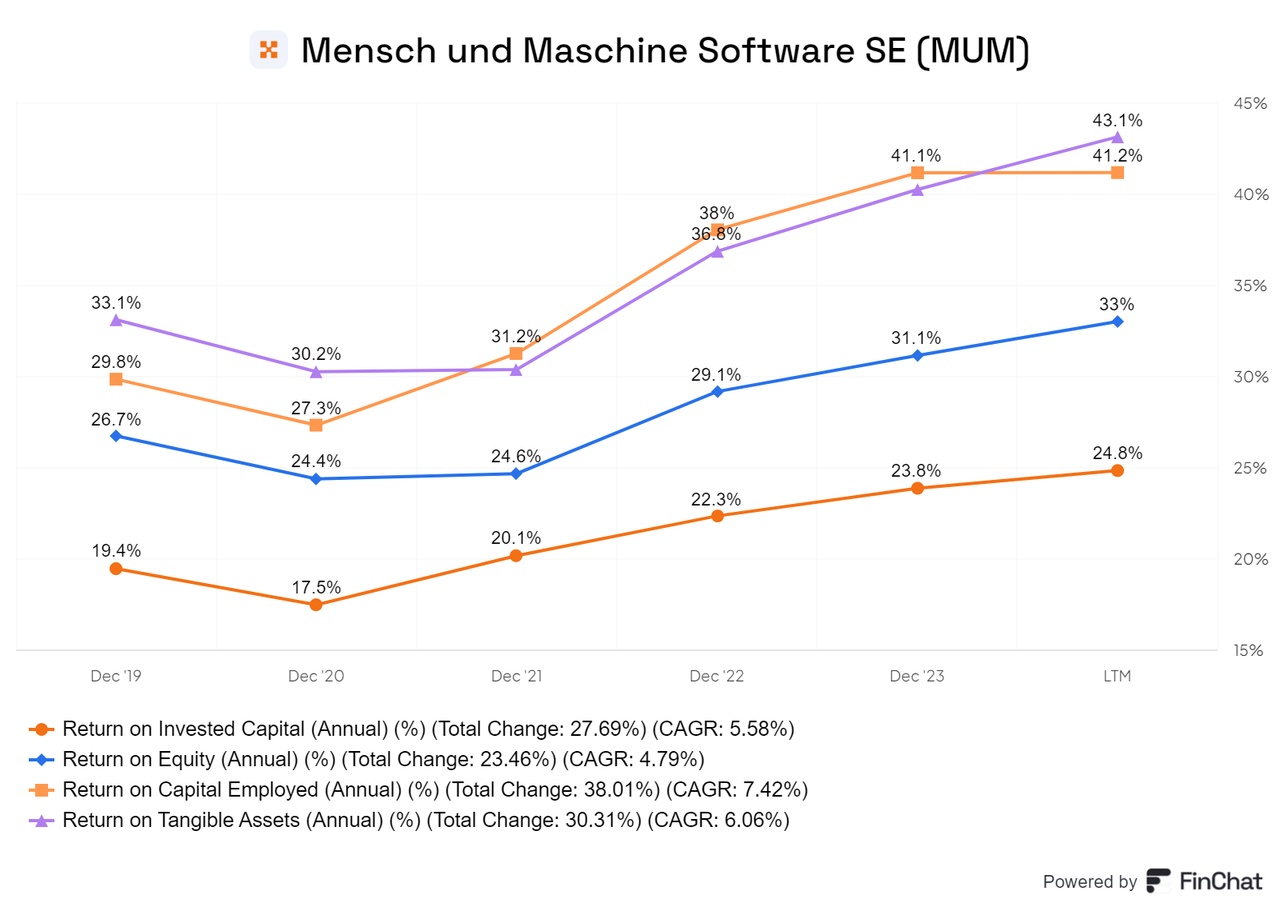

The capital efficiency is very good and a larger part of the distributions could be retained in order to invest in the business to gain even more market share.

Conclusion

The picture speaks for itself: with an insider share of 48% and a promising history, I am convinced that the company can achieve its goals. Earnings per share (EPS) should double in the next 4 to 5 years. The share is performing well, but is still undervalued. There is also an attractive dividend, which has been rising steadily for some time. The business case is convincing and the company's name is simply cool. The only thing that could really hinder the company is Germany, as most of its sales come from this market and the tax burden here is very high.

They could work on the presentation, as it seems a bit strange for a digital company, but ultimately it's going well.