Company presentation - Asian Berkshire ?

Hello everyone, this will be my first company introduction I hope I have not forgotten anything important and can introduce you to an interesting company.

Today it is about the Jardine Matheson Holding / BMG507361001 /$J36 (+1,75%)

The company

[1] Jardine Matheson is a highly diversified Asian conglomerate with unrivaled experience in the region. The company comprises a broad portfolio of market-leading businesses whose operations are focused on the increasingly affluent consumers of the Asian region.

Its main business is in China and Southeast Asia where its subsidiaries and related businesses benefit from the extensive experience, expertise and long-standing relationships from its network in the region.

[2] On July 1, 1832, as a result of a meeting between William Jardine and James Matheson, a Scottish merchant from Sutherland, the company was named Jardine, Matheson & Co. Incorporated.

In 1834, the first shipload of Chinese tea was shipped to England. In those years they also traded silk which was shipped to England and on the way back opium was shipped to China. In 1872 the company withdrew from the opium trade.

Today, the holding company has over 400,000 employees and consists of a large number of companies. In the following, I will list the most important holdings.

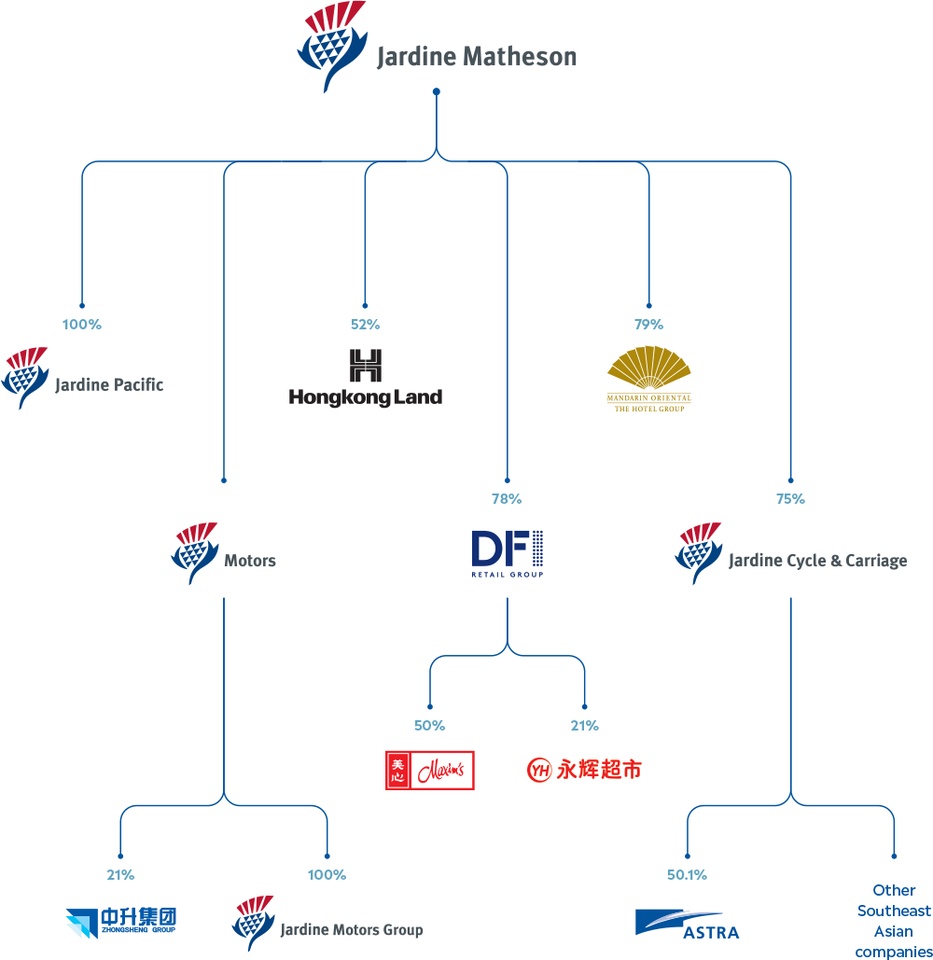

[3][4][5][6]

100% in Jardine Pacific / engineering and construction, aviation and transportation services, and restaurants.

100% to Jardine Motors Group / The group comprises leading Asian automotive companies, including Zung Fu Motors Group in Hong Kong and Macau; Cycle & Carriage in Singapore, Malaysia and Myanmar; Tunas Ridean in Indonesia; and Jardine Motors Group in the United Kingdom.

85% of Jardine Strategic is held by a holding company. This in turn has a stake in the following companies:

50% in Hong Kong Land / An Investment, Management and Development Group. Founded in 1889, the group owns and manages more than 850,000 sqm of prime office and retail space in Hong Kong, Singapore, Beijing, Jakarta and other major Asian cities.

78% in Diary Farm / With over 10,000 stores and 230,00 employees, DFI Group operates in the food retail, health, beauty and home textile sectors.

75% in Mandarin Oriental / Mandarin Oriental Hotel Group is a hotel chain headquartered in Hong Kong. They operate nearly 40 luxury 5-star hotels. Their portfolio includes hotels in Asia, Europe, the Middle East, Africa and the Americas.

75% in Jardine Cycle&carriage / JC&J is the investment holding company of Jardine Matheson Group in Southeast Asia. JC&C is committed to creating growth for Southeast Asia by investing in market-leading companies based on themes of urbanization and the emerging consumer class.

JC&C in turn holds a 50% stake in Astra International, which is active in heavy equipment, mining, construction and energy, agriculture, infrastructure and logistics.

The holding structure of Jardine Matheson is huge and extends into countless business areas through its many holdings and their subsidiaries.

Key figures[5][7][8]

P/E RATIO

2021 9,15

2022e 9,27

2023e 9,13

2024e 8,47

PEG

2022e +1,70

2023e +1,17

KBV

2017 0,89

2018 1,00

2019 0,68

2020 0,70

2021 0,58

2022e 0,46

The current dividend is €1.97 per share. At a share price of 47.68, this gives a div. yield of 4.14%.

The dividend has not been reduced for 23 years.

Pay-Out Profit 25,2%

Pay-Out Free-CF 17,3%

Average dividend growth is 6.82% over 5 years

The EBIT of the last years is also impressive. Figures in USD in millions:

2018 3.969

2019 3.991

2020 2.337

2021 3.328

2022e 3.171

Currently, only 67% of the shares are in free float.

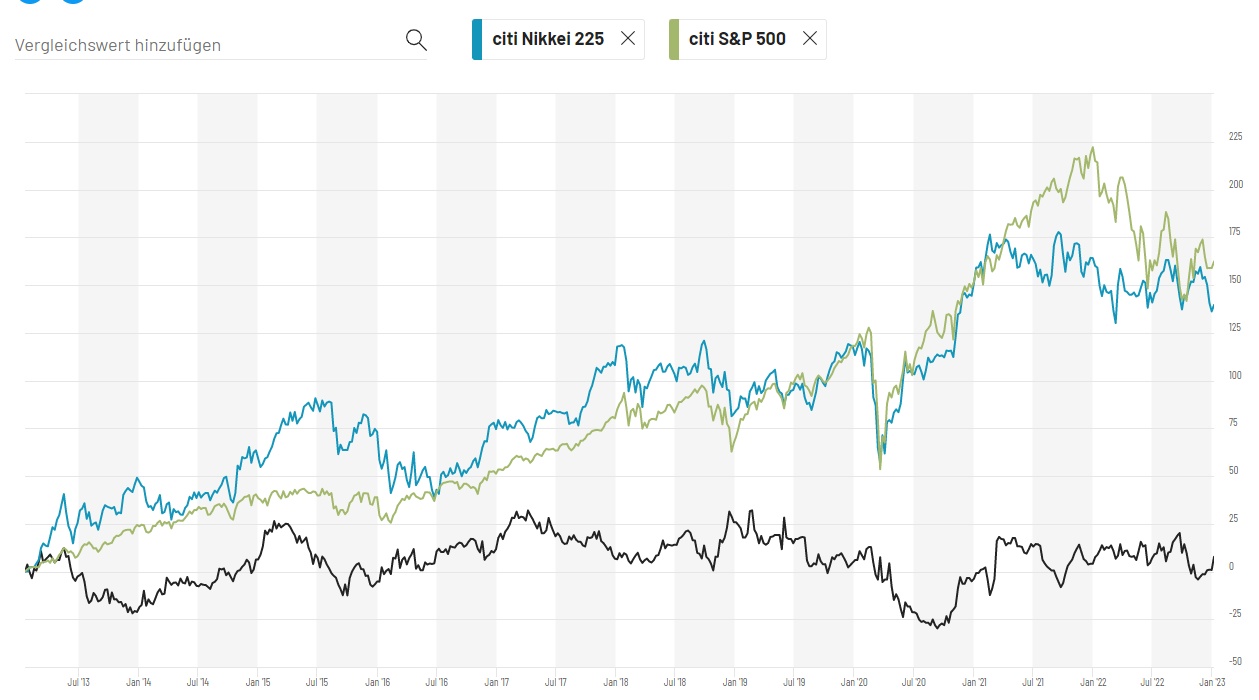

Chart-wise, Jardine Matheson is no wonder, probably more sobering for many.

The last 10 years the share price runs rather in a range. The last major correction was October 2020 with a low of 38US$ and the last ATH was February 2019 at 71US$. At the moment, Jardine Matheson is at about 50US$.

In the near future Jardine Matheson will find its way into my dividend portfolio. I hope I could introduce you to a new company.

For improvement suggestions and criticism I am grateful!

Sources

[1] https://www.jardines.com/en/about-us

[2]https://de.wikipedia.org/wiki/Jardine_Matheson_Holdings

[3] https://www.jardines.com/en/our-businesses

[4] https://ar.jardines.com/2021/JardineMotors.html

[5] https://aktienfinder.net/dividenden-profil/Jardine%20Matheson-Dividende

[6] https://de.wikipedia.org/wiki/Mandarin_Oriental

[7] https://de.marketscreener.com/kurs/aktie/JARDINE-MATHESON-HOLDINGS-6491154/fundamentals/

[8] https://www.onvista.de/aktien/kennzahlen/JARDINE-MATHESON-HOLDINGS-Aktie-BMG507361001

[9] https://de.marketscreener.com/kurs/aktie/JARDINE-MATHESON-HOLDINGS-6491154/charts/?tw=1#