The cocoa futures have now risen by over 10k US dollars per tonne the highest level in history.

The cocoa market is currently experiencing difficulties due to poor harvests in West Africa, which is a major contributor to the crop. According to estimates from the "Ivorian cocoa regulatory body" the upcoming interim harvest, which officially begins in April, is expected to be delayed due to unfavorable weather conditions and lack of fertilizers to 400-500 kt. Chocolate producers in particular, such as Nestlé ($NESN (+1,15 %) ), Barry Callebaut ($BARN (+0,36 %) ) & Hershey Company ($HSHY34 ) are suffering from the high price of the raw material.

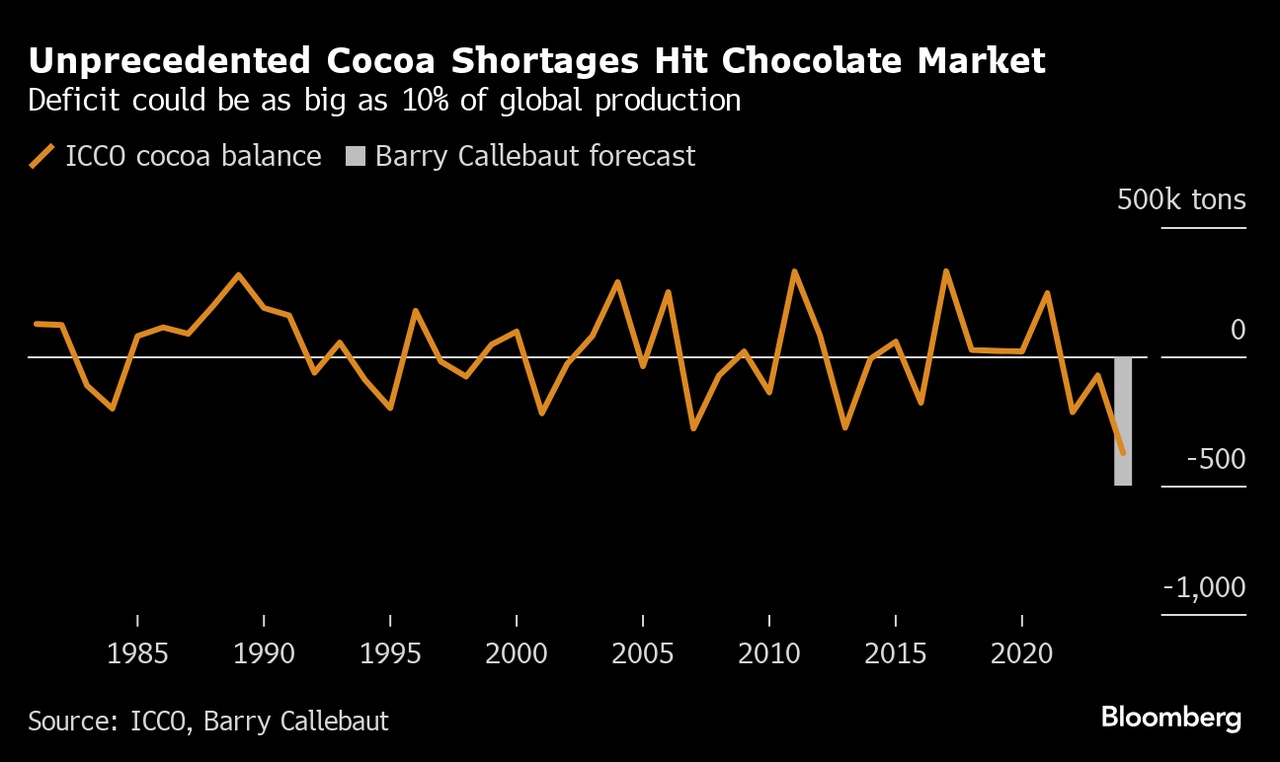

The regulatory authority emphasizes that the weather plays a decisive role in shaping the market balance for the season. Previously, the International Cocoa Organization (ICCO) had forecast that the ratio of stocks to grindings this season to the lowest level in more than 4 decades in four decades. The group also predicted that the existing supply deficit this season will increase to 374 kt compared to a deficit of 74 kt last season.