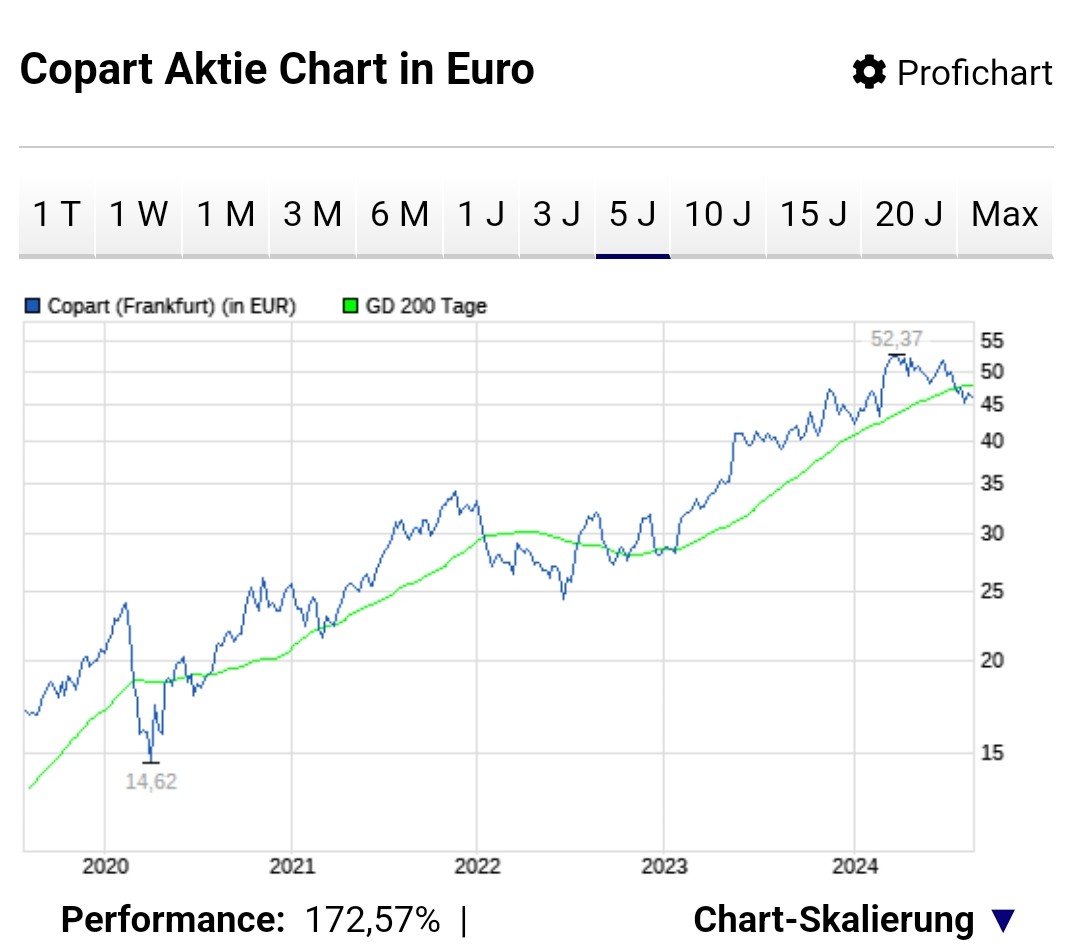

A long-term runner below the 200-day line.

Is it worth getting in?

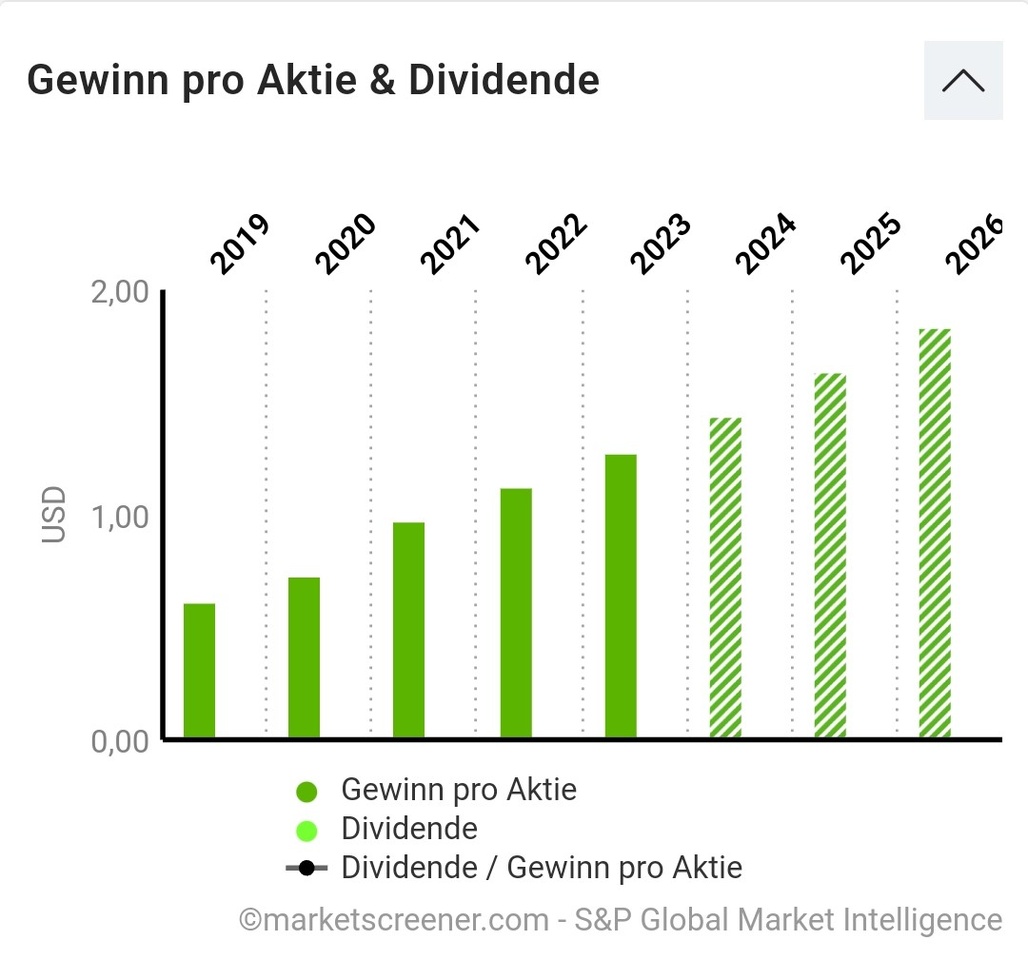

Profit growth expected 22% in 2025

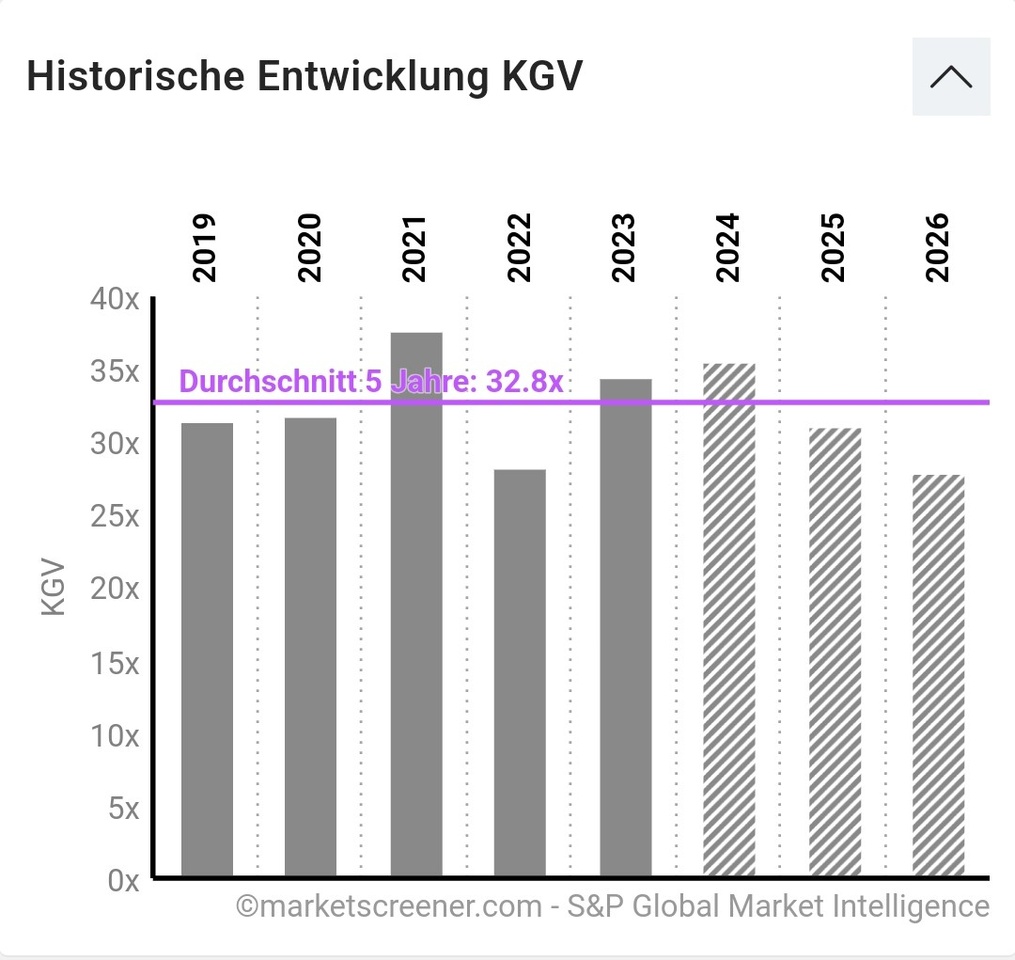

P/E RATIO 2024: 33

P/E RATIO 2025: 32

Free cash flow: 2024: 997

2025: 1424

2026: 1658

EBitT margin: 2024: 38.48%

2025: 40,04%

2026: 39,84%

Book value per share: 2024: 1.446

2025: 1,644

2026: 1,835

Key figures continue to increase.

Can anyone find a fly in the ointment?

Company Profile

Copart, Inc. engages in the provision of online auctions and vehicle remarketing services. It offers vehicle sellers a full range of services to process and sell vehicles primarily over the Internet using Virtual Bidding Third Generation Internet auction-style sales technology. The company sells vehicles primarily to licensed vehicle dismantlers, remanufacturers, repair licensees, used car dealers and exporters and in certain locations, as well as to the general public. The company's services include online seller access, residual value estimating services, appraisal services, salvage vehicle processing, virtual insurance exchange, transportation services, vehicle inspection stations, on-demand reporting, DMV processing, and vehicle processing programs. It operates through the United States and International segments. The company was founded by Willis J. Johnson in 1982 and is headquartered in Dallas, TX.