$TMDX (+1,52%) - Company presentation part 2

Why $TMDX (+1,52%) could be an opportunity - reasons and concerns

Positive:

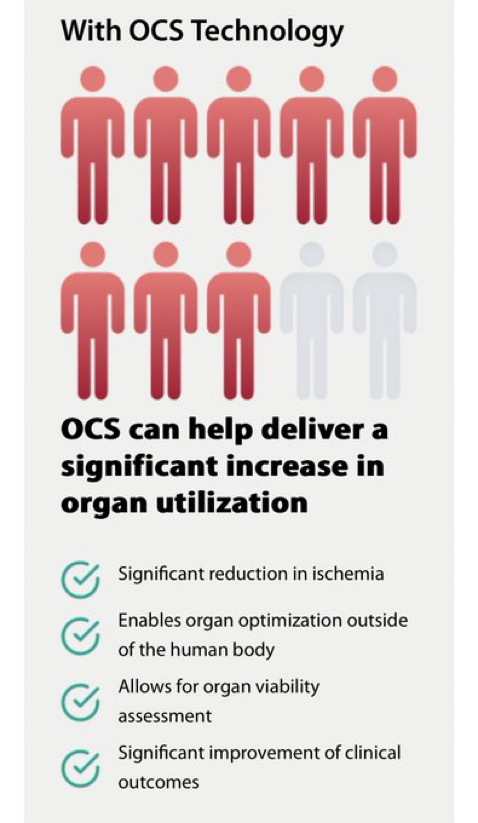

- $TMDX (+1,52%) Is a demand-driven business. Selling products that people need usually means that the products sell themselves. In any economic climate, there are people waiting for organs.

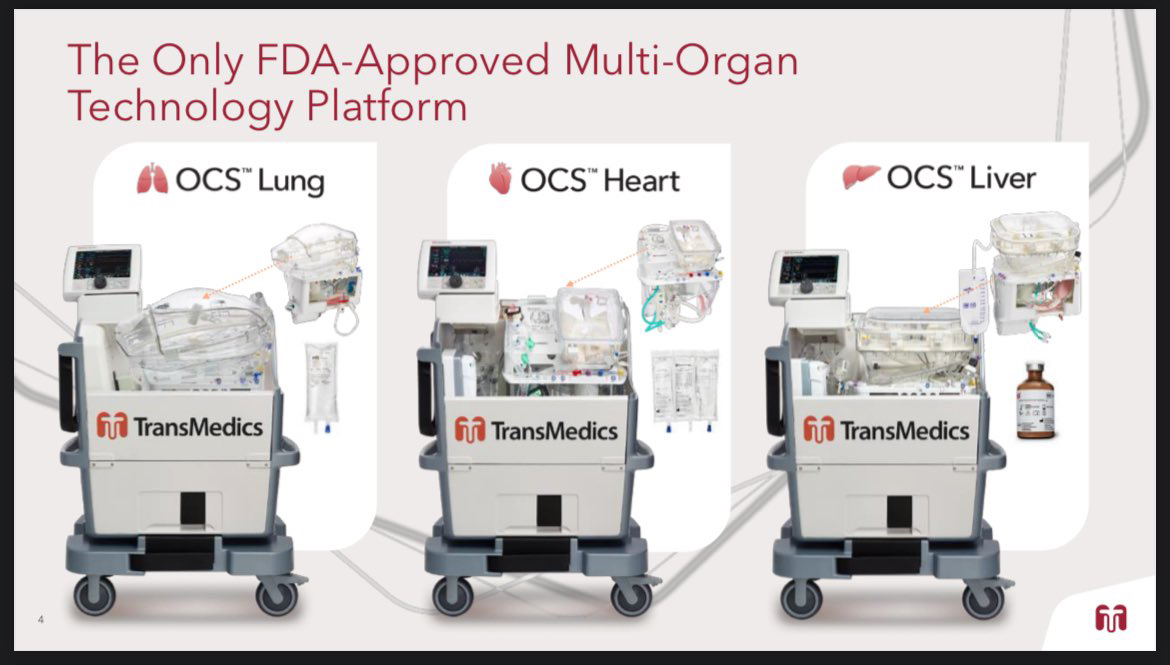

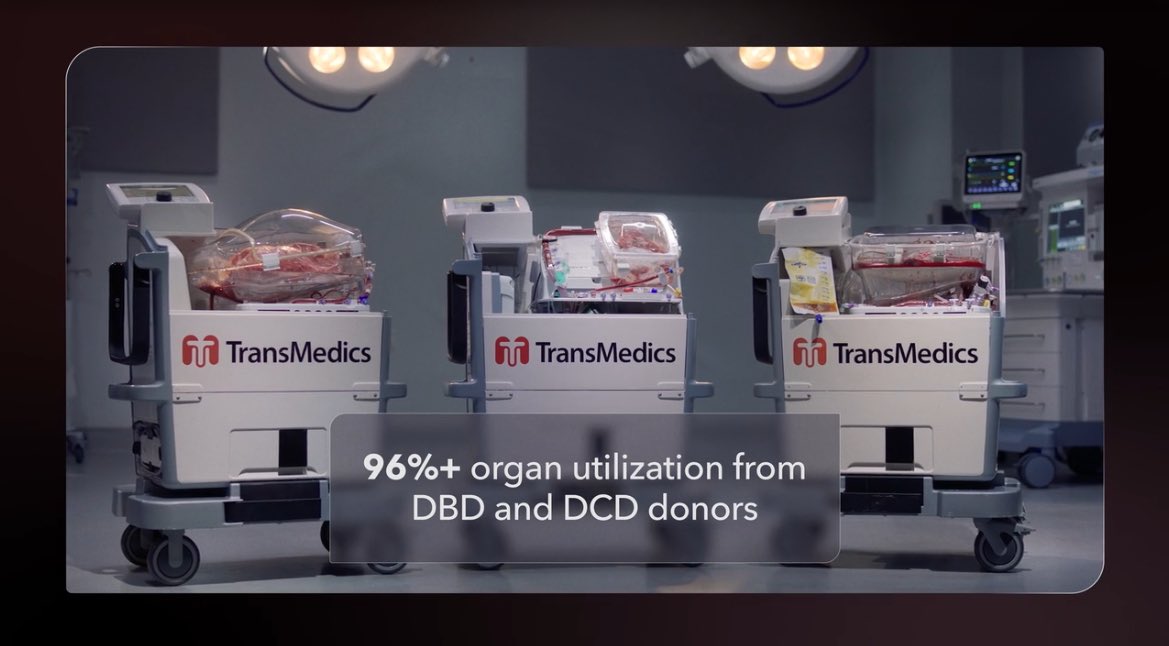

- The business model of $TMDX (+1,52%) is very robust. When an organization buys an organ, it keeps the console. When it uses the organ, it immediately buys a new organ to replenish the console. If an organization wants to use the NOP service for transport only, the contracts usually provide for OCS to be used in some way, whether to house/monitor the organ during transport or to purchase OCS outright to house the organ once the organization receives it.

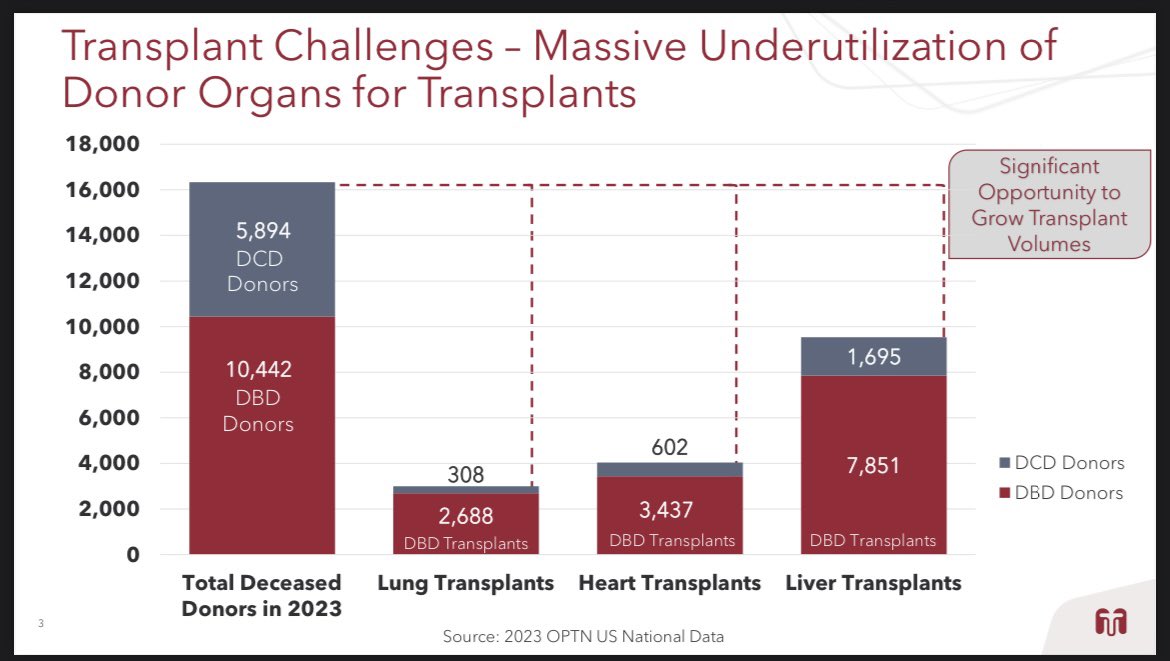

- The entire transplant industry is massively underutilized

- Why $TMDX (+1,52%) wins in transplants:

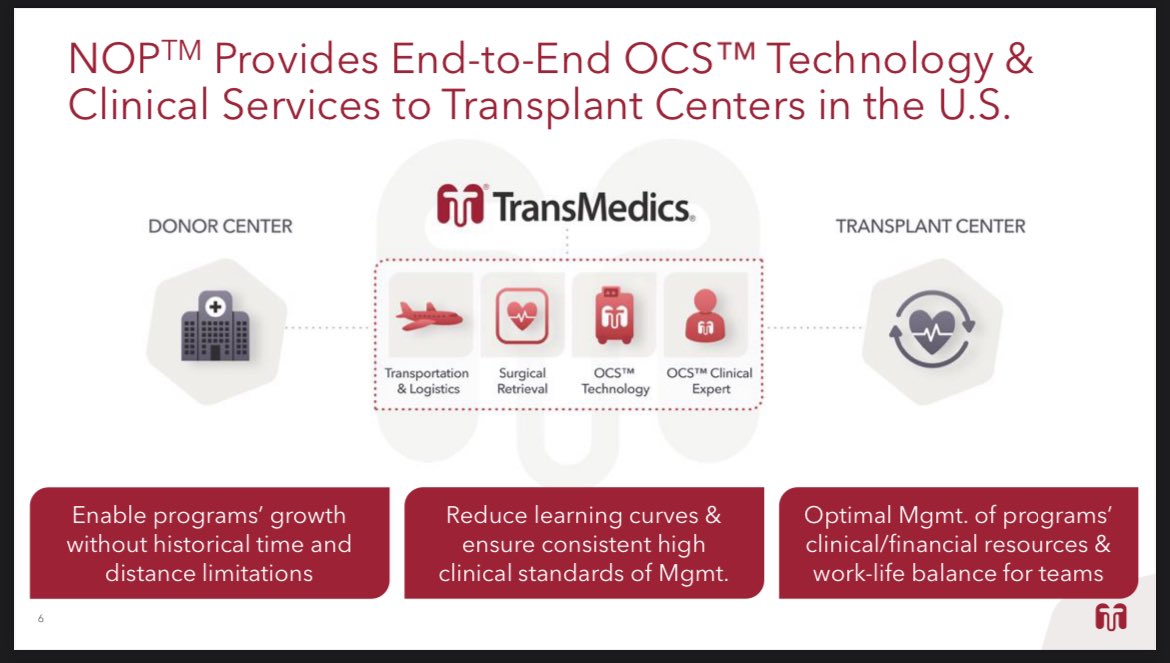

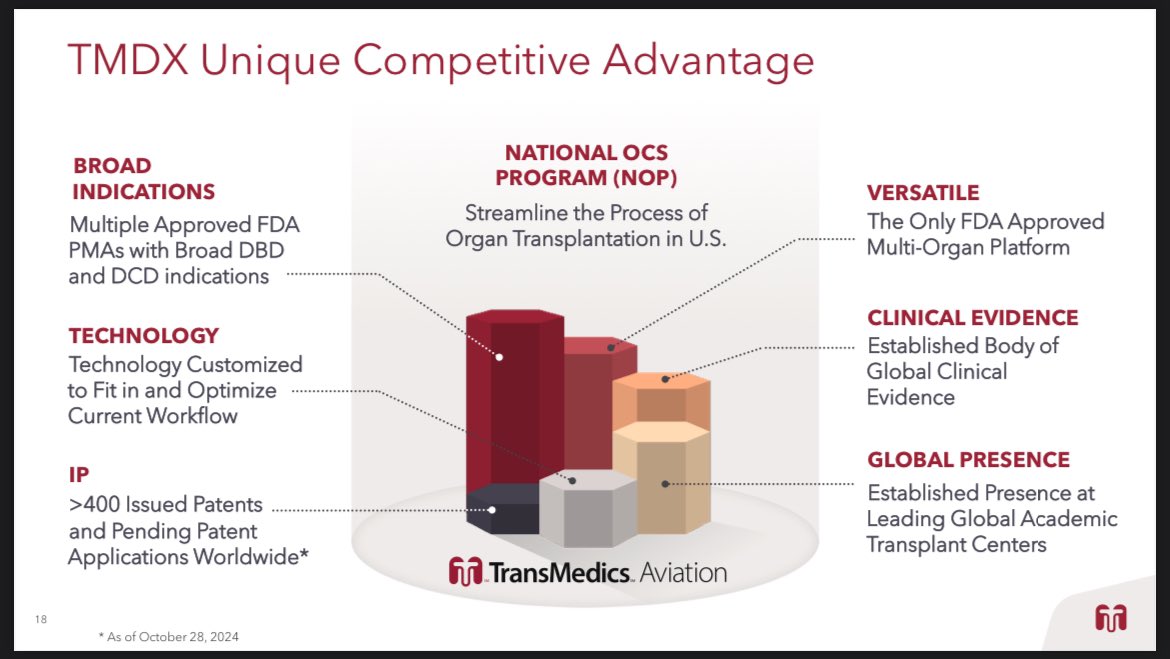

$TMDX (+1,52%) Could easily become a monopoly (especially NOP) or expand their lead. You start in a niche, dominate it and keep expanding.

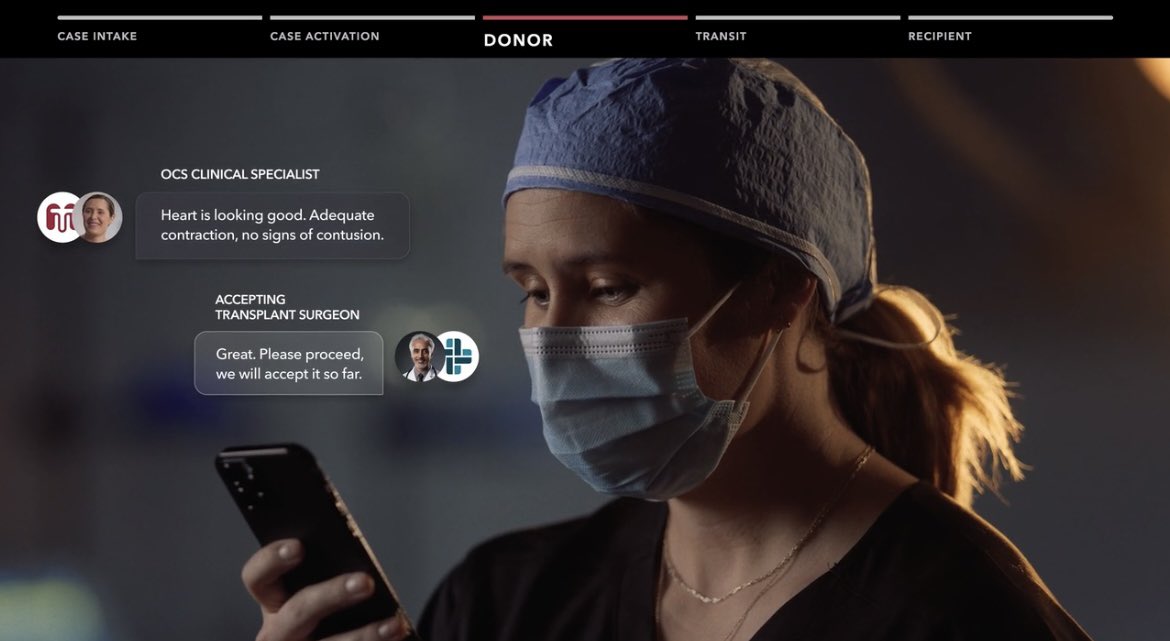

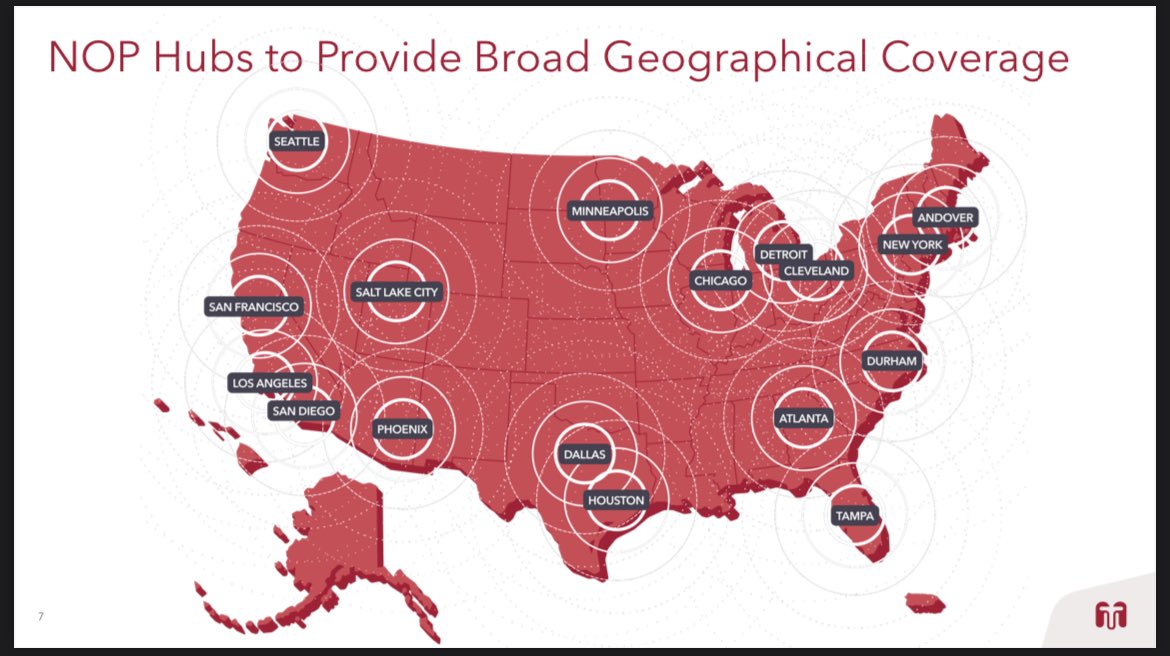

- $TMDX (+1,52%) the NOP logistics command center:

- Unique competitive advantage:

Concerns:

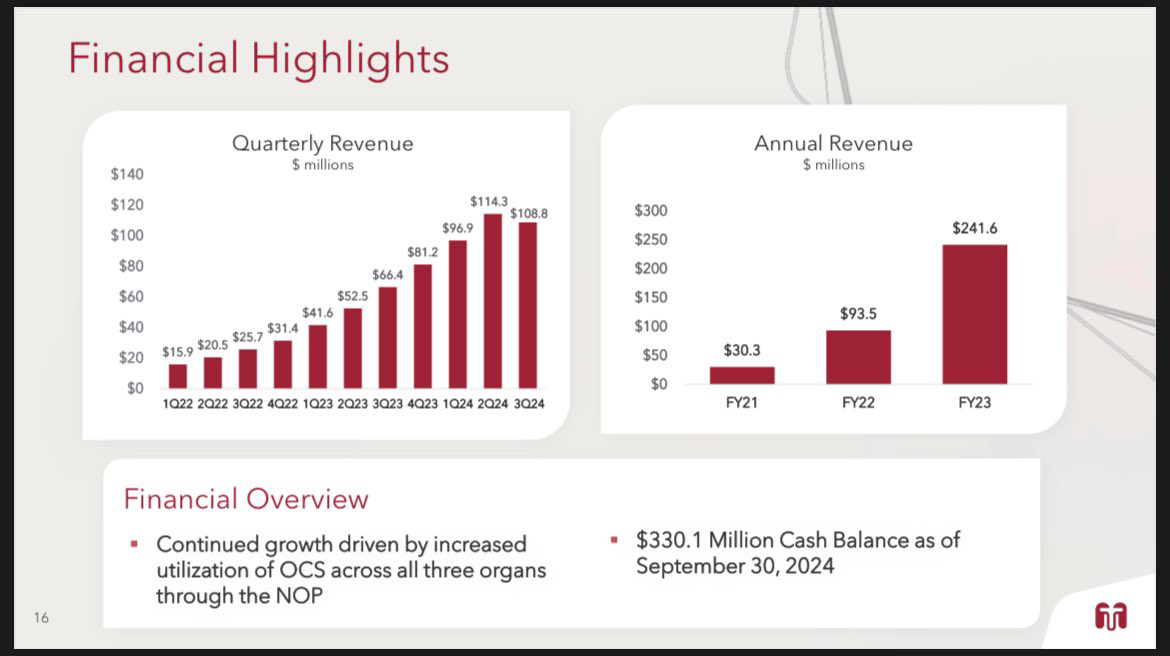

- $TMDX Has only recently become profitable and is inconsistent. You only reached profitability a year ago.

Net income:

Q4 2023: 4 million $

Q1 2024: 12.2 million $

Q2 2024: 12.2 million dollars

Q3 2024: 4.2 million USD

- In the last four quarters, costs have risen faster than revenue. This is something you don't want to see in a company that has recently become profitable.

- $TMDX (+1,52%) Has about $330m in cash, but still has about $178m in net debt

- $TMDX (+1,52%) would be a candidate for loss absorption. The share price has fallen sharply for half a year. For people who are still holding the share with a book loss, a sale now would be a good opportunity to offset this with profits from this year.

- The sentiment at $TMDX is at a multi-year low. Having just posted their first QoQ decline (although still up 64% y/y), the aesthetics of their rising sales, which has led to a 900% return on share price in 4.5 years, is ruined. If $TMDX (+1,52%) delivers another disappointing quarter, it could leave a nasty taste in Wall Street's mouth in the long run, regardless of how well the business might be doing - much like $PYPL (-0,38%) and $SOFI (+1,24%)

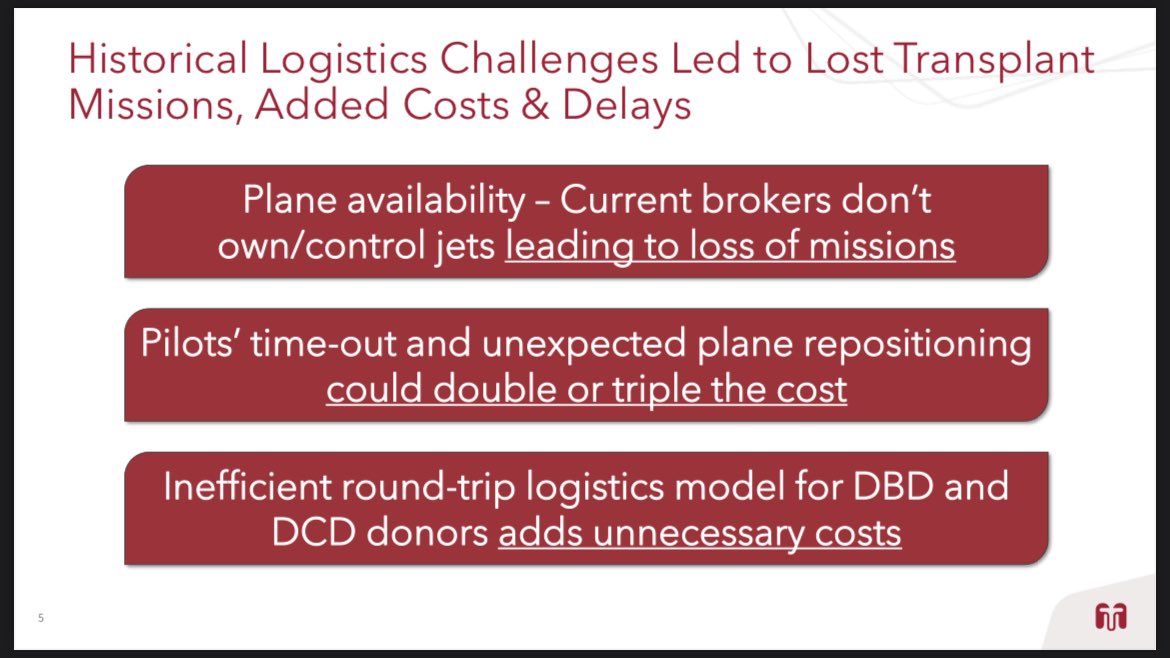

- $TMDX has a very asset-heavy business model. They own a fleet of aircraft, they own hubs that store OCS consoles and maintain aircraft, they own vehicles for ground transportation. All these assets are not cheap to maintain. This is a very complex logistics network that needs to be utilized/utilized, as opposed to e.g. $SHOP (+0,9%) , $PLTR (+6,35%) and Co, whose entire business is based on software.

- The whole business depends on the generosity of others. Without donors, there is no business. It is not the case that $TMDX (+1,52%) can ramp up/scale organ production to higher numbers. I could see NOP and renting out this fleet in the future, for medical purposes only, could be a great way to expand the monopoly on transplants.

- has a very niche business. There are only a limited number of people looking for a new organ. This will lead to some restrictions on business growth unless they expand at some point.

Bottom line:

I think $TMDX (+1,52%) could be a good buy now. The current weakness in the numbers is fundamentally not due to weakness in the business, but it is being sold off heavily as if it is. Down 50% because the transplant industry as a whole is down ? Because more was spent this quarter on expanding the business for 2025 ? Because the QoQ increase could not be sustained due to aircraft maintenance ?

I will consider getting in, what stops me at the moment is that you can't control the supply, but if you continue to develop the technology and others also use your services, the growth should be able to be sustained.