📊 $UBER (+0,1%)

Discounted cash flow (DCF) analysis: Intrinsic value shows upside potential! 🚀

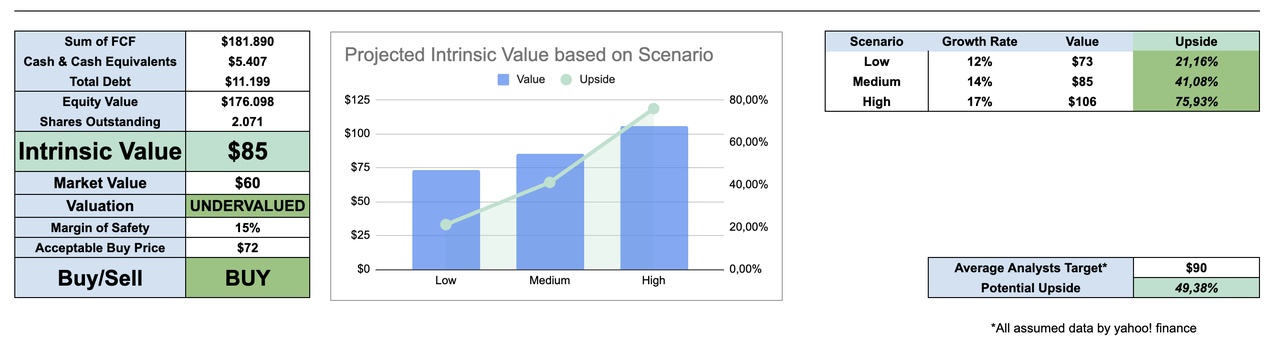

If you look at a DCF valuation model for $UBER (+0,1%) the figures show a clear investment opportunity:

🔑 Key Findings:

1. intrinsic value: 85 dollars per share

- Current market price: $60 per share

- This means that based on its intrinsic value, Uber is up 41% undervalued. (assuming 14% average growth over the next 10 years, WACC 9% and infinite growth rate 6%)

2. upside scenarios:

- Low growth (12%)→ Value: $73 → Upside potential: 21%

- Medium growth (14%) → Value: $85 → Upside potential: 41%

- High growth (17%) → Value: $106 → Upside potential: 76%

3rd average analyst target: $90 → Potential upside: 49% 📈.

📌 Valuation insights:

- Margin of Safety: 15% → Acceptable buy price: $72.

- Uber's equity value is robust at $176B, with a healthy balance sheet of FCF and cash reserves.

🔍 Bottom LineUber appears undervalued with a high margin of safety. Could go through the roof in the near future after the dust settles on the worries with $GOOG (+0,32%) 's Waymo has settled, could go through the roof, assuming they see a future in the business model. 🚀

If you are interested, here is a summary of the last earning call, which once again shows the risks and growth opportunities of Uber:

Who has Uber in their portfolio and with how much weight?