S&P500 sector performance and weekly review $SPY (+0,01%)

S&P 500 starts December with a weekly rise to new highs, led by consumer discretionary

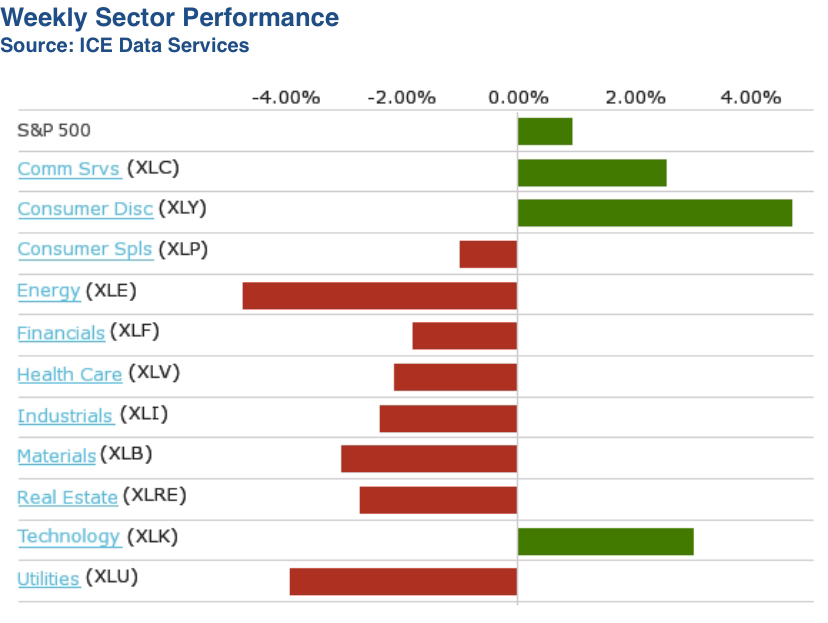

The S&P 500 index rose 1% this week and reached new highs, driven by gains in the sectors consumer discretionary, communication services and technology.

However, the other eight sectors of the S&P 500 recorded weekly losses. Nevertheless, the market index closed Friday's session with a new closing record of 6,090.27 points . Over the course of the day, the index even reached a new intraday high of 6,099.97 points and has recorded an increase of almost 28 %.

Drivers of the increase

- Consumer discretionary (+5.9%): This sector recorded the strongest rise of the week, mainly thanks to retailers Lululemon Athletica (+25%) and Ulta Beauty (+11%)which both reported better-than-expected quarterly results and raised their full-year forecasts.

- Communication Services (+4.1%): Meta Platforms (META) increased by 8,6 % after a US federal appeals court upheld a change in the law requiring TikTok to divest its US operations by January 19. January 19 January 19. Meta could benefit from this as Facebook and Instagram compete with TikTok for users and advertising revenue.

- Technology (+3.3%): Super Micro Computer (SMCI) increased by 35 %after it was announced that the company had been acquired in connection with Elon Musk's xAI project "Colossus" to provide hardware for a new data center project in Memphis, Tennessee.

Loser of the week

- Energy sector (-4.5 %)The decline is due to falling crude oil futures after OPEC+ decided to extend voluntary production cuts while the market is expected to be oversupplied. Losers included Texas Pacific Land (-16 %) and Halliburton (-9.7 %).

- Utilities (-3.8 %), Materials (-3 %) and real estate, industry, Healthcare, finance and consumer goods for daily needs also recorded losses.

Labor market data

On Friday, US economic data showed that the nonfarm payrolls rose by 227,000 jobs in November (expected: 220,000). The unemployment rate rose to 4.2% (previously 4.1%), while the labor force participation rate fell to 62.5 (previously 62.6 %).

Outlook for next week

Important economic data is due in the coming week, including the Consumer Price Index (CPI) for November on Wednesday and the Producer Price Index (PPI) for November on Thursday. In addition, quarterly reports from companies such as Oracle (ORCL), Adobe (ADBE), Broadcom (AVGO) and Costco (COST) expected.