Comdirect - Birthday promotion!

Good morning dear Quinies,

I became aware of a cool Comdirect promotion through our dwarf's junior custody account.

First of all: I had a custody account with Comdirect for many years before I switched to ING and never had any problems there and always received first-class support when I needed it. I only switched at the time for cost reasons. As part of the campaign that I would like to present to you in more detail, I have now opened a second custody account with Comdirect again.

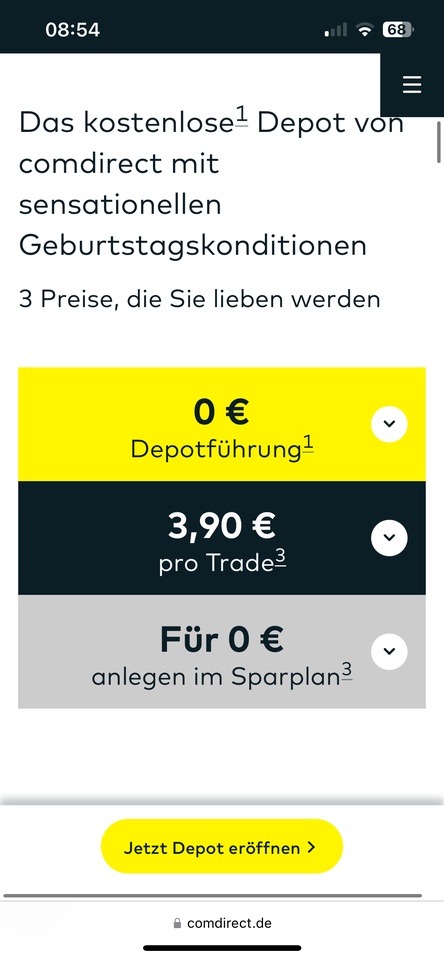

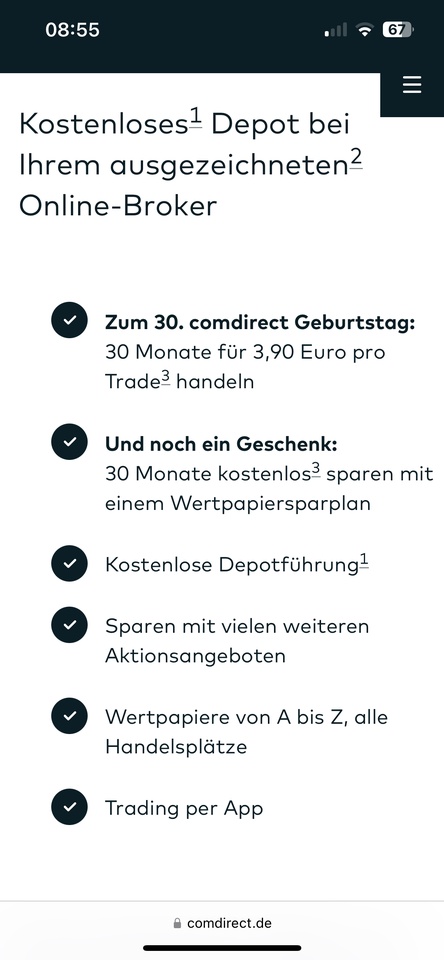

Specifically, Comdirect is offering the following when opening a custody account until 05.12.2024:

- Free custody account management (already standard for regular savings plan executions)

- Free savings plans for the entire available range of shares, funds, ETFs and certificates for 30 months

- 3.90 flat fee per trade (i.e. no additional costs in live trading, otherwise plus exchange-dependent fees)

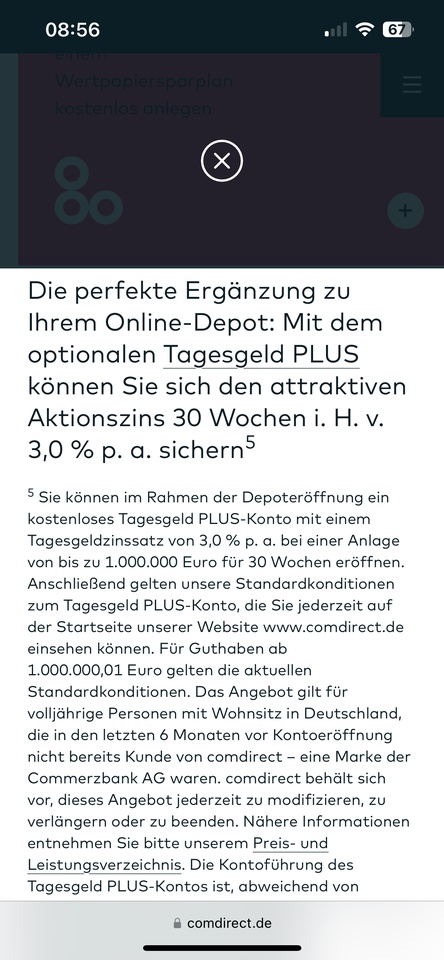

- When opening a Tagesgeld-Plus account, there is 3.0% p.a. for 30 weeks on this account for new customers

Why have I opened a second custody account there?

As some of you may know, share savings plans at ING are subject to a fee. In addition, unlike ING, Comdirect offers the option of adding other/more shares/ETFs (a number of growth stocks, REITs and private equity, which are not possible with ING) to a savings plan. This was the decisive advantage for me. Comdirect also offers the option of taking out a securities loan and opening foreign currency accounts. Of course, I also used a payback coupon when I opened the account💰(more content from me on the subject of cashback soon😉, I received/will receive 6,000 points, which equates to €60, so some trades would already have been financed).

Since my main strategy at ING runs fully automatically without any effort on my part, but I realize that I'm getting a bit bored without a bit of playing and experimenting in the investment area, I'm using the second custody account at Comdirect as a "gamble portfolio" for the next 30 months. After that, the securities will probably be transferred to ING and I'll think about what to do with them.

So I will invest part of my Christmas money (€2,500) once on 23.11.24 as a savings plan in the following 6 individual stocks and 4 ETFs and then save €25 each month on the 1st for the next 30 months (we are really talking about gambling money here, share of the portfolio <5% of my total portfolio):

From January 2025 I will share monthly updates on my "gamblefolio" here with you.

If you are interested in opening a securities account with Comdirect as part of the birthday campaign, please use the reference link in my bio😉.

I hope you find the article interesting (please leave a like).

Have a nice, relaxed Sunday🆓😎.

Greetings, Marcus