👁️ Carl Zeiss Meditec AG: The share that catches the eye 🔍

Carl Zeiss Meditec AG is a leading medical technology company specializing in the development and manufacture of innovative products and solutions for ophthalmology and microsurgery. The company is headquartered in Jena, Germany.

Company presentation

Carl Zeiss Meditec AG offers a comprehensive portfolio of products for the diagnosis and treatment of eye diseases and for visualization in minimally invasive surgical procedures. This includes neurosurgery, ENT medicine, spinal surgery and dentistry.

Historical development

Founded in 2002, Carl Zeiss Meditec AG is part of the renowned ZEISS Group, which has a long tradition in optics. Since its foundation, the company has developed into one of the world's leading medical technology companies.

Business model and core competencies

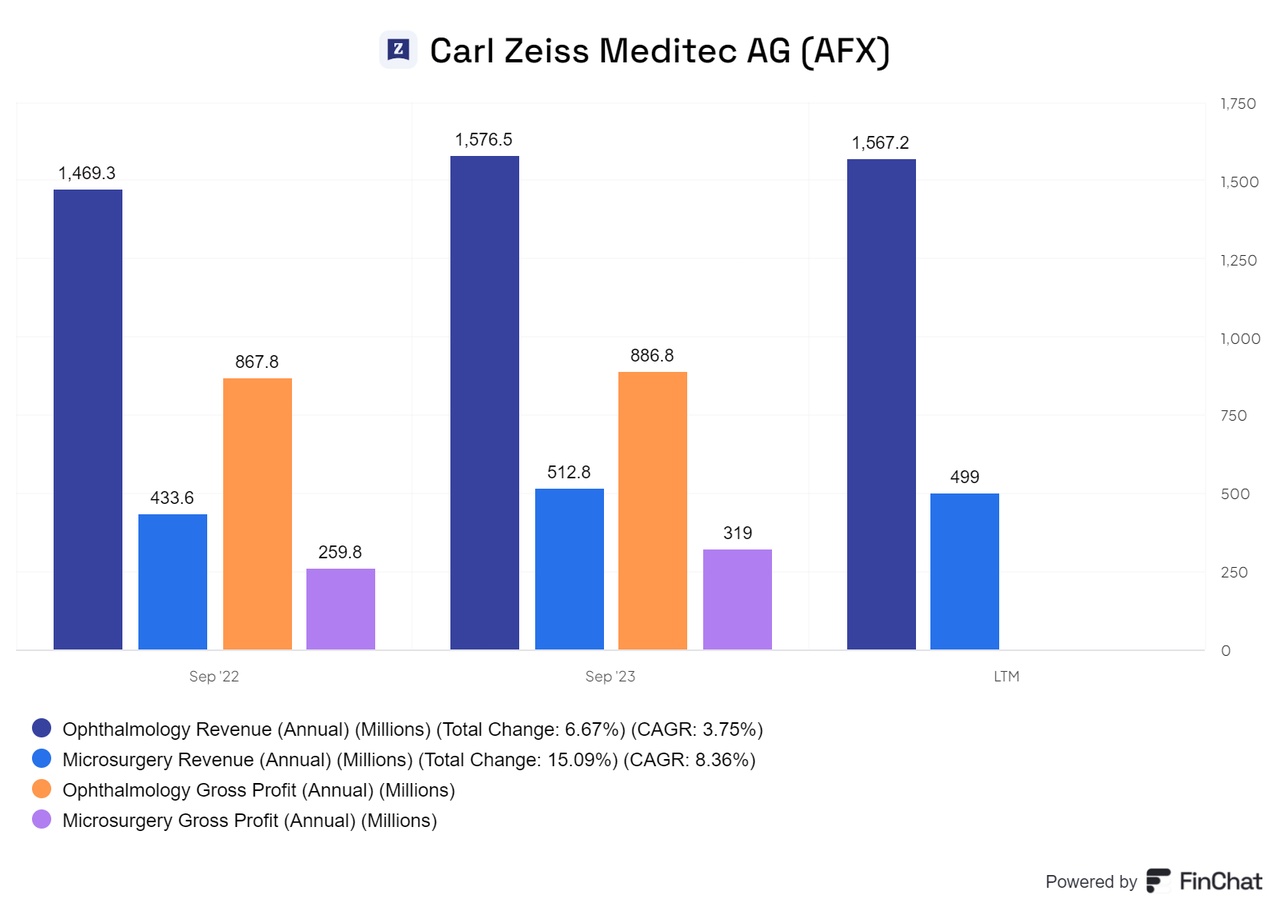

Carl Zeiss Meditec AG operates mainly in two segments:

1. ophthalmic devices: This segment comprises products for ophthalmology, including surgical ophthalmology.

2. microsurgery: Here the company offers advanced solutions for visualization in minimally invasive surgical procedures.

The company is characterized by its core competencies in the development of innovative optical and digital technologies for medical applications.

Future prospects and strategic initiatives

Carl Zeiss Meditec AG is committed to continuous innovation and the expansion of its product portfolio. The company invests heavily in research and development in order to integrate new technologies such as artificial intelligence and digital solutions.

Market position and competition

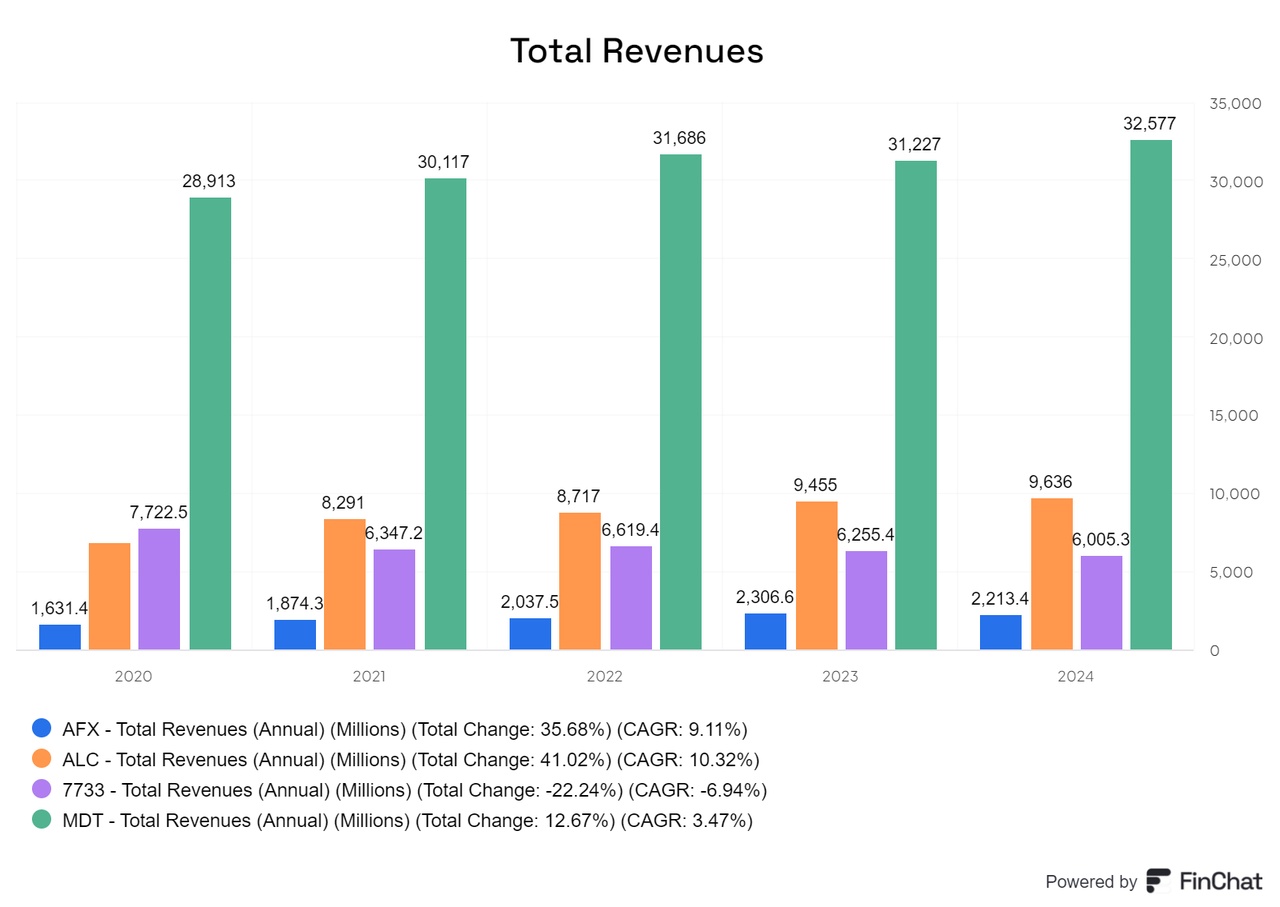

As one of the leading providers in its market segments, the company competes $AFX (+0,2%) with $7733 (+2,4%) , $ALC (+0,53%) and $MDT (+0,81%) ,

other major medical technology companies in the fields of ophthalmology and microsurgery. They are also major players in the field of medical technology, each with different focuses and strengths.

Total Addressable Market (TAM)

The addressable market for Carl Zeiss Meditec AG comprises the global market for ophthalmic and microsurgical devices and solutions. In view of the increasing ageing of the world's population and the rising demand for medical care, this market is expected to grow further in the coming years.

Share performance

The Carl Zeiss Meditec AG share is traded on the Frankfurt Stock Exchange. As at September 12, 2024, the share price was EUR 57.55, which corresponds to a TR of around minus 32.21% since the beginning of the year. The dividend yield was most recently 1.87%.

Since the IPO on March 22, 2000, the TR has been a sad 197.24%.

Main shareholder

The main shareholder of Carl Zeiss Meditec AG is the Carl Zeiss Foundation, which holds 59.14% of the company shares. This corresponds to 52,893,270 shares with a value of around EUR 3.9 billion. The remaining 41% of the shares are in free float.

Development

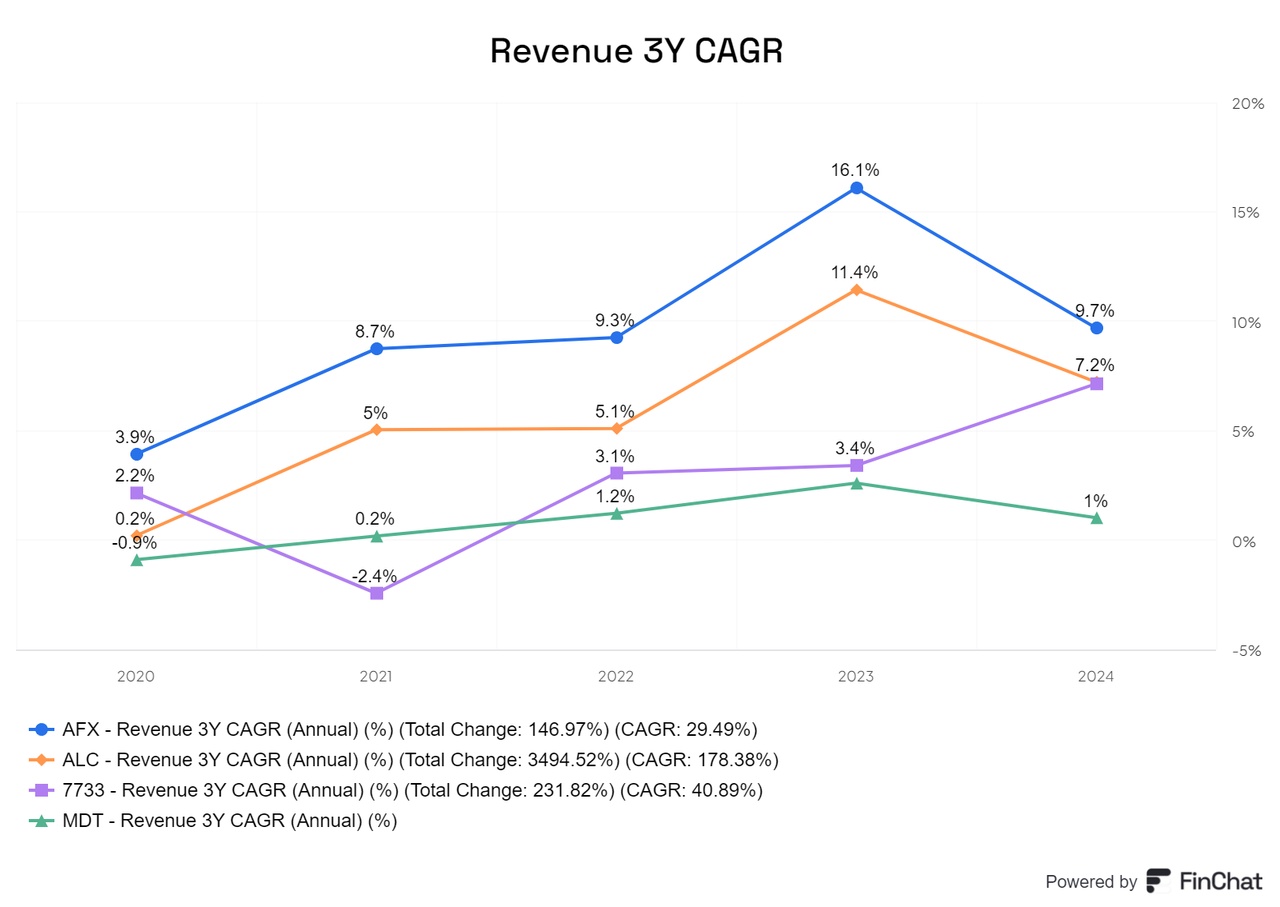

Although a comparison with the larger medical technology providers may be misleading, Carl Zeiss Meditec AG is particularly noteworthy in terms of sales growth. The company may be smaller than its larger competitors, but it is among the top performers in terms of annual growth rates.

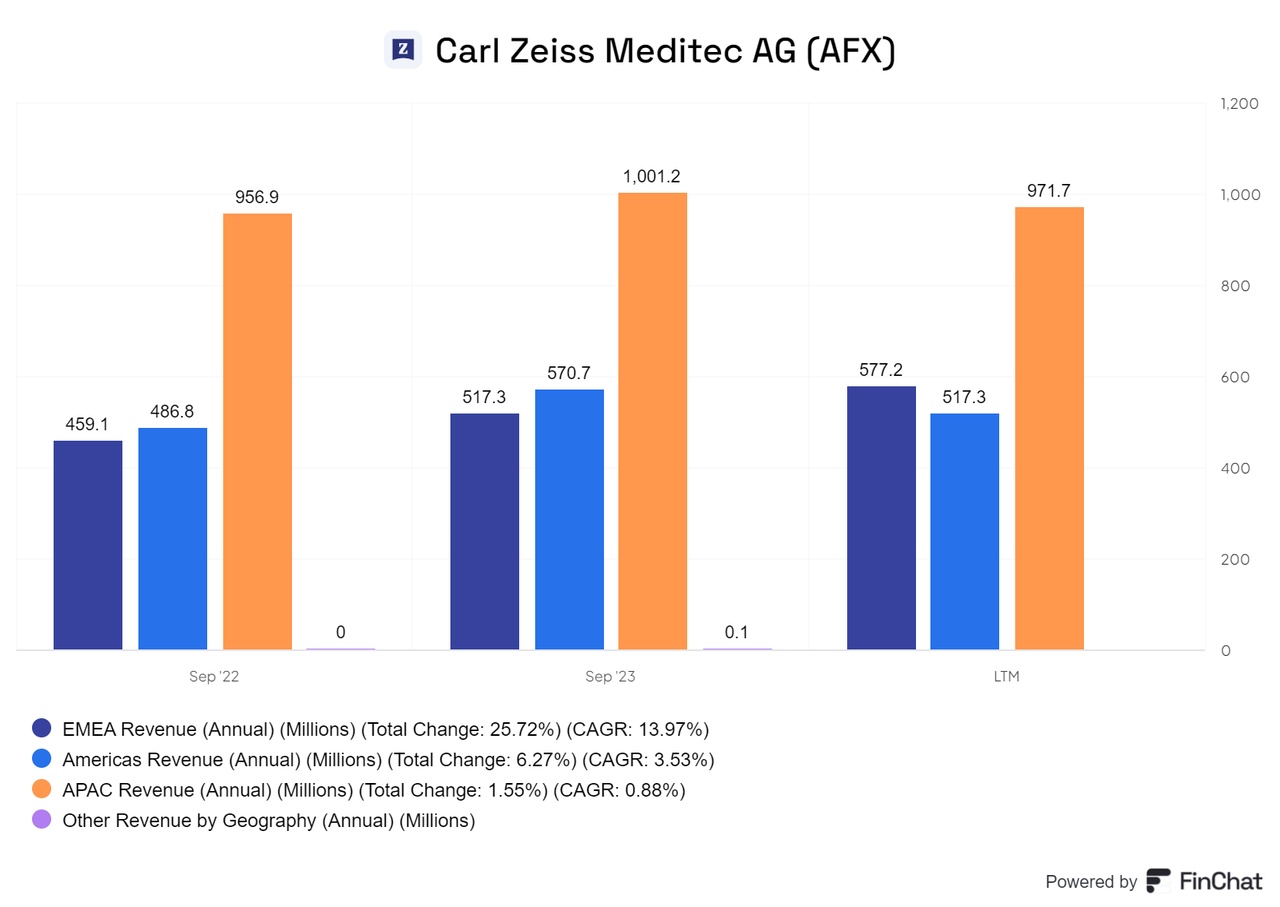

When analyzing sales by country, it becomes clear that the risk in Asia is considerable, particularly due to the uncertainties in China. While China can offer sales potential in the short term, there is a risk that these sales will either remain protected due to a lack of imitation or, conversely, be displaced by imitators, which could lead to a decline in the market in the long term.

The focus should therefore be on increasing sales in the USA. The American markets offer a more stable and often less risky source of revenue, which is crucial for a long-term strategy.

An analysis of sales by segment shows that the majority of sales come from ophthalmology products, which are around three times as large as sales from microsurgery products. Nevertheless, microsurgery products are more profitable in terms of gross profit. This indicates that, despite the higher sales volume in the ophthalmology segment, microsurgery products are more profitable

Looking at growth rates, Carl Zeiss Meditec AG is also performing strongly but is in decline. Despite a previously high growth rate, the trend is declining, which indicates challenges.

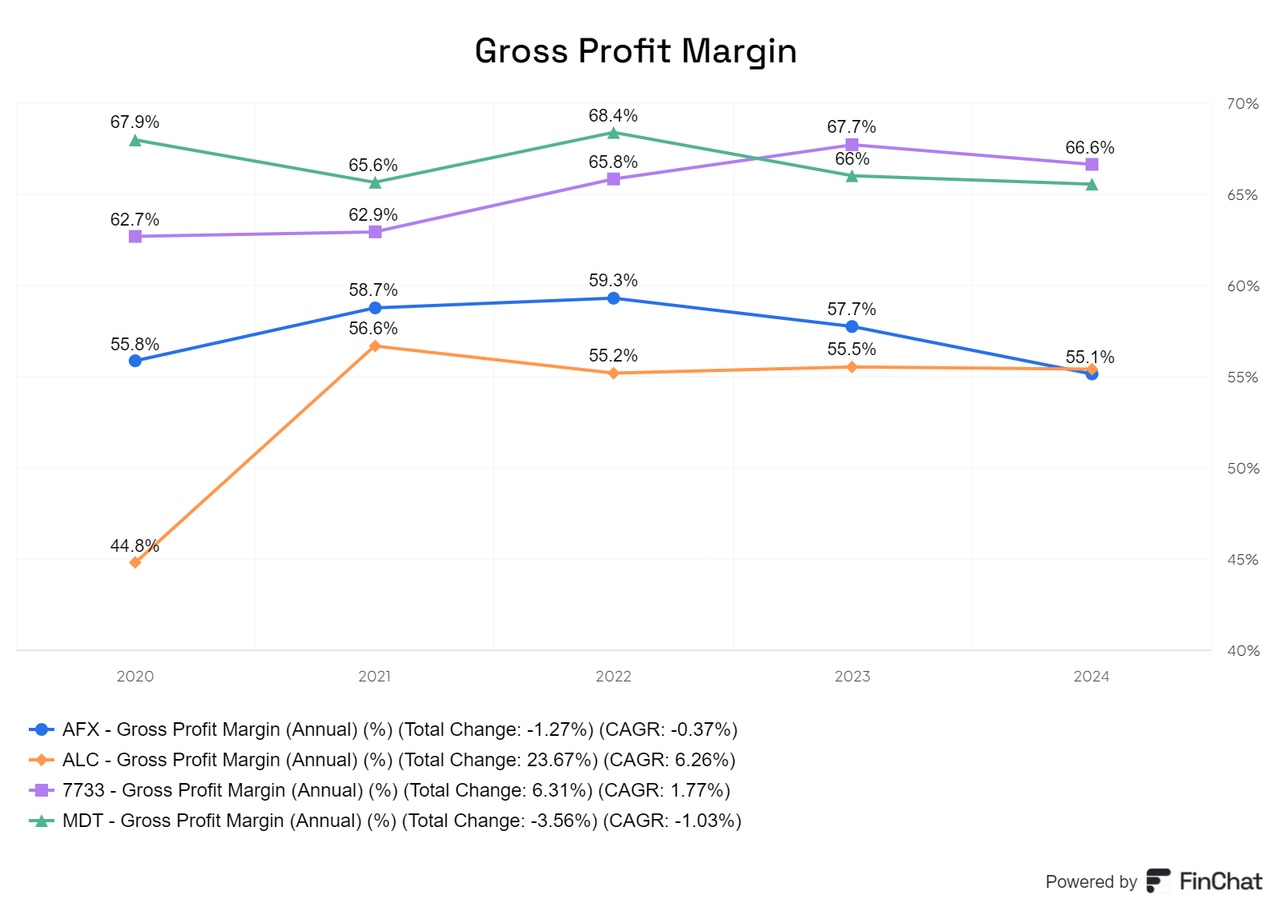

Carl Zeiss Meditec AG's gross margin is the lowest in comparison. However, the actual margin could be above 60% if the impact of the lower shareholding is taken into account and included in the calculation. With this adjustment, the company could come close to the top positions compared to its peers.

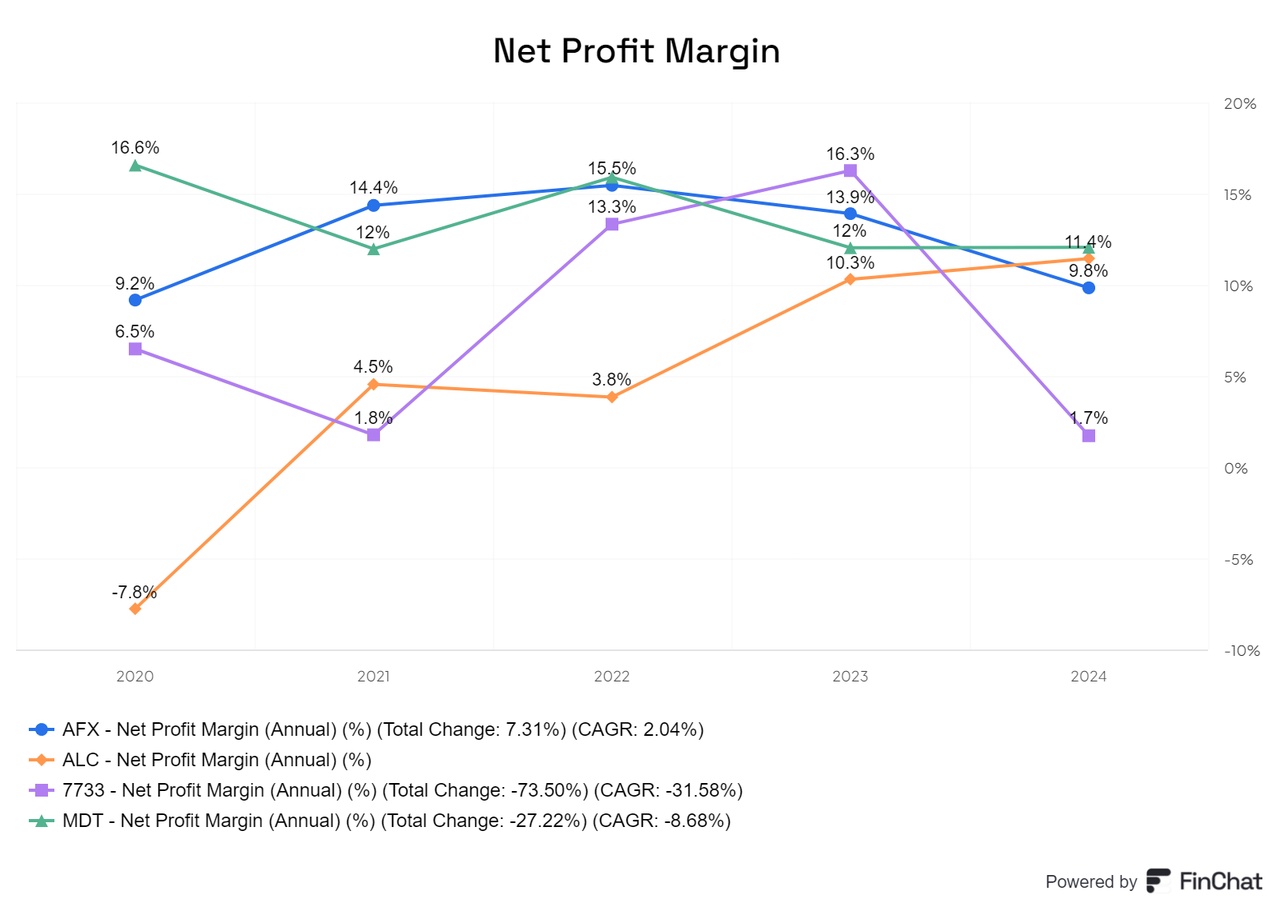

The net profit margin of Carl Zeiss Meditec AG actually decreases, but remains competitive compared to its peers. However, it would be desirable if the company could return to its previous higher margins in order to further strengthen its position.

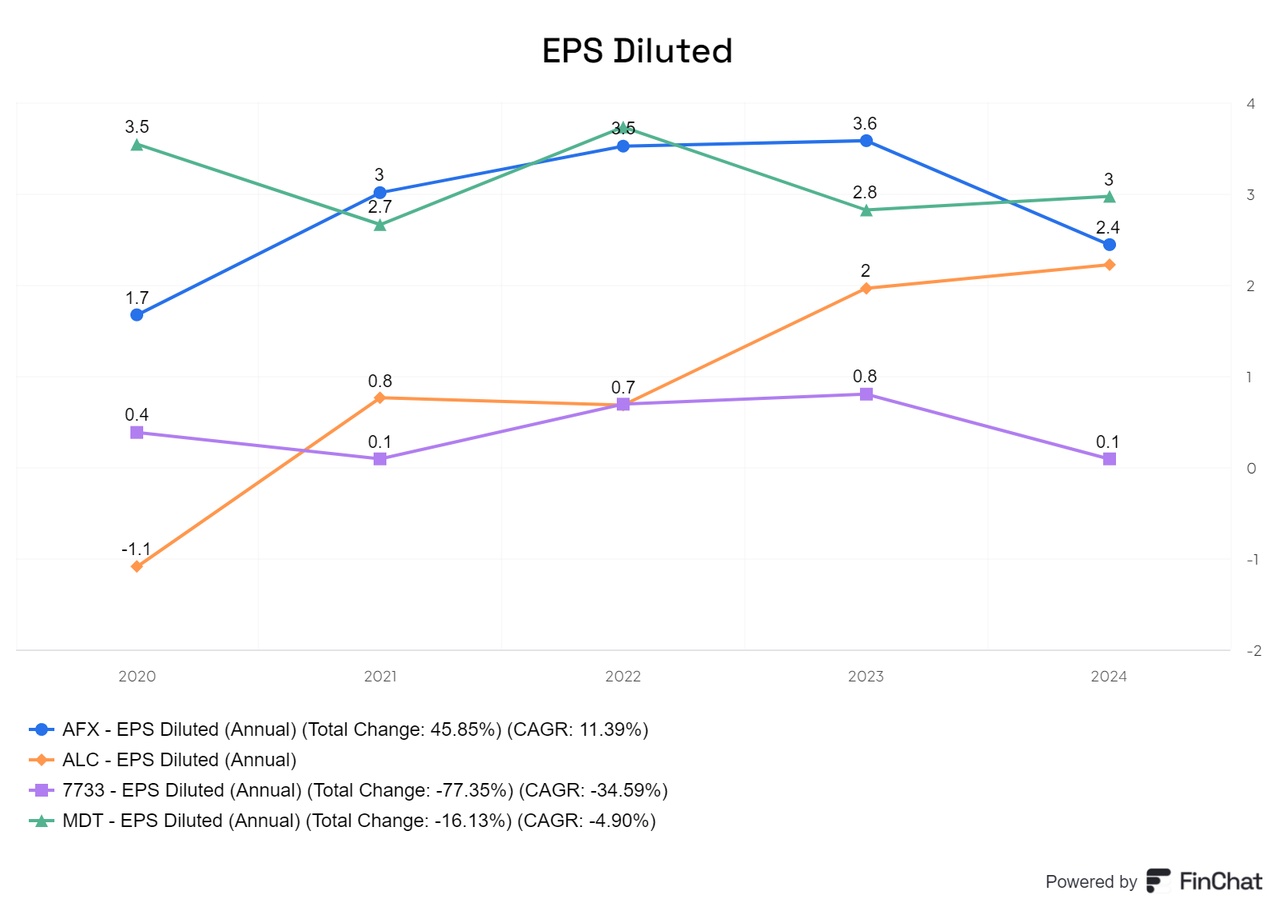

Despite the decline in net profit margins, Carl Zeiss Meditec AG's EPS (earnings per share) remains the second best among its competitors.

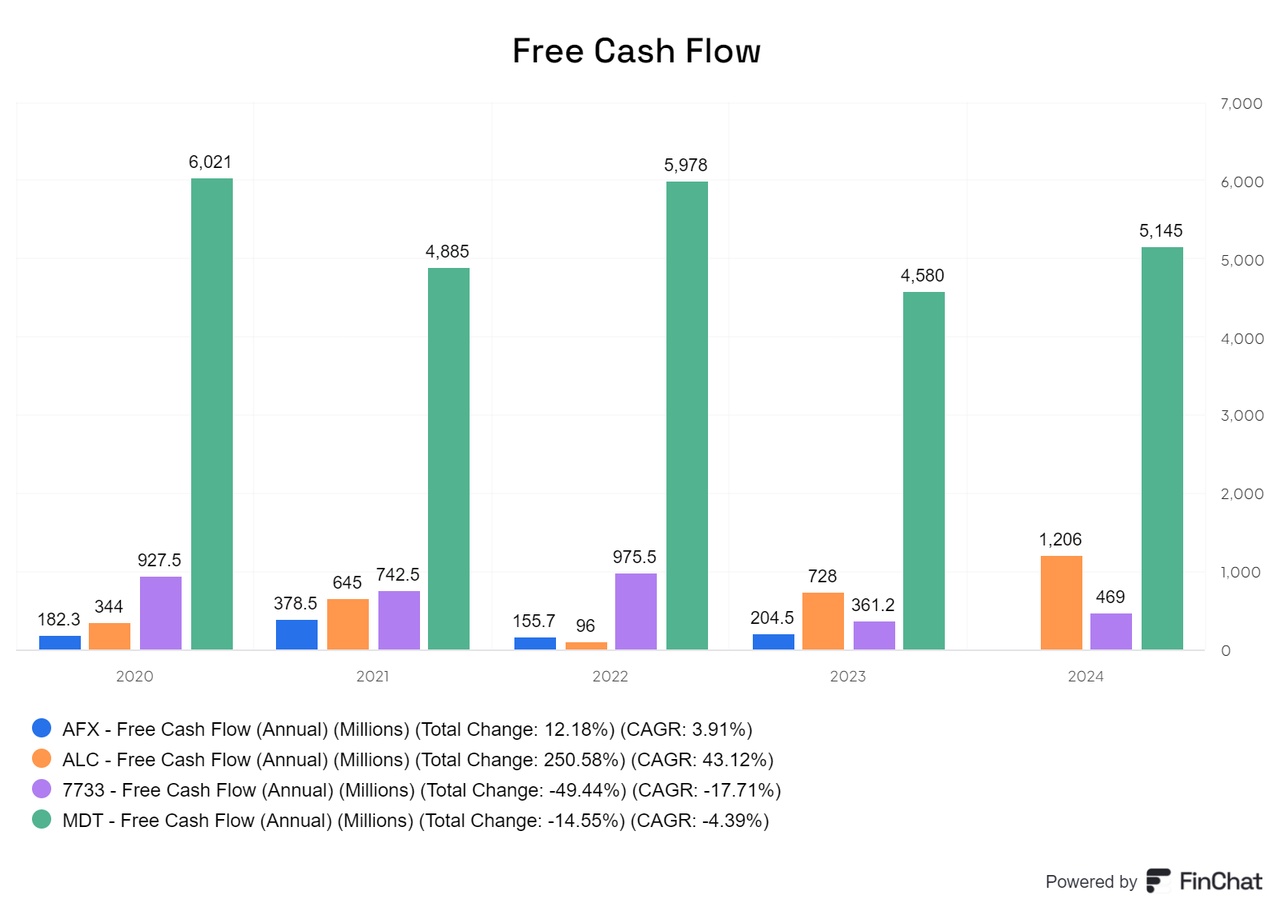

Free cash flow (FCF) is positive for all companies, although Carl Zeiss Meditec AG is likely to record a decline compared to the previous year. As the other companies generate higher revenue, their FCF figures are correspondingly higher.

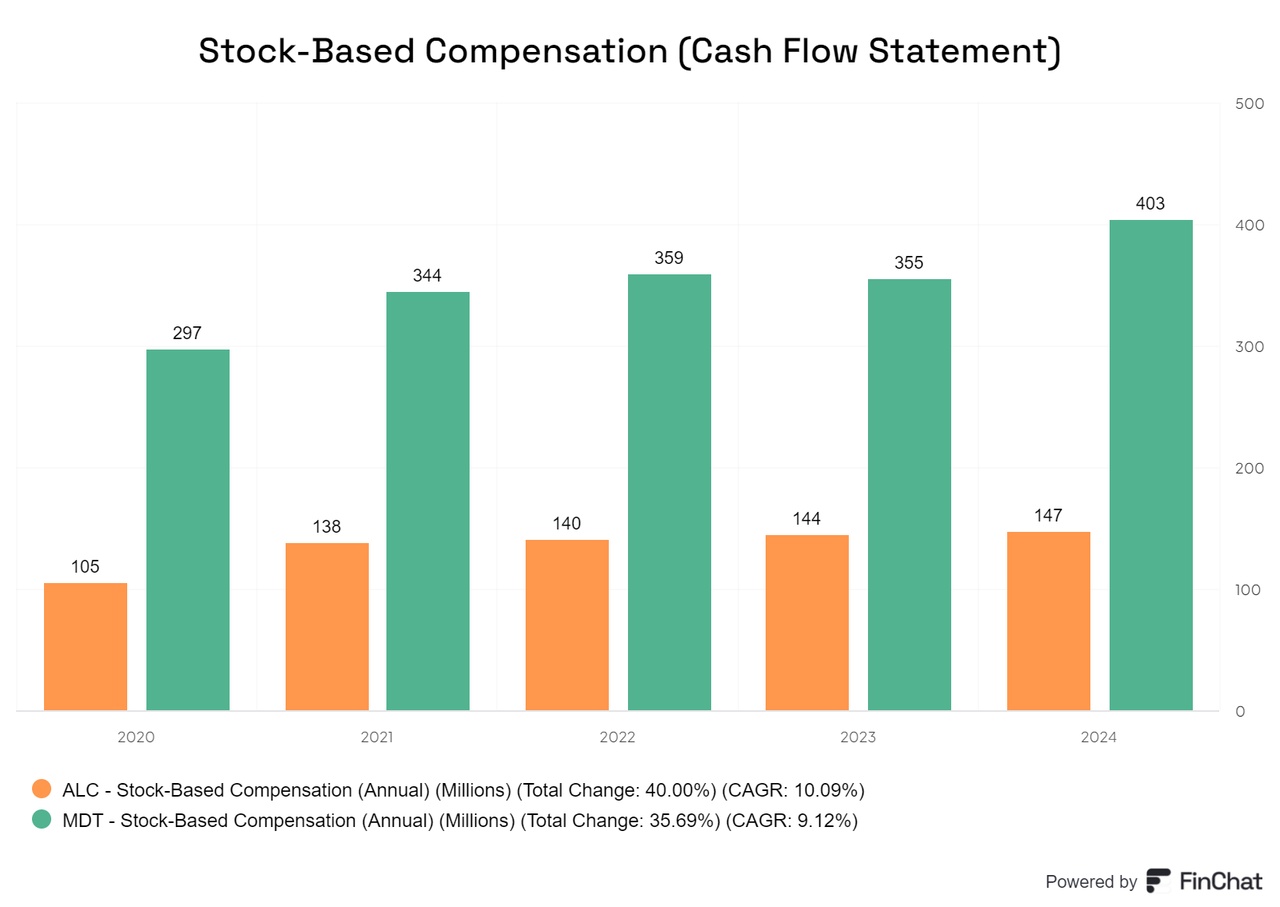

Share-based remuneration is only particularly pronounced at two companies.

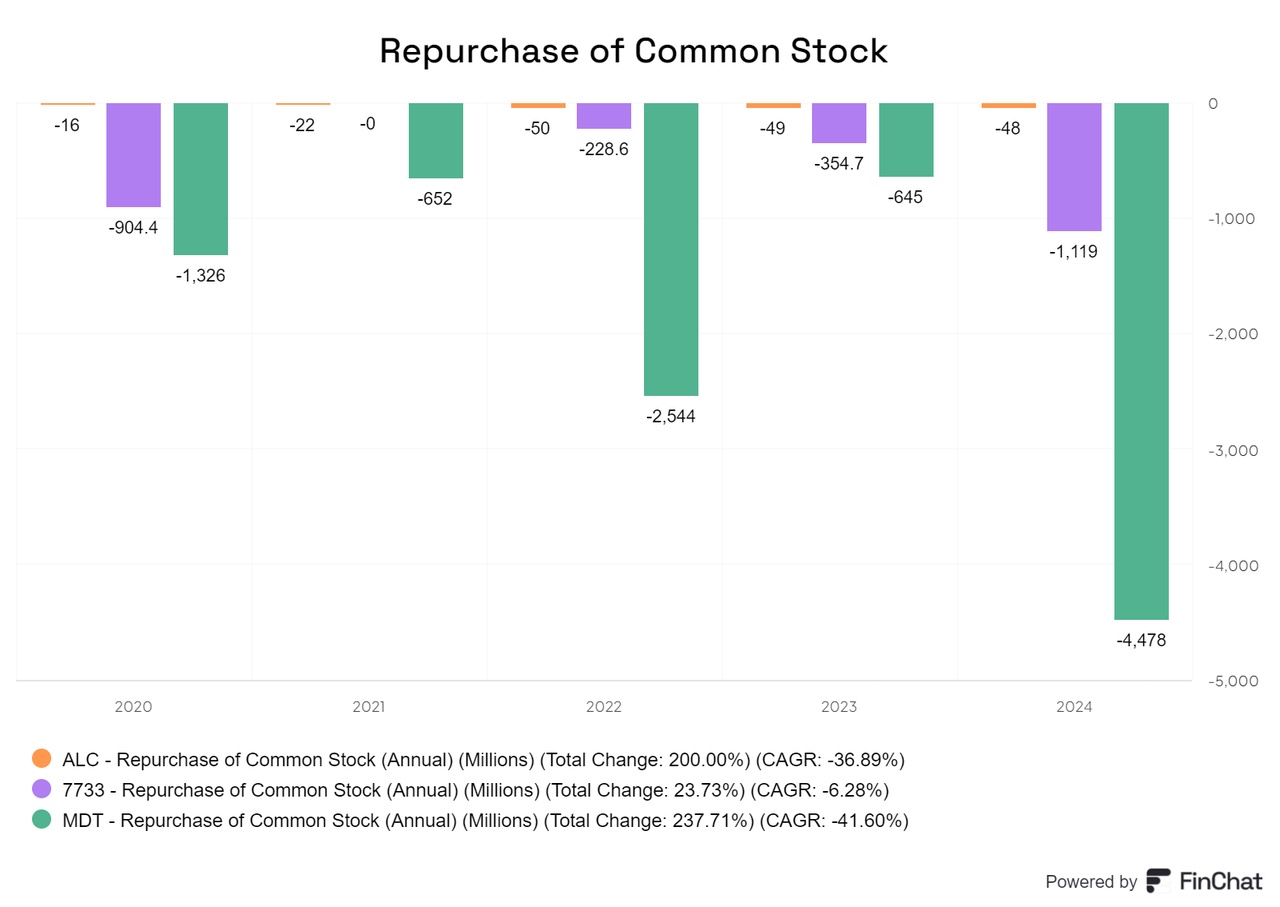

All companies, except Carl Zeiss Meditec AG, carry out share buy-backs.

Part 2:https://getqu.in/xnYohI/