The goal of my post is to give a comparison to the different Clean Energy ETFs and discuss the topic with you in the long run. There is already a good page here at https://app.getquin.com/learn/nachhatlig-investieren-in-2021/

Therefore, I would first go into the topic of Clean Energy in general.

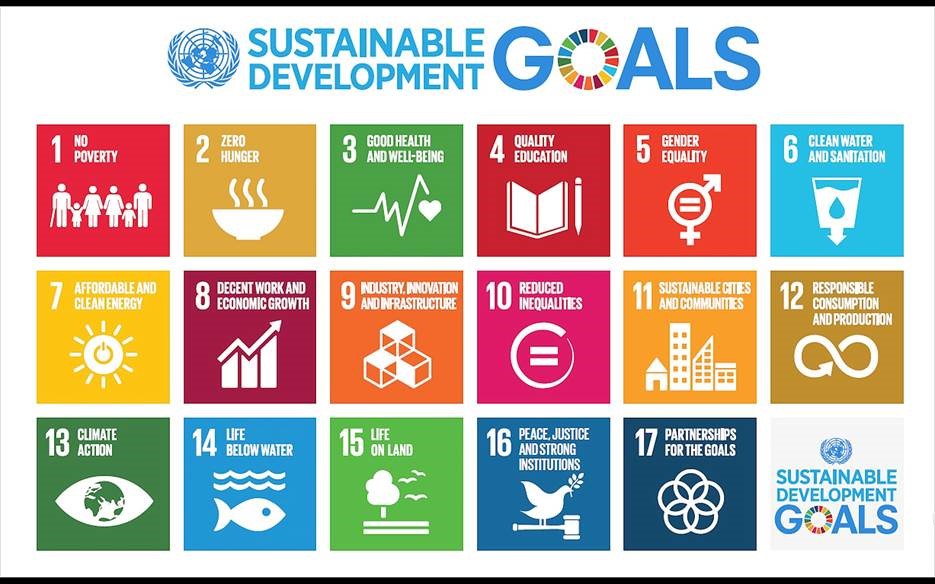

First of all, you have to understand what the framework conditions are and why clean energy is such an important topic. Clean Energy is one of the 17 development goals of the UN, also under the title Agenda 2030 - Transformation of the World.

People as "the center of sustainable development". To better engage people with the UN SDG (sustainaible development goals) targets, there is a strong regional and local focus to drive implementation in concrete activities. An example of this would be: promoting charging stations for electric cars.

As part of the European Green Deal, the Commission proposed in September 2020 to increase the greenhouse gas emissions reduction target to at least 55% by 2030 (emissions and removals) compared to 1990 levels. It considered what measures - including more energy efficiency and renewables - are needed across all sectors, and will initiate work by June 2021 on detailed legislative proposals to implement and deliver the more ambitious targets.

Why 1990? Global emissions of carbon dioxide (CO2) have increased by almost 50 percent since 1990!

--> specifically, the EU wants to be climate neutral by 2050.

What is the Paris Climate Agreement?

Paris Agenda:

The Paris Agreement sets out a global framework to combat climate change: Global warming is to be kept well below 2°C; the temperature rise is to be limited to 1.5°C through further measures. In addition, countries are to be supported in adapting to the consequences of climate change.

This results in strong demand and high investments in renewable energies. What is meant by "clean energy"?

I would classify it into different sectors:

Renewables

- biofuels

- solar

- wind

- Hydropower

- Geothermal energy, etc

Energy transition

- Energy conversion (i.e. conversion technologies, fuel cells, hydrogen technology,etc)

-Energy efficiency

- energy storage

What Clean Energy Indices are available in the market?

- S&P Global Clean Energy

- WilderHill New Energy Global Innovation Index

- World Alternative Energy Index

- Solactive Clean Energy Index

- Nasdaq Clean Edge Green Energy Index

I. S&P Global Clean Energy

Description:

Clean energy companies, primarily those that produce clean energy or are involved in providing clean energy technology and equipment.

Inception date: 2007

Region: global

Number of index components: 83

Weighting methodology: by market capitalization

Top-10 weighting: 48.37% --> Concentration risk of single stocks!

Exposure USA: 39,15%

Rebalancing: Semiannual

ETF Provider: iShares Global Clean Energy UCITS ETF

ISIN: IE00B1XNHC34

II. WilderHill New Energy Global Innovation Index

Description:

Profits from solutions to climate change. Consists of companies around the world whose innovative technologies are focused on clean energy, renewable energy, decarbonization and efficiency.

Launch date: 2006

Region: global

Number of index components: 125

Weighting methodology: Equal weighted

Top 10 weighting: 10.6%

Exposure USA: 26.73

Rebalancing: quarterly

ETF Provider: Invesco Global Clean Energy UCITS ETF

ISIN: IE00BLRB0242

III World Alternative Energy Index

Description:

The largest renewable energy, distributed energy or energy efficiency companies that derive at least 40% of their revenue from alternative energy activities.

Launch date: 2006

Region: global

Number of index components: 40

Weighting methodology: by market capitalization

Top-10 weighting: 65,13% --> Concentration risk of single stocks!

Exposure USA: 36,44%

Rebalancing: Half-yearly

ETF Provider: Lyxor New Energy (DR) UCITS ETF

ISIN: FR0010524777

IV Solactive Clean Energy Index

Description:

Companies actively engaged in the global clean energy industry in various segments of the value chain (clean energy services, original equipment manufacturing, and clean energy production companies).

Launch date: 2020

Region: global

Number of index components: 44

Weighting methodology: Equal weighted

Top 10 weighting: 34.4%

Exposure USA: 33.0%

Rebalancing: semi-annual

ETF Provider: L&G Clean Energy UCITS ETF

ISIN: IE00BK5BCH80

V. Nasdaq Clean Edge Green Energy Index

Description:

Companies that are manufacturers, developers, distributors and/or installers of clean energy technologies.

Launch date: 2006

Region: USA

Number of index components: 44

Weighting methodology: by market capitalization

Top-10 weighting: 55.50% --> Concentration risk of single stocks!

Exposure USA: 78,71

Rebalancing: quarterly

ETF Provider: First Trust NASDAQ Clean Edge Green Energy UCITS ETF

ISIN: IE00BDBRT036

Comment on all indices:

All five indices deal with clean energy, with ishares probably being the best known ETF currently if you look at the charts at the brokers. The problem with the S&P Global Clean Energy Index, however, is that due to the weighting by market capitalization, the top 10 stocks, similar to the Lyxor and First Trust product, make up about 50% of the entire index and so you have a high dependence on individual stocks, which you would logically not actually want to have in an ETF, because otherwise you could also buy 5 individual stocks. In addition, one has an overweighting of the USA with almost 40%.

With Lyxor's New Energy ETF one has with the top 10 over 65% index weighting, diversified goes differently. US exposure at 36%.

The WilderHill index has the broadest exposure to clean energy with 125 small cap stocks and the equal weighting makes it really broadly diversified. The top 10 make up just 10% of the index. The country distribution is really broad across the world. The ETF is still young though, but that doesn't mean it has to be worse than the 5 billion Ishares Clean Energy ETF.

On the contrary, due to the enormous size of the ishares ETF and the small market capitalizations of the index companies, the ishares ETF currently poses the greatest risk of market distortions in my view.

First Trust's product is U.S.-focused (79% exposure!) and thus one has a strong exposure to the U.S., which could help with the Biden infrastructure program. The top 10 make up over 55% of the index weight. USA sector bet I would say.

The L&G ETF is also equally weighted, so it's in the middle of the pack in terms of theme. Top Ten at 23%, the only ETF in the range where Eurozone is overweight in the index.

For me, the winner is the Invesco Global Clean Energy ETF. Looking forward to your comments!