The day before yesterday $SIVB yesterday $CSGN tomorrow $DBK (-0,27%) ?

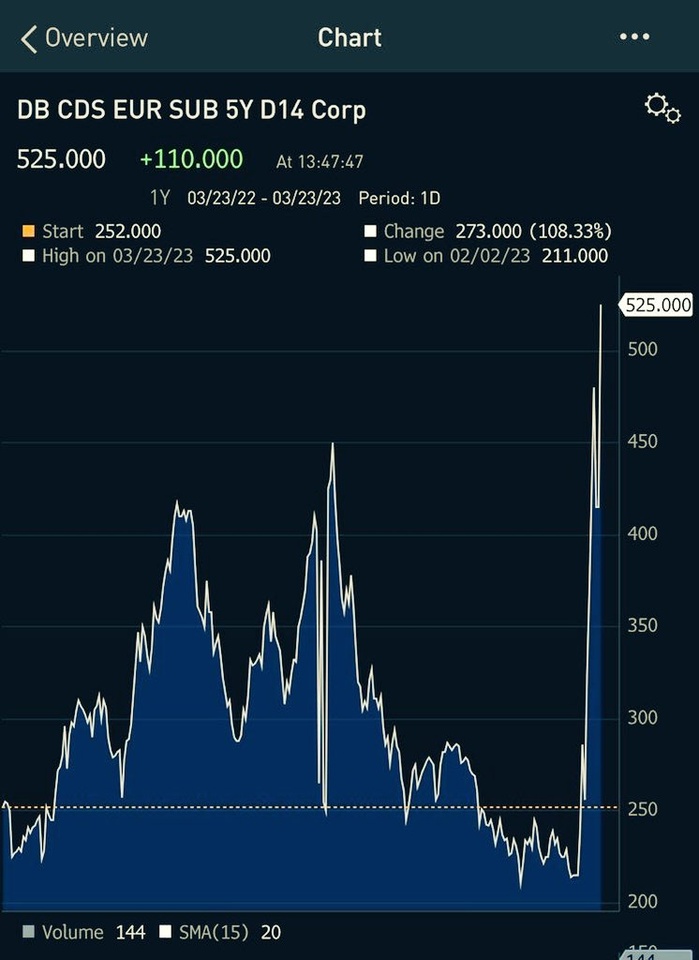

Credit default swaps (CDS) on Deutsche Bank are rising dramatically right now! Share price falls like a stone and pulls the DAX down.

Those who experienced 2008 know what this means. And anyone who knows Deutsche Bank's balance sheet a little has an idea of what a collapse would mean for Germany and the global economy.

And then there's this: "There is no cause for concern about the German banking sector, a spokesperson for the German government said on Friday." (Reuters)

Just a hint of what to keep on your radar for the next few days.

Addendum: The CDS on $DBK (-0,27%) now indicate an insolvency risk of 25% within the next 5 years. By the way, derivatives worth around €50,000 billion are on the books.